Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help on all 4 questions please Fielder, Inc. is in the process of preparing its annual financial statements for December 31 , 2020. In doing

Help on all 4 questions please

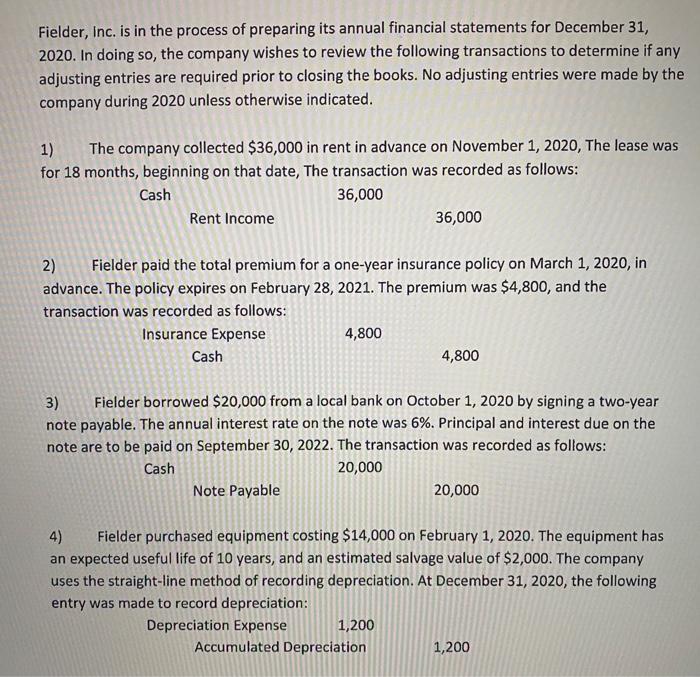

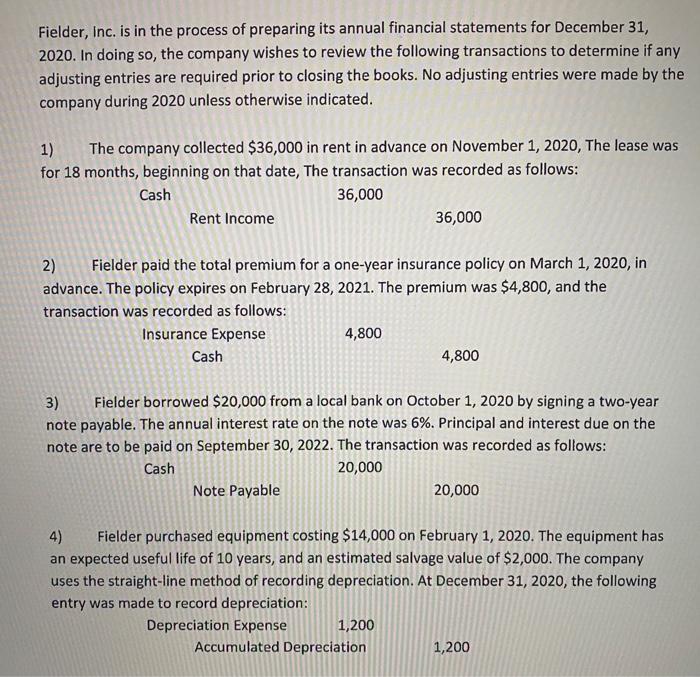

Fielder, Inc. is in the process of preparing its annual financial statements for December 31 , 2020. In doing so, the company wishes to review the following transactions to determine if any adjusting entries are required prior to closing the books. No adjusting entries were made by the company during 2020 unless otherwise indicated. 1) The company collected $36,000 in rent in advance on November 1,2020 , The lease was for 18 months, beginning on that date, The transaction was recorded as follows: Cash 36,000 2) Fielder paid the total premium for a one-year insurance policy on March 1,2020 , in advance. The policy expires on February 28,2021 . The premium was $4,800, and the transaction was recorded as follows: 3) Fielder borrowed $20,000 from a local bank on October 1, 2020 by signing a two-year note payable. The annual interest rate on the note was 6%. Principal and interest due on the note are to be paid on September 30,2022 . The transaction was recorded as follows: Cash 20,000 Note Payable 20,000 4) Fielder purchased equipment costing $14,000 on February 1,2020 . The equipment has an expected useful life of 10 years, and an estimated salvage value of $2,000. The company uses the straight-line method of recording depreciation. At December 31, 2020, the following entry was made to record depreciation: Depreciation Expense 1,200 Accumulated Depreciation 1,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started