Answered step by step

Verified Expert Solution

Question

1 Approved Answer

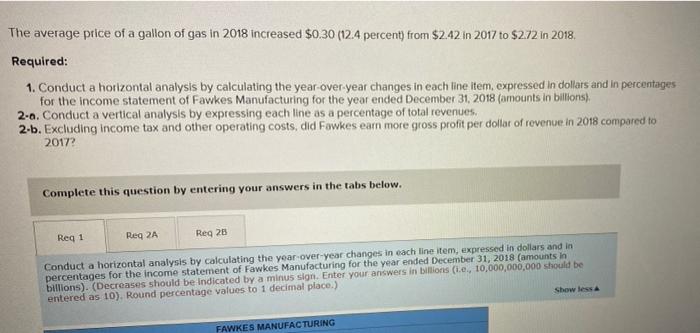

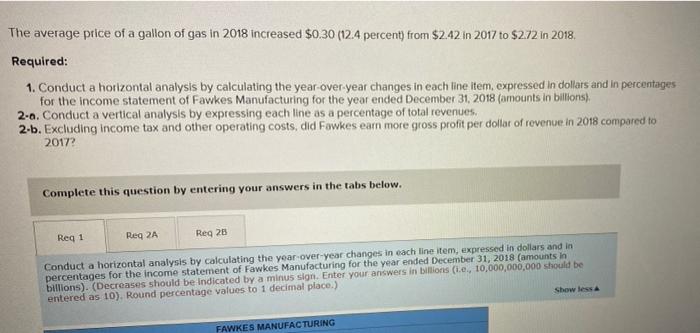

help please please The average price of a gallon of gas in 2018 increased $0.30 (12.4 percent) from $2.42 in 2017 to $2.72 in 2018

help please please

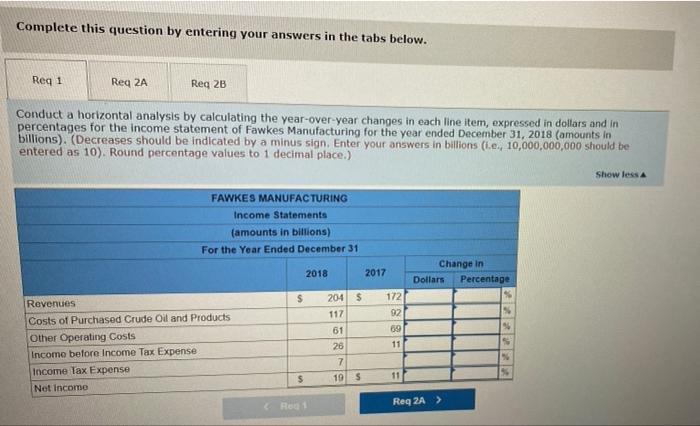

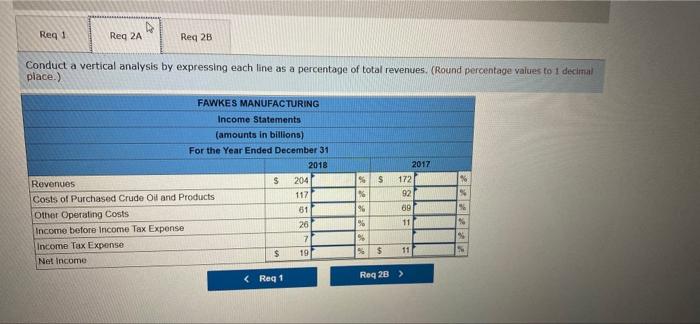

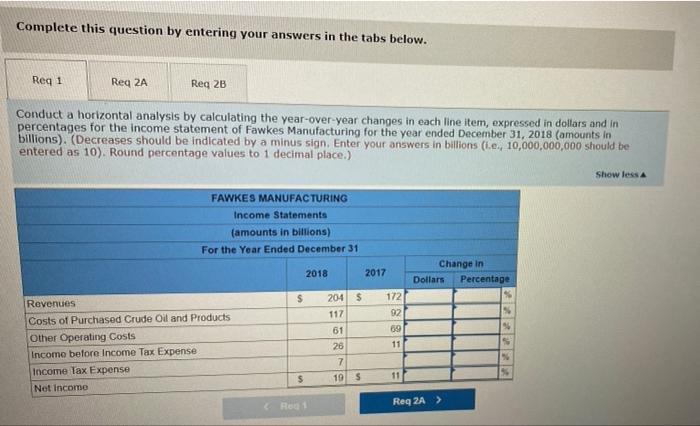

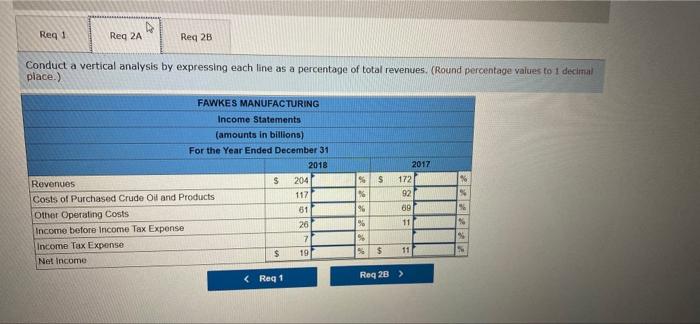

The average price of a gallon of gas in 2018 increased $0.30 (12.4 percent) from $2.42 in 2017 to $2.72 in 2018 Required: 1. Conduct a horizontal analysis by calculating the year over year changes in each line item, expressed in dollars and in percentages for the income statement of Fawkes Manufacturing for the year ended December 31, 2018 (amounts in billions), 2-0. Conduct a vertical analysis by expressing each line as a percentage of total revenues. 2-b. Excluding income tax and other operating costs, did Fowkes earn more gross profit per dollar of revenue in 2018 compared to 2017? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 25 Conduct a horizontal analysis by calculating the year over-year changes in each line item, expressed in dollars and in percentages for the income statement of Fawkes Manufacturing for the year ended December 31, 2018 (amounts in billions). (Decreases should be indicated by a minus sign. Enter your answers in billions (ie, 10,000,000,000 should be entered as 10). Round percentage values to 1 decimal place.) Show less FAWKES MANUFACTURING Complete this question by entering your answers in the tabs below. Req 1 Reg 2A Reg 2B Conduct a horizontal analysis by calculating the year-over-year changes in each line item, expressed in dollars and in percentages for the income statement of Fawkes Manufacturing for the year ended December 31, 2018 (amounts in billions). (Decreases should be indicated by a minus sign. Enter your answers in billions (1.e., 10,000,000,000 should be entered as 10). Round percentage values to 1 decimal place.) Show less FAWKES MANUFACTURING Income Statements (amounts in billions) For the Year Ended December 31 2018 2017 Change in Dollars Percentage $ 172 N88 92 69 Revenues Costs of Purchased Crude Oil and Products Other Operating Costs Income before Income Tax Expense Income Tax Expense Not Income 204 $ 117 61 26 7 10 s 11 $ 11 Rou Req2A > Reg 1 Reg 2A Req 26 Conduct a vertical analysis by expressing each line as a percentage of total revenues. (Round percentage values to 1 decimal place.) FAWKES MANUFACTURING Income Statements (amounts in billions) For the Year Ended December 31 2018 Revenues $ 204 Costs of Purchased Crude Oil and Products 117 Other Operating Costs 61 Income before Income Tax Expense 26 7 Income Tax Exponse $ 19 Net Income SIN 2017 $ $ 172 %92 % 09 % 11 % 50 $ 11 #ly 1. Conduct a horizontal analysis by calculating the year-over-year changes in each line item, expressed in dollars and in percentages for the income statement of Fawkes Manufacturing for the year ended December 31, 2018 (amounts in billions) 2-a. Conduct a vertical analysis by expressing each line as a percentage of total revenues. 2-b. Excluding income tax and other operating costs, did Fawkes earn more gross profit per dollar of revenue in 2018 compared to 2017? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 2B Excluding income tax and other operating costs, did Fowkes earn more gross profit per dollar of revenue in 2018 compared to 2017? OYes ONO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started