Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help please asap On January 2, 2014, Pet Spa purchased fatures for $31,600 cash, oxpecting the fixtures to remain in service for six years. Pet

help please asap

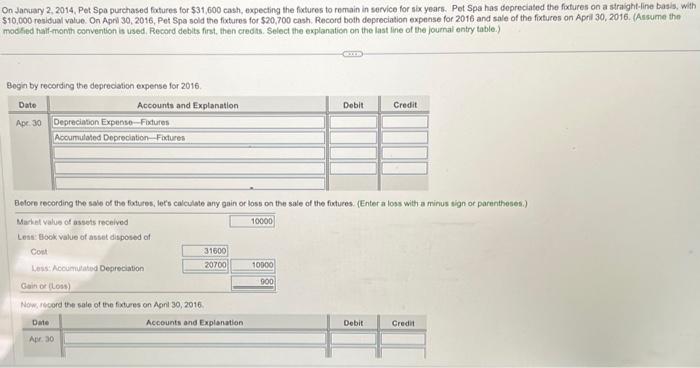

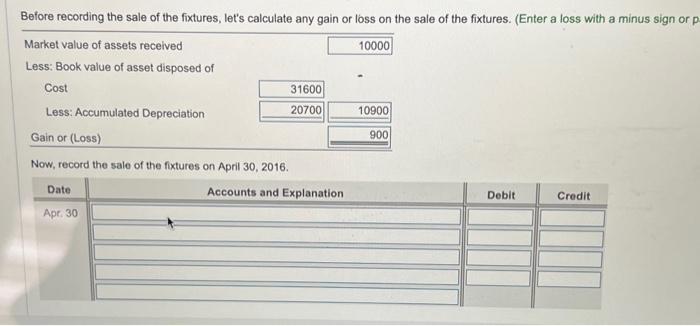

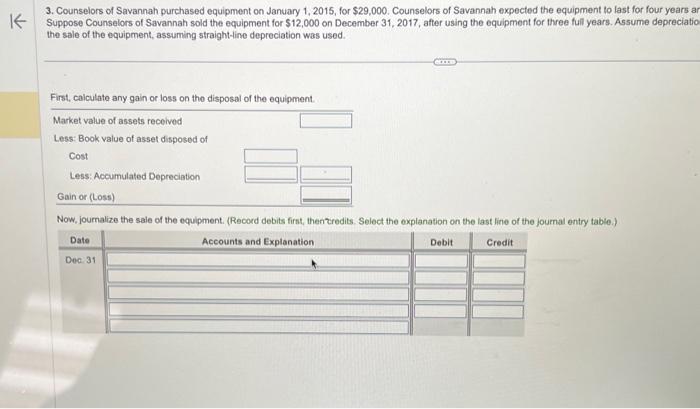

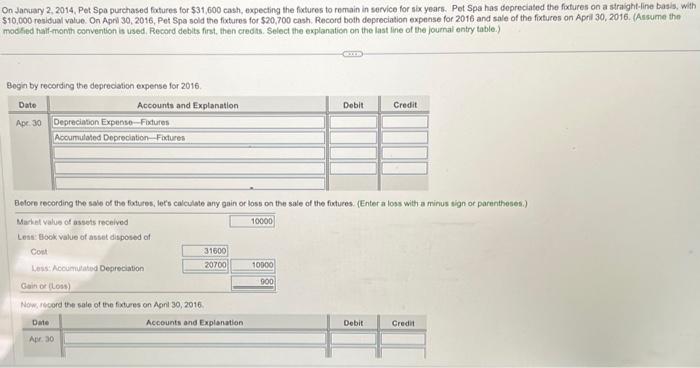

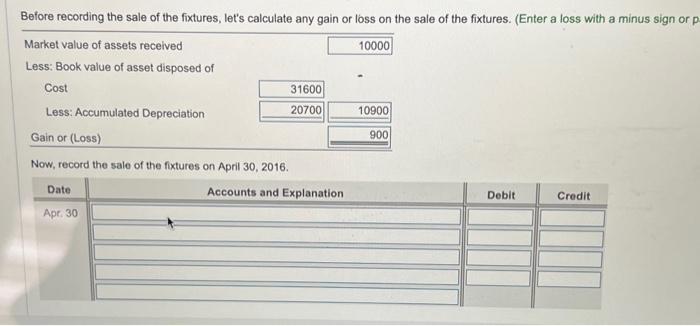

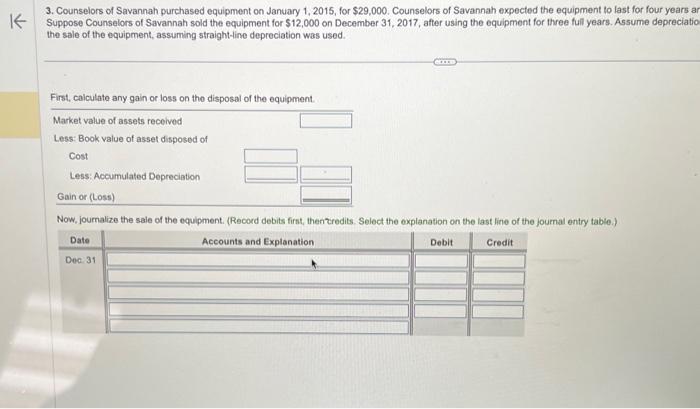

On January 2, 2014, Pet Spa purchased fatures for $31,600 cash, oxpecting the fixtures to remain in service for six years. Pet Spa has dopreciated the foxtures on a straight-line basis, with $10,000 residual value. On Apni 30, 2016, Pet Spa sold the fixtures for $20,700 cash. Record both depreciation expense for 2016 and sole of the fixtures on April 30,2016 . (Assume the modked half-menth convention is used, Record debits first, then credts. Select the explanation on the last line of the joumal entry table.). Bogin by recording the depreciation expense for 2016 Before recording the sale of the fotures, lets calculate any gain or loss on the sale of the futures. (Enter a loss with a minus tign or parentheses.) Now record the sale of the fixtures on Agel 30, 2016 Now, record the sale of the fixtures on April 30, 2016. 3. Counselors of Savannah purchased equipment on January 1,2015, for $29,000. Counselors of Savannah expected the equipment to last for four years a Suppose Counselors of Savannah sold the equipment for $12,000 on December 31, 2017, after using the equipment for three full years. Assume depreciatic the sale of the equipment, assuming straight-line depreciation was used. First, calculate any gain or loss on the disposal of the equipment. On January 2, 2014, Pet Spa purchased fatures for $31,600 cash, oxpecting the fixtures to remain in service for six years. Pet Spa has dopreciated the foxtures on a straight-line basis, with $10,000 residual value. On Apni 30, 2016, Pet Spa sold the fixtures for $20,700 cash. Record both depreciation expense for 2016 and sole of the fixtures on April 30,2016 . (Assume the modked half-menth convention is used, Record debits first, then credts. Select the explanation on the last line of the joumal entry table.). Bogin by recording the depreciation expense for 2016 Before recording the sale of the fotures, lets calculate any gain or loss on the sale of the futures. (Enter a loss with a minus tign or parentheses.) Now record the sale of the fixtures on Agel 30, 2016 Now, record the sale of the fixtures on April 30, 2016. 3. Counselors of Savannah purchased equipment on January 1,2015, for $29,000. Counselors of Savannah expected the equipment to last for four years a Suppose Counselors of Savannah sold the equipment for $12,000 on December 31, 2017, after using the equipment for three full years. Assume depreciatic the sale of the equipment, assuming straight-line depreciation was used. First, calculate any gain or loss on the disposal of the equipment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started