help plz!!

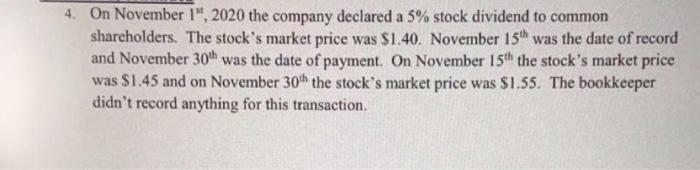

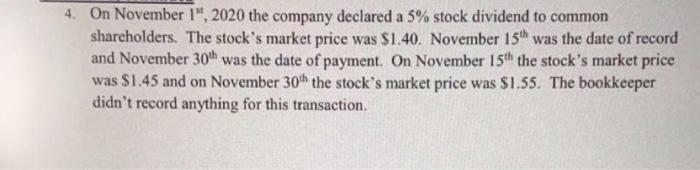

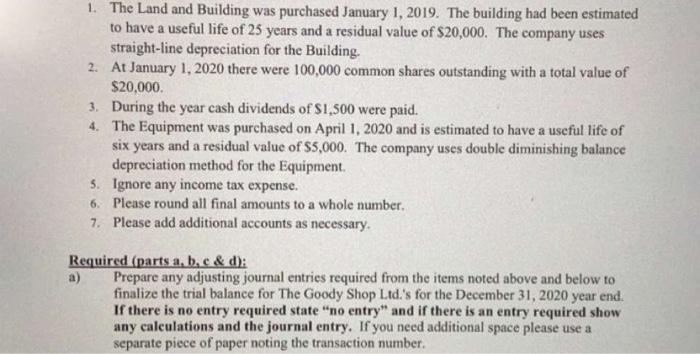

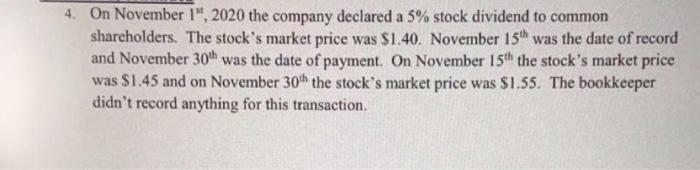

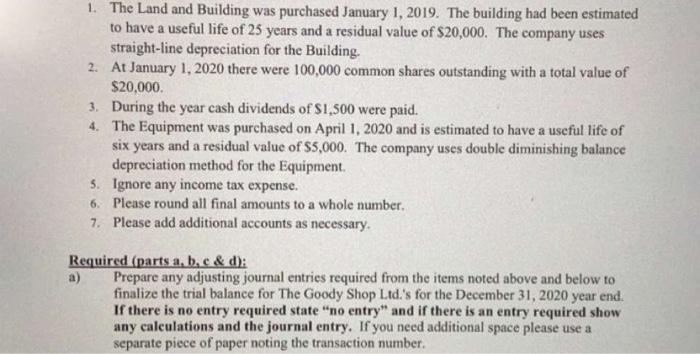

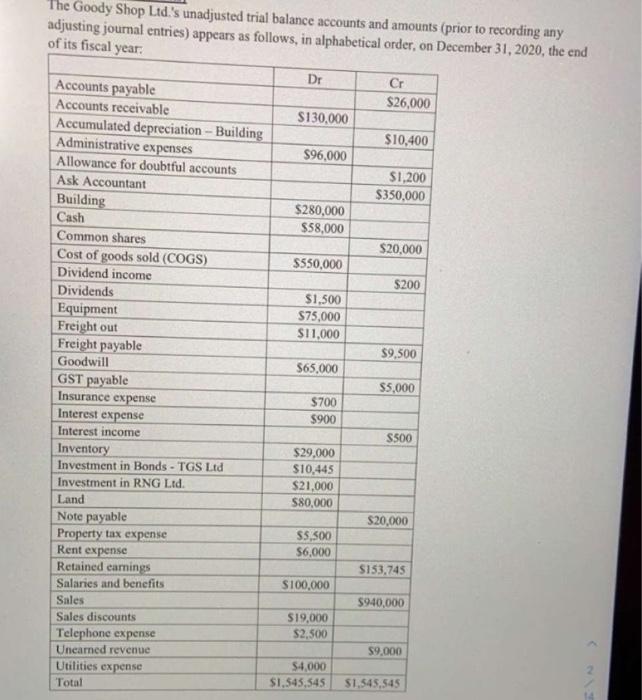

4. On November 1", 2020 the company declared a 5% stock dividend to common shareholders. The stock's market price was $1.40. November 15th was the date of record and November 30th was the date of payment. On November 15th the stock's market price was $1.45 and on November 30th the stock's market price was $1.55. The bookkeeper didn't record anything for this transaction. 1. The Land and Building was purchased January 1, 2019. The building had been estimated to have a useful life of 25 years and a residual value of $20,000. The company uses straight-line depreciation for the Building. 2. At January 1, 2020 there were 100,000 common shares outstanding with a total value of $20,000. 3. During the year cash dividends of $1,500 were paid. 4. The Equipment was purchased on April 1, 2020 and is estimated to have a useful life of six years and a residual value of $5,000. The company uses double diminishing balance depreciation method for the Equipment. 5. Ignore any income tax expense. 6. Please round all final amounts to a whole number, 7. Please add additional accounts as necessary. Required (parts a, b, c & d): Prepare any adjusting journal entries required from the items noted above and below to finalize the trial balance for The Goody Shop Ltd.'s for the December 31, 2020 year end. If there is no entry required state "no entry" and if there is an entry required show any calculations and the journal entry. If you need additional space please use a separate piece of paper noting the transaction number. The Goody Shop Ltd.'s unadjusted trial balance accounts and amounts (prior to recording any adjusting journal entries) appears as follows, in alphabetical order, on December 31, 2020, the end of its fiscal year: Dr Cr Accounts payable $26,000 Accounts receivable S130.000 Accumulated depreciation - Building $10,400 Administrative expenses $96,000 Allowance for doubtful accounts $1,200 Ask Accountant $350,000 Building $280,000 Cash $58,000 Common shares $20,000 Cost of goods sold (COGS) $550,000 Dividend income $200 Dividends $1,500 Equipment $75,000 Freight out $11,000 Freight payable $9,500 Goodwill $65.000 GST payable $5,000 Insurance expense $700 Interest expense Interest income 500 Inventory $29,000 Investment in Bonds - TGS Ltd $10.445 Investment in RNG Ltd. $21,000 Land 580,000 Note payable $20,000 Property tax expense 55,500 Rent expense $6,000 Retained earnings S153.745 Salaries and benefits $100,000 Sales $940,000 Sales discounts $19,000 Telephone expense $2,500 Unearned revenue $9.000 Utilities expense $4,000 Total S1,545,545 $1,545,545 $900 4. On November 1", 2020 the company declared a 5% stock dividend to common shareholders. The stock's market price was $1.40. November 15th was the date of record and November 30th was the date of payment. On November 15th the stock's market price was $1.45 and on November 30th the stock's market price was $1.55. The bookkeeper didn't record anything for this transaction. 1. The Land and Building was purchased January 1, 2019. The building had been estimated to have a useful life of 25 years and a residual value of $20,000. The company uses straight-line depreciation for the Building. 2. At January 1, 2020 there were 100,000 common shares outstanding with a total value of $20,000. 3. During the year cash dividends of $1,500 were paid. 4. The Equipment was purchased on April 1, 2020 and is estimated to have a useful life of six years and a residual value of $5,000. The company uses double diminishing balance depreciation method for the Equipment. 5. Ignore any income tax expense. 6. Please round all final amounts to a whole number, 7. Please add additional accounts as necessary. Required (parts a, b, c & d): Prepare any adjusting journal entries required from the items noted above and below to finalize the trial balance for The Goody Shop Ltd.'s for the December 31, 2020 year end. If there is no entry required state "no entry" and if there is an entry required show any calculations and the journal entry. If you need additional space please use a separate piece of paper noting the transaction number. The Goody Shop Ltd.'s unadjusted trial balance accounts and amounts (prior to recording any adjusting journal entries) appears as follows, in alphabetical order, on December 31, 2020, the end of its fiscal year: Dr Cr Accounts payable $26,000 Accounts receivable S130.000 Accumulated depreciation - Building $10,400 Administrative expenses $96,000 Allowance for doubtful accounts $1,200 Ask Accountant $350,000 Building $280,000 Cash $58,000 Common shares $20,000 Cost of goods sold (COGS) $550,000 Dividend income $200 Dividends $1,500 Equipment $75,000 Freight out $11,000 Freight payable $9,500 Goodwill $65.000 GST payable $5,000 Insurance expense $700 Interest expense Interest income 500 Inventory $29,000 Investment in Bonds - TGS Ltd $10.445 Investment in RNG Ltd. $21,000 Land 580,000 Note payable $20,000 Property tax expense 55,500 Rent expense $6,000 Retained earnings S153.745 Salaries and benefits $100,000 Sales $940,000 Sales discounts $19,000 Telephone expense $2,500 Unearned revenue $9.000 Utilities expense $4,000 Total S1,545,545 $1,545,545 $900