Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help please On the Data Tables - Student tab in your Excel spreadsheet, update the given information section of the Income Statement for Hello Company

help please

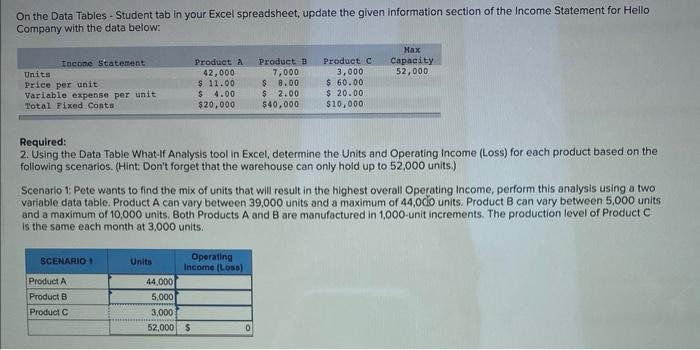

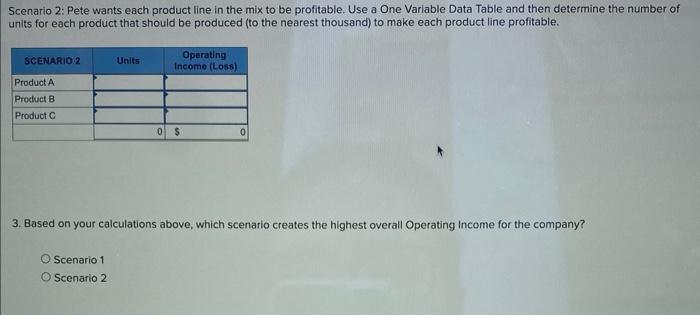

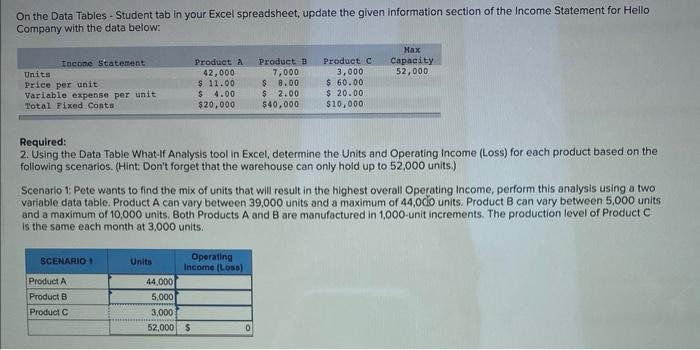

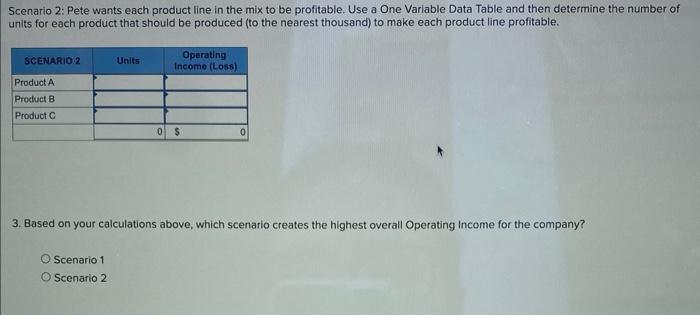

On the Data Tables - Student tab in your Excel spreadsheet, update the given information section of the Income Statement for Hello Company with the data below: Required: 2. Using the Data Table What-If Analysis tool in Excel, determine the Units and Operating income (Loss) for each product based on the following scenarios. (Hint: Don't forget that the warehouse can only hold up to 52,000 units.) Scenario 1: Pete wants to find the mix of units that will result in the highest overall Operating income, perform this analysis using a two variable data table. Product A can vary between 39,000 units and a maximum of 44,0 dio units. Product B can vary between 5,000 units and a maximum of 10,000 units. Both Products A and B are manufactured in 1,000-unit increments. The production level of Product C is the same each month at 3,000 units. Scenario 2: Pete wants each product line in the mix to be profitable. Use a One Variable Data Table and then determine the number of units for each product that should be produced (to the nearest thousand) to make each product line profitable. 3. Based on your calculations above, which scenario creates the highest overall Operating Income for the company? Scenario 1 Scenario 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started