Help

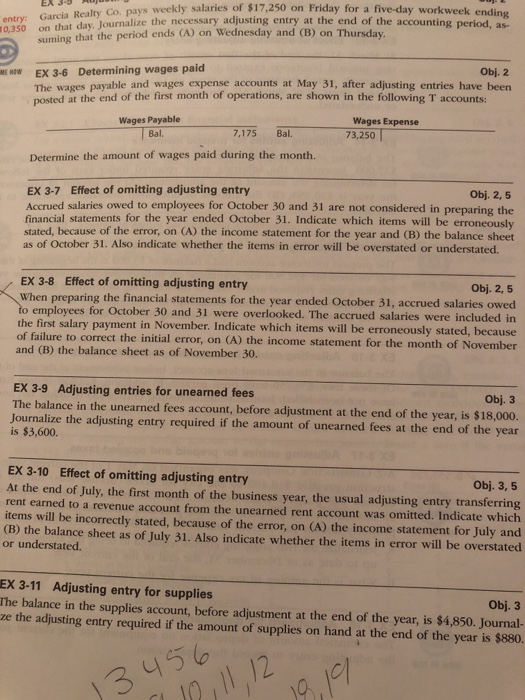

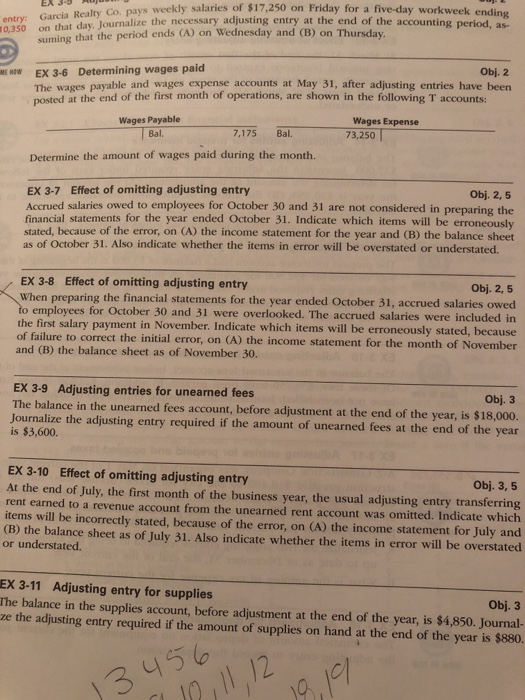

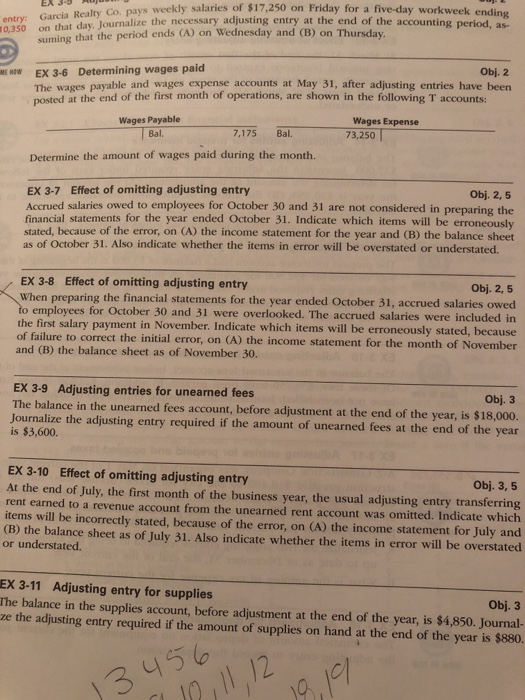

s weekly salaries of $17,250 on Friday for a five-day workweek ending Garcia Realty Co. pay entry 0,350 on that Jou day. lournalize the necessary adjusting entry at the end of the accounting period that the period ends (A) on Wednesday and (B) on Thursda W EX 3-6 Determining wages paid obj. 2 The wages payable and wages expense accounts at May 31, after adjusting entries have been posted at the end of the first month of operations, are shown in the following T accounts: Wages Expense 73,250 Wages Payable Bal. 7,175 Bal. Determine the amount of wages paid during the month. EX 3-7 Effect of omitting adjusting entry Accrued salaries owed to employees for October 30 and 31 are not considered in preparing the financial statements for the year ended October 31. Indicate which items will be erroneous stated, because of the error, on (A) the income statement for the year and (B) the balance sheet as of October 31. Also indicate whether the items in error will be overstated or understated. Obj. 2, 5 EX 3-8 Effect of omitting adjusting entry When preparing the financial statements for the year ended October 31, accrued salaries owed o employees for October 30 and 31 were overlooked. The accrued salaries were included in Obj. 2, 5 the first salary payment in November. Indicate which items will be erroneously stated, because he initial error, on (A) the income statement for the month of November and (B) the balance sheet as of November 30 EX 3-9 Adjusting entries for unearned fees The balance in the unearned fees account, before adjustment at the end of the year, is $18,000 Journalize the adjusting entry required if the amount of unearned fees at the end of the year Obj. 3 is $3,600. EX 3-10 Effect of omitting adjusting entry At the end of July, the first month of the business year, the usual adjusting entry transferring Obj. 3, 5 nt earned to a revenue account from the unearned rent account was omitted. Indicate which items will be incorrectly stated, because of the error, on (A) the income statement for July and (B) the balance sheet as of July 31. Also indicate whether the items in error will be overstated or understated. EX 3-11 Adjusting entry for supplies The balance in the supplies account, before adjustment at the end of the year, is $4,850. Journal- ze the adjusting entry required if the amount of supplies on hand at the end of the year is $880 Obj. 3 5 10