Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help pls Instructions. USE 2023 TAX RULES FOR THESE QUESTIONS. There are three parts to these questions. Part 1 contains multiple choice questions that relate

help pls

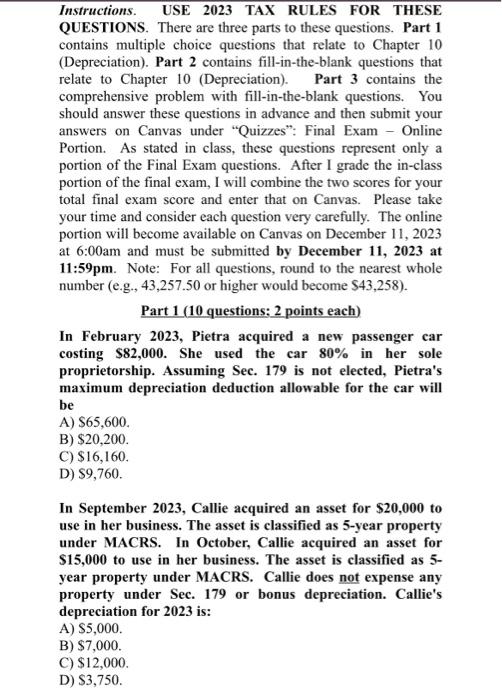

Instructions. USE 2023 TAX RULES FOR THESE QUESTIONS. There are three parts to these questions. Part 1 contains multiple choice questions that relate to Chapter 10 (Depreciation). Part 2 contains fill-in-the-blank questions that relate to Chapter 10 (Depreciation). Part 3 contains the comprehensive problem with fill-in-the-blank questions. You should answer these questions in advance and then submit your answers on Canvas under "Quizzes": Final Exam - Online Portion. As stated in class, these questions represent only a portion of the Final Exam questions. After I grade the in-class portion of the final exam, I will combine the two scores for your total final exam score and enter that on Canvas. Please take your time and consider each question very carefully. The online portion will become available on Canvas on December 11, 2023 at 6:00am and must be submitted by December 11, 2023 at 11:59pm. Note: For all questions, round to the nearest whole number (e.g., 43,257.50 or higher would become $43,258 ). Part 1 (10 questions: 2 points each) In February 2023, Pietra acquired a new passenger car costing $82,000. She used the car 80% in her sole proprietorship. Assuming Sec. 179 is not elected, Pietra's maximum depreciation deduction allowable for the car will be A) $65,600. B) $20,200. C) $16,160. D) $9,760. In September 2023, Callie acquired an asset for $$20,000 to use in her business. The asset is classified as 5-year property under MACRS. In October, Callie acquired an asset for $15,000 to use in her business. The asset is classified as 5year property under MACRS. Callie does not expense any property under Sec. 179 or bonus depreciation. Callie's depreciation for 2023 is: A) $5,000. B) $7,000. C) $12,000. D) $3,750

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started