Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help please due soon(very clear pics) Reak the itsithimath Samson Go-Karts sells motorized go-karts. Samson Go-Karts are motorized and are typically purchased by amusement parks

help please due soon(very clear pics)

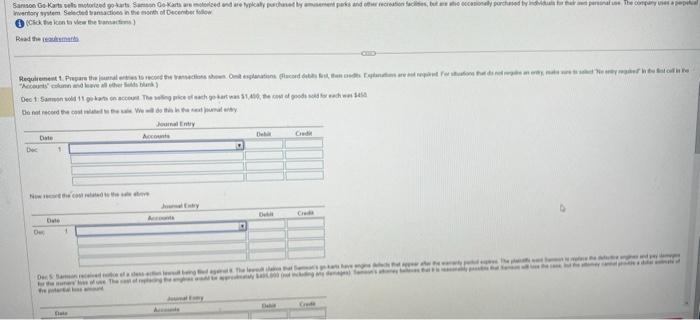

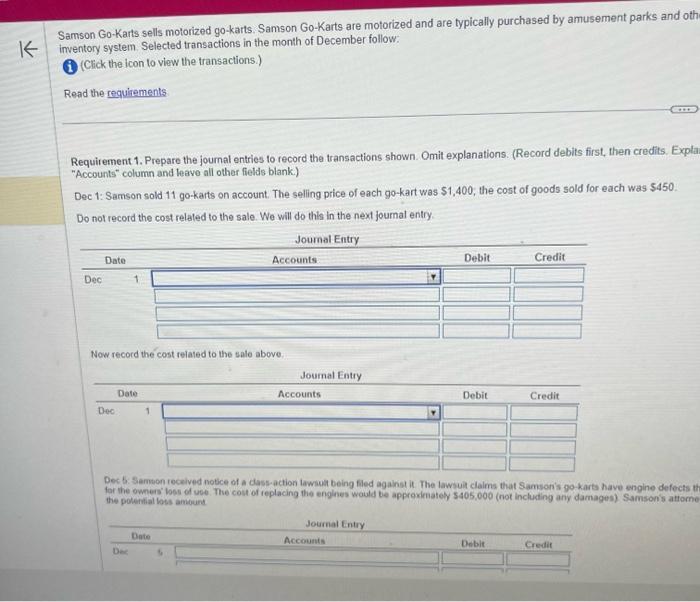

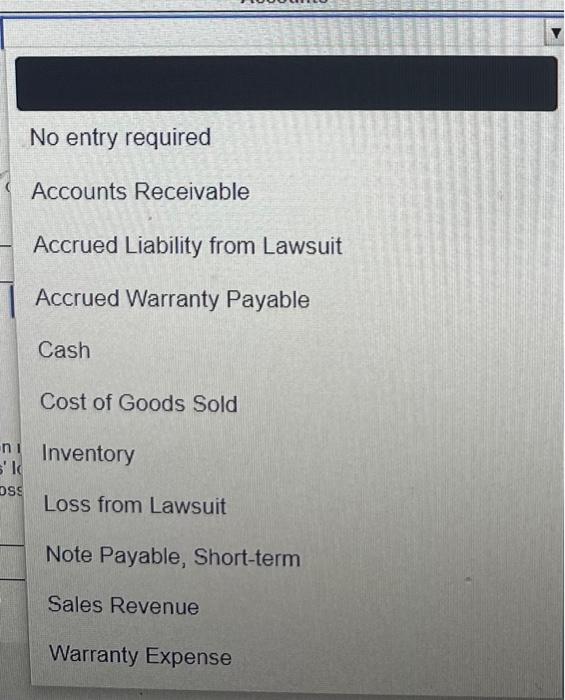

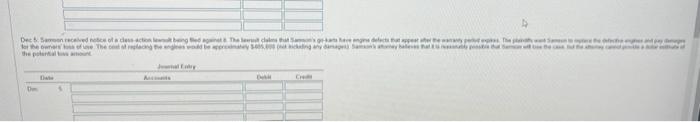

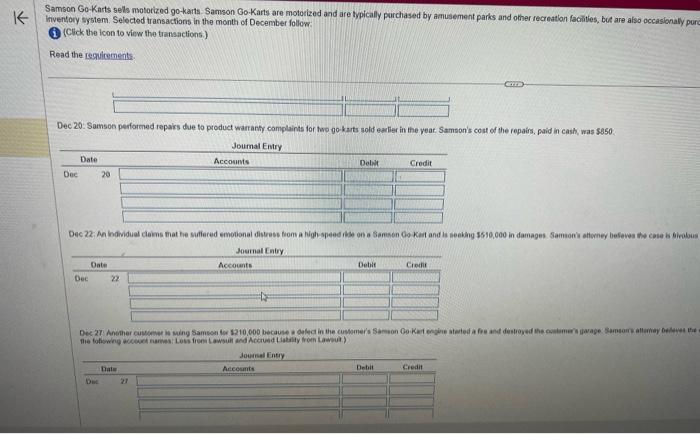

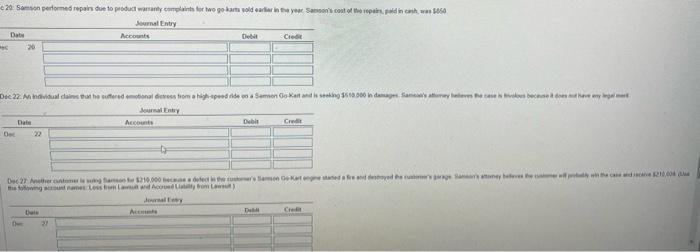

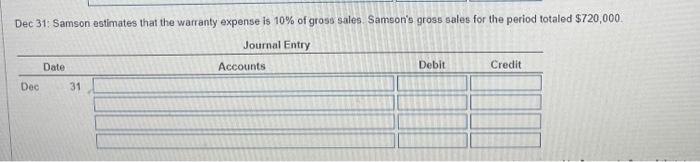

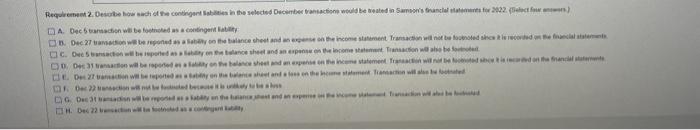

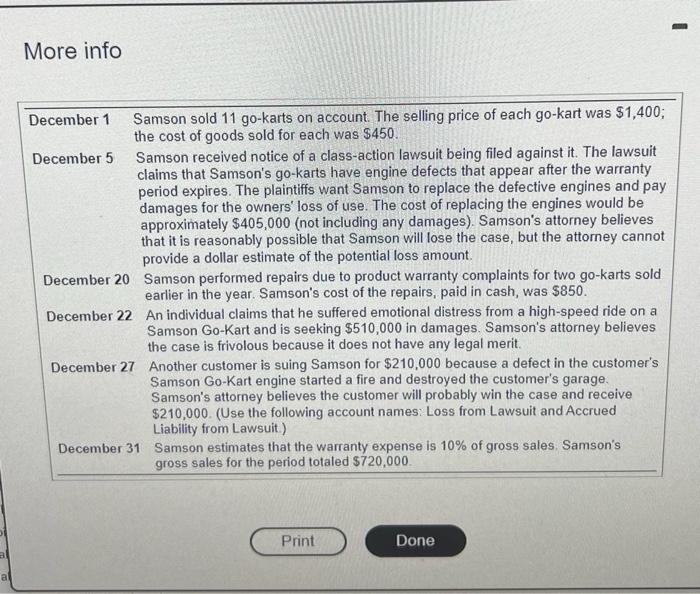

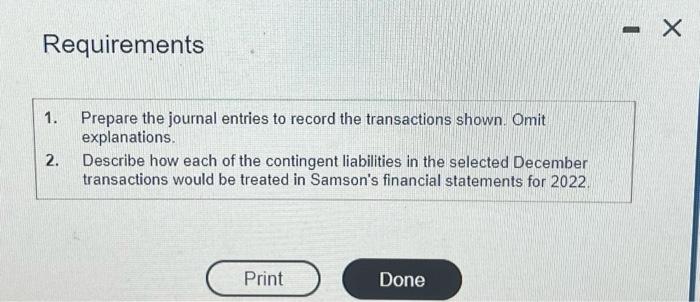

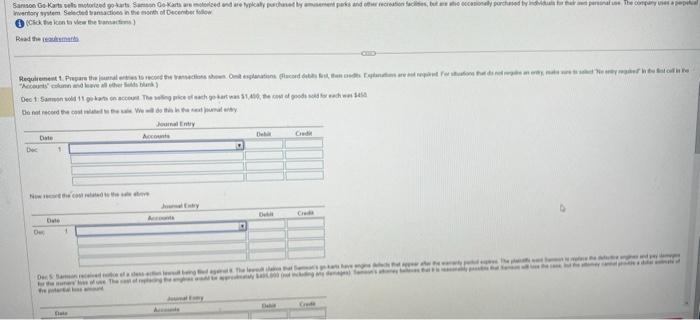

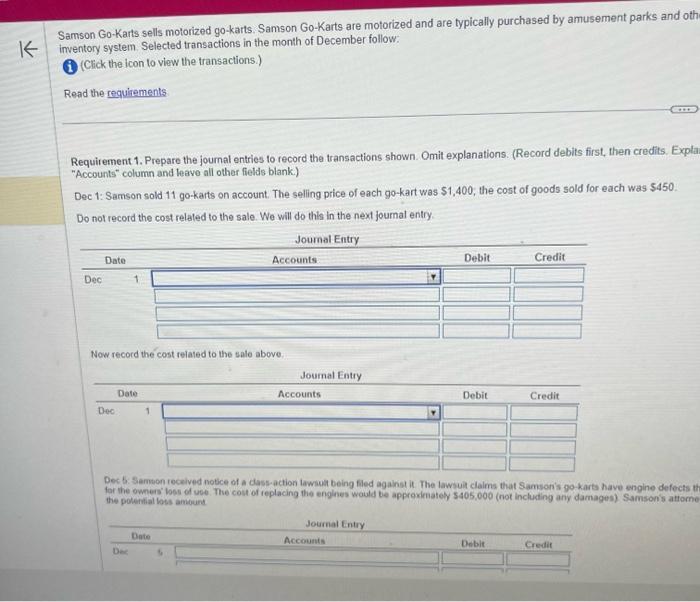

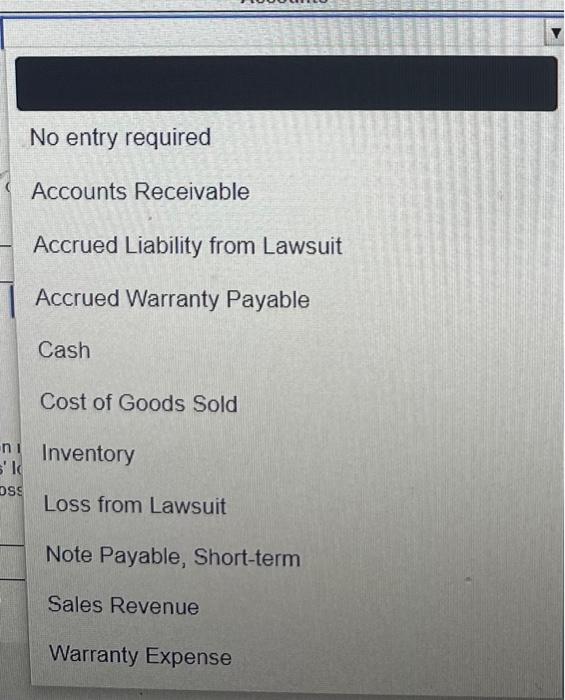

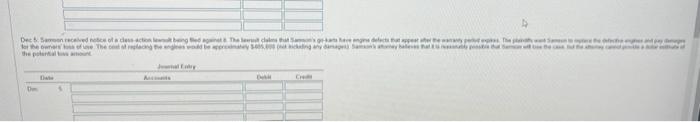

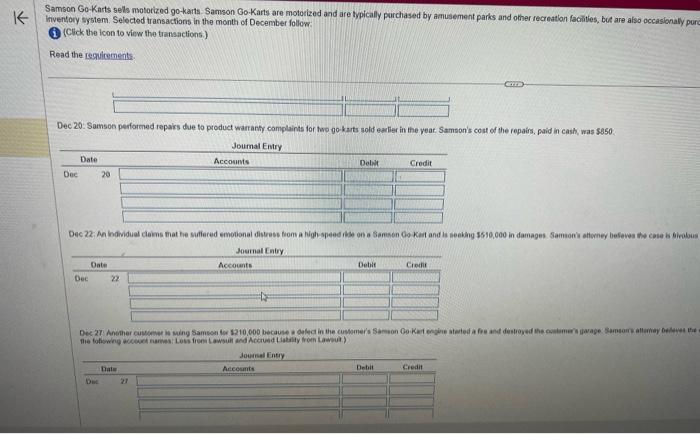

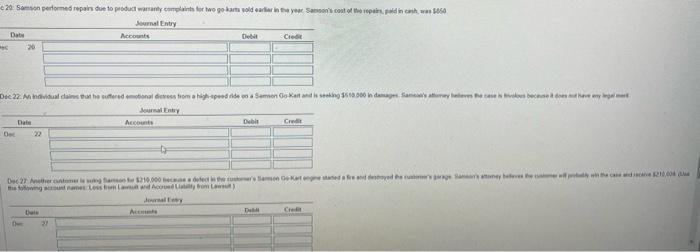

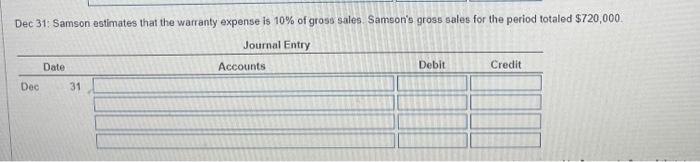

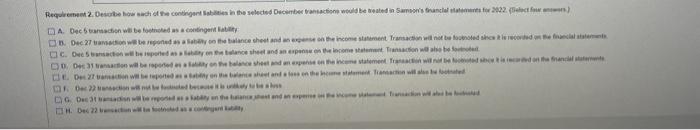

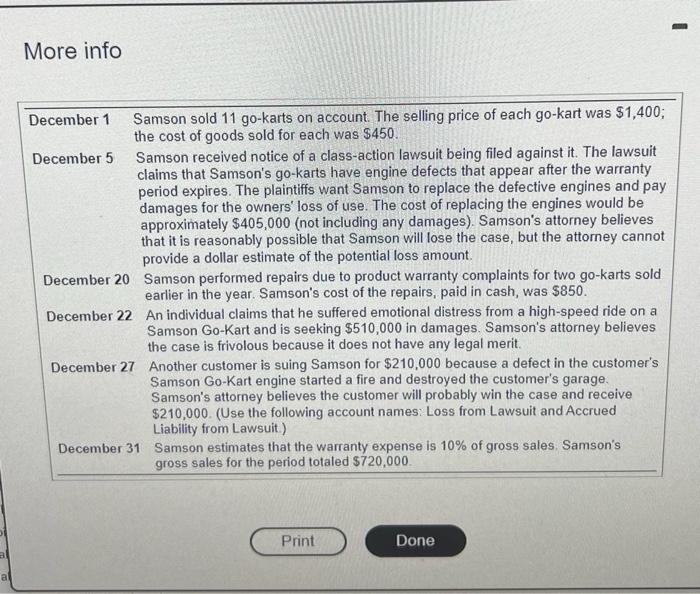

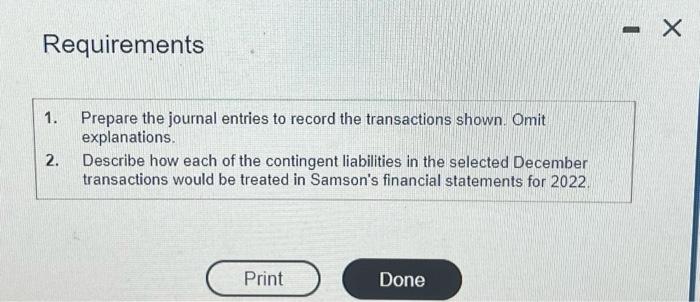

Reak the itsithimath Samson Go-Karts sells motorized go-karts. Samson Go-Karts are motorized and are typically purchased by amusement parks and oth inventory system. Selected transactions in the month of December follow: 1) (Click the icon to view the transactions.) Read the requigements Requirement 1. Prepare the joumal entries to record the transactions shown. Omit explanations. (Record debits first, then credits. Expla "Accounts" column and teave all other fields blank) Dec 1: Samson sold 11 go-karts on account. The selling price of each go-kart was $1,400, the cost of goods sold for each was $450. Do not record the cost relaled to the sale. We will do this in the next joumal entry. Now record the cost related to the sale above. Dec b. Samson received notice of a dass-action lawaua being filed against it. The lawsuit clalms that Samson's go-karts have sagine defocts th for the owmers' boss of ves. The cost of replacing the englnes would be approximatey 5405,000 (not inclucting any damages). Samson's attome the potertial loss ambunt. No entry required Accounts Receivable Accrued Liability from Lawsuit Accrued Warranty Payable Cash Cost of Goods Sold Inventory Loss from Lawsuit Note Payable, Short-term Sales Revenue Warranty Expense amson Go-Karts sels motorized go-karts. Samson Go-Karts are motoized and are typically parchased by amusement parks and other recreation facitities, but are also occasionaly pe iventory system, Selected transactions in the month of Decernber follow: 1. (Click the icon to view the transactions.) Read the regificment: Dec 20: Samsoe performed repairs the to product warranty complaints for two gok kats sold earlier in the year. Samson's cost of the repairs, paid in cash, was s850. Dec 31: Samson estimates that the warranty expense is 10% of gross sales. Samson's gross sales for the period totaled $720,000. A. Dec 5 trarnachen wi be toptisted as a cositingent latity More info December 1 Samson sold 11 go-karts on account. The selling price of each go-kart was $1,400; the cost of goods sold for each was $450. December 5 Samson received notice of a class-action lawsuit being filed against it. The lawsuit claims that Samson's go-karts have engine defects that appear after the warranty period expires. The plaintiffs want Samson to replace the defective engines and pay damages for the owners' loss of use. The cost of replacing the engines would be approximately $405,000 (not including any damages). Samson's attorney believes that it is reasonably possible that Samson will lose the case, but the attorney cannot provide a dollar estimate of the potential loss amount. December 20 Samson performed repairs due to product warranty complaints for two go-karts sold earlier in the year. Samson's cost of the repairs, paid in cash, was $850. December 22 An individual claims that he suffered emotional distress from a high-speed ride on a Samson Go-Kart and is seeking $510,000 in damages. Samson's attorney believes the case is frivolous because it does not have any legal merit. December 27 Another customer is suing Samson for $210,000 because a defect in the customer's Samson Go-Kart engine started a fire and destroyed the customer's garage. Samson's attorney believes the customer will probably win the case and receive $210,000. (Use the following account names: Loss from Lawsuit and Accrued Liability from Lawsuit.) December 31 Samson estimates that the warranty expense is 10% of gross sales. Samson's gross sales for the period totaled $720,000. Requirements 1. Prepare the journal entries to record the transactions shown. Omit explanations. 2. Describe how each of the contingent liabilities in the selected December transactions would be treated in Samson's financial statements for 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started