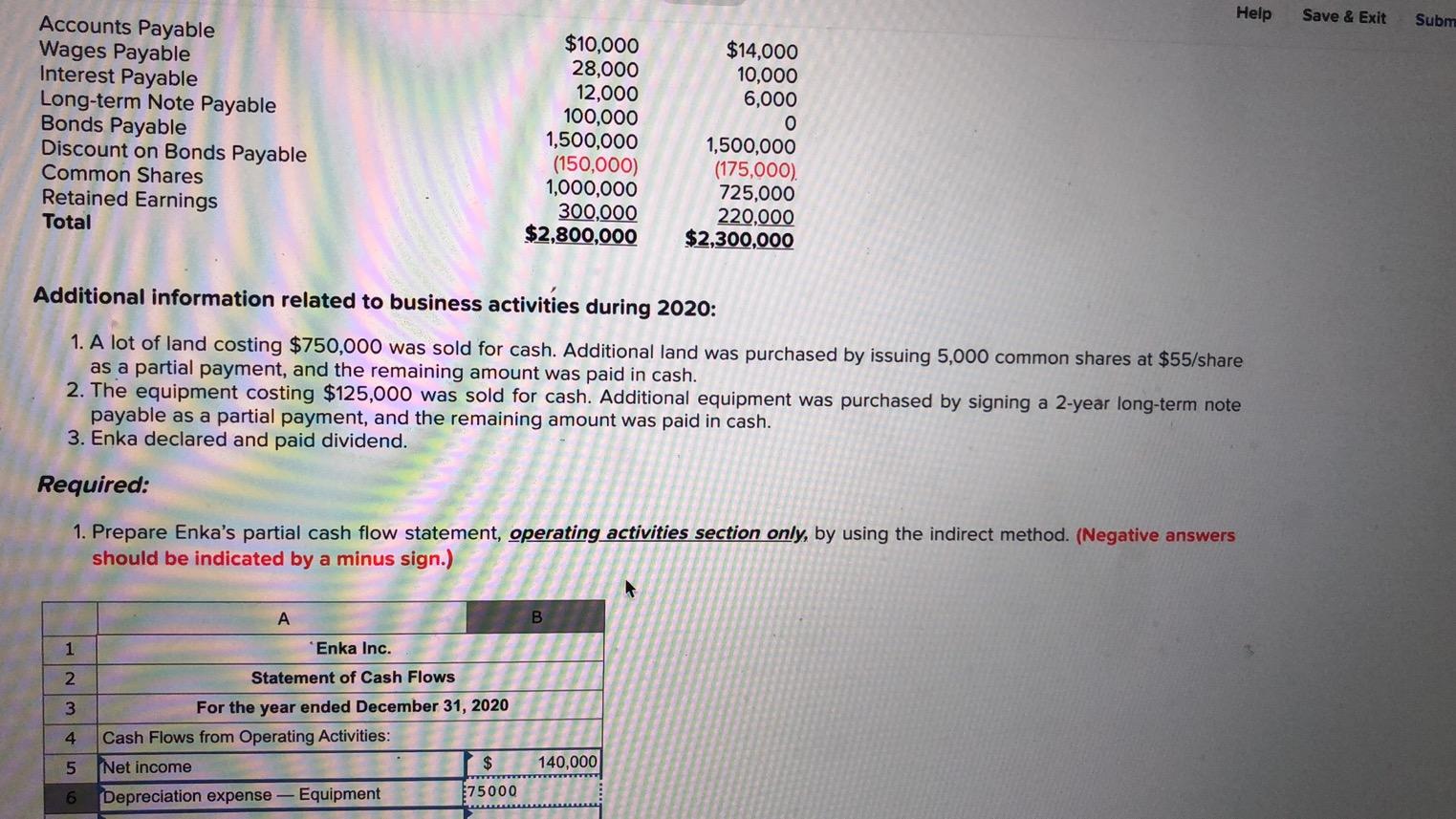

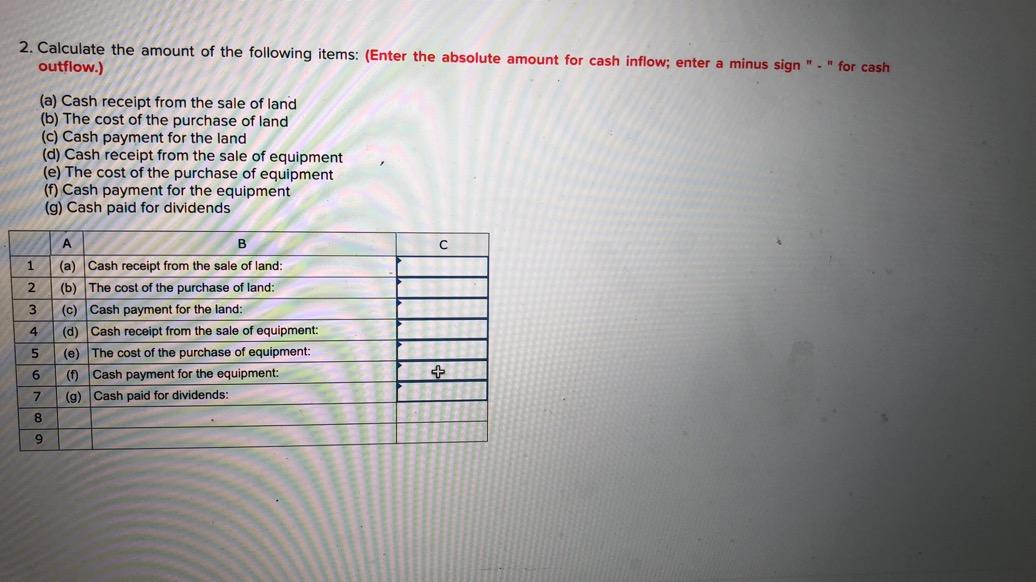

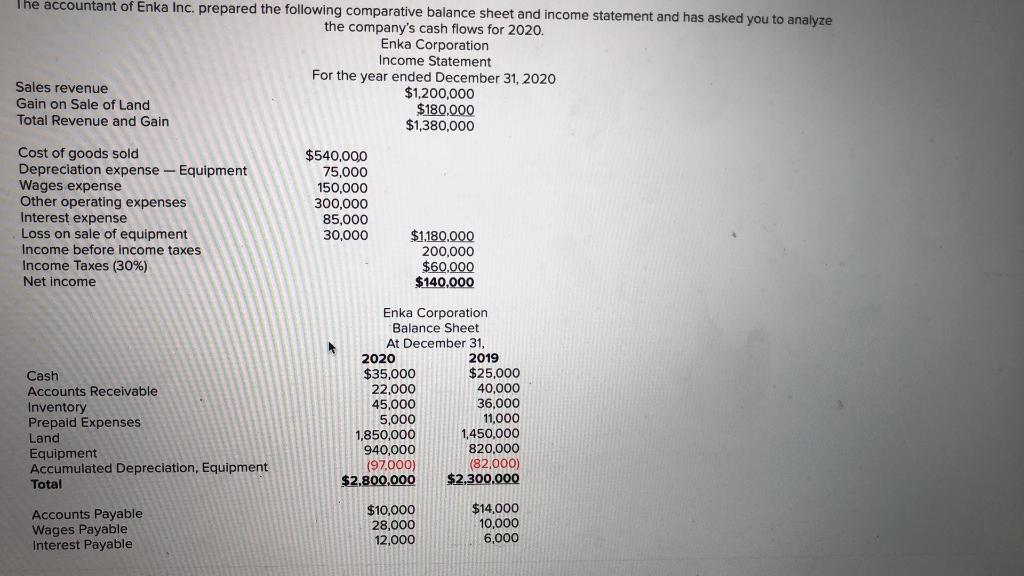

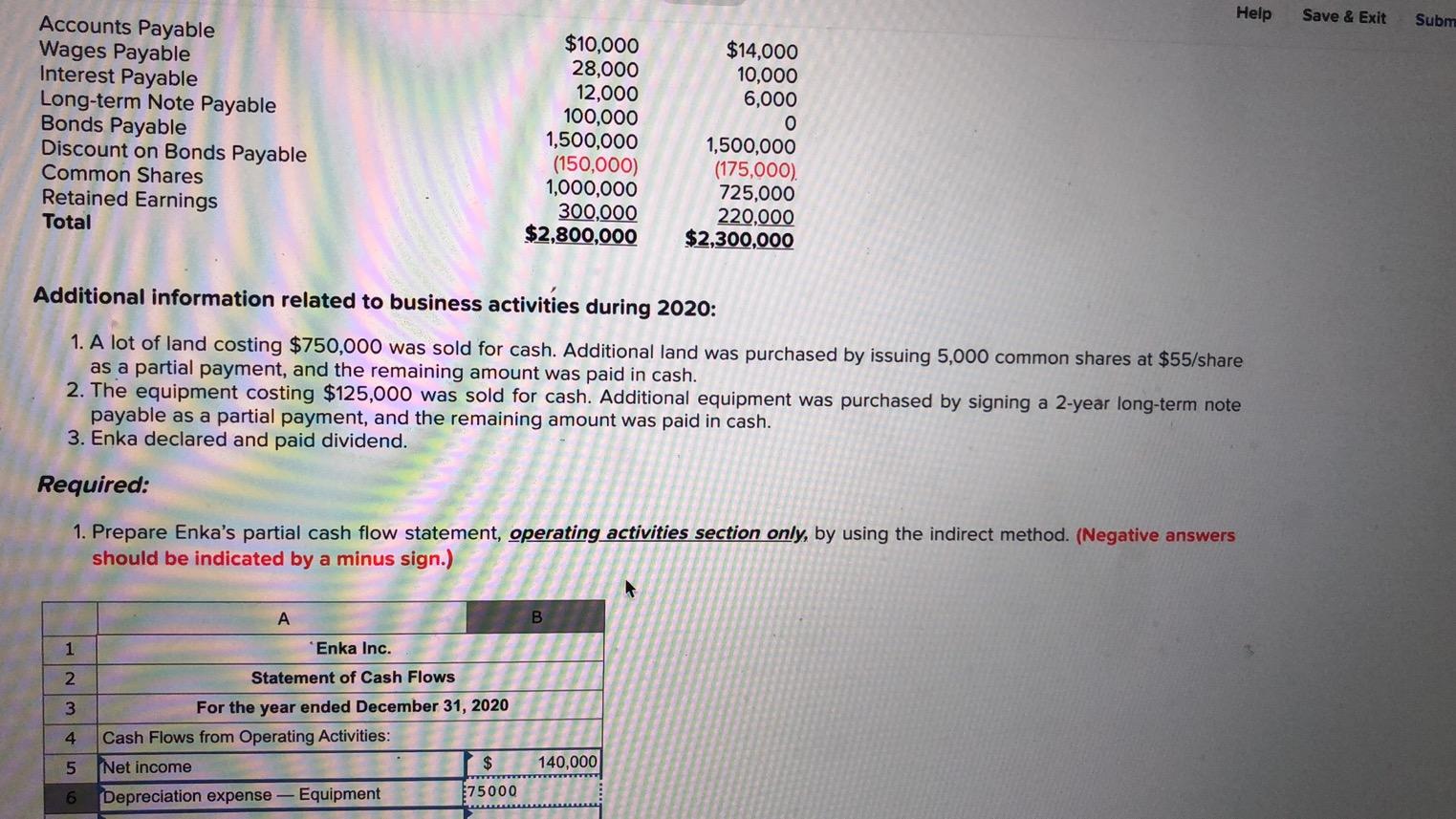

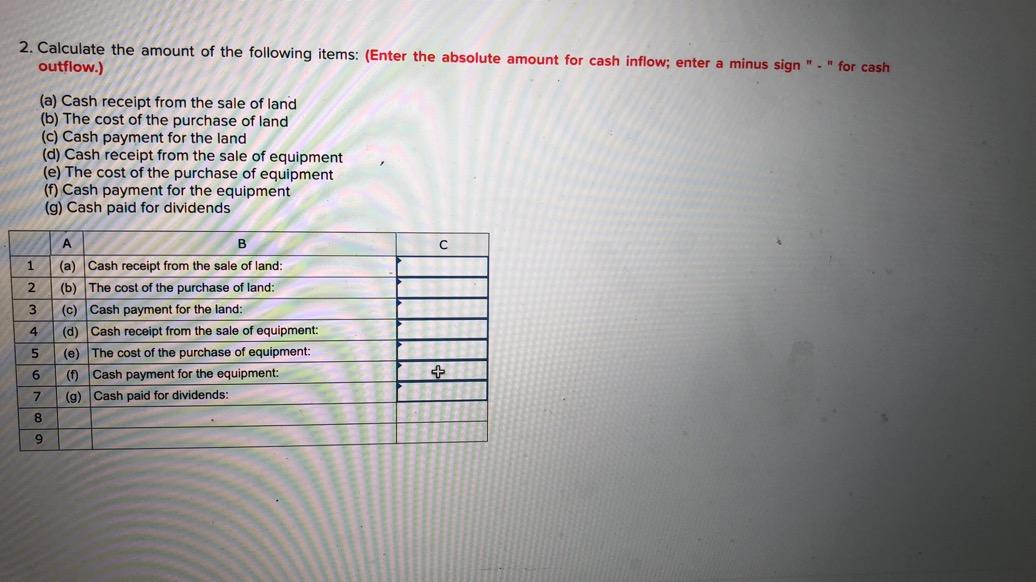

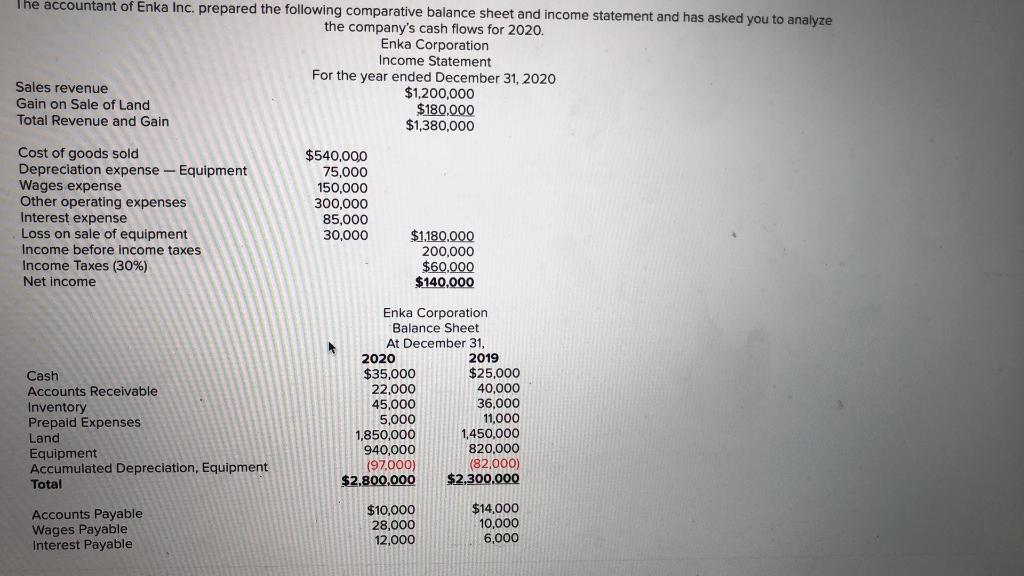

Help Save & Exit Subm Accounts Payable Wages Payable Interest Payable Long-term Note Payable Bonds Payable Discount on Bonds Payable Common Shares Retained Earnings Total $10,000 28,000 12,000 100,000 1,500,000 (150,000) 1,000,000 300,000 $2,800,000 $14,000 10,000 6,000 O 1,500,000 (175,000). 725,000 220,000 $2,300,000 Additional information related to business activities during 2020: 1. A lot of land costing $750,000 was sold for cash. Additional land was purchased by issuing 5,000 common shares at $55/share as a partial payment, and the remaining amount was paid in cash. 2. The equipment costing $125,000 was sold for cash. Additional equipment was purchased by signing a 2-year long-term note payable as a partial payment, and the remaining amount was paid in cash. 3. Enka declared and paid dividend. Required: 1. Prepare Enka's partial cash flow statement, operating activities section only, by using the indirect method. (Negative answers should be indicated by a minus sign.) A B 1 Enka Inc. 2 3 4 Statement of Cash Flows For the year ended December 31, 2020 Cash Flows from Operating Activities: Net income $ Depreciation expense - Equipment E75000 5 140,000 6 2. Calculate the amount of the following items: (Enter the absolute amount for cash inflow; enter a minus sign " . " for cash outflow.) (a) Cash receipt from the sale of land (b) The cost of the purchase of land (c) Cash payment for the land (d) Cash receipt from the sale of equipment (e) The cost of the purchase of equipment (1) Cash payment for the equipment (g) Cash paid for dividends B (a) Cash receipt from the sale of land: (b) The cost of the purchase of land: (c) Cash payment for the land: (d) Cash receipt from the sale of equipment: (e) The cost of the purchase of equipment: 0) Cash payment for the equipment: (g) Cash paid for dividends: 4 5 TH 6 + 7 8 9 The accountant of Enka Inc. prepared the following comparative balance sheet and income statement and has asked you to analyze the company's cash flows for 2020. Enka Corporation Income Statement For the year ended December 31, 2020 Sales revenue $1,200,000 Gain on Sale of Land $180,000 Total Revenue and Gain $1,380,000 Cost of goods sold Depreciation expense - Equipment Wages expense Other operating expenses Interest expense Loss on sale of equipment Income before income taxes Income Taxes (30%) Net income $540,000 75,000 150,000 300,000 85,000 30.000 $1,180.000 200,000 $60.000 $140,000 Cash Accounts Receivable Inventory Prepaid Expenses Land Equipment Accumulated Depreciation Equipment Total Enka Corporation Balance Sheet At December 31, 2020 2019 $35,000 $25,000 22.000 40,000 45,000 36,000 5,000 11,000 1,850,000 1,450,000 940,000 820,000 (97,000) (82,000) $2.800.000 $2,300.000 Accounts Payable Wages Payable Interest Payable $10,000 28,000 12,000 $14,000 10,000 6,000