Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help please!! I do not know how to do the balance sheet During the current year, the following transactions affected its stockholders' equity accounts. January

help please!!

I do not know how to do the balance sheet

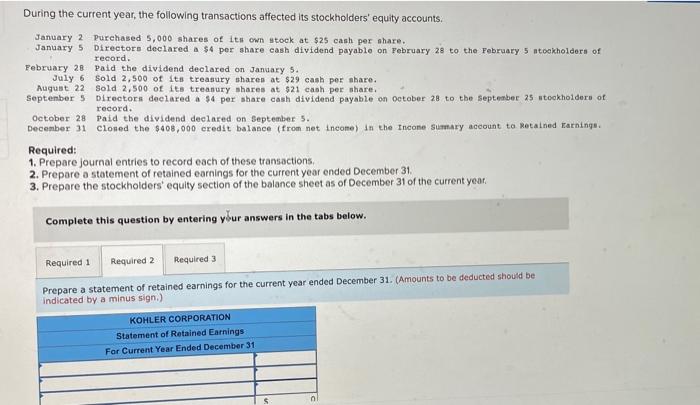

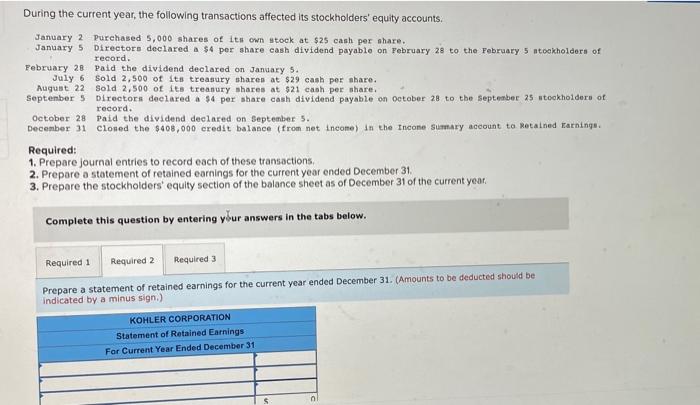

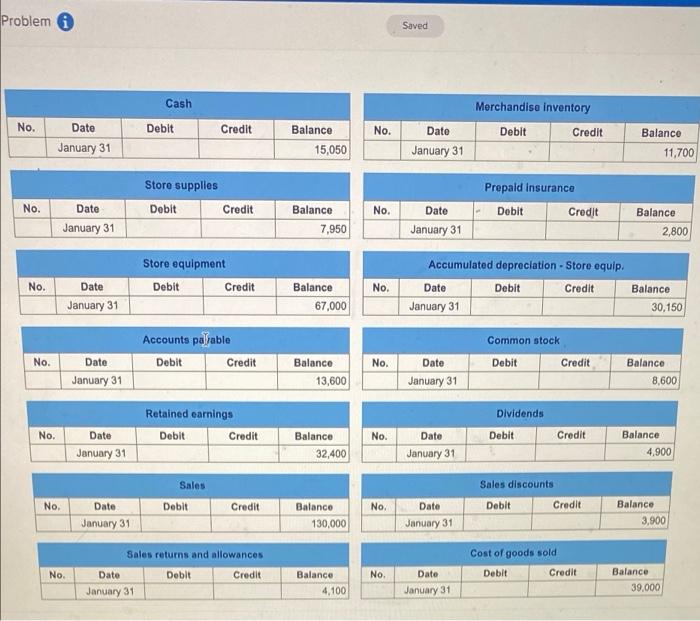

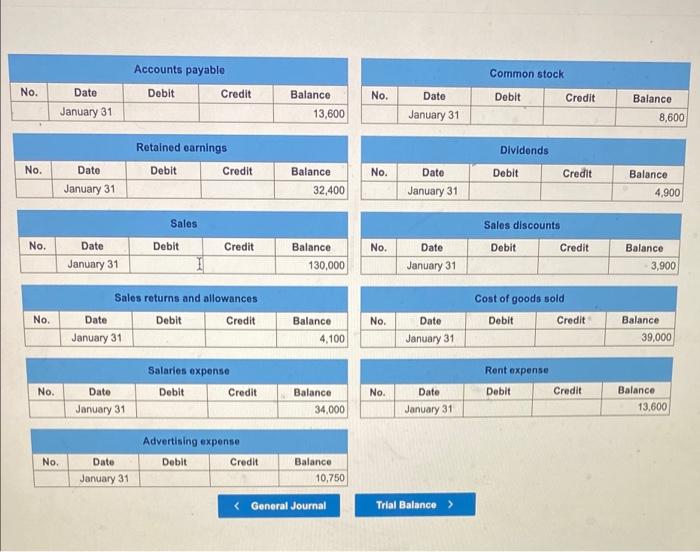

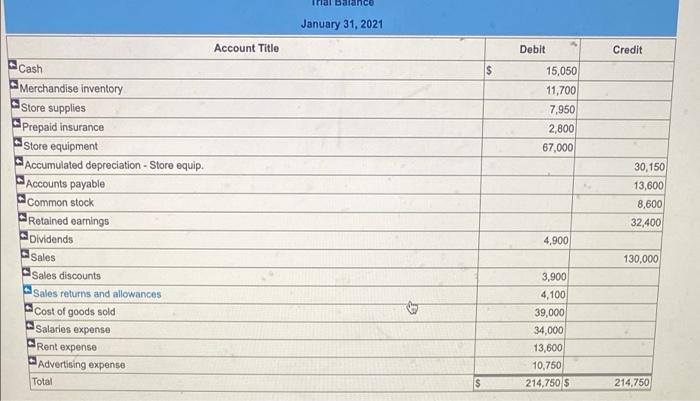

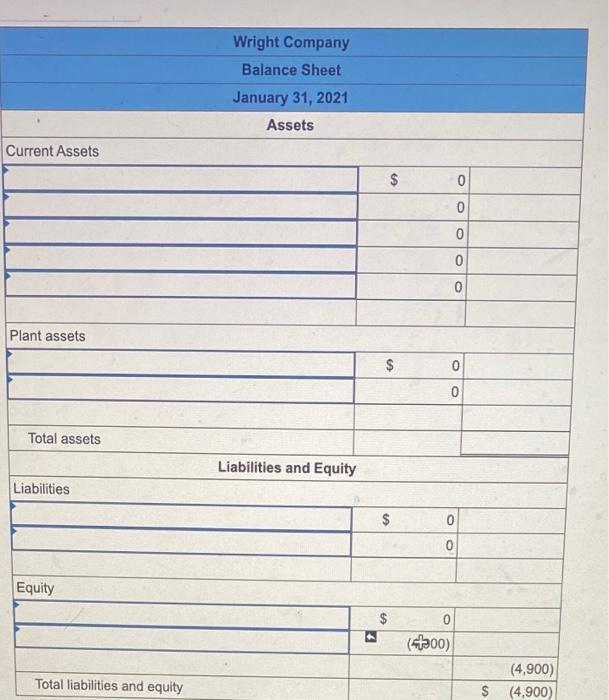

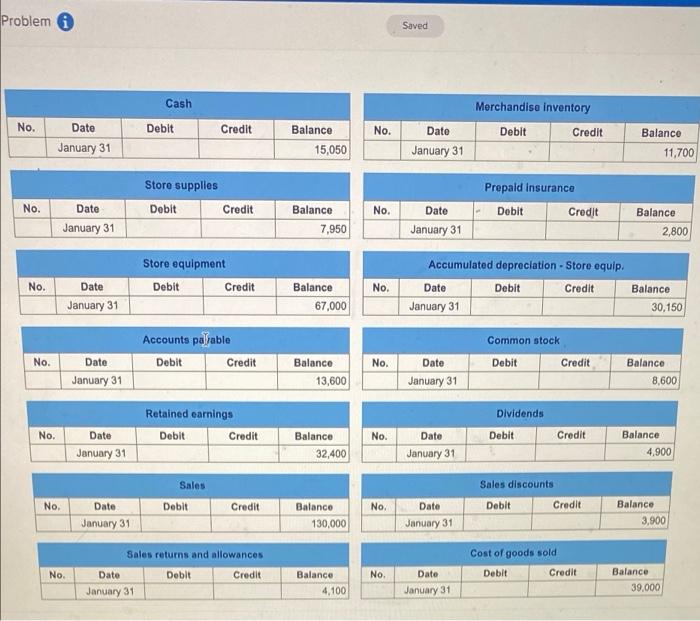

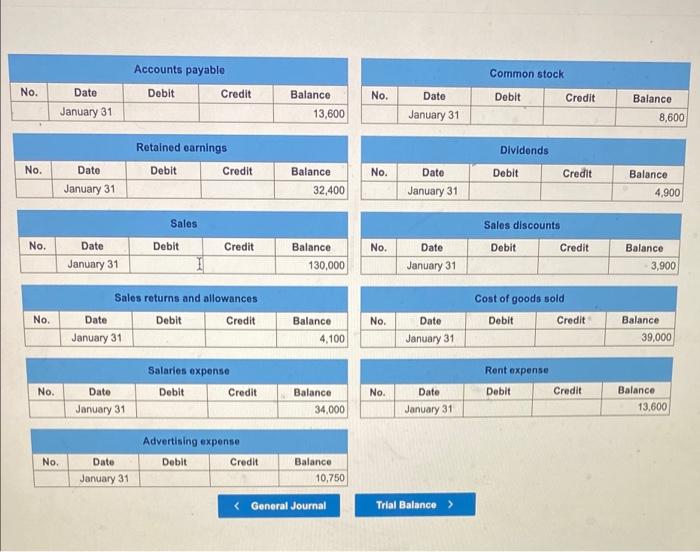

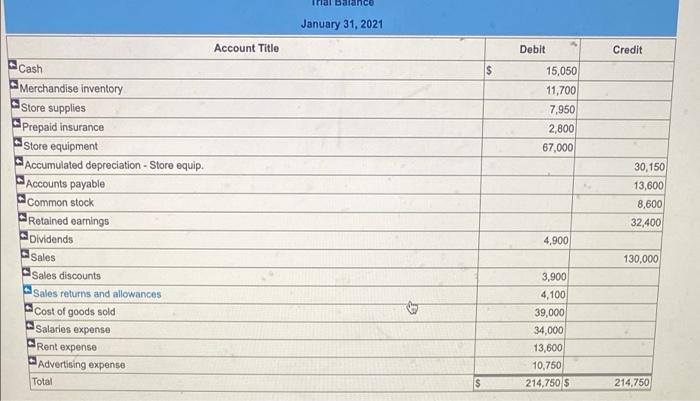

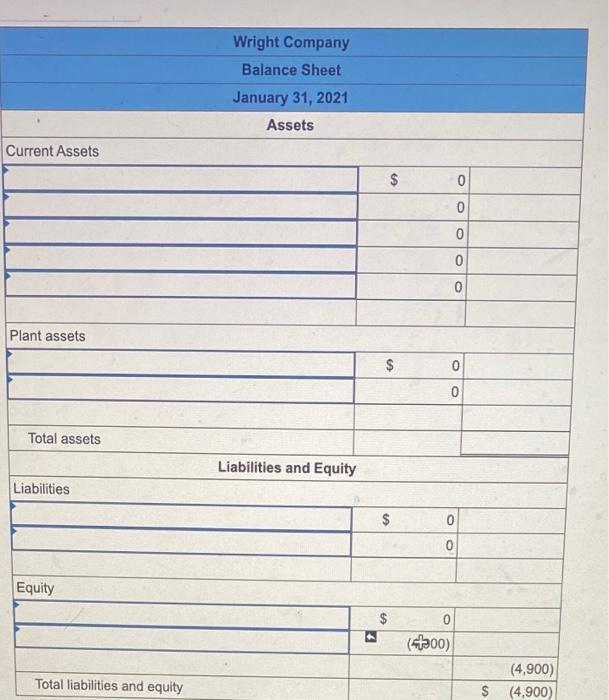

During the current year, the following transactions affected its stockholders' equity accounts. January 2 Purchased 5,000 shares of its own stock at $25 cash per share. January 5 Directors declared a $4 per share cash dividend payable on February 28 to the February 5 stockholders of record. February 28 Paid the dividend declared on January 5. July 6 Sold 2,500 of its treasury shares at $29 cash per share. August 22 Sold 2,500 of its treasury shares at $21 cash per share, September 5 Directors declared a $4 per share cash dividend payable on October 28 to the September 25 stockholders of record. October 28 Paid the dividend declared on September 5. December 31 Closed the $400,000 credit balance (from net income) in the Incone Sumary account to retained Earnings. Required: 1. Prepare journal entries to record each of these transactions 2. Prepare a statement of retained earnings for the current year ended December 31 3. Prepare the stockholders' equity section of the balance sheet as of December 31 of the current year, Complete this question by entering yur answers in the tabs below. Required 1 Required 2 Required 3 Prepare a statement of retained earnings for the current year ended December 31. (Amounts to be deducted should be indicated by a minus sign.) KOHLER CORPORATION Statement of Retained Earnings For Current Year Ended December 31 Problem i Saved Cash Merchandise inventory Debit Credit No. Debit Credit No. Date Date January 31 Balance 15,050 January 31 Balance 11,700 Store supplies Debit Credit Prepaid insurance Debit Credit No. No. Date January 31 Balance 7,950 Date January 31 Balance 2,800 Store equipment Debit Credit No. No. Date January 31 Balance 67,000 Accumulated depreciation - Store equip, Date Debit Credit January 31 Balance 30,150 Accounts payable Debit Credit Common stock Debit Credit No. No. Date January 31 Balance 13,600 Date January 31 Balance 8,600 Retained earnings Debit Credit Dividends Debit No. No. Credit Date January 31 Balance 32,400 Date January 31 Balance 4,900 Sales Debit Sales discounts Debit Credit No. Credit No. Date January 31 Balanco 130,000 Date January 31 Balance 3,900 Sales returns and allowances Cost of goods sold Debit Credit No. Debit Credit No. Date January 31 Balance 4,100 Date January 31 Balance 39.000 Common stock Accounts payable Debit Credit No. No. Debit Credit Date January 31 Balance 13,600 Date January 31 Balance 8,600 No. Retained earnings Debit Credit Dividends Debit No. Balance 32,400 Dato January 31 Credit Date January 31 Balance 4,900 Sales No. Debit Sales discounts Debit Credit Credit No. Date January 31 Balance 130,000 Date January 31 Balance 3,900 Cost of goods sold Debit Credit No. Sales returns and allowances Date Debit Credit January 31 No. Balance 4,100 Date January 31 Balance 39,000 Salaries expense Debit Credit Rent expense Debit No. No. Credit Date January 31 Balance 34,000 Date January 31 Balance 13,600 Advertising expense Debit Credit No. Date January 31 Balance 10,750 Arial Balance January 31, 2021 Account Title 5 Debit Credit $ 15,050 11,700 7,950 2,800 67,000 Cash Merchandise inventory Store supplies Prepaid insurance Store equipment Accumulated depreciation - Store equip. Accounts payable Common stock Retained earnings Dividends Sales Sales discounts Sales returns and allowances Cost of goods sold Salaries expense Rent expense Advertising expense Total 30,150 13,600 8,600 32,400 4,900 130,000 3,900 4,100 39,000 34,000 13,600 10.750 214.750 $ $ 214.750 Wright Company Balance Sheet January 31, 2021 Assets Current Assets $ 0 0 0 0 0 Plant assets $ 0 0 Total assets Liabilities and Equity Liabilities $ $ 0 O Equity $ 0 (400) Total liabilities and equity (4,900) $ (4,900)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started