Question

HELP: Please solve questions I & j !!!!!!!!!!!!!! Please also check the answers I have done for questions a - g and tell me if

HELP:

Please solve questions I & j !!!!!!!!!!!!!!

Please also check the answers I have done for questions a - g and tell me if they are correct!

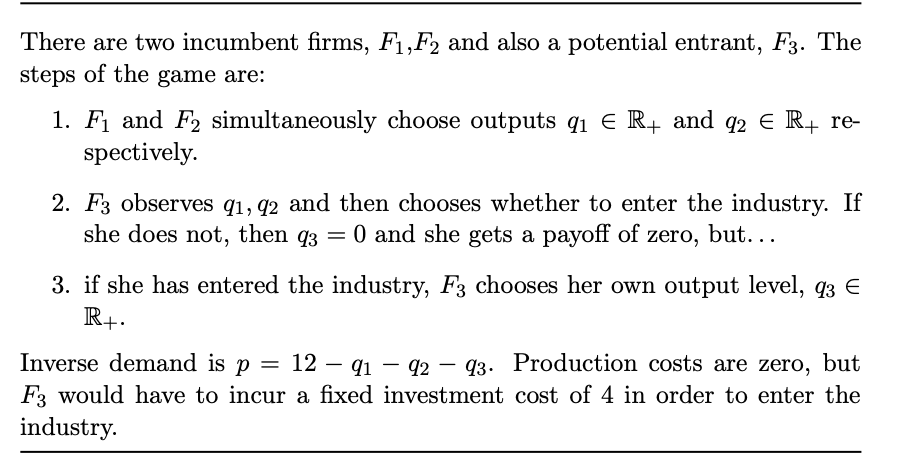

a) In step 3, F3 chooses q3 to maximise her profits, given an observed level of q1 + q2. Write down a mathematical expression for her profits, price times quantity less entry costs. Your expression should involve q1, q2, q3, but price should have been substituted out.

My answer:12q3- q1q3- q2q3- (q3)2- 4

b) Take F3's first-order condition wrt q3.

My answer: 12 - q1- q2- 2q3

c) Solve your condition from question (b) for q3. The result should be F3's best response function, q3 = B3(q1 + q2).

My answer: q3= (12 - q1- q2) / 2

d) How high would F3's payoff be if she does enter, (and then chooses q3 according to the best response you found in (c))? Your answer should be a function of q1 + q2, but q3 should have been substituted out.

My answer: ?3*= (q1*- q2*) / 2

e) In step 2, F3 decides whether to enter the industry. She will enter if her payoff from entry (which you found in (d)) is higher than zero. How high would q1 + q2 have to be, in order to persuade her not to enter? Assume that F3 will not enter if she would get exactly the same payoff from entering and staying out.

My answer: q1+ q2? 12

f) Write down F1's payoffs. Remember that he doesn't have any costs.

My answer: (12-q2-q3/ 2 ) q1

g) Now we investigate how much F1 would have to produce in order to successfully deter F3's entry. Imagine that in step 1, F1 decided to produce just enough so that it would not be worthwhile for F3 to enter the industry (but no more than that). Continue to assume that if F3 was just indifferent about entry, then she would stay out. How much would F1 have to produce to deter entry? Your answer should be a function of q2 but not of q3, ie. of the form q1 = D(q2). Your answer to question (e) may be useful here.

My answer: q1+ D(q2) = 12

h) How high would F1's profits be, if he followed the strategy you identified in the previous question? Your answer should be a function of q2.

My answer: q3?12-q3/ 2

i) Now imagine that in step 1, F1 didn't take into account the possibility that his output could deter entry by F3. That is, he just chose q1 to maximise his profits for an assumed fixed level of q2 and also subject to q3 = B3(q1 +q2), the best-response function for F3 that you derived in (c). Solve this problem. You might wish to use the method of substitution. Just as in question (g), your answer should be a function of q2 but not of q3, ie. q1 = S(q2). Hint: If you are finding this problem difficult, you might like to review the lecture notes on Stackelberg equilibrium. The method is quite similar, although you have to include F2's output in your derivation now.

j) Of course, neither of questions (g) or (i) describe the real problem faced by F1 in step 1. In fact, he has to account for both the possibility that entry might be deterred and the profit consequences of selling more output. Assume that his profits are higher from blocking entry than accommodating entry when q2 ? 7 but higher from accommodating entry when q2 > 7 (this assumption is not actually correct, but please answer this question as if it was correct). What would F1's overall best response, B1(q2), be under this assumption?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started