Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help please Question 2: Federal Tax Payable Vicky Day is 64 years old. Her net income for the year 2017 is S170,000. This income consists

help please

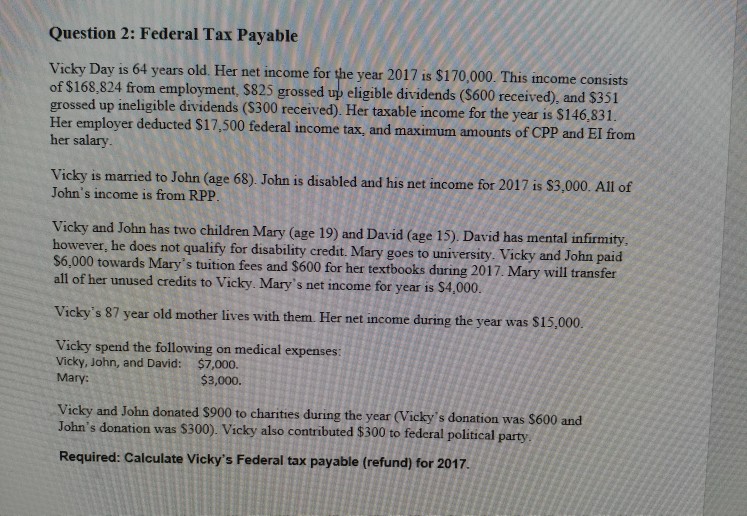

Question 2: Federal Tax Payable Vicky Day is 64 years old. Her net income for the year 2017 is S170,000. This income consists of $168,824 from employment, $825 grossed up eligible dividends ($600 received), and $351 grossed up ineligible dividends ($300 received). H Her employer deducted S17,500 federal income tax, and maximum amounts of her salary e inco CPP and EI from Vicky is married to John (age 68). John is disabled and his net income for 2017 is $3,000. All of John's income is from RPP Vicky and John has two children Mary (age 19) and David (age 15). David has mental infirmity. however, he does not qualify for disability credit. Mary goes to university. Vicky and John paid S6,000 towards Mary's tuition fees and $600 for her textbooks during 2017. Mary will transfer all of her unused credits to Vicky. Mary's net income for year is $4,000. Vicky's 87 year old mother lives with them. Her net income during the year was $15,000. Vicky spend the following on medical expenses: Vicky, John, and David: $7,000. Mary: $3,000. Vicky and John donated $900 to charities during the year (Vicky's donation was $600 and John's donation was $300). Vicky also contributed $300 to federal political party Required: Calculate Vicky's Federal tax payable (refund) for 2017. Question 2: Federal Tax Payable Vicky Day is 64 years old. Her net income for the year 2017 is S170,000. This income consists of $168,824 from employment, $825 grossed up eligible dividends ($600 received), and $351 grossed up ineligible dividends ($300 received). H Her employer deducted S17,500 federal income tax, and maximum amounts of her salary e inco CPP and EI from Vicky is married to John (age 68). John is disabled and his net income for 2017 is $3,000. All of John's income is from RPP Vicky and John has two children Mary (age 19) and David (age 15). David has mental infirmity. however, he does not qualify for disability credit. Mary goes to university. Vicky and John paid S6,000 towards Mary's tuition fees and $600 for her textbooks during 2017. Mary will transfer all of her unused credits to Vicky. Mary's net income for year is $4,000. Vicky's 87 year old mother lives with them. Her net income during the year was $15,000. Vicky spend the following on medical expenses: Vicky, John, and David: $7,000. Mary: $3,000. Vicky and John donated $900 to charities during the year (Vicky's donation was $600 and John's donation was $300). Vicky also contributed $300 to federal political party Required: Calculate Vicky's Federal tax payable (refund) for 2017Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started