Answered step by step

Verified Expert Solution

Question

1 Approved Answer

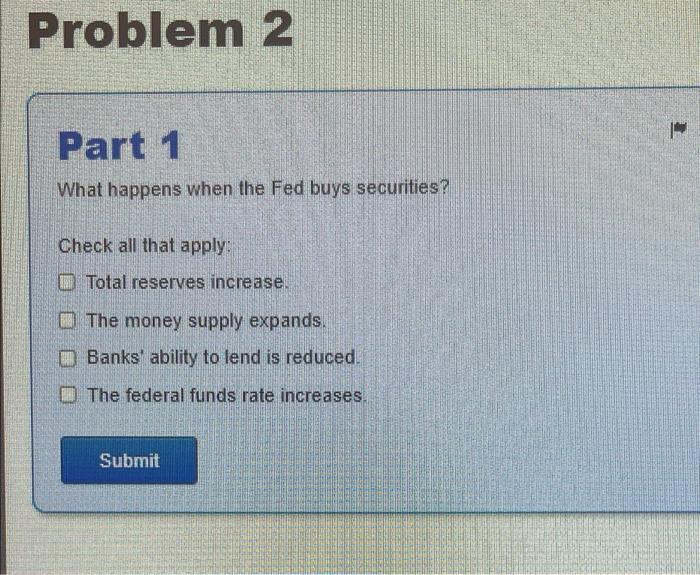

help! please answer all. i will give a thumbs up Problem 2 Part 1 What happens when the Fed buys securities? Check all that apply:

help! please answer all. i will give a thumbs up

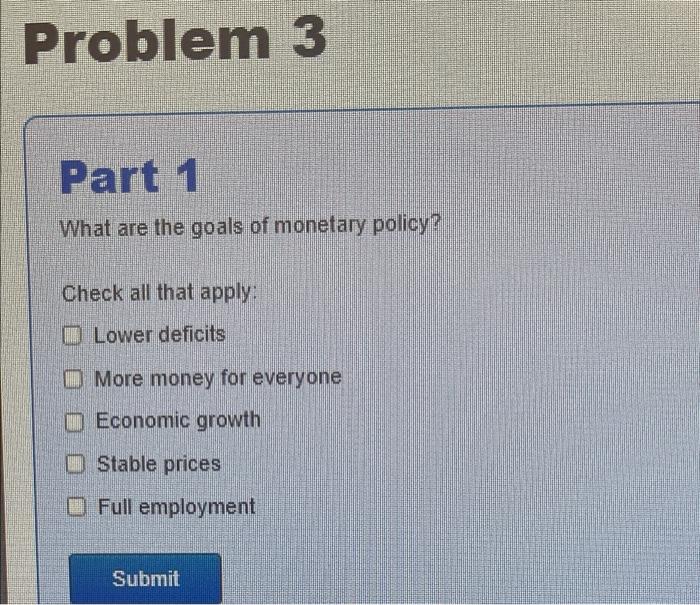

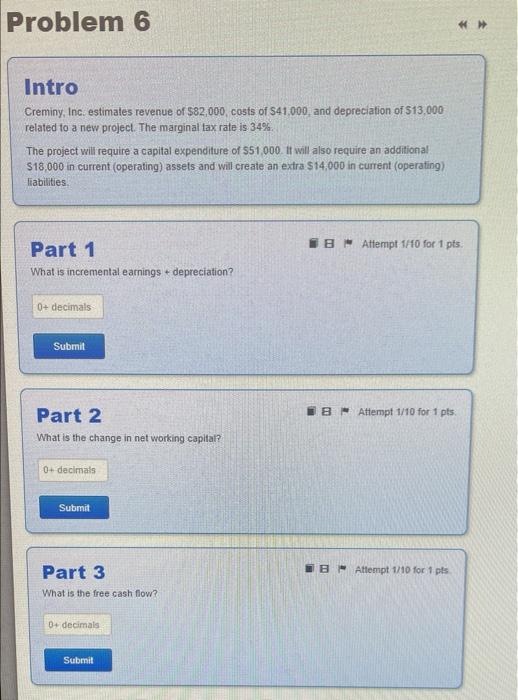

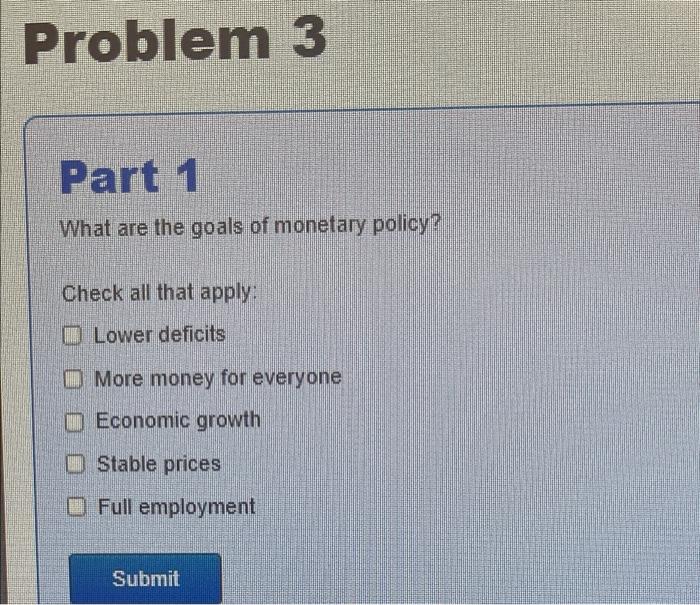

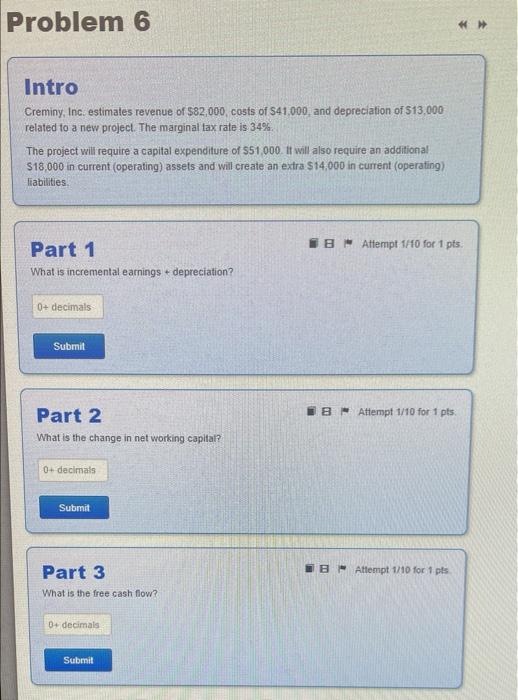

Problem 2 Part 1 What happens when the Fed buys securities? Check all that apply: Total reserves increase. The money supply expands. Banks' ability to lend is reduced. The federal funds rate increases. Submit H Problem 3 Part 1 What are the goals of monetary policy? Check all that apply: Lower deficits More money for everyone Economic growth Stable prices Full employment Submit Problem 6 Intro Creminy, Inc. estimates revenue of $82,000, costs of $41,000, and depreciation of $13,000 related to a new project. The marginal tax rate is 34%. The project will require a capital expenditure of $51,000. It will also require an additional $18,000 in current (operating) assets and will create an extra $14,000 in current (operating) liabilities. Part 1 What is incremental earnings + depreciation? 0+ decimals Submit Part 2 What is the change in net working capital? 0+ decimals Submit Part 3 What is the free cash flow? 0+ decimals Submit B Attempt 1/10 for 1 pts. B Attempt 1/10 for 1 pts. BAttempt 1/10 for 1 pts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started