help solving 3) and 4) using info below

question 3) and 4) below

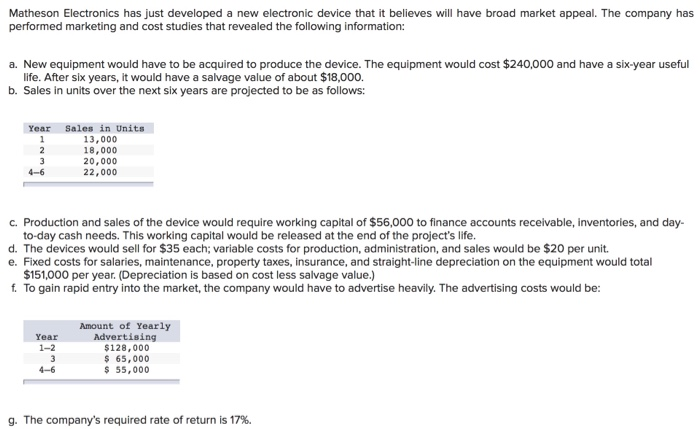

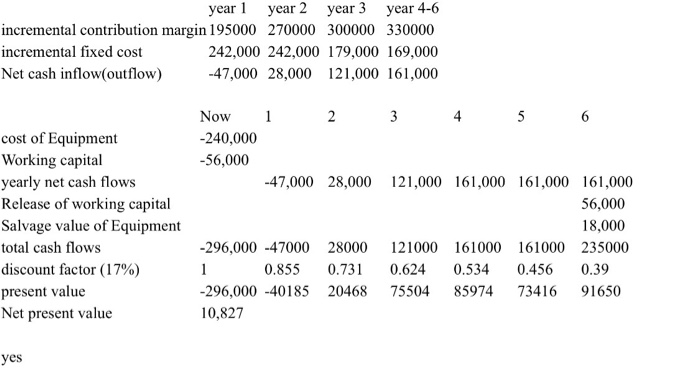

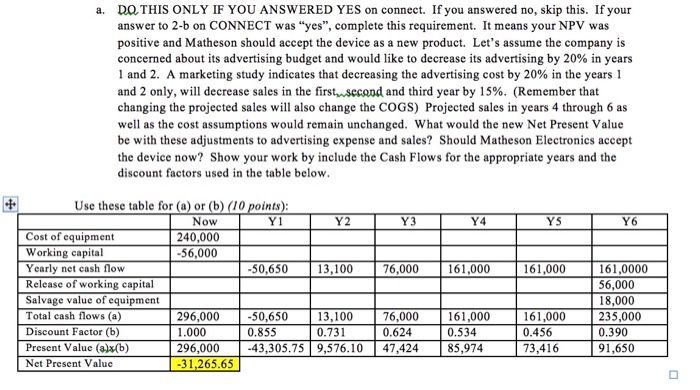

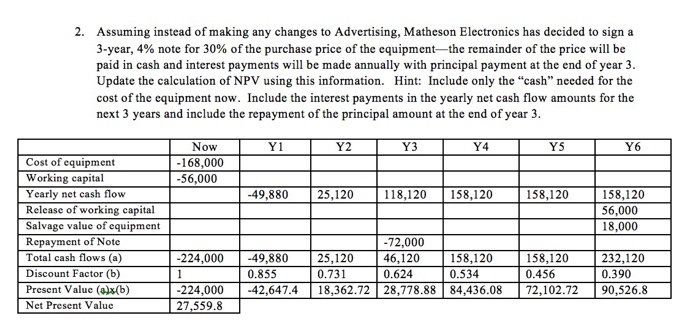

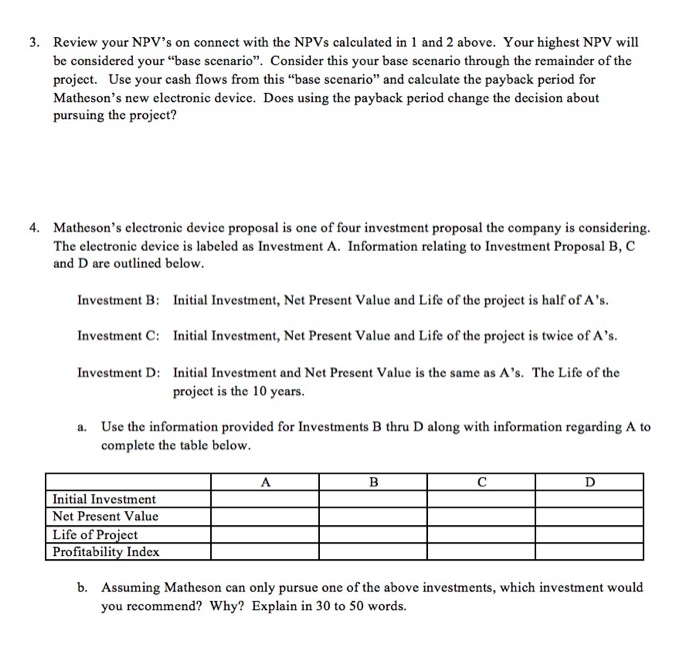

Matheson Electronics has just developed a new electronic device that it believes will have broad market appeal. The company has performed marketing and cost studies that revealed the following information: a. New equipment would have to be acquired to produce the device. The equipment would cost $240,000 and have a six-year useful life. After six years, it would have a salvage value of about $18,000. b. Sales in units over the next six years are projected to be as follows: Year 1 2 3 Sales in Units 13,000 18,000 20,000 22,000 c. Production and sales of the device would require working capital of $56,000 to finance accounts receivable, inventories, and day- to-day cash needs. This working capital would be released at the end of the project's life. d. The devices would sell for $35 each; variable costs for production, administration, and sales would be $20 per unit. e. Fixed costs for salaries, maintenance, property taxes, insurance, and straight-line depreciation on the equipment would total $151,000 per year. (Depreciation is based on cost less salvage value.) f. To gain rapid entry into the market, the company would have to advertise heavily. The advertising costs would be: Year 1-2 3 4-6 Amount of Yearly Advertising $128,000 $ 65,000 $ 55,000 g. The company's required rate of return is 17%. year 1 year 2 year 3 year 4-6 incremental contribution margin 195000 270000 300000 330000 incremental fixed cost 242,000 242,000 179,000 169,000 Net cash inflow(outflow) -47,000 28,000 121,000 161,000 2 cost of Equipment Working capital yearly net cash flows Release of working capital Salvage value of Equipment total cash flows discount factor (17%) present value Net present value Now 3 4 5 6 -240,000 -56,000 -47,000 28,000 121,000 161,000 161,000 161,000 56,000 18,000 -296,000 -47000 28000 121000 161000 161000 235000 0.855 0.731 0.624 0.534 0.456 0.39 -296,000 -40185 20468 75504 85974 73416 91650 10,827 yes a. DO THIS ONLY IF YOU ANSWERED YES on connect. If you answered no, skip this. If your answer to 2-b on CONNECT was "yes", complete this requirement. It means your NPV was positive and Matheson should accept the device as a new product. Let's assume the company is concerned about its advertising budget and would like to decrease its advertising by 20% in years 1 and 2. A marketing study indicates that decreasing the advertising cost by 20% in the years 1 and 2 only, will decrease sales in the first second and third year by 15%. (Remember that changing the projected sales will also change the COGS) Projected sales in years 4 through 6 as well as the cost assumptions would remain unchanged. What would the new Net Present Value be with these adjustments to advertising expense and sales? Should Matheson Electronics accept the device now? Show your work by include the Cash Flows for the appropriate years and the discount factors used in the table below. Y3 Y4 YS Y6 76,000 161,000 161,000 Use these table for (a) or (b) (10 points): Now Y1 Y2 Cost of equipment 240,000 Working capital -56,000 Yearly net cash flow -50,650 13,100 Release of working capital Salvage value of equipment Total cash flows (a) 296,000 -50,650 13,100 Discount Factor (b) 1.000 0.855 0.731 Present Value (a)x(b) 296,000 -43,305.759,576.10 Net Present Value -31,265.65 161,0000 56,000 18,000 235,000 0.390 91,650 76,000 0.624 47,424 161,000 0.534 85,974 161,000 0.456 73,416 2. Assuming instead of making any changes to Advertising, Matheson Electronics has decided to sign a 3-year, 4% note for 30% of the purchase price of the equipment-the remainder of the price will be paid in cash and interest payments will be made annually with principal payment at the end of year 3. Update the calculation of NPV using this information. Hint: Include only the "cash needed for the cost of the equipment now. Include the interest payments in the yearly net cash flow amounts for the next 3 years and include the repayment of the principal amount at the end of year 3. Y1 Y2 Y3 Y4 Y5 Y6 Now -168,000 -56,000 -49,880 25,120 118,120 158,120 158,120 Cost of equipment Working capital Yearly net cash flow Release of working capital Salvage value of equipment Repayment of Note Total cash flows (a) Discount Factor (b) Present Value (a)x(b) Net Present Value 158,120 56,000 18,000 -224,000 -49,880 0.855 -42,647.4 -72,000 25,120 46,120 158,120 0.731 0.624 0.534 18,362.72 28,778.88 84,436.08 158,120 0.456 72,102.72 232,120 0.390 90,526.8 -224,000 27,559.8 3. Review your NPV's on connect with the NPVs calculated in 1 and 2 above. Your highest NPV will be considered your "base scenario". Consider this your base scenario through the remainder of the project. Use your cash flows from this "base scenario" and calculate the payback period for Matheson's new electronic device. Does using the payback period change the decision about pursuing the project? 4. Matheson's electronic device proposal is one of four investment proposal the company is considering. The electronic device is labeled as Investment A. Information relating to Investment Proposal B, C and D are outlined below. Investment B: Initial Investment, Net Present Value and Life of the project is half of A's. Investment C: Initial Investment, Net Present Value and Life of the project is twice of A's. Investment D: Initial Investment and Net Present Value is the same as A's. The Life of the project is the 10 years. a. Use the information provided for Investments B thru D along with information regarding A to complete the table below. A B D Initial Investment Net Present Value Life of Project Profitability Index b. Assuming Matheson can only pursue one of the above investments, which investment would you recommend? Why? Explain in 30 to 50 words