Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help please!! TI BALI Plus Image used with permission of copyright owner, Texas Instruments Incorporated. Text superimposed on product display by Cengage Learning, Inc. does

help please!!

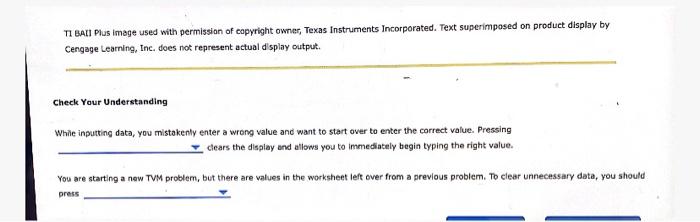

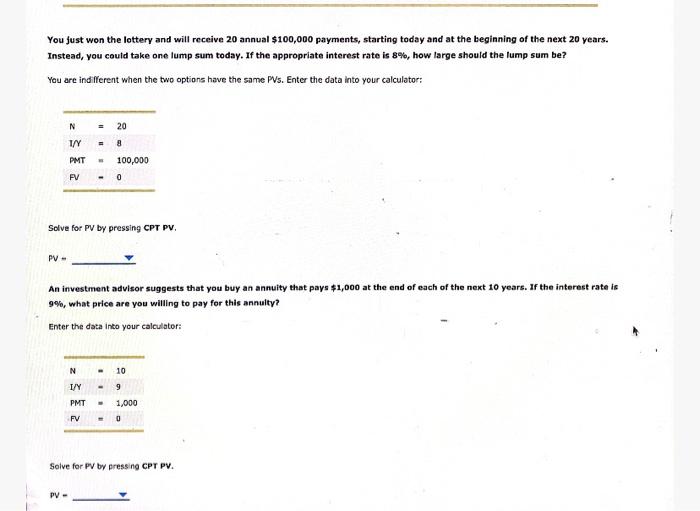

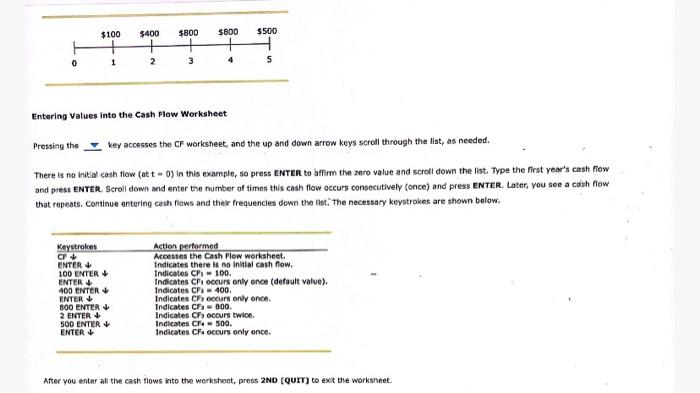

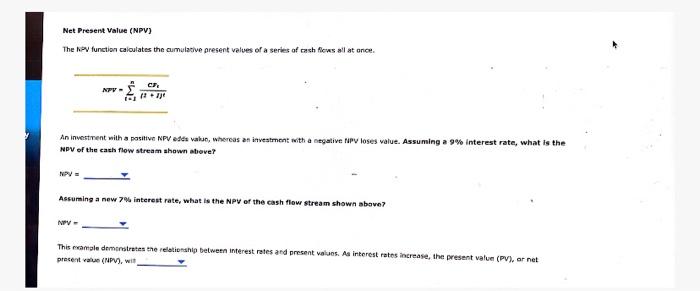

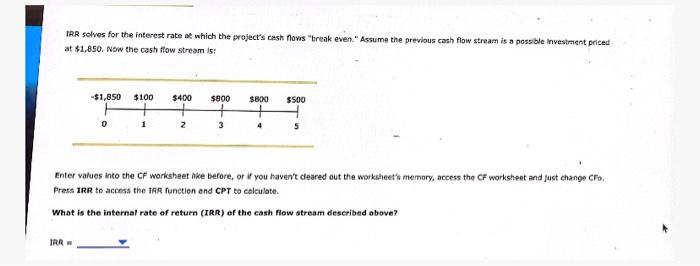

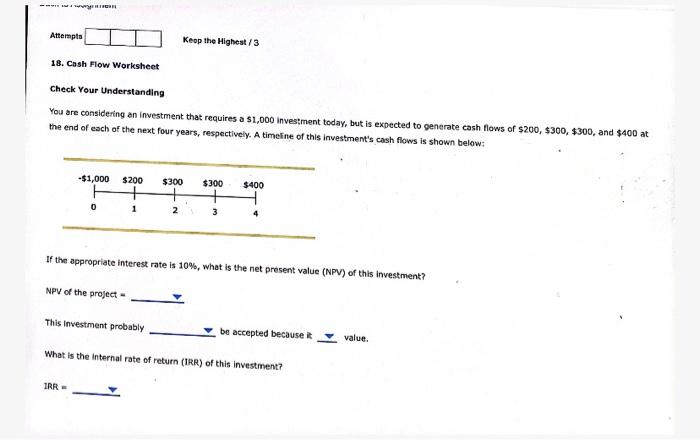

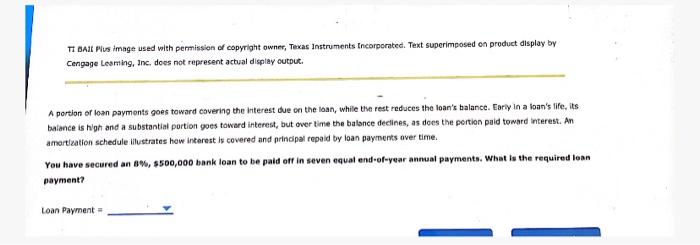

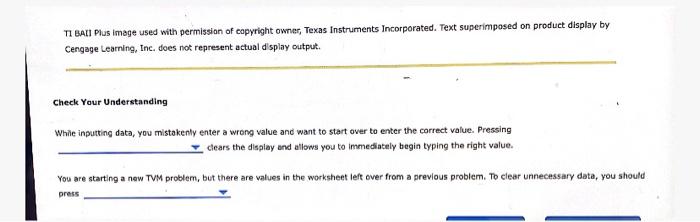

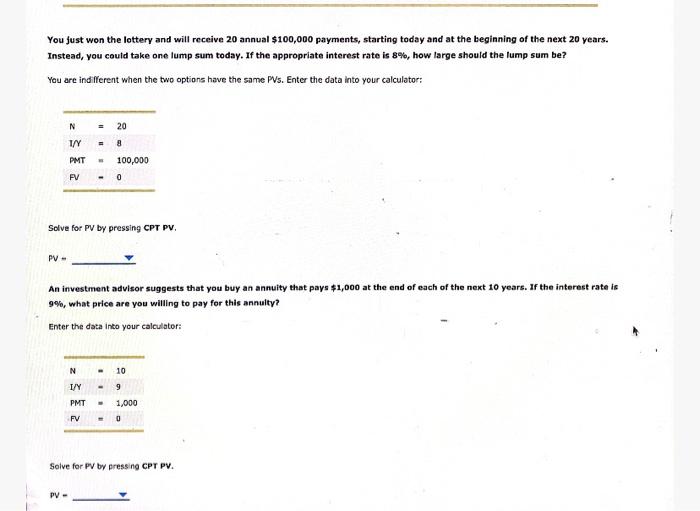

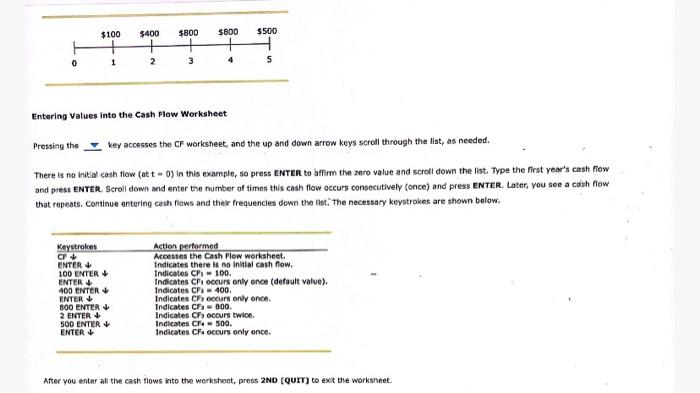

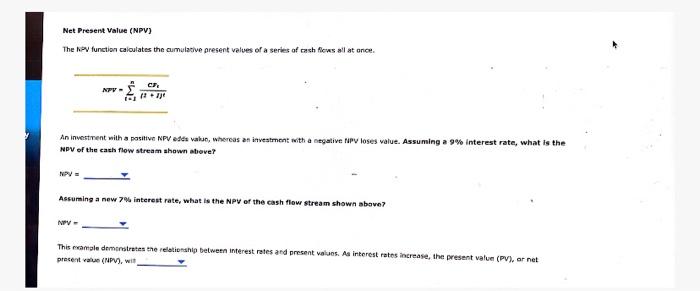

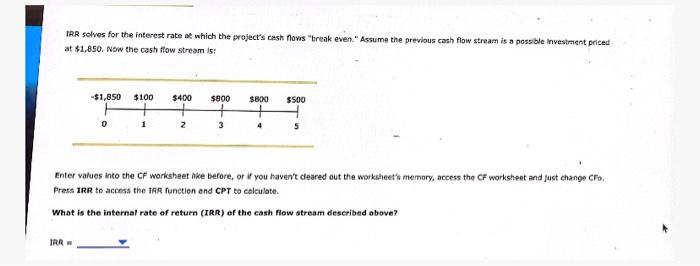

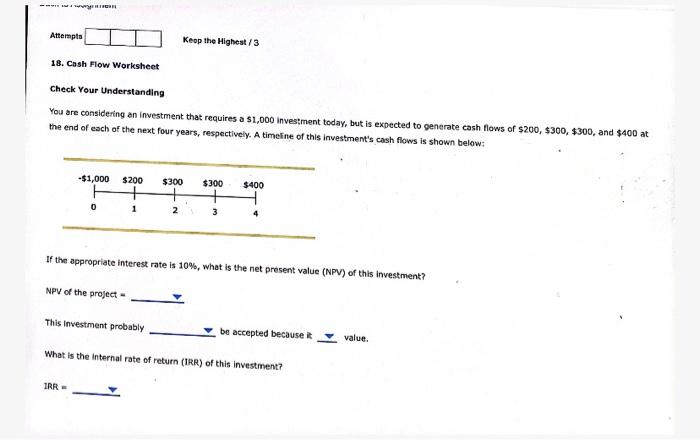

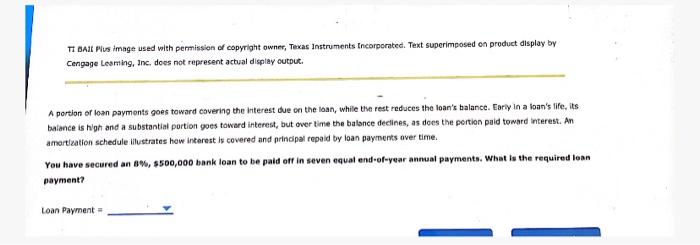

TI BALI Plus Image used with permission of copyright owner, Texas Instruments Incorporated. Text superimposed on product display by Cengage Learning, Inc. does not represent actual display output Check Your Understanding While inputting data, you mistakenly enter a wrong value and want to start over to enter the correct value. Pressing clears the display and allows you to immediately begin typing the right value. You are starting a new TVM problem, but there are values in the worksheet left over from a previous problem. To clear unnecessary data, you should press You just won the lottery and will receive 20 annual $100,000 payments, starting today and at the beginning of the next 20 years. Instead, you could take one lump sum today. If the appropriate interest rate is 8%, how large should the lump sum be? You are indifferent when the two options have the same PVs. Enter the data into your calculator: N = 20 1/Y 8 PMT 100,000 - 0 FV Solve for PV by pressing CPT PV. PV - An investment advisor suggests that you buy an annuity that pays $1,000 at the end of each of the next 10 years. If the interest rate is 9%, what price are you willing to pay for this annulty? Enter the data into your calculator: N 10 I/Y PMT FV 9 1,000 0 Solve for PV by pressing CPT PV. PV - $100 $400 $800 $500 + $800 + 4 0 1 2 S 3 Entering values into the Cash Flow Worksheet Pressing the key accesses the CF worksheet, and the up and down arrow keys scroll through the list, as needed. There is no Initial cash flow (att - 0) in this example, so press ENTER to affirm the zero value and scroll down the list. Type the first year's cash flow and press ENTER. Scroll down and enter the number of times this cash flow accurs consecutively conce) and press ENTER. Later, you see a cash now that repeats. Continue antering cash flows and ther frequencies down the list. The necessary keystrokes are shown below. Keystrokes CF ENTER 100 ENTER ENTER 100 ENTER ENTER 800 ENTER 2 ENTER 500 ENTER ENTER Action performed Accesses the Cash Flow worksheet. Indicates there is no initial cash flow. Indicates CF 100. Indicates Choccurs only once (default value). Indicates CF - 400 Indicates CF occurs only once Indicates CF - 300 Indicates Ch occurs twice Indicates CF 500. Indicates CF. occurs only once. After you enter all the cash flows into the worksheet, press 2ND (QUIT) to exit the worksheet. Net Present Value (NPV) The key function calculates the cumulative present values of a series of cash flows oil at once. PVC An investment with a positive NPV este vahun, whereas an investment with a negative for loses value. Assuming a 9% interest rate, what is the NPV of the cash flow stream shown above? NPV = Assuming a new 7 interest rate, what is the NPV of the cash flow stream shown above? NPV- This namele demonstrates the relationship between interest rates and present values. As interest rates increase the present value (PV). ar net procent value (NPV), wil IRR solves for the interest rate at which the project's cash flows "break even." Assume the previous cash flow stream is a possible investment priced at $1,850. Now the cash flow stream is: -$1,850 $100 $400 $500 + + $800 + 3 $800 + 4 0 1 2 Enter values into the CF worksheet Nke before, or if you haven't cleared out the worksheet's memory, access the CF worksheet and just change Cro Press IRR to access the IRR function and CPT to calculate. What is the internal rate of return (IRR) of the cash flow stream described above? IRR www Attempts Keep the Highest/3 18. Cash Flow Worksheet Check Your Understanding You are considering an investment that requires a $1,000 investment today, but is expected to generate cash flows of $200, $300, $300, and $400 at the end of each of the next four years, respectively. A timeline of this investment's cash flows is shown below: -$1,000 $300 $400 $200 + 1 $300 + 2 0 3 4 If the appropriate interest rate is 10%, what is the net present value (NPV) of this investment? NPV of the project - This investment probably be accepted because value. What is the internal rate of return (IRR) of this investment? IRR - TI BAIL Plus Image used with permission of copyright owner, Texas Instruments Incorporated. Text superimposed on product display by Cengage Leaming, Inc. does not represent actual display output A portion of loan payments goes toward covering the interest due on the loan, while the rest reduces the loan's balance. Early in a loan's life, its balance is high and a substantial portion goes toward interest, but over time the balance declines, as does the portion paid toward interest. An amortization schedule ilustrates how interest is covered and principal repaid by loan payments over time. You have secured an 8%, $500,000 bank loan to be paid off in seven equal end-of-year annual payments. What is the required loan payment? Loan Payment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started