help please

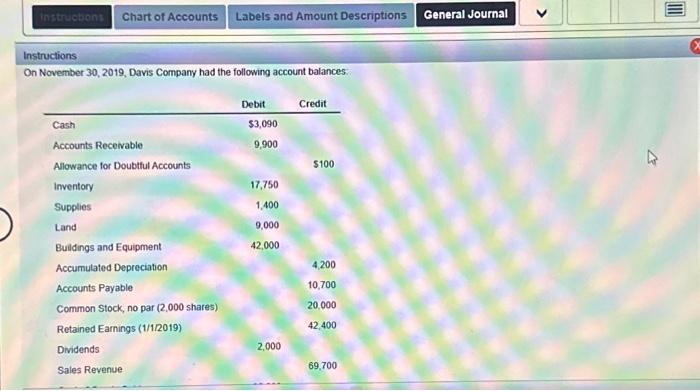

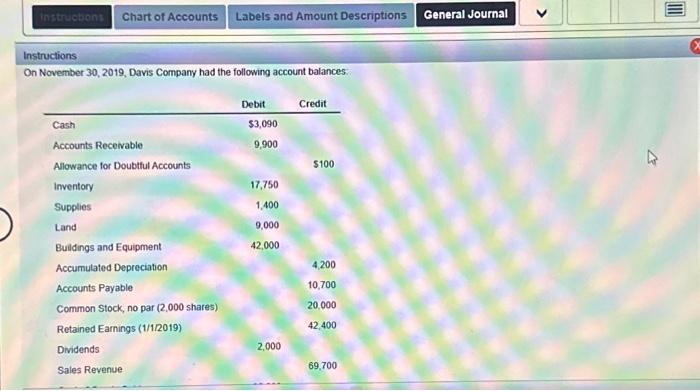

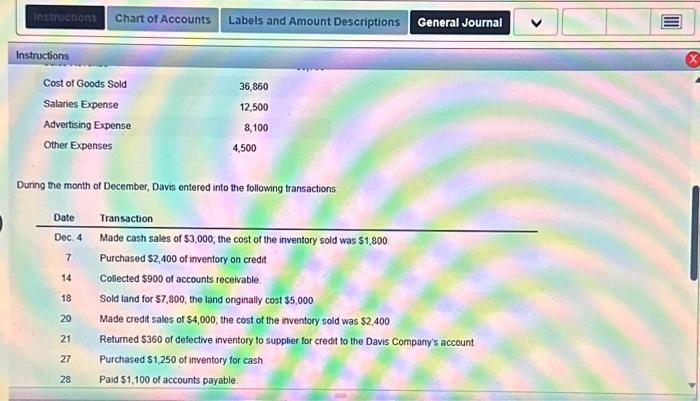

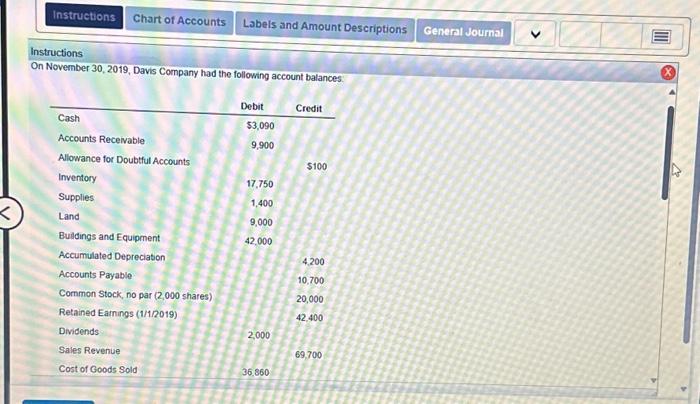

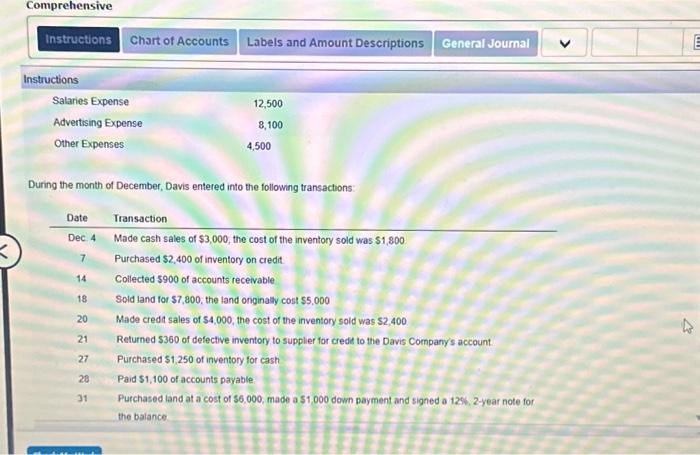

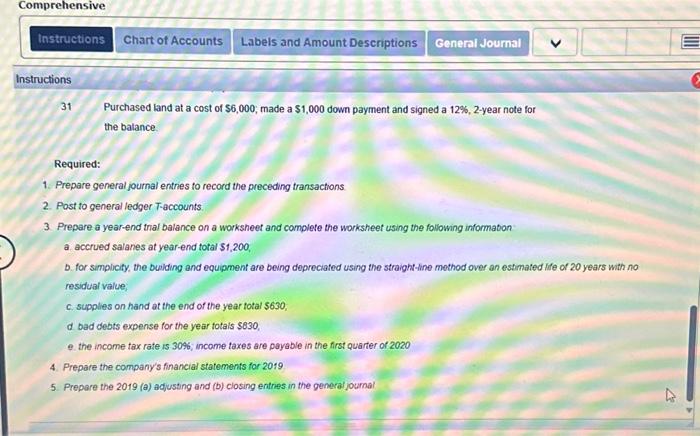

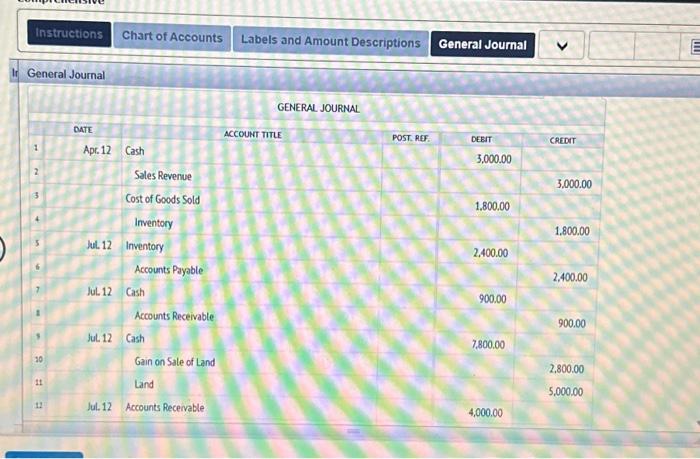

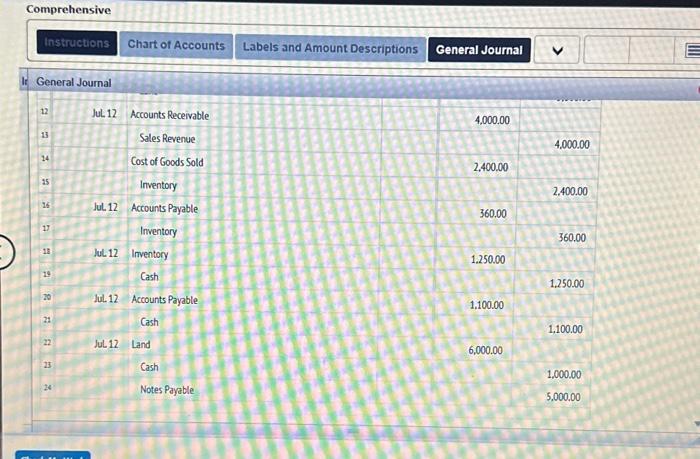

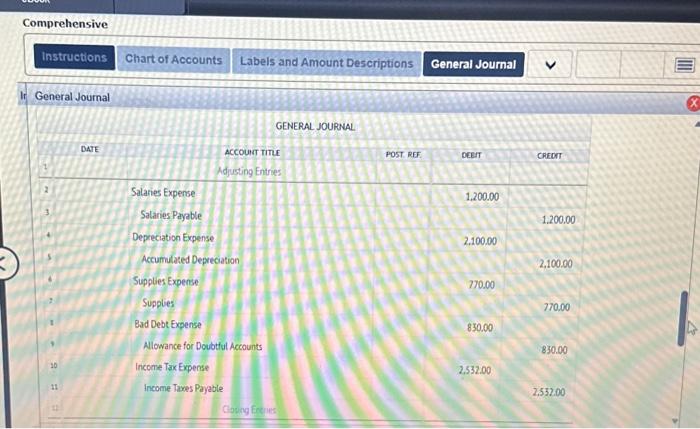

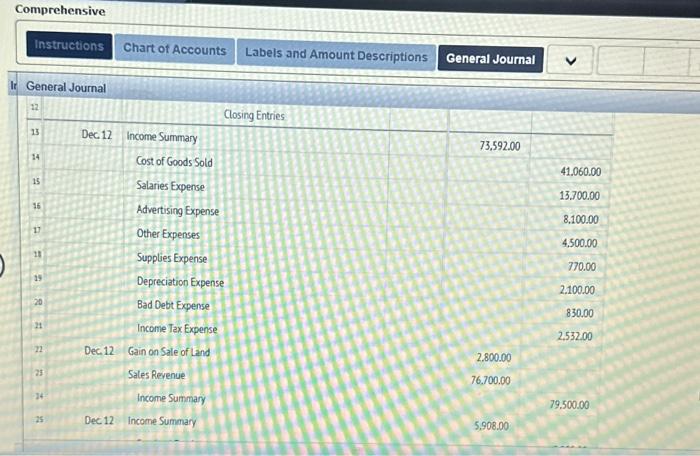

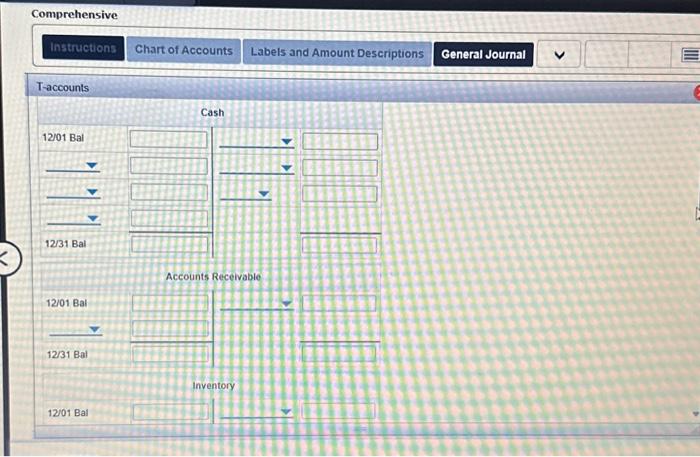

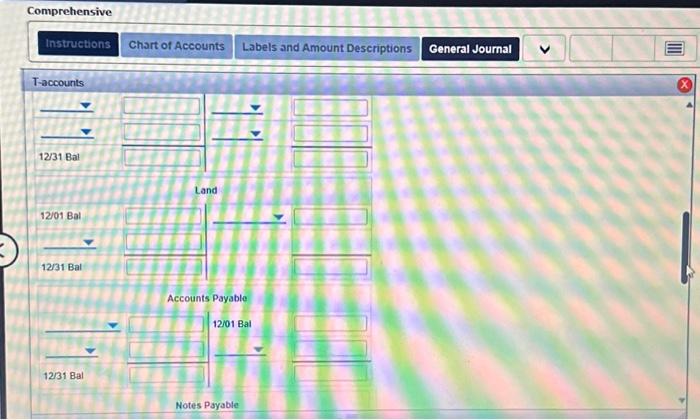

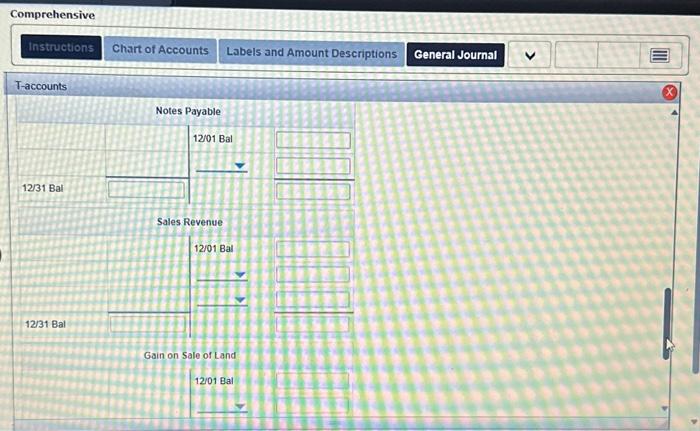

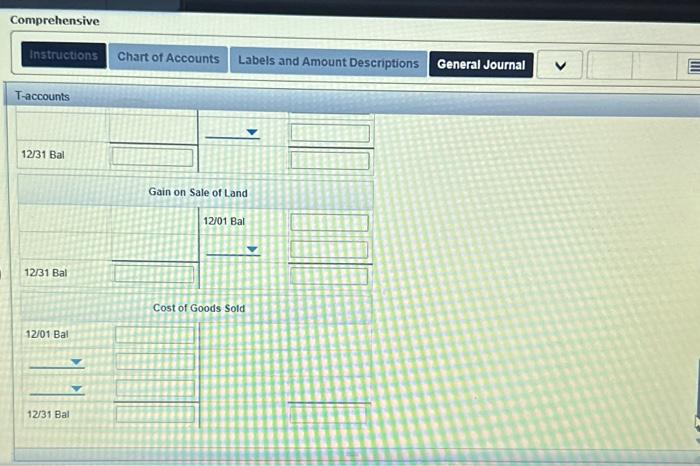

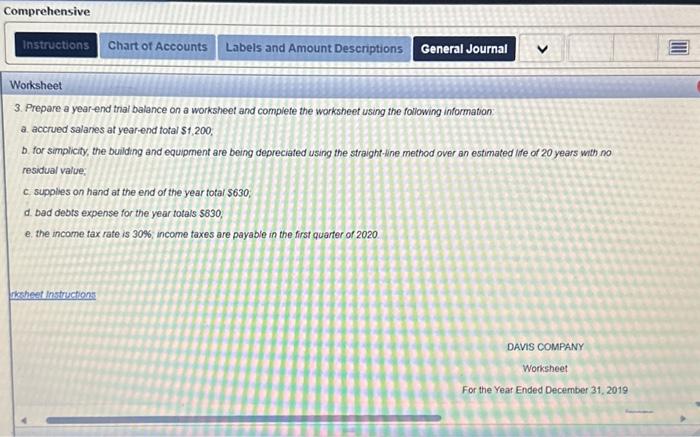

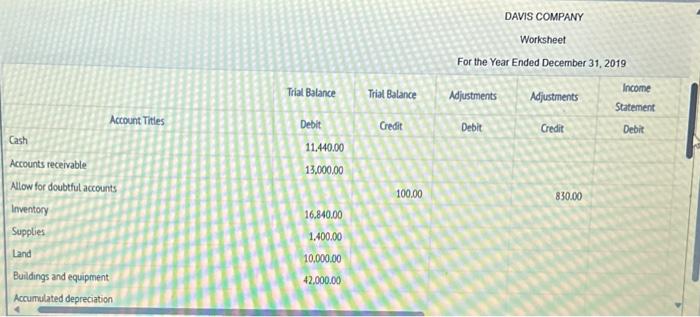

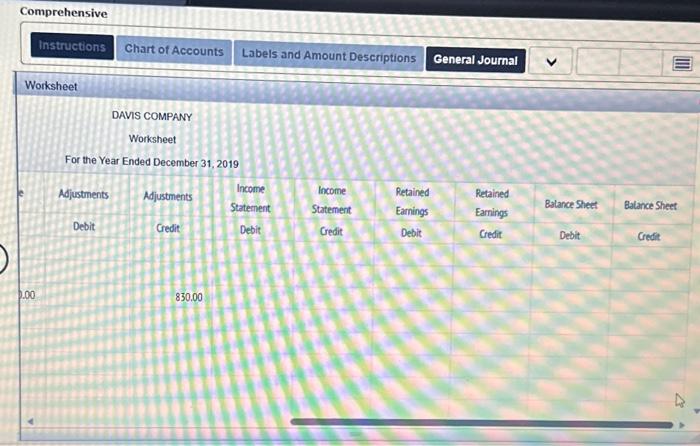

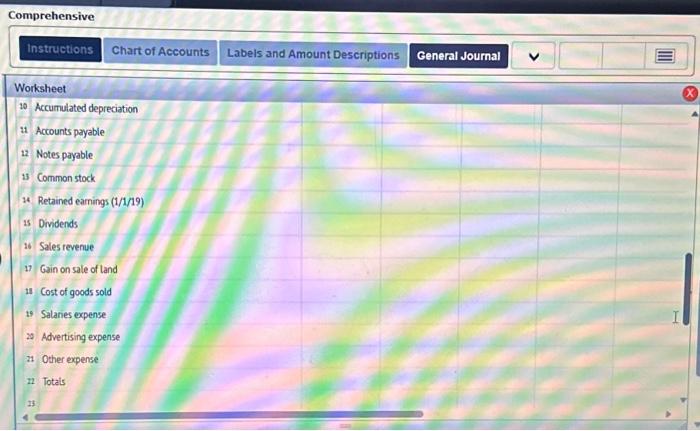

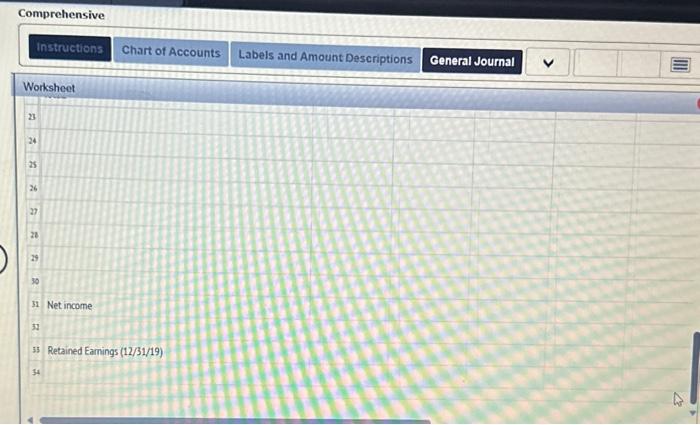

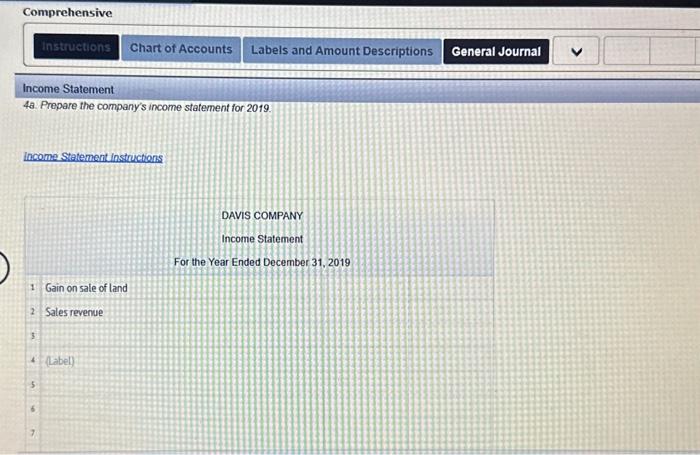

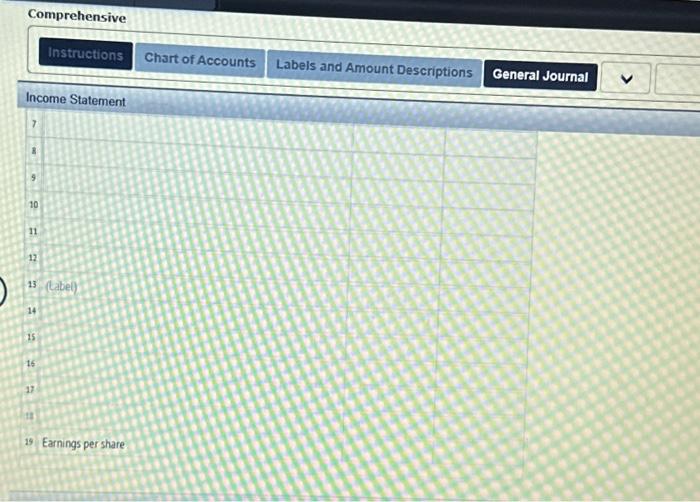

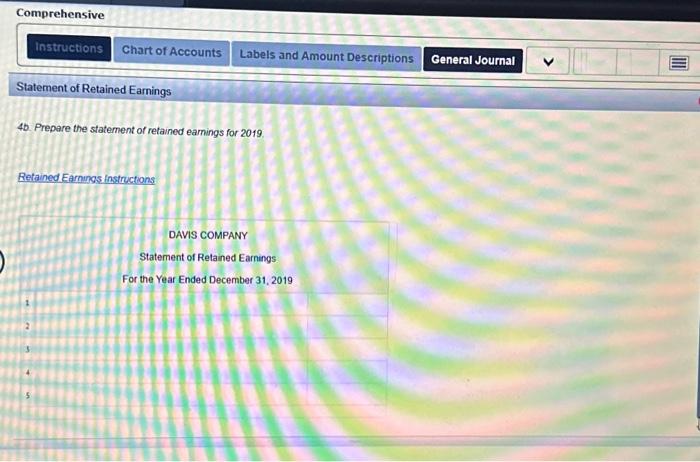

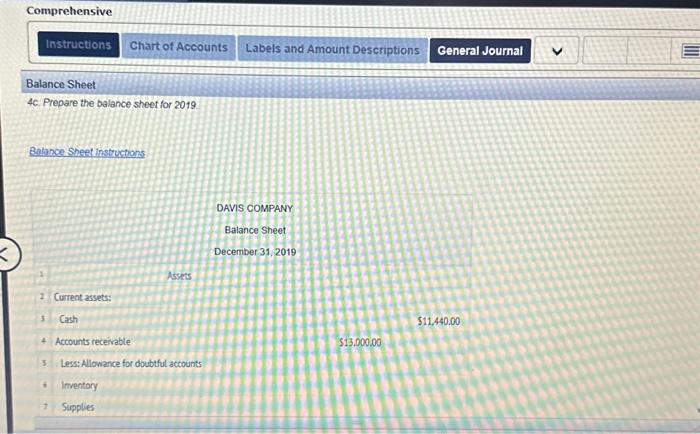

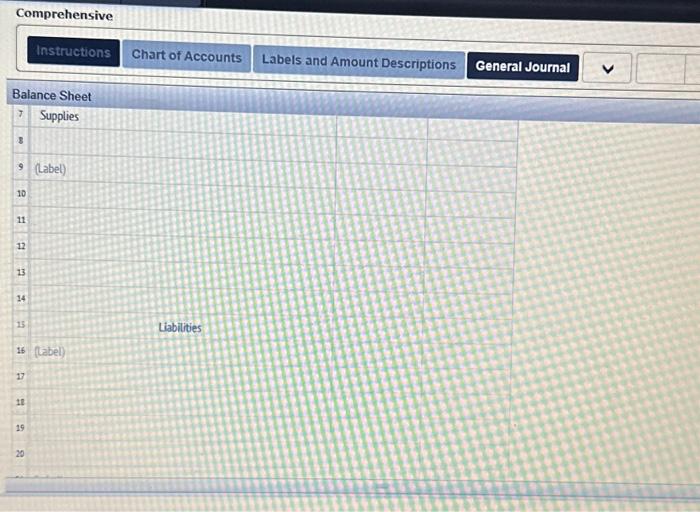

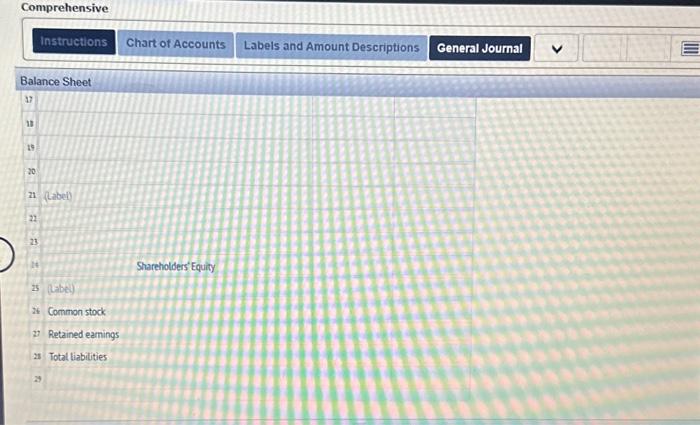

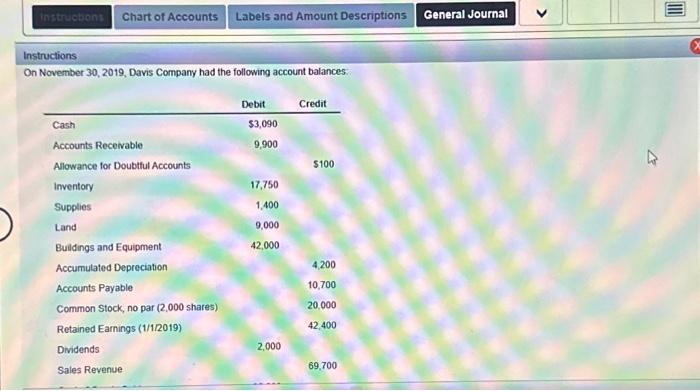

On November 30, 2019, Davis Company had the following account balances During the month of December, Davis entered into the following transactions Comprehensive instructions Chart of Accounts Labels and Amount Descriptions General Journal Worksheet 2 24 25 26 27 28 29 30 31 Net income is Retained Earnings (12/31/19) 34 Comprehensive instructions Chart of Accounts Labels and Amount Descriptions General Journal Income Statement 4a. Prepare the company's income statement for 2019. income Statement instructions DAVIS COMPANY Income Statement For the Year Ended December 31, 2019 1 Gain on sale of land 2 Sales revenue 3 4 (Label) 5 6 , Comprehensive Instructions Chart of Accounts Labels and Amount Descriptions General Journal Traccounts 12/31Bal 12/31Bal Gain on Sale of Land Cost of Goods Sold 1201 Bal 12/31Bal Comprehensive Comprehensive Instructions Chart of Accounts Labels and Amount Descriptions General Joumal V T-accounts 12/31Bal Land 12/01Bal 12/31Bal Accounts Payable 12/31 Bal 1201Ba Notes Payable 4c. Prepare the balance sheet for 2019 Comprehensive Instructions Chart of Accounts Labels and Amount Descriptions General Journal Worksheet DAVIS COMPANY Worksheet For the Year Ended December 31, 2019 , Adjustments Debit Adjustments Income Income Statement Statement Retained credit Debit Gedit Earnings Balance Shet Eatance Sheet Debit 830.00 For the Year Ended December 31. 2019 31 Purchased land at a cost of $6,000, made a $1,000 down payment and signed a 12%,2-year note for the balance. Required: 1. Prepare general journal entines to record the preceding transactions. 2. Post to general ledger T-accounts. 3. Prepare a year-end trial batance on a warksheet and complete the worksheot using the following information a. accrued salaries at year-end total $1,200, b. for simplicity, the building and equipment are beving depreciated using the straight-ine method over an estimated life of 20 years with no residual value; c. supplies on hand at the end of the year total $630, d bad debts expense for the year totals $830. e. the income tax rate is 30%, income taxes are payabie in the first quarter of 2020 4. Prepare the company's financial statements for 2019 5. Prepare the 2019 (a) adjusting and (b) closing entnes in the general journal' Comprehensive instructions Chart of Accounts Labels and Amount Descriptions General Journal T-accounts 12/31 Bal Cash Accounts Receivable 12/01Ba! 12/31Bal inventory 1201Bal Instructions Chart of Accounts Labels and Amount Descriptions General Journal GENERAL JOURNAL General Journal Comprehensive instructions Chart of Accounts Labels and Amount Descriptions General Journal Worksheet 10 Accumulated depreciation 11 Accounts payable 12 Notes payable is Common stock 14. Retained earnings (1/1/19) 15 Dividends 16 Sales revenue 17) Gain on sale of tand it Cost of goods sold 19 Salanies expense Advertising expense Other expense Totals Comprehensive Instructions Chart of Accounts Labels and Amount Descriptions General Journal Income Statement 7 8 , 10 11 12 13 (Cabel) 14 15 16 1) 19 Earnings per share 4b. Prepare the statement of retained eamings for 2019 Comprehensive Instructions Chart of Accounts Labels and Amount Descriptions General Journal Balance Sheet 1) it 19 30 nt (tabel) n. 21 (4) Shareholders Equity Is (label) is Common stock v) Retained eamings as Total tiabilities 3. Comprehensive Instructions Chart of Accounts Labels and Amount Descriptions General Journal GENERAL JOURLAL ir General Journal 17. DATE AccoundtimePOSTREE.DEETCreorAdjustingEntres:SalariesExpense1.200.00SatariesPayableDepreciationExpense1.200.00AccumulatedDepreciation Supplies Expense 2.100.00 Supplies Bad Debt Expense Allowance for Doubdul Accounts Income Tax Expense 770.00 2,100.00 770.00 830.00 830.00 2,532.00 2.532 .00 Instructions On Novernber 30,2019 , Davis Company had the following account balances: Comprehensive Comprehensive Instructions Chart of Accounts Labels and Amount Descriptions General Journal Balance Sheet 7 Supplies 8 9 (Label) 10 11 12 13 14 15 Liabilities 16 (tabel) 17 11 19 20 During the month of December, Davis entered into the following transactions Comprehensive Instructions Chart of Accounts Labels and Amount Descriptions General Joumal General Journal 3. Prepare a yearend thal balance on a worksheet and complete the worksheet using the following information a. accrued salanes at year-end total $1,200, D. for simplicity, the building and equipment are being depreciated using the straight-line method over an estimated ife of 20 years with no residual value; c. supplies on hand at the end of the year fotar 5630 , d. bad debts expense for the year totals $830; e. the income tax rate is 30%; income taxes are payable in the first quarter or 2020 . 31 Purchased land at a cost of $6,000; made a $1,000 down payment and signed a 12%,2-year note for the balance. Required: 1. Prepare general journal entries fo record the preceding transactions. 2. Post to general ledger T-accounts. 3 Prepare a year-end tnal balance on a worksheet and complete the worksheet using the following information a. accrued salanes at year-end total $1,200, D. for simplicity, the building and equipment are being depreciated using the straight-line mothod over an estimated he of 20 years with no residual value; c. supplies on hand at the end of the year total $630, d bad debts expense for the year fotals $830, e. the income tax rate is 30%; incame taxes are payable in the first quarter or 2020 4. Prepare the company's financial statements for 2019 5. Prepare the 2019 (a) edjusting and (b) closing entres in the general joumal On November 30, 2019, Davis Company had the following account balances During the month of December, Davis entered into the following transactions Comprehensive instructions Chart of Accounts Labels and Amount Descriptions General Journal Worksheet 2 24 25 26 27 28 29 30 31 Net income is Retained Earnings (12/31/19) 34 Comprehensive instructions Chart of Accounts Labels and Amount Descriptions General Journal Income Statement 4a. Prepare the company's income statement for 2019. income Statement instructions DAVIS COMPANY Income Statement For the Year Ended December 31, 2019 1 Gain on sale of land 2 Sales revenue 3 4 (Label) 5 6 , Comprehensive Instructions Chart of Accounts Labels and Amount Descriptions General Journal Traccounts 12/31Bal 12/31Bal Gain on Sale of Land Cost of Goods Sold 1201 Bal 12/31Bal Comprehensive Comprehensive Instructions Chart of Accounts Labels and Amount Descriptions General Joumal V T-accounts 12/31Bal Land 12/01Bal 12/31Bal Accounts Payable 12/31 Bal 1201Ba Notes Payable 4c. Prepare the balance sheet for 2019 Comprehensive Instructions Chart of Accounts Labels and Amount Descriptions General Journal Worksheet DAVIS COMPANY Worksheet For the Year Ended December 31, 2019 , Adjustments Debit Adjustments Income Income Statement Statement Retained credit Debit Gedit Earnings Balance Shet Eatance Sheet Debit 830.00 For the Year Ended December 31. 2019 31 Purchased land at a cost of $6,000, made a $1,000 down payment and signed a 12%,2-year note for the balance. Required: 1. Prepare general journal entines to record the preceding transactions. 2. Post to general ledger T-accounts. 3. Prepare a year-end trial batance on a warksheet and complete the worksheot using the following information a. accrued salaries at year-end total $1,200, b. for simplicity, the building and equipment are beving depreciated using the straight-ine method over an estimated life of 20 years with no residual value; c. supplies on hand at the end of the year total $630, d bad debts expense for the year totals $830. e. the income tax rate is 30%, income taxes are payabie in the first quarter of 2020 4. Prepare the company's financial statements for 2019 5. Prepare the 2019 (a) adjusting and (b) closing entnes in the general journal' Comprehensive instructions Chart of Accounts Labels and Amount Descriptions General Journal T-accounts 12/31 Bal Cash Accounts Receivable 12/01Ba! 12/31Bal inventory 1201Bal Instructions Chart of Accounts Labels and Amount Descriptions General Journal GENERAL JOURNAL General Journal Comprehensive instructions Chart of Accounts Labels and Amount Descriptions General Journal Worksheet 10 Accumulated depreciation 11 Accounts payable 12 Notes payable is Common stock 14. Retained earnings (1/1/19) 15 Dividends 16 Sales revenue 17) Gain on sale of tand it Cost of goods sold 19 Salanies expense Advertising expense Other expense Totals Comprehensive Instructions Chart of Accounts Labels and Amount Descriptions General Journal Income Statement 7 8 , 10 11 12 13 (Cabel) 14 15 16 1) 19 Earnings per share 4b. Prepare the statement of retained eamings for 2019 Comprehensive Instructions Chart of Accounts Labels and Amount Descriptions General Journal Balance Sheet 1) it 19 30 nt (tabel) n. 21 (4) Shareholders Equity Is (label) is Common stock v) Retained eamings as Total tiabilities 3. Comprehensive Instructions Chart of Accounts Labels and Amount Descriptions General Journal GENERAL JOURLAL ir General Journal 17. DATE AccoundtimePOSTREE.DEETCreorAdjustingEntres:SalariesExpense1.200.00SatariesPayableDepreciationExpense1.200.00AccumulatedDepreciation Supplies Expense 2.100.00 Supplies Bad Debt Expense Allowance for Doubdul Accounts Income Tax Expense 770.00 2,100.00 770.00 830.00 830.00 2,532.00 2.532 .00 Instructions On Novernber 30,2019 , Davis Company had the following account balances: Comprehensive Comprehensive Instructions Chart of Accounts Labels and Amount Descriptions General Journal Balance Sheet 7 Supplies 8 9 (Label) 10 11 12 13 14 15 Liabilities 16 (tabel) 17 11 19 20 During the month of December, Davis entered into the following transactions Comprehensive Instructions Chart of Accounts Labels and Amount Descriptions General Joumal General Journal 3. Prepare a yearend thal balance on a worksheet and complete the worksheet using the following information a. accrued salanes at year-end total $1,200, D. for simplicity, the building and equipment are being depreciated using the straight-line method over an estimated ife of 20 years with no residual value; c. supplies on hand at the end of the year fotar 5630 , d. bad debts expense for the year totals $830; e. the income tax rate is 30%; income taxes are payable in the first quarter or 2020 . 31 Purchased land at a cost of $6,000; made a $1,000 down payment and signed a 12%,2-year note for the balance. Required: 1. Prepare general journal entries fo record the preceding transactions. 2. Post to general ledger T-accounts. 3 Prepare a year-end tnal balance on a worksheet and complete the worksheet using the following information a. accrued salanes at year-end total $1,200, D. for simplicity, the building and equipment are being depreciated using the straight-line mothod over an estimated he of 20 years with no residual value; c. supplies on hand at the end of the year total $630, d bad debts expense for the year fotals $830, e. the income tax rate is 30%; incame taxes are payable in the first quarter or 2020 4. Prepare the company's financial statements for 2019 5. Prepare the 2019 (a) edjusting and (b) closing entres in the general joumal