Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help said to use data solver but i cant solve it Wo necd to save for out child's expected college-costs- We hove cash flow restrictions,

help said to use data solver but i cant solve it

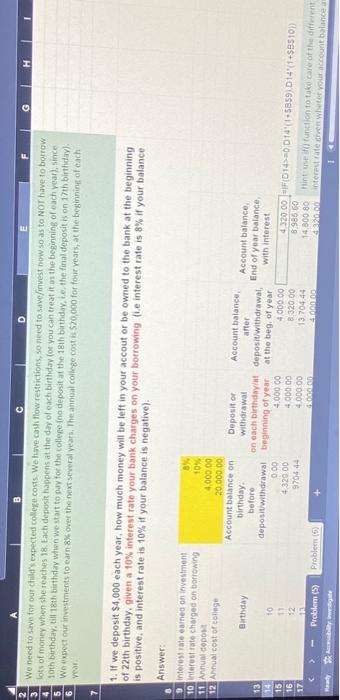

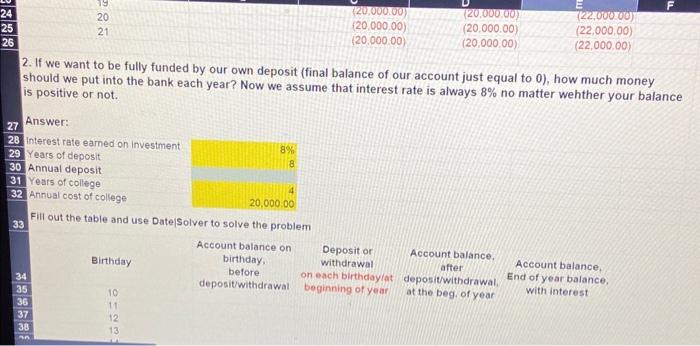

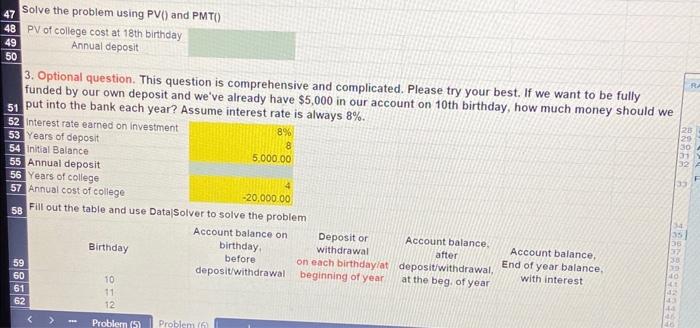

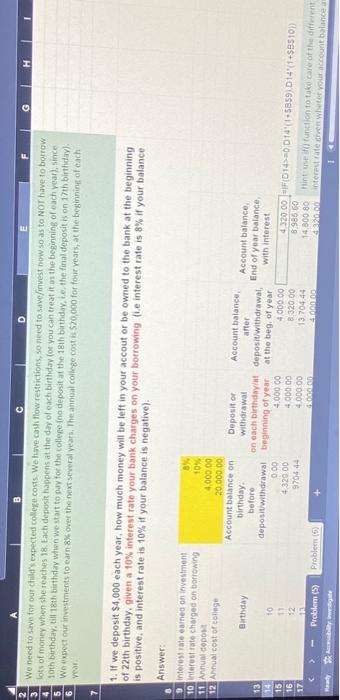

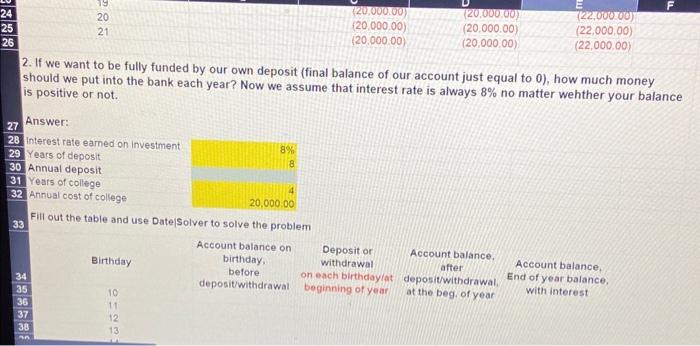

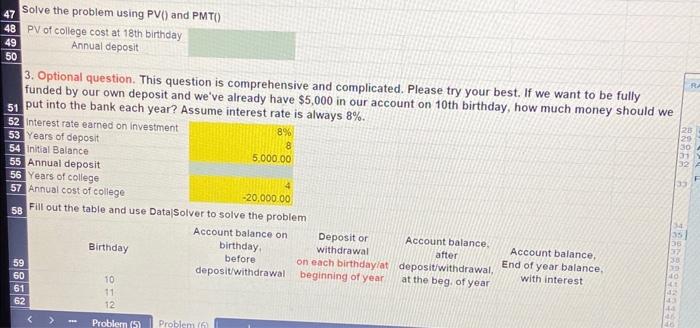

Wo necd to save for out child's expected college-costs- We hove cash flow restrictions, so niecd to save/invest how so as to Nor hawe to borrow lots of money when she reaches 18. Each deposit happens at the day of each birthday (or you can treat it an the beginning of each vear), since 10 th birthday, till 18 th birthiday when we start to pay for the college (no deposit at the 18 it birthiday, ie, the final deposit is on 17 th birthday). We uxpect our investmens to earn 8% ovet the next several years, The annial collicge cost is 570,000 for four veats, at the beginning of each vear. 1. If we deposit $4,000 each year, how much money will be left in your accout or be owned to the bank at the beginning of 22 th birthday. given a 10% interest rate your bank charges on your borrowing (i.e interest rate is 8% if your balance is positive, and interest rate is 10% if your balance is negative). 2. If we want to be fully funded by our own deposit (final balance of our account just equal to 0 ), how much money should we put into the bank each year? Now we assume that interest rate is always 8% no matter wehther your balance is positive or not. Fill out the table and use Date|solver to solve the problem Solve the problem using PV()and PMT() PV of college cost at 18 th birthday Annual deposit 3. Optional question. This question is comprehensive and complicated. Please try your best. If we want to be fully funded by our own deposit and we've already have $5,000 in our account on 10 th birthday, how much money should we put into the bank each year? Assume interest rate is always 8%. FIII out the table and use Data|Solver to solve the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started