help please help

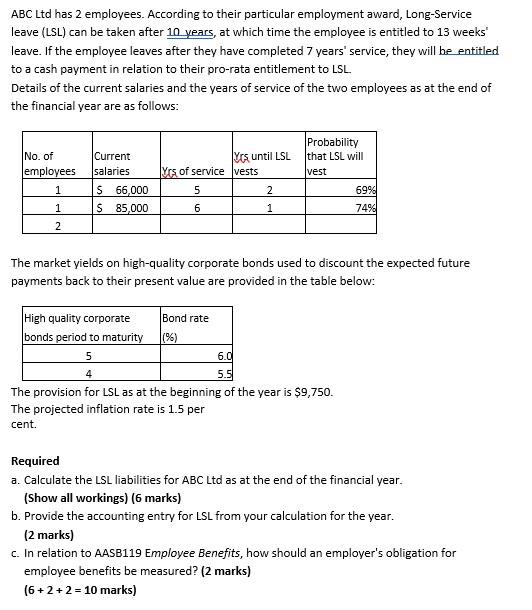

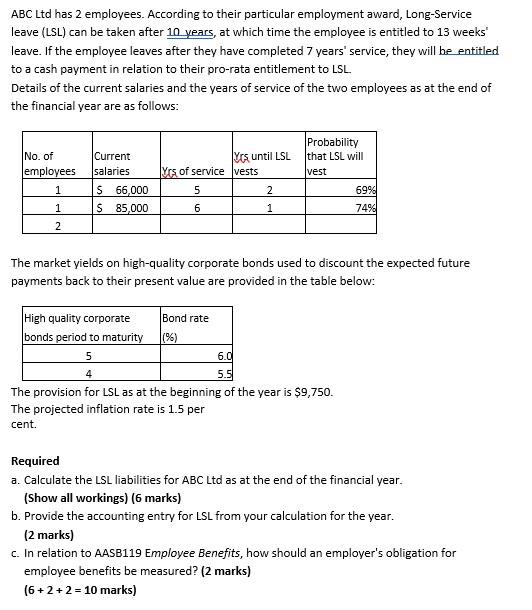

ABC Ltd has 2 employees. According to their particular employment award, Long-Service leave (LSL) can be taken after 10 years, at which time the employee is entitled to 13 weeks" leave. If the employee leaves after they have completed 7 years' service, they will be entitled to a cash payment in relation to their pro-rata entitlement to LSL. Details of the current salaries and the years of service of the two employees as at the end of the financial year are as follows: Probability that LSL will Current Ys, until LSL No. of employees salaries Yrs of service vests vest 1 $ 66,000 5 2 69% 1 $ 85,000 6 1 74% 2 The market yields on high-quality corporate bonds used to discount the expected future payments back to their present value are provided in the table below: High quality corporate Bond rate bonds period to maturity (%) 5 6.0 4 5.5 The provision for LSL as at the beginning of the year is $9,750. The projected inflation rate is 1.5 per cent. Required a. Calculate the LSL liabilities for ABC Ltd as at the end of the financial year. (Show all workings) (6 marks) b. Provide the accounting entry for LSL from your calculation for the year. (2 marks) c. In relation to AASB119 Employee Benefits, how should an employer's obligation for employee benefits be measured? (2 marks) (6+2+2 = 10 marks) ABC Ltd has 2 employees. According to their particular employment award, Long-Service leave (LSL) can be taken after 10 years, at which time the employee is entitled to 13 weeks" leave. If the employee leaves after they have completed 7 years' service, they will be entitled to a cash payment in relation to their pro-rata entitlement to LSL. Details of the current salaries and the years of service of the two employees as at the end of the financial year are as follows: Probability that LSL will Current Ys, until LSL No. of employees salaries Yrs of service vests vest 1 $ 66,000 5 2 69% 1 $ 85,000 6 1 74% 2 The market yields on high-quality corporate bonds used to discount the expected future payments back to their present value are provided in the table below: High quality corporate Bond rate bonds period to maturity (%) 5 6.0 4 5.5 The provision for LSL as at the beginning of the year is $9,750. The projected inflation rate is 1.5 per cent. Required a. Calculate the LSL liabilities for ABC Ltd as at the end of the financial year. (Show all workings) (6 marks) b. Provide the accounting entry for LSL from your calculation for the year. (2 marks) c. In relation to AASB119 Employee Benefits, how should an employer's obligation for employee benefits be measured? (2 marks) (6+2+2 = 10 marks)