help to complete excel worksheet. how I can insert the values in excel worksheet

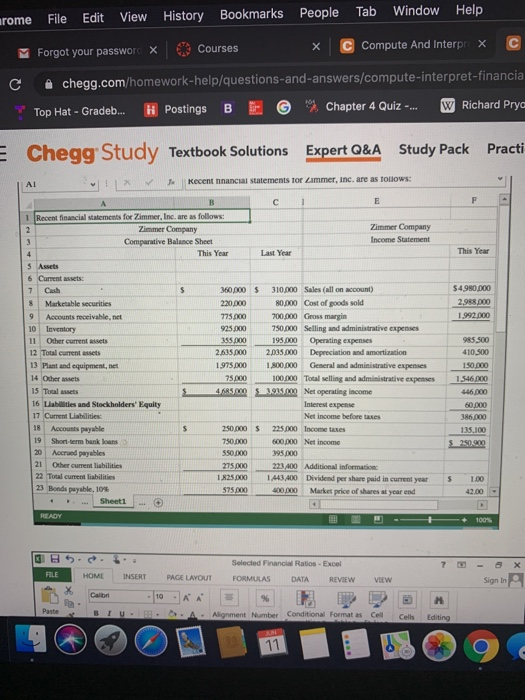

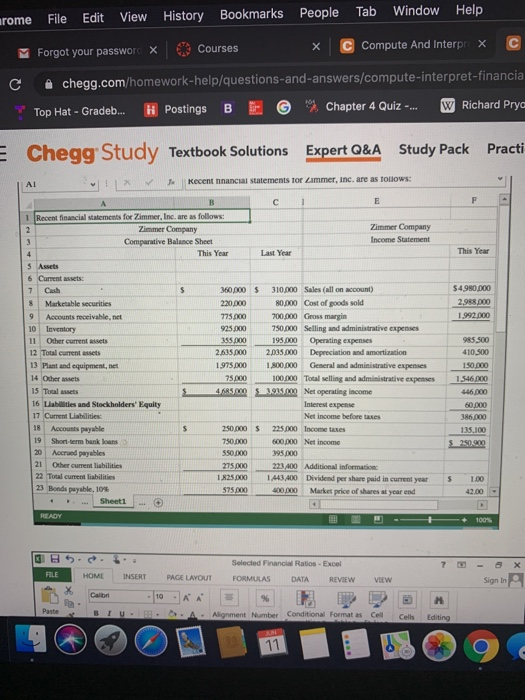

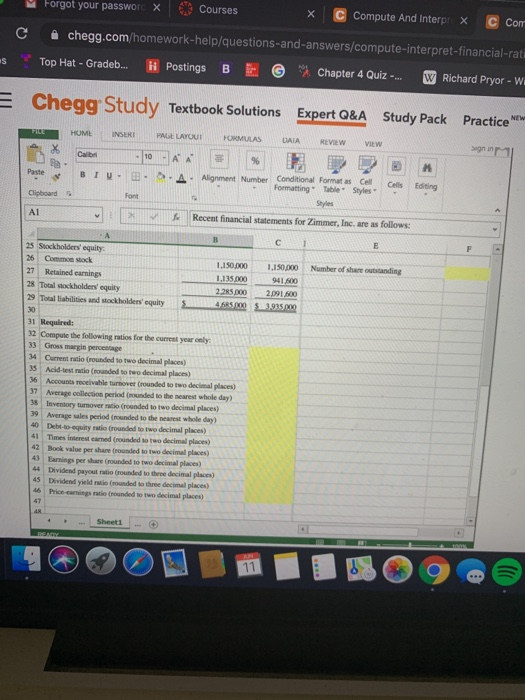

rome File View Tab Edit History Window Help Bookmarks People Courses C Forgot your passwore X Compute And Interpr X c chegg.com/homework-help/questions-and-answers/compute-interpret-financia Top Hat - Gradeb... Hi Postings Chapter 4 Quiz -... W Richard Pryo E Chegg Study Textbook Solutions Expert Q&A Study Pack Practi Tu Recent ninancial statements Tor Zimmer, Inc. are as follows: F This Year 7 $4.980.000 2.968.000 1.992.000 E 1 Recent financial statements for Zimmer, Inc. are as follows: 2 Zimmer Company Zimmer Company 3 Comparative Balance Sheet Income Statement 4 This Year Last Year 5 Assets 6 Current assets Cash $ 360,000 $ 310,000 Sales (all on account) $ Marketable securities 220.000 80,000 Cost of goods sold 9 Accounts receivable, net 775.000 700.000 Gross margin 10 Inventory 925.000 750.000 Selling and administrative expenses 11 Other current 355.000 195.000 Operating expenses 12 Total current assets 2.635.000 2,035.000 Depreciation and amortization 13 Plant and equipment, net 1.975.000 1.800.000 General and administrative expenses 14 Other assets 75.000 100.000 Total selling and administrative expenses 15 Total assets $ URSO 390500 Net operating income 16 Liabilities and Stockholders' Equity Interest expense 17 Current Liabilities Net income before taxes 18 Accounts payable $ 250.000 $ 225.000 Income taxes 19 Short-term bank loans 750.000 600.000 Net income Accrued payables 550.000 395,000 21 Other current liabilities 275.000 223.400 Additional information 22 Total current liabilities 1.825.000 1,443,400 Dividend per share paid in current year 23 Bonds payable, 10% 575.000 400.000 Market price of shares at year end Sheet1 985.500 410.500 150.000 1.546.000 446,000 60.000 386,000 135.100 20.000 $ 1.00 42.00 READY 100% Q FILE Selected Financial Ratios - Excel FORMULAS DATA REVIEW HOME INSERT PAGE LAYOUT VIEW Sign In Calibri 10 A % Paste Alignment Number Conditional Formatas Cell Cells Editing 11 O Forgot your passworx Courses C Compute And InterprX C Com chegg.com/homework-help/questions-and-answers/compute-interpret-financial-rati Top Hat - Gradeb... Postings BE Chapter 4 Quiz W Richard Pryor - W. S = Chegg Study Textbook Solutions Expert Q&A Study Pack Practice NEW HOME INSERT PAGE LAYOUT HORMULAS DATA REVIEW VIEW gin Calib -10 96 M Paste B TV- A Alignment Number Conditional Format as Cell Formatting Table Styles Cells Editing Clipboard Font A1 2 Recent financial statements for Zimmer, Inc. are as follows: E Number of share outstanding B 25 Stockholders' equity 26 Common stock 1.150.000 1,150.000 27 Retained earnings 1.135.000 941100 28 Total stockholders' equity 2.285.000 2.091.00 29 Total abilities and stockholders' equity $ 465/0003925000 30 31 Required: 32 Compute the following ratios for the current year only 33 Gross margin percentage 34 Current ratio rounded to two decimal places) 35 Acid-test ratio (rounded to two decimal places) 36 Accounts receivable tumoverrounded to two decimal places) 37 Average collection period (rounded to the nearest whole day) 38 Inventory tumover ratio (rounded to two decimal places) 39 Average sales period rounded to the nearest whole day) Debt-to-equity ratio (rounded to two decimal places) Times interest earned (rounded to two decimal places) 42 Book value per share rounded to two decimal places) 43 Earnings per share rounded to two decimal places) 44 Dividend payout ratio (rounded to three decimal places) 45 Dividend yield rate rounded to three decimal places) 46 Price-camins ratio (unded to two decimal places) 40 41 LR Sheet1 g