Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help please im getting stuck at the req 1b 0 Required information [The following information applies to the questions displayed below) On December 1 Year

help please im getting stuck at the req 1b

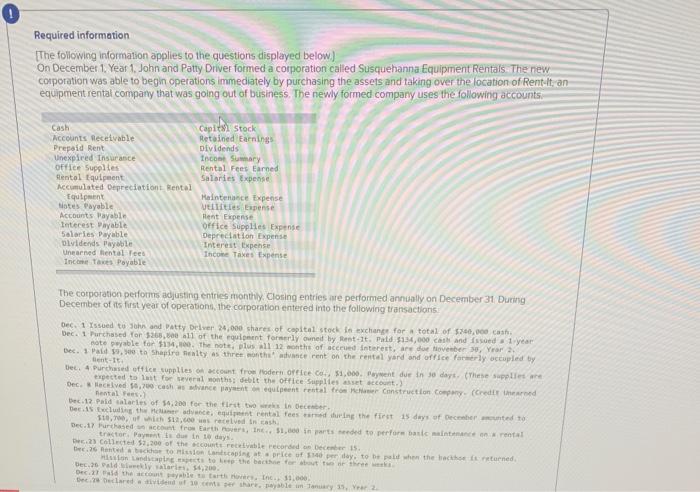

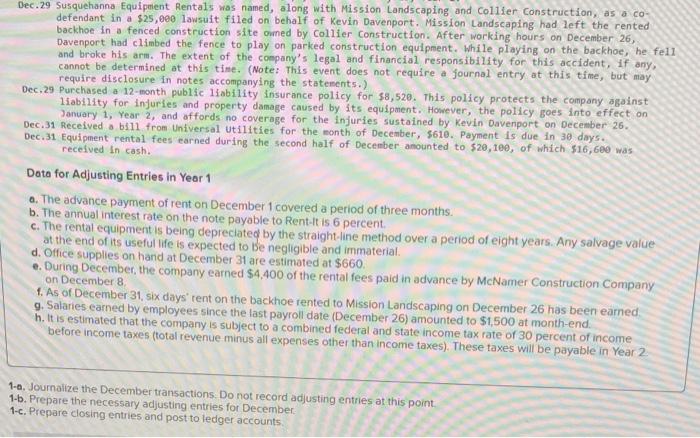

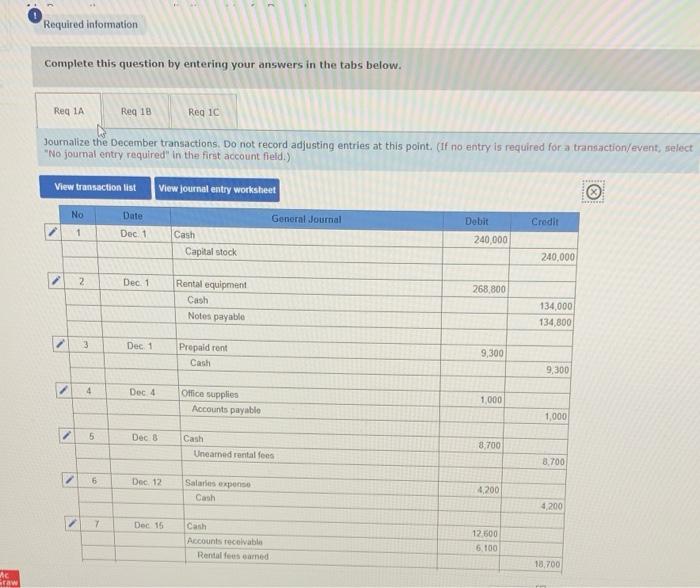

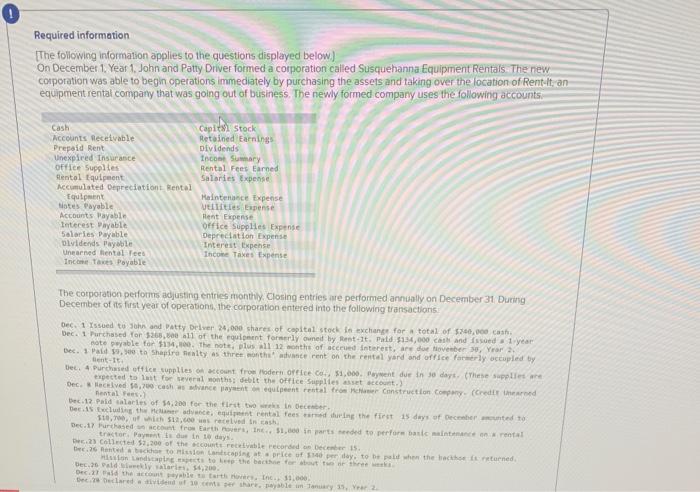

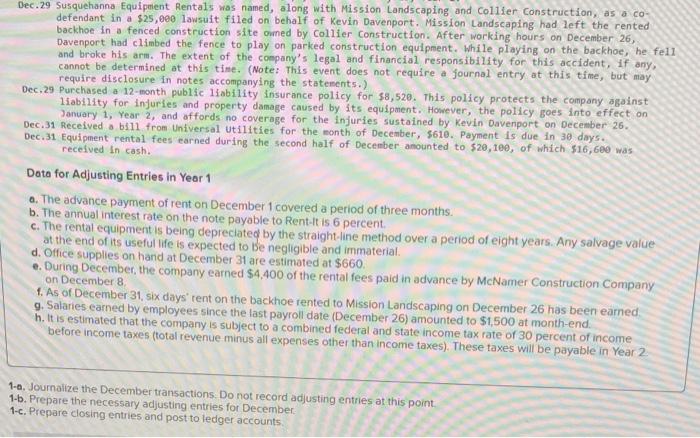

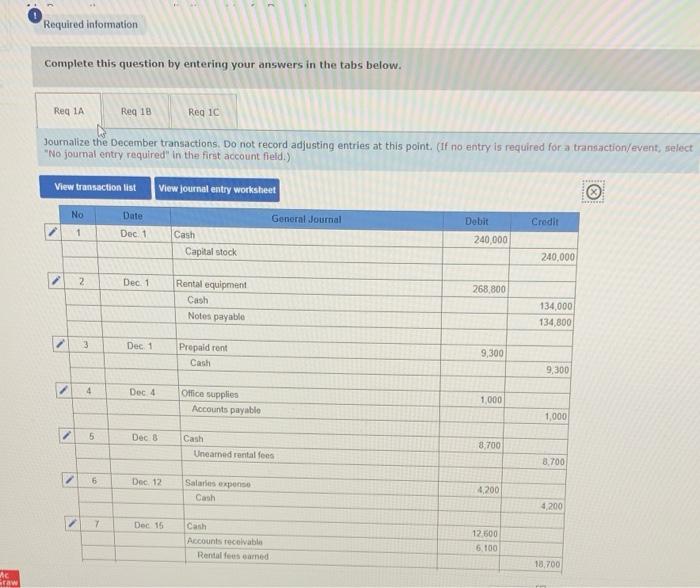

0 Required information [The following information applies to the questions displayed below) On December 1 Year 1. John and Patty Driver formed a corporation called Susquehanna Equipment Rentals The new corporation was able to begin operations immediately by purchasing the assets and taking over the location of Rent-lt an equipment rental company that was going out of business. The newly formed company uses the following accounts. Capital Stock Retained Earnings Dividends Inco Summary Rental Fees Earned Salaries Expense Cash Accounts Receivable Prepaid Rent Unexpired Insurance Office Supplies Sentol Equipment Accumulated Depreciation Rental Equipment Notes Payable Accounts Payable Interest Payable Salaries Payable olvidends Payable Une and Rental Tees Income Tax Payable Maintenance Expense Ulities Expense Hent Expense Office Supplies Expense Depreciation Expense Interest Expense Income Tax Expense The corporation performs adjusting entries monthly, Closing entries are performed annually on December 31 During December of its first year of operations, the corporation entered into the following transactions Dec. 1 Yssued to you and Patty Driver 24,000 shares of capital stock in exchange for total of $340,000 cash Dec. 1 Purchased for 5368.00 all of the equipment formerly owned by Restit. Pald $134,000 cash and issod 1 year note payable for $114. The note, plus all 12 months of accrued interest, are due to be . Year Dec. 1 Pald 5.500th Shapiralty as three months we rent on the real yard and office formerly occupied by Rent-it. Det. 4 purchased office supplies on account from Modern Office Co. 51,000. Payment due in 30 days. These supplies are expected to last for several months bit the office Supplies asset account Dec laceved 50,700 cavance payentupant rental from Construction Commy (Credit thered antalo Dec. 12 Paid stories of 54,200 for the first to win December Detecting th He decentral fees and thing the first 15 days of December uted to $10,00, of which are tradelved in cash Dec. 17 Purchased from Earth roversInc. 11,600 in parts needed to perfora basic maintenance on rental tractor Payant is due tn 18 days De Collected $1.200 of the court receivable recorded on December 15. te ne bih to mission Landscaping price of 1140 per day, to the pat when the bacho turned Hon Land to be the bath for better the Beso Pately 54,200 De the let tartson Inc. $1.000 De Declaredato 10 hayable in-Taury 1.2 Dec.29 Susquehanna Equipment Rentals was named, along with Mission Landscaping and Collier Construction, as a co defendant in a $25,000 lawsuit filed on behalf of Kevin Davenport. Mission Landscaping had left the rented backhoe in a fenced construction site owned by Collier Construction. After working hours on December 26, Davenport had climbed the fence to play on parked construction equipment. While playing on the backhoe, he fell and broke his arm. The extent of the company's legal and financial responsibility for this accident, if any, cannot be determined at this time. (Note: This event does not require a journal entry at this time, but may require disclosure in notes accompanying the statements.) Dec. 29 Purchased a 12-month public liability insurance policy for $8,520. This policy protects the company against liability for injuries and property damage caused by its equipment. However, the policy goes into effect on January 1, Year 2, and affords no coverage for the injuries sustained by Kevin Davenport on December 26. Dec.31 Received a bill from Universal Utilities for the month of December, 5610. Payment is due in 30 days. Dec.31 Equipment rental fees earned during the second half of December amounted to $20,100, of which $16,600 was received in cash. Data for Adjusting Entries in Year 1 a. The advance payment of rent on December 1 covered a period of three months. b. The annual interest rate on the note payable to Rent-It is 6 percent. c. The rental equipment is being depreciated by the straight line method over a period of eight years. Any salvage value at the end of its useful life is expected to be negligible and immaterial. d. Office supplies on hand at December 31 are estimated at $660. e. During December, the company earned $4,400 of the rental fees paid in advance by McNamer Construction Company 1. As of December 31, six days' tent on the backhoe rented to Mission Landscaping on December 26 has been earned. g. Salaries earned by employees since the last payroll date (December 26) amounted to $1,500 at month-end. h. It is estimated that the company is subject to a combined federal and state income tax rate of 30 percent of income before income taxes (total revenue minus all expenses other than income taxes). These taxes will be payable in Year 2 1-0. Journalize the December transactions. Do not record adjusting entries at this point 1-b. Prepare the necessary adjusting entries for December 1-c. Prepare closing entries and post to ledger accounts Required information Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Reg 10 Joumalize the December transactions. Do not record adjusting entries at this point. (If no entry is required for a transaction/event, select "No joumal entry required" in the first account field.) View transaction list View journal entry worksheet No General Journal Date Dec. 1 Credit 1 Cash Dobit 240,000 Capital stock 240,000 2 Dec. 1 268,800 Rental equipment Cash Notes payable 134,000 134,800 3 Dec 1 Prepaid ront Cash 9,300 9,300 4 Dec 4 Office supplies Accounts payable 1.000 1,000 5 Dec 8 Cash Uneamed rental fees 8700 8.700 7 6 Dec 12 Salaries expose 4,200 Cash 4,200 Dec 15 Cars Accounts receivable Rental fees samed 12 600 6.100 18.700 no Taw 0 Required information [The following information applies to the questions displayed below) On December 1 Year 1. John and Patty Driver formed a corporation called Susquehanna Equipment Rentals The new corporation was able to begin operations immediately by purchasing the assets and taking over the location of Rent-lt an equipment rental company that was going out of business. The newly formed company uses the following accounts. Capital Stock Retained Earnings Dividends Inco Summary Rental Fees Earned Salaries Expense Cash Accounts Receivable Prepaid Rent Unexpired Insurance Office Supplies Sentol Equipment Accumulated Depreciation Rental Equipment Notes Payable Accounts Payable Interest Payable Salaries Payable olvidends Payable Une and Rental Tees Income Tax Payable Maintenance Expense Ulities Expense Hent Expense Office Supplies Expense Depreciation Expense Interest Expense Income Tax Expense The corporation performs adjusting entries monthly, Closing entries are performed annually on December 31 During December of its first year of operations, the corporation entered into the following transactions Dec. 1 Yssued to you and Patty Driver 24,000 shares of capital stock in exchange for total of $340,000 cash Dec. 1 Purchased for 5368.00 all of the equipment formerly owned by Restit. Pald $134,000 cash and issod 1 year note payable for $114. The note, plus all 12 months of accrued interest, are due to be . Year Dec. 1 Pald 5.500th Shapiralty as three months we rent on the real yard and office formerly occupied by Rent-it. Det. 4 purchased office supplies on account from Modern Office Co. 51,000. Payment due in 30 days. These supplies are expected to last for several months bit the office Supplies asset account Dec laceved 50,700 cavance payentupant rental from Construction Commy (Credit thered antalo Dec. 12 Paid stories of 54,200 for the first to win December Detecting th He decentral fees and thing the first 15 days of December uted to $10,00, of which are tradelved in cash Dec. 17 Purchased from Earth roversInc. 11,600 in parts needed to perfora basic maintenance on rental tractor Payant is due tn 18 days De Collected $1.200 of the court receivable recorded on December 15. te ne bih to mission Landscaping price of 1140 per day, to the pat when the bacho turned Hon Land to be the bath for better the Beso Pately 54,200 De the let tartson Inc. $1.000 De Declaredato 10 hayable in-Taury 1.2 Dec.29 Susquehanna Equipment Rentals was named, along with Mission Landscaping and Collier Construction, as a co defendant in a $25,000 lawsuit filed on behalf of Kevin Davenport. Mission Landscaping had left the rented backhoe in a fenced construction site owned by Collier Construction. After working hours on December 26, Davenport had climbed the fence to play on parked construction equipment. While playing on the backhoe, he fell and broke his arm. The extent of the company's legal and financial responsibility for this accident, if any, cannot be determined at this time. (Note: This event does not require a journal entry at this time, but may require disclosure in notes accompanying the statements.) Dec. 29 Purchased a 12-month public liability insurance policy for $8,520. This policy protects the company against liability for injuries and property damage caused by its equipment. However, the policy goes into effect on January 1, Year 2, and affords no coverage for the injuries sustained by Kevin Davenport on December 26. Dec.31 Received a bill from Universal Utilities for the month of December, 5610. Payment is due in 30 days. Dec.31 Equipment rental fees earned during the second half of December amounted to $20,100, of which $16,600 was received in cash. Data for Adjusting Entries in Year 1 a. The advance payment of rent on December 1 covered a period of three months. b. The annual interest rate on the note payable to Rent-It is 6 percent. c. The rental equipment is being depreciated by the straight line method over a period of eight years. Any salvage value at the end of its useful life is expected to be negligible and immaterial. d. Office supplies on hand at December 31 are estimated at $660. e. During December, the company earned $4,400 of the rental fees paid in advance by McNamer Construction Company 1. As of December 31, six days' tent on the backhoe rented to Mission Landscaping on December 26 has been earned. g. Salaries earned by employees since the last payroll date (December 26) amounted to $1,500 at month-end. h. It is estimated that the company is subject to a combined federal and state income tax rate of 30 percent of income before income taxes (total revenue minus all expenses other than income taxes). These taxes will be payable in Year 2 1-0. Journalize the December transactions. Do not record adjusting entries at this point 1-b. Prepare the necessary adjusting entries for December 1-c. Prepare closing entries and post to ledger accounts Required information Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Reg 10 Joumalize the December transactions. Do not record adjusting entries at this point. (If no entry is required for a transaction/event, select "No joumal entry required" in the first account field.) View transaction list View journal entry worksheet No General Journal Date Dec. 1 Credit 1 Cash Dobit 240,000 Capital stock 240,000 2 Dec. 1 268,800 Rental equipment Cash Notes payable 134,000 134,800 3 Dec 1 Prepaid ront Cash 9,300 9,300 4 Dec 4 Office supplies Accounts payable 1.000 1,000 5 Dec 8 Cash Uneamed rental fees 8700 8.700 7 6 Dec 12 Salaries expose 4,200 Cash 4,200 Dec 15 Cars Accounts receivable Rental fees samed 12 600 6.100 18.700 no Taw

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started