Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help please 13. Cassie Flohr, employee #375, was hired on May 1, last year at an annual salary of $36,000.00, paid bi-weekly. As of May

help please

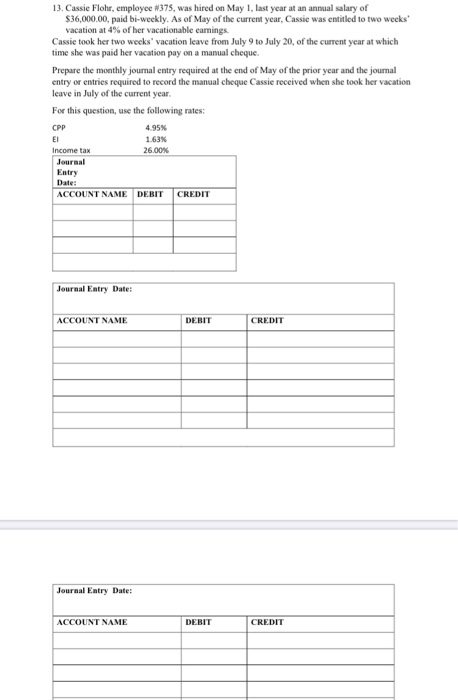

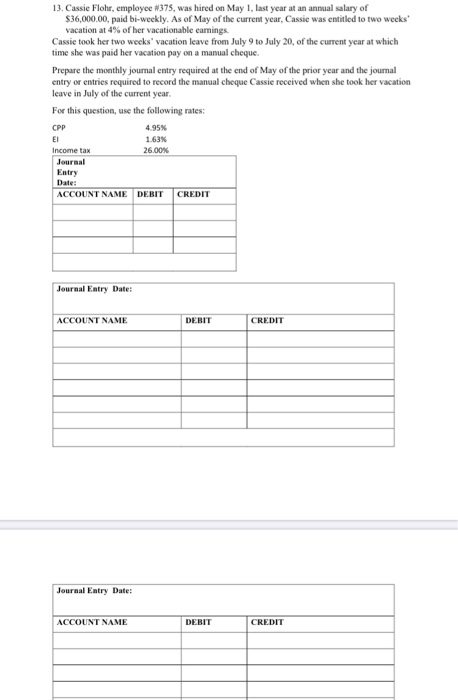

13. Cassie Flohr, employee #375, was hired on May 1, last year at an annual salary of $36,000.00, paid bi-weekly. As of May of the current year, Cassie was entitled to two weeks Vacation at 4% of her vacationable carings Cassie took her two weeks' vacation leave from July 9 to July 20, of the current year at which time she was paid her vacation pay on a manual cheque. Prepare the monthly journal entry required at the end of May of the prior year and the journal entry or entries required to record the manual cheque Cassie received when she took her vacation leave in July of the current year For this question, use the following rates CPP 26.00% Income tax Journal Date ACCOUNT NAME DEBIT CREDIT Journal Entry Date: ACCOUNT NAME DEBIT CREDIT Journal Entry Date: ACCOUNT NAME

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started