Answered step by step

Verified Expert Solution

Question

1 Approved Answer

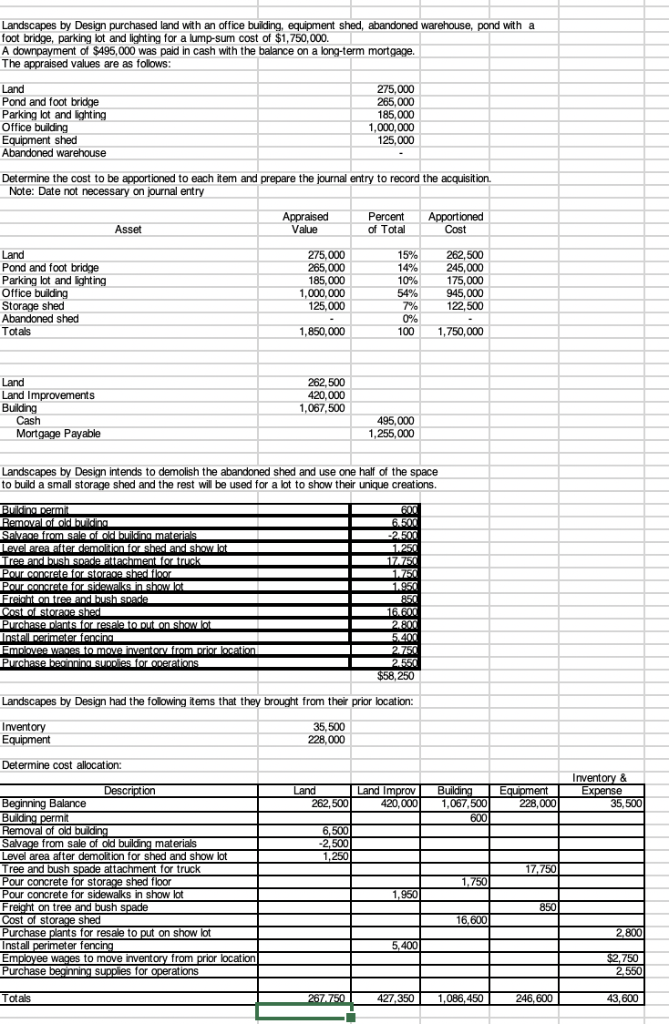

HELP PLEASE!!! t Landscapes by Design purchased land with an office building, equipment shed, abandoned warehouse, pond with a foot bridge, parking lot and lighting

HELP PLEASE!!!

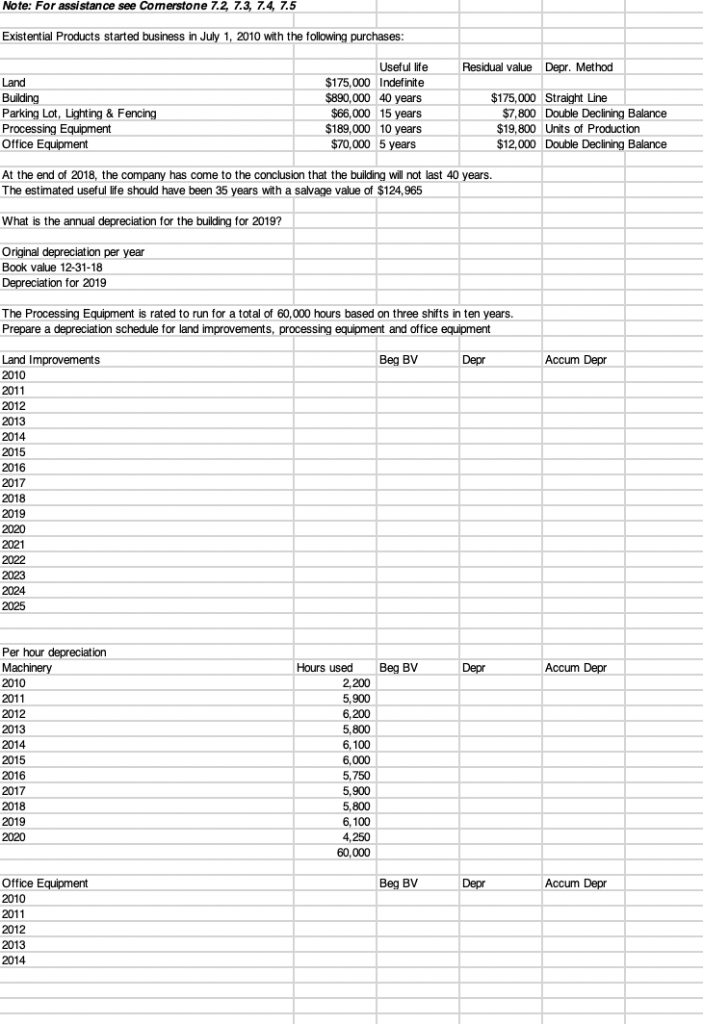

t Landscapes by Design purchased land with an office building, equipment shed, abandoned warehouse, pond with a foot bridge, parking lot and lighting for a lump-sum cost of $1,750,000. A downpayment of $495,000 was paid in cash with the balance on a long-term mortgage. The appraised values are as follows Land Pond and foot bridge Parking lot and ighting Office building Equipment shed Abandoned warehouse 275,000 265,000 185,000 ,000,000 25,000 Determine the cost to be apportioned to each item and prepare the journal entry to record the acquisition. Note:Date not necessary on journal entry AppraisedPercent Apportioned Asset Value of TotalCost Land Pond and foot bridge Parking lot and ighting Office buiding Storage shed Abandoned shed Totals 275,000 265,000 85,000 ,000,000 25,000 15% 262,500 1496 245,000 10%-175,000 %945,000 7% 122,500 0% ,850,000 100 1,750,000 Land Land Improvements Building 262,500 420,000 1,067,500 Cash Mortgage Payable 95,000 ,255,000 Landscapes by Design intends to demolish the abandoned shed and use one haltf of the space to build a small storage shed and the rest wil be used for a lot to show their unique creations. 500 Savage from sale of oldlbuildin Landscapes by Design had the folowing items that they brought from their prior location: Inventory Equipment Determine cost allocation: 35,500 228,000 Inventory & 262,500 20,000 1,067,500 228,000 35,500 uild Salvage from sale of old Level area after demolition for shed and show lot Tree and bush materials 2,500 1,250 attachment for truck our concrete for storage s Pour concrete for sidewalks in show on tree and bush of storage shed 850 16,600 s for resale to put on shOW Install perimeter fenc Emplovee wages to move invent Purchase beginning suppies for operations rom prior location 750 otals 43,600 Note: For assistance see Comerstone 7.2 7.3, 7.4,7.5 Existential Products started business in July 1, 2010 with the following purchases: Useful life Residual value Depr. Methoo Land Building Parking Lot, Lighting& Fencing Processing Equipment Office Equipment 175,000 Indefinite 890,000 40 years $66,000 15 years 189,000 10 years $70,000 5 years $175,000 Straight Line 7,800 Double Declining Balance $19,800 Units of Production 12,000 Double Declining Balance At the end of 2018, the company has come to the conclusion that the building will not last 40 years. The estimated useful life should have been 35 years with a salvage value of $124,965 What is the annual depreciation for the building for 2019? Original depreciation per year Book value 12-31-18 Depreciation for 2019 The Processing Equipment is rated to run for a total of 60,000 hours based on three shifts in ten years Prepare a depreciation schedule for land improvements, processing equipment and office equipmet Land Improvements 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Beg BV Depr Accum Depr 2024 2025 Per hour depreciation Hours used Beg BV 2,200 5,900 6,200 5,800 6,100 6,000 5,750 5,900 5,800 6,100 4,250 Depr Accum Depr 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 60,000 Office Equipment 2010 2011 2012 2013 2014 Beg BV Accum Depr t Landscapes by Design purchased land with an office building, equipment shed, abandoned warehouse, pond with a foot bridge, parking lot and lighting for a lump-sum cost of $1,750,000. A downpayment of $495,000 was paid in cash with the balance on a long-term mortgage. The appraised values are as follows Land Pond and foot bridge Parking lot and ighting Office building Equipment shed Abandoned warehouse 275,000 265,000 185,000 ,000,000 25,000 Determine the cost to be apportioned to each item and prepare the journal entry to record the acquisition. Note:Date not necessary on journal entry AppraisedPercent Apportioned Asset Value of TotalCost Land Pond and foot bridge Parking lot and ighting Office buiding Storage shed Abandoned shed Totals 275,000 265,000 85,000 ,000,000 25,000 15% 262,500 1496 245,000 10%-175,000 %945,000 7% 122,500 0% ,850,000 100 1,750,000 Land Land Improvements Building 262,500 420,000 1,067,500 Cash Mortgage Payable 95,000 ,255,000 Landscapes by Design intends to demolish the abandoned shed and use one haltf of the space to build a small storage shed and the rest wil be used for a lot to show their unique creations. 500 Savage from sale of oldlbuildin Landscapes by Design had the folowing items that they brought from their prior location: Inventory Equipment Determine cost allocation: 35,500 228,000 Inventory & 262,500 20,000 1,067,500 228,000 35,500 uild Salvage from sale of old Level area after demolition for shed and show lot Tree and bush materials 2,500 1,250 attachment for truck our concrete for storage s Pour concrete for sidewalks in show on tree and bush of storage shed 850 16,600 s for resale to put on shOW Install perimeter fenc Emplovee wages to move invent Purchase beginning suppies for operations rom prior location 750 otals 43,600 Note: For assistance see Comerstone 7.2 7.3, 7.4,7.5 Existential Products started business in July 1, 2010 with the following purchases: Useful life Residual value Depr. Methoo Land Building Parking Lot, Lighting& Fencing Processing Equipment Office Equipment 175,000 Indefinite 890,000 40 years $66,000 15 years 189,000 10 years $70,000 5 years $175,000 Straight Line 7,800 Double Declining Balance $19,800 Units of Production 12,000 Double Declining Balance At the end of 2018, the company has come to the conclusion that the building will not last 40 years. The estimated useful life should have been 35 years with a salvage value of $124,965 What is the annual depreciation for the building for 2019? Original depreciation per year Book value 12-31-18 Depreciation for 2019 The Processing Equipment is rated to run for a total of 60,000 hours based on three shifts in ten years Prepare a depreciation schedule for land improvements, processing equipment and office equipmet Land Improvements 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Beg BV Depr Accum Depr 2024 2025 Per hour depreciation Hours used Beg BV 2,200 5,900 6,200 5,800 6,100 6,000 5,750 5,900 5,800 6,100 4,250 Depr Accum Depr 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 60,000 Office Equipment 2010 2011 2012 2013 2014 Beg BV Accum DeprStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started