Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help Sudbury Softball Inc makes sofball bats and expects most of its sales to occur in the late spring and summer. The sales manager projects

help

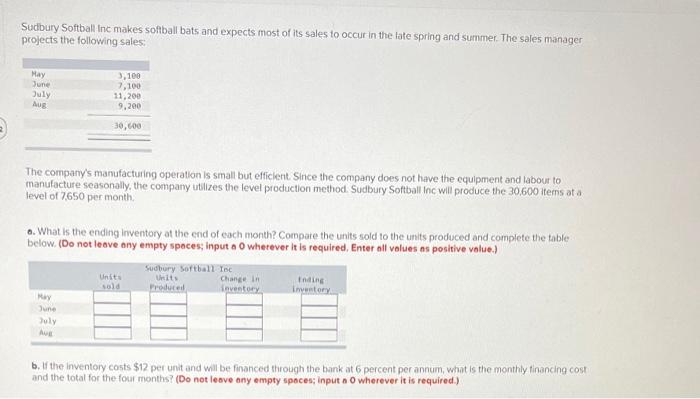

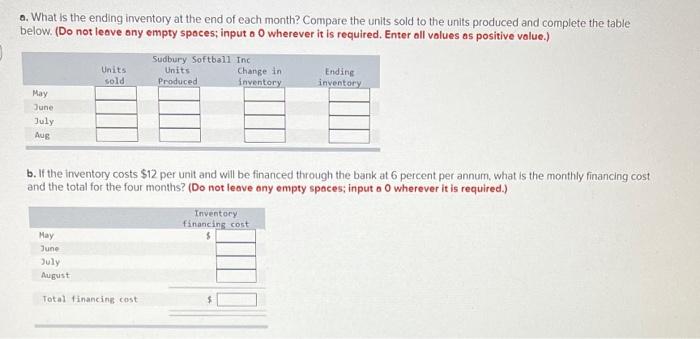

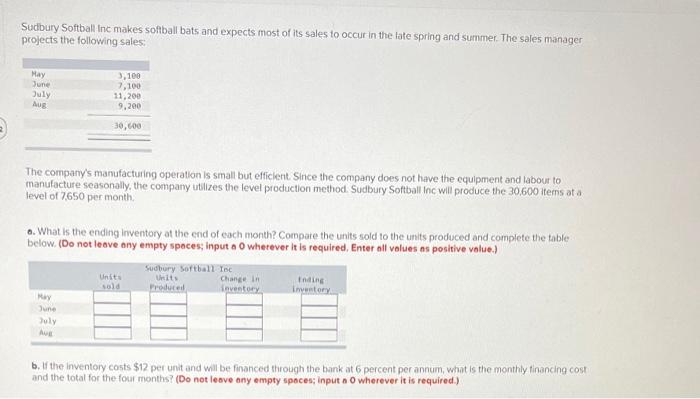

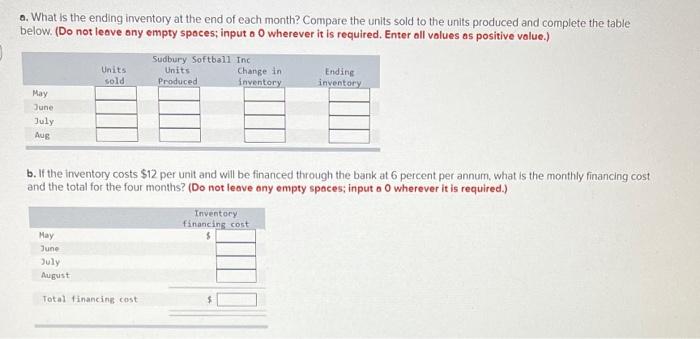

Sudbury Softball Inc makes sofball bats and expects most of its sales to occur in the late spring and summer. The sales manager projects the following sales: The company's manufacturing operation is small but efficient. Since the company does not have the equipment and labout to manufacture seasonally. the comparry utilizes the level production method. Sudbury Softball inc will produce the 30,600 items at a level of 7,650 per month. 0. What is the ending inventory at the end of each month? Compare the units sold to the units produced and complete the table below. (Do not leave any empty spaces, input a 0 wherever it is required, Enter all values ns positive value.) b. If the inventory costs $12 per unit and will be financed through the bank at 6 percent per annum, what is the monthly financing cost and the total for the foul months? (Do not leove any empty spoces; input n0 wherever it is required) a. What is the ending inventory at the end of each month? Compare the units sold to the units produced and complete the table below. (Do not leave any empty spaces; input o 0 wherever it is required. Enter all values as positive volue.) b. If the inventory costs $12 per unit and will be financed through the bank at 6 percent per annum, what is the monthly financing cost and the total for the four months? (Do not leave ony empty spaces; input a 0 wherever it is required.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started