Help please! Thanks :)

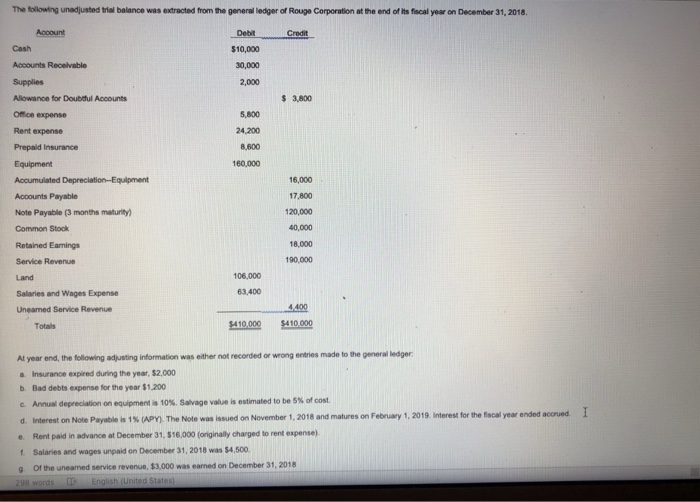

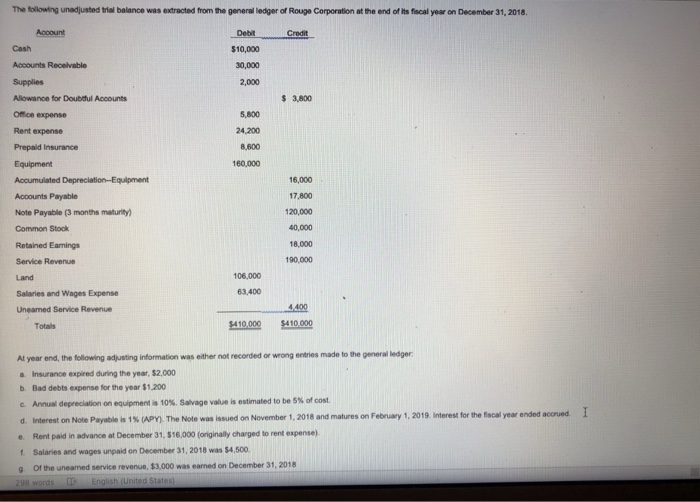

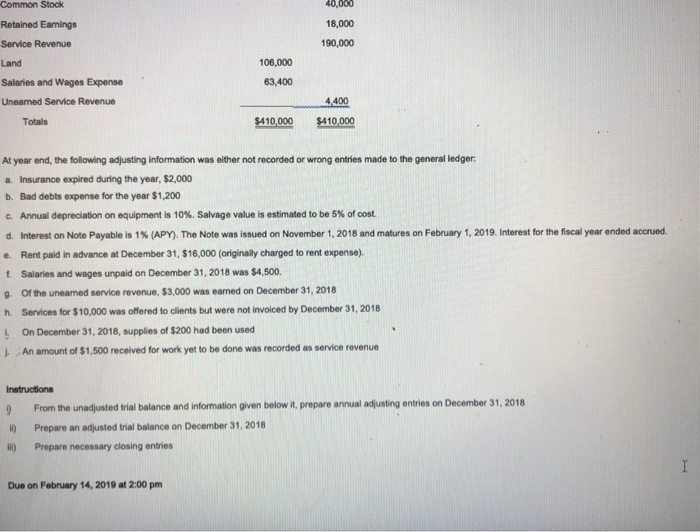

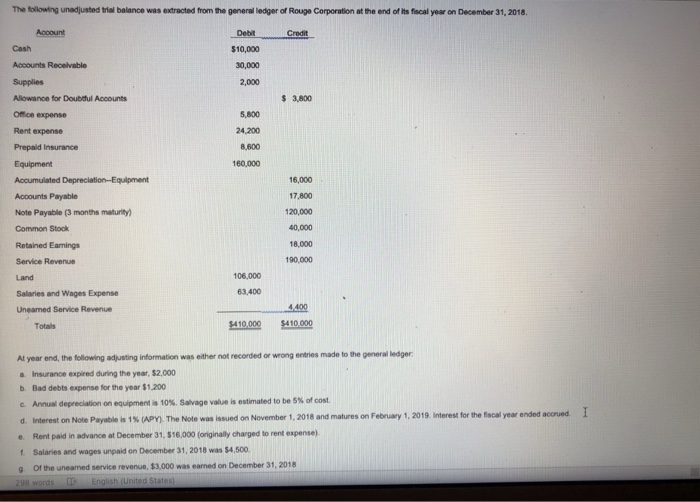

The following unadjusted trial balance was extracted from the general ledger of Rouge Corporation at the end of lts fiscal year on December 31, 2018. Debit $10,000 30,000 2,000 Cash Accounts Recelvable 3,800 Allowanoe for Doubtul Accounts Office expense Rent expense Prepaid Insurance 5,800 24,200 8,600 160,000 Accumulated Depreciation-Equipment Accounts Payable Note Payable (3 months maturity) Common Stock Retained Earnings Service Revenue 16,000 17,800 120,000 18,000 190,000 106,000 Salaries and Wages Expense 63,400 Uneaned Service Revenue 410000 $410,000 Totals At year end, the following adjusting information was either not recorded or wrong entries made to the general ledger a Insurance expired during the year, $2,000 b. Bad debts expense for the year $1,200 c. Annual depreciation on equipment i, 10%. Salvage value is estimated to be 5% of cost d. Interest on Note Payable is 1 % (APY) The Note was issued on November 1, 2018 and e. Rent paid in advance at December 31, $16,000 (originally charged to rent expense) t Salaries and wages unpaid on December 31, 2018 was $4,500 matures on February 1, 2019 Interest for the fiscal year ended accrued I Of the uneamed service revenue, $3,000 was eamed on December 31, 2018 Common Stock Retained Eamings Service Revenue Land Salaries and Wages Expense Uneamed Service Revenue 0,000 18,000 190,000 106,000 63,400 9410000 $410,000 Totals At year end, the following adjusting information was either not recorded or wrong entries made to the general ledger a. Insurance expired during the year, $2,000 b. Bad debts expense for the year $1,200 c. Annual depreciation on equipment is 10%. Salvage value is estimated to be 5% of cost d. Interest on Note Payable is 1% (APY)The Note was issued on November 1, 2018 and matures on February 1, 2019. Interest for the fiscal year ended accrued. e. Rent pald in advance at December 31, $16,000 (originally charged to rent expense). t. Salaries and wages unpaid on December 31, 2018 was $4,500. g Of the uneamed service revenue, $3,000 was eamed on December 31, 2018 h. Services for $10,000 was offered to clients but were not invoiced by December 31, 2018 L On December 31, 2018, supplies of $200 had been used J. An amount of $1,500 received for work yet to be done was recorded as service revenue ) From the unadjusted trial balance and information given below t, prepare annual adjusting entries on December 31, 2018 i Prepare an adjusted trial balance on December 31, 2018 R) Prepare necessary closing entries Due on February 14, 2019 at 2:00 pm