Answered step by step

Verified Expert Solution

Question

1 Approved Answer

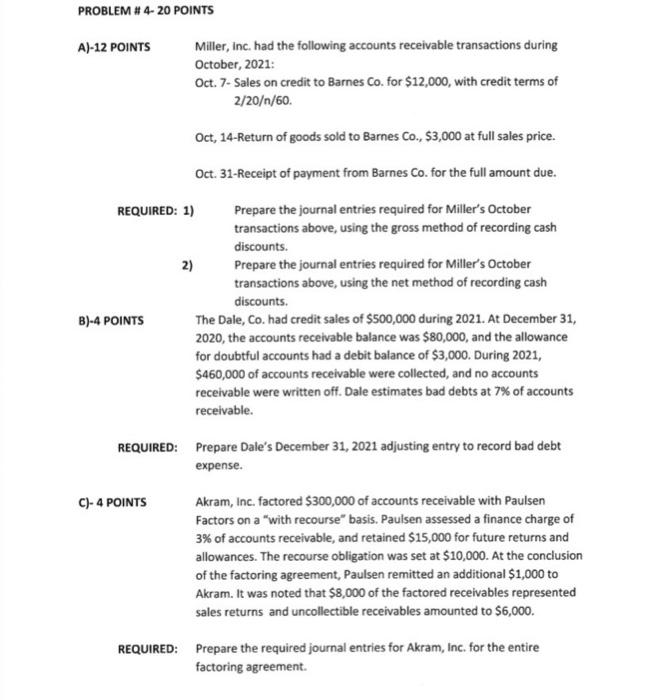

Help on 3 questions A)-12 POINTS Miller, inc, had the following accounts receivable transactions during October, 2021: Oct. 7- Sales on credit to Barnes Co.

Help on 3 questions

A)-12 POINTS Miller, inc, had the following accounts receivable transactions during October, 2021: Oct. 7- Sales on credit to Barnes Co. for $12,000, with credit terms of 2/20/60. Oct, 14-Return of goods sold to Barnes Co., $3,000 at full sales price. Oct. 31-Receipt of payment from Barnes Co. for the full amount due. REQUIRED: 1) Prepare the journal entries required for Miller's October transactions above, using the gross method of recording cash discounts. Prepare the journal entries required for Miller's October transactions above, using the net method of recording cash discounts. The Dale, Co. had credit sales of $500,000 during 2021. At December 31 , 2020 , the accounts receivable balance was $80,000, and the allowance for doubtful accounts had a debit balance of $3,000. During 2021 , $460,000 of accounts receivable were collected, and no accounts receivable were written off. Dale estimates bad debts at 7% of accounts receivable. REQUIRED: Prepare Dale's December 31, 2021 adjusting entry to record bad debt expense. C)- 4 POINTS Akram, Inc. factored $300,000 of accounts receivable with Paulsen Factors on a "with recourse" basis. Paulsen assessed a finance charge of 3% of accounts receivable, and retained $15,000 for future returns and allowances. The recourse obligation was set at $10,000. At the conclusion of the factoring agreement, Paulsen remitted an additional $1,000 to Akram. It was noted that $8,000 of the factored receivables represented sales returns and uncollectible receivables amounted to $6,000. REQUIRED: Prepare the required journal entries for Akram, Inc. for the entire factoring agreement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started