help please

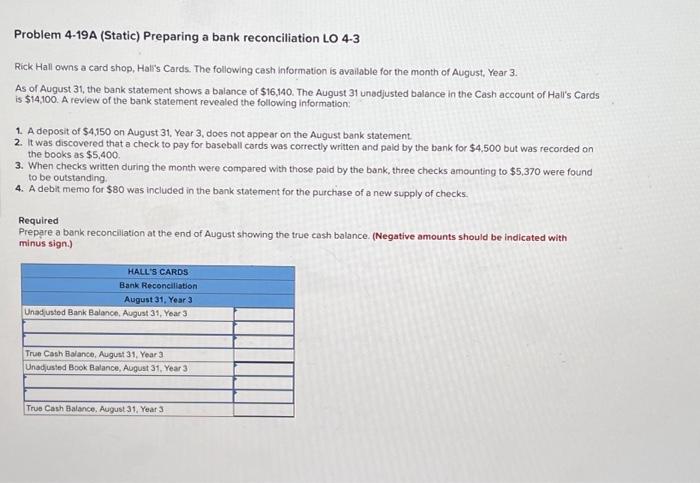

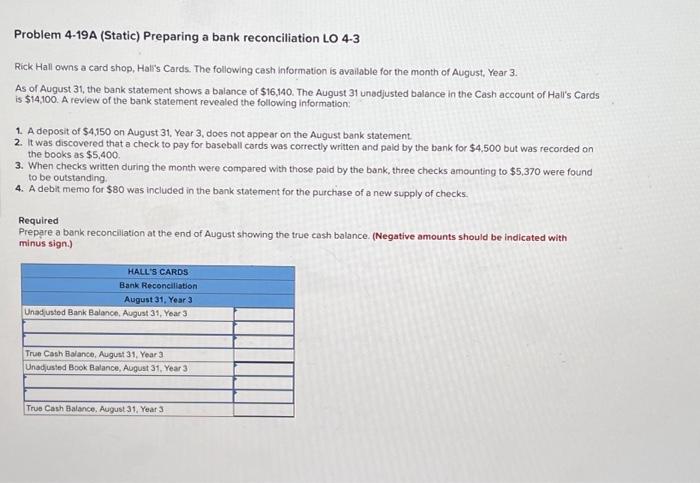

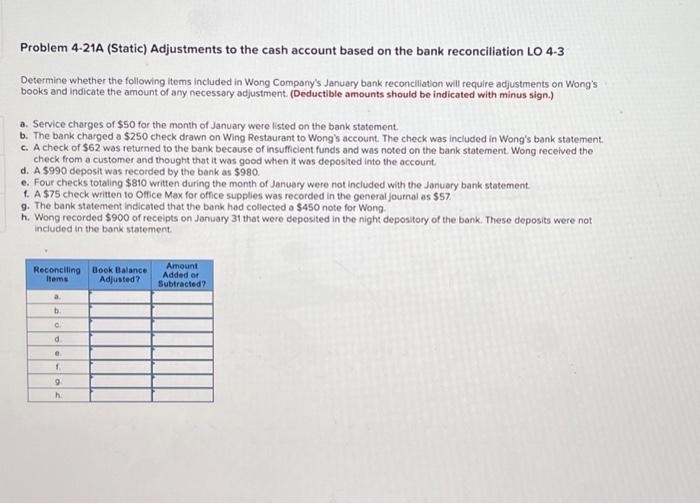

Problem 4-19A (Static) Preparing a bank reconciliation LO 4-3 Rick Hall owns a card shop, Hall's Cards. The following cesh information is available for the month of August, Year 3. As of August 31, the bank statement shows a balance of $16,140. The August 31 unadjusted balance in the Cash account of Hall's Cards is $14,100. A review of the bank statement revealed the following information: 1. A deposit of $4,150 on August 31, Year 3, does not appear on the August bank statement. 2. It was discovered that a check to pay for baseball cards was correctly written and paid by the bank for $4.500 but was recorded on the books as $5,400. 3. When checks written during the month were compared with those poid by the bank, three checks amounting to $5,370 were found to be outstanding 4. A debit memo for $80 was included in the bank statement for the purchase of a new supply of checks. Required Prepare a bank reconciliation at the end of August showing the true cash balance. (Negative amounts should be indicated with minus sign.) Problem 4-21A (Static) Adjustments to the cash account based on the bank reconciliation LO 4-3 Determine whether the following items included in Wong Company's January bank reconciliation will require adjustments on Wong's books and indicate the amount of any necessary adjustment. (Deductible amounts should be indicated with minus sign.) a. Service charges of $50 for the month of January were listed on the bank statement. b. The bank charged a $250 check drawn on Wing Restaurant to Wong's account. The check was included in Wong's bank statement. c. A check of $62 was returned to the bank becouse of insufficient funds and was noted on the bank statement. Wong recelved the check from a customer and thought that it was good when it wos deposited into the account: d. A $990 deposit was recorded by the bank as $980. e. Four checks totaling $810 written during the month of January were not included with the January bank statement. 1. A $75 check written to Office Max for office supplies was recorded in the general joumal as $57. 9. The bank statement indicated that the bank had collected a $450 note for Wong. h. Wong recorded $900 of receipts on January 31 that were deposited in the night depository of the bank. These deposits were not included in the bonk stotement