Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help Save & Exit Your company is investigating the opportunity to produce MP3 players. The equipment required for the project initially costs $1,200,000 and will

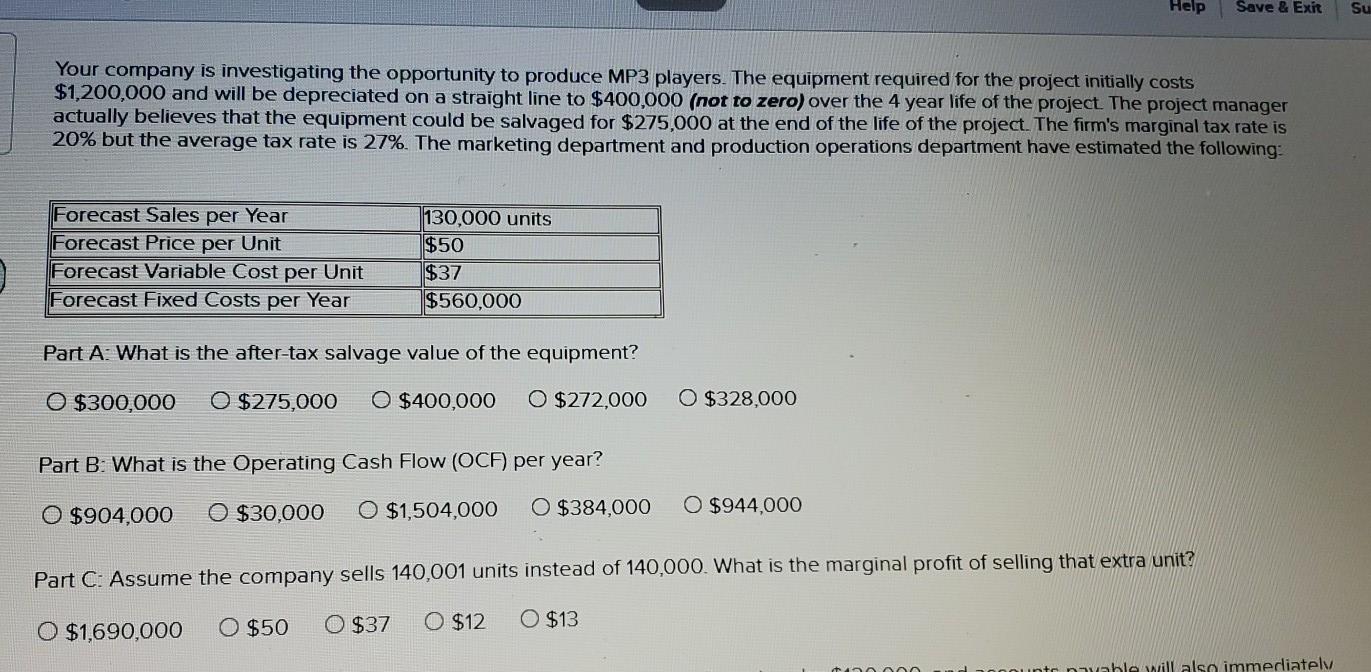

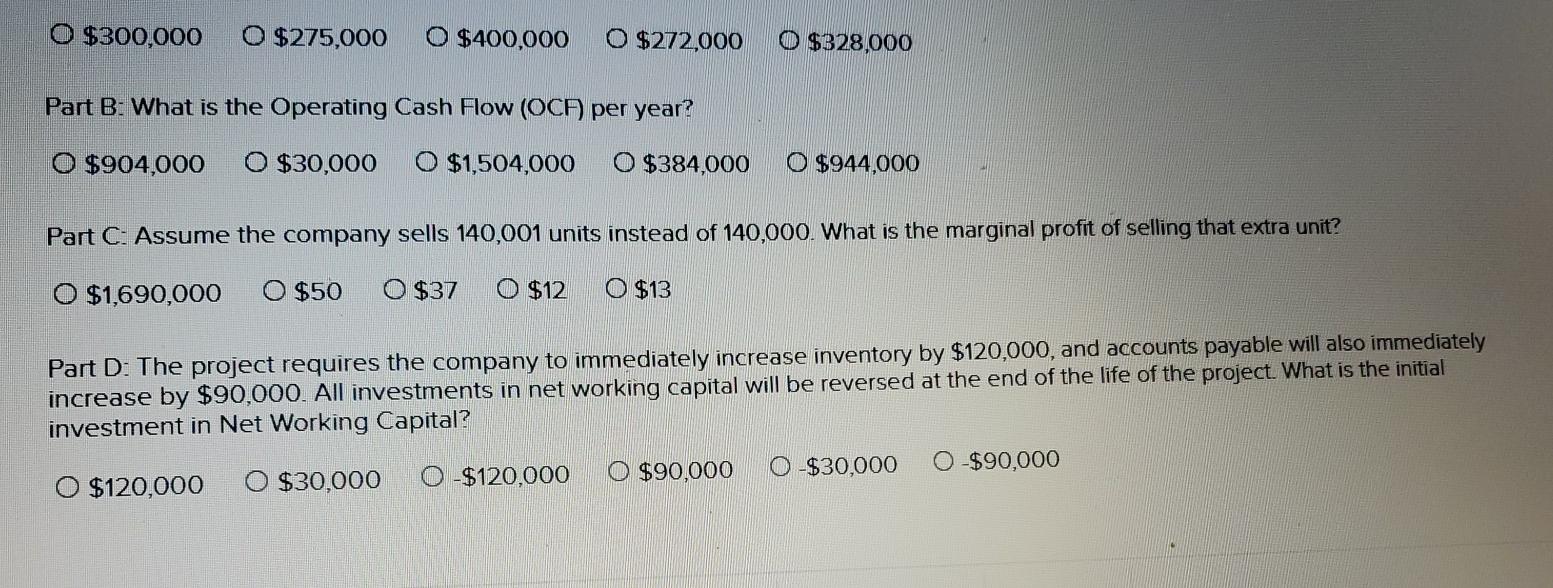

Help Save & Exit Your company is investigating the opportunity to produce MP3 players. The equipment required for the project initially costs $1,200,000 and will be depreciated on a straight line to $400,000 (not to zero) over the 4 year life of the project. The project manager actually believes that the equipment could be salvaged for $275,000 at the end of the life of the project. The firm's marginal tax rate is 20% but the average tax rate is 27%. The marketing department and production operations department have estimated the following: Forecast Sales per Year Forecast Price per Unit Forecast Variable Cost per Unit Forecast Fixed Costs per Year 130,000 units $50 $37 $560,000 Part A: What is the after-tax salvage value of the equipment? O $300,000 O $275,000 O $400,000 O $272,000 O $328,000 Part B: What is the Operating Cash Flow (OCF) per year? O $904,000 O $30,000 O $1,504,000 O $384,000 O $944,000 Part C: Assume the company sells 140,001 units instead of 140,000. What is the marginal profit of selling that extra unit? O $1,690,000 O $50 O $37 O $12 O $13 2000untryable will also immediately O $300,000 O $275,000 0 $400,000 O $272,000 0 $328,000 Part B: What is the Operating Cash Flow (OCA) per year? 0 $904,000 0 $30,000 O $1,504,000 O $384,000 0 $944,000 Part C. Assume the company sells 140,001 units instead of 140,000. What is the marginal profit of selling that extra unit? O $1,690,000 O $50 O $37 O $12 O $13 Part D: The project requires the company to immediately increase inventory by $120,000, and accounts payable will also immediately increase by $90,000. All investments in net working capital will be reversed at the end of the life of the project. What is the initial investment in Net Working Capital? O $90,000 0 $30,000 0 $90,000 O $120,000 O $30,000 O $120,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started