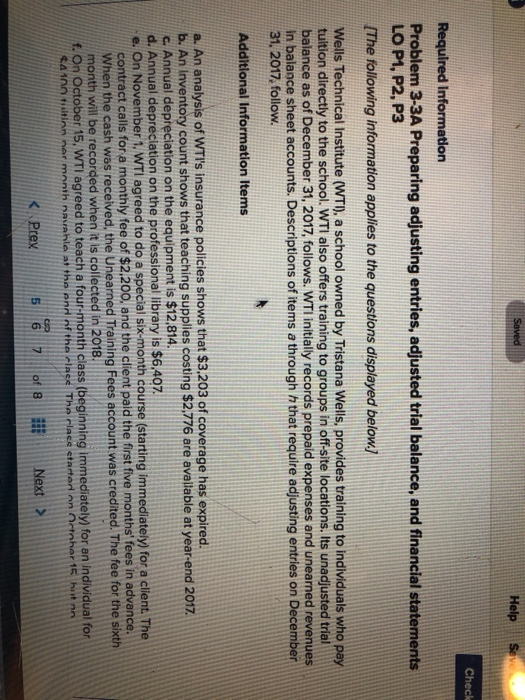

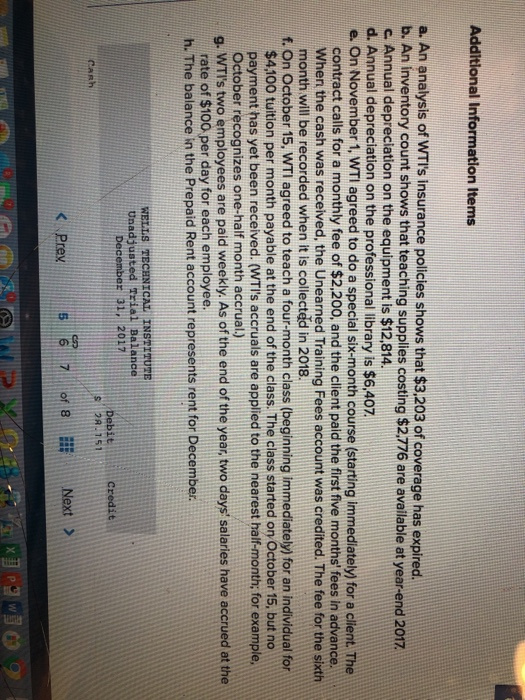

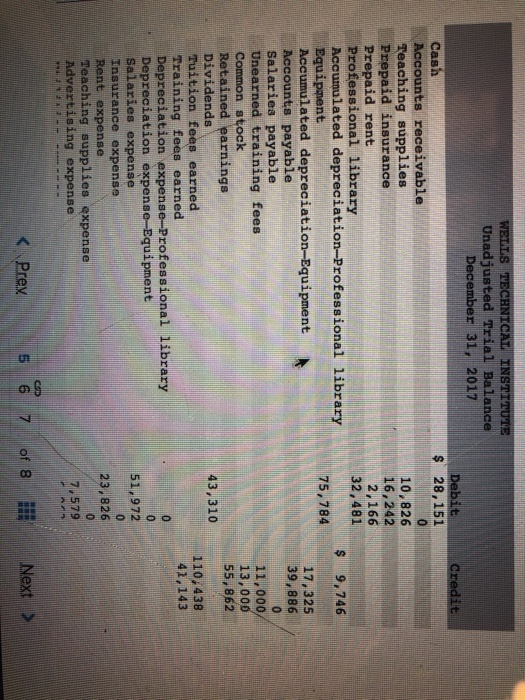

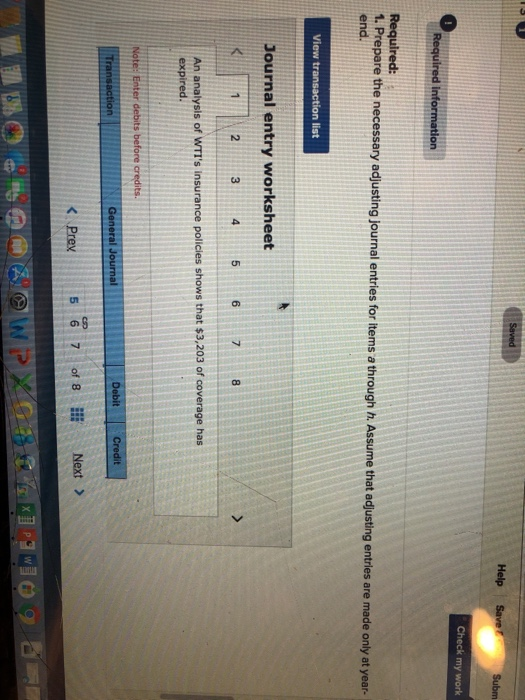

Help Seve Check Required Information Problem 3-3A Preparing adjusting entries, adjusted trial balance, and financial statements LO P1, P2, P3 [The following information applies to the questions displayed below. Wells Technical Institute (WT), a school owned by Tristana Wells, provides training to individuals who pay tultion directly to the school. WTI also offers training to groups in off-site locations. Its unadjusted trial balance as of December 31, 2017, follows. WTI initially records prepaid expenses and unearned revenues in balance sheet accounts. Descriptions of items a through h that require adjusting entries on December 31, 2017, follow Additional Information Items a. An analysis of WTI's insurance policies shows that $3.203 of coverage has expired. b. An inventory count shows that teaching supplies costing $2,776 are avaliable at yearend 2017 c. Annual depreciation on the equipment is $12.814 d. Annual depreciation on the professional library is $6.407 e. On November 1. WTI agreed to do a special six-month course (starting immediately) for a client. The contract calls for a monthly fee of $2.200, and the client paid the first five months fees in advance. When the cash was received, the Unearned Training Fees account was credited. The fee for the si month will be recorded when it is collected in 2018. f. On October 15. WTI agreed to teach a four-month class (beginning immediately) for an individual for ctnher15 hut 4 100 tisition ner month navahle at the endnf the class Tha clase started on O Prex 5 67 of 8ENext WELLS TECHNICAL INSTITUTE Unadjusted Trial Balance December 31, 2017 28,151 Accounts receivable Teaching supplies Pre paid insurance Prepaid rent Professional library Accumulated depreciation-Professional libra Equipment 10,826 16,242 2,166 32,481 ry $ 9,746 75,784 Accumulated depreciation-Equipment 17,325 39,886 Accounts payable Salaries payable Unearned training fees Common stock Retained earnings Dividends Tuition fees earned Training fees earned Depreciation expense-Professional library Depreciation expense Equipment Salaries expense 11,000/ 13,000 55,862 43,310 110,438 41,143 51 972 Insurance expense Rent expense Teaching supplies expense Advertising expense 23, 826 5 6 7 of 8 "Next > Accumulated depreciation Professional library Equipment Accumulated depreciation Equipment Accounts payable Salar Unearned training fees Common stock Retained earnings Dividends Tuition fees earned Training fees earned Depreciation expense-Professional library Depreciation expense-Equipment Salaries expense Insuranice expense Rent expense Teaching supplies expense Advertising expense Utilities expense s 9/746 75,784 17.325 39, 886 ies payable 11,000 13,000 55,862 43.310 110,438 51,972 23,826 7,579 6, 063 otals s 298,400 $298,400 Problem 3-3A Part 1 Renuired: Required i Journal entry worksneet 2 3 5 6 7 8 An analysis of WTI's insurance policies shows that $3,203 of coverage has expired Ge rnal a.

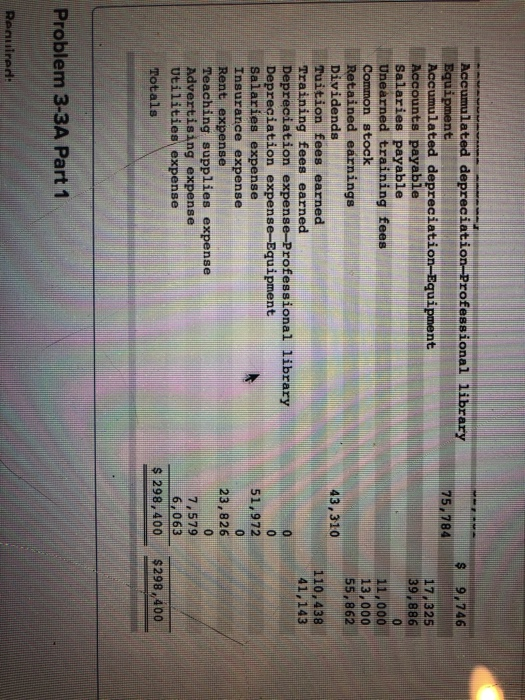

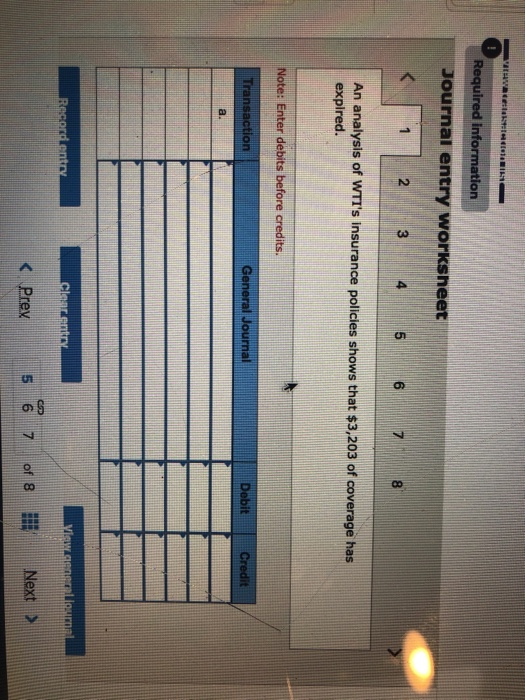

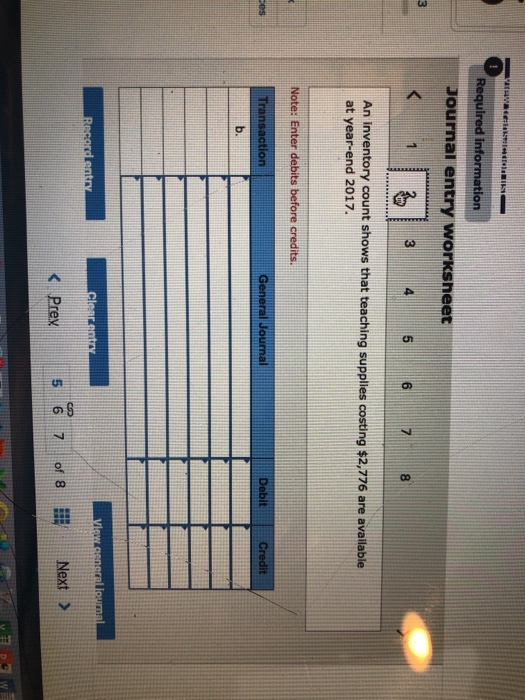

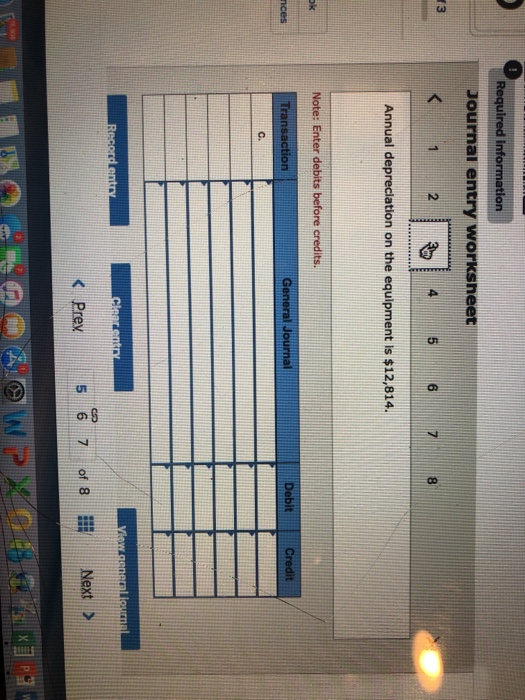

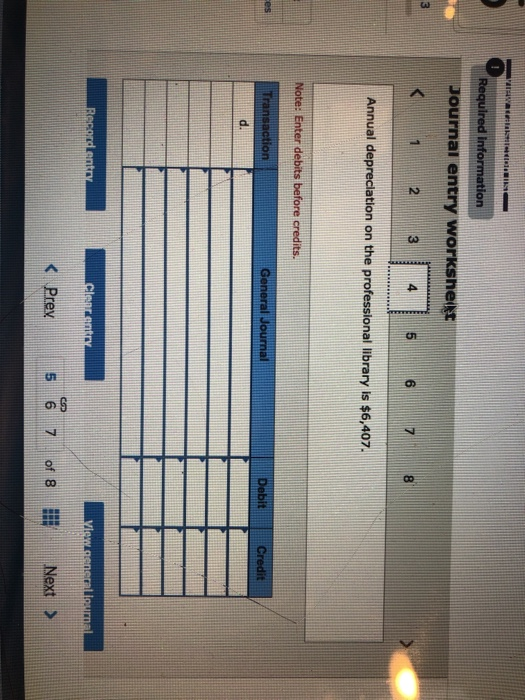

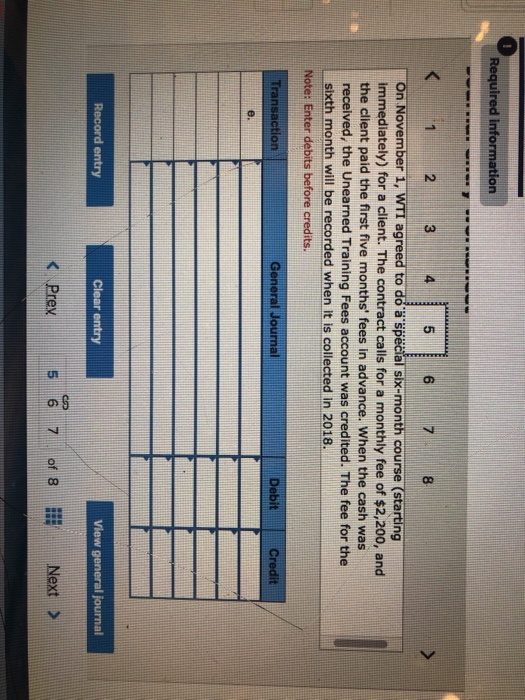

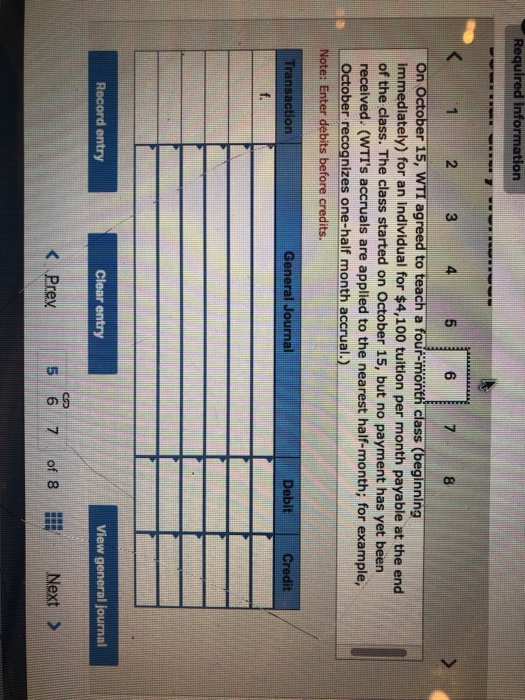

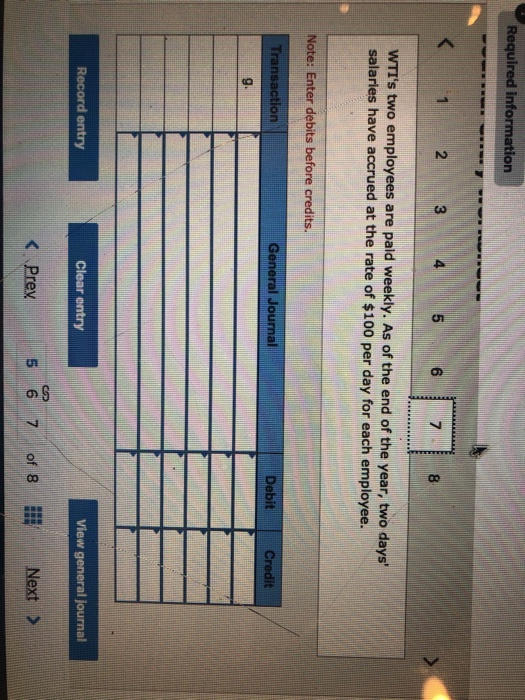

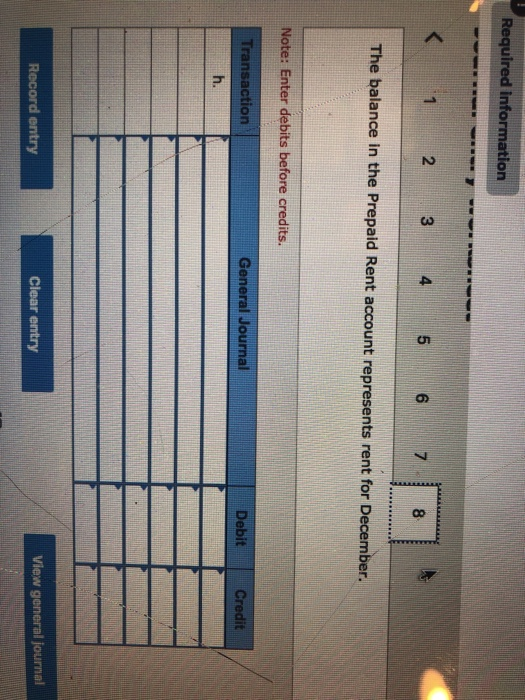

Journal entry worksnee 3 8 An inventory count shows that teaching supplies costing $2.776 are available at year-end 2017. es bit b. Prex 15671018 Next > lJournal entry worksneet 13 2 5 6 8 Annual depreciation on the equipment is $12,814 C. c Prev 5670f8 Next > Journal entry worksne 2 3 5 6 Annual depreclation on the professional library is $6,407 Note: Enter debits before credits. d. uired information On November 1, WTI agreed to do a special six-month course (starting immediately) for a client. The contract calls for a monthly fee of $2,200, and the client paid the first five months fees in advance. When the cash was received, the Unearned Training Fees account was credited. The fee for the sixth month will be recorded when It is collected in 2018. Note: Enter debits before credits. Required information 2 3 5 6 7 8 on October 15, WTI agreed to teach a four-monthi class (beginning immediately) for an individual for $4,100 tuition per month payable at the end of the class. The class started on October 15, but no payment has yet been recelved. (WTI's accruals are applied to the nearest half-month; for example, October recognizes one-half month accrual.) Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry View general journal Required information 2 4 5 6 8 WTI's two employees are pald weekly. As of the end of the year, two days salaries have accrued at the rate of $100 per day for each employee. Note: Enter debits before credits. eral Jou Credit g. View general journal Required information The balance in the Prepaid Rent account represents rent for December. Note: Enter debits before credits. ransaction General Journal Debit Credit h. View general journal Record entry Clear entry