Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help to solve this /c/NDg2NzQyNjMxODIO/a/NTMyNTA4MTc2NjQ0/details 1. At the end of its first year of operations, Lockerbie and Role Company has total assets of $3,000,000 and

help to solve this

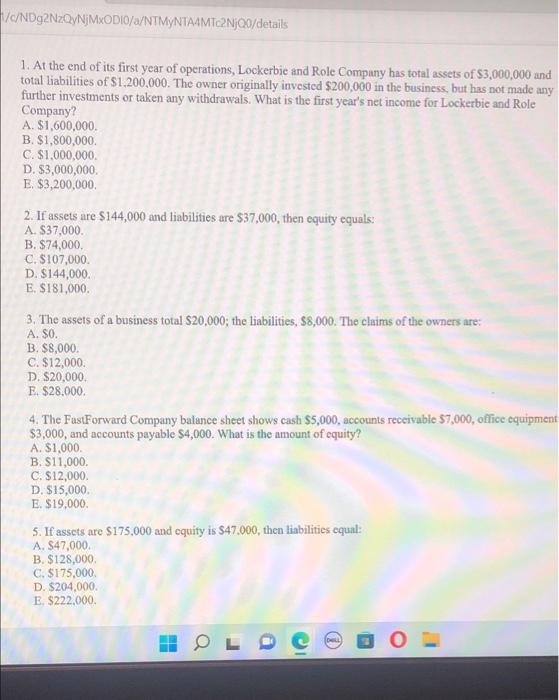

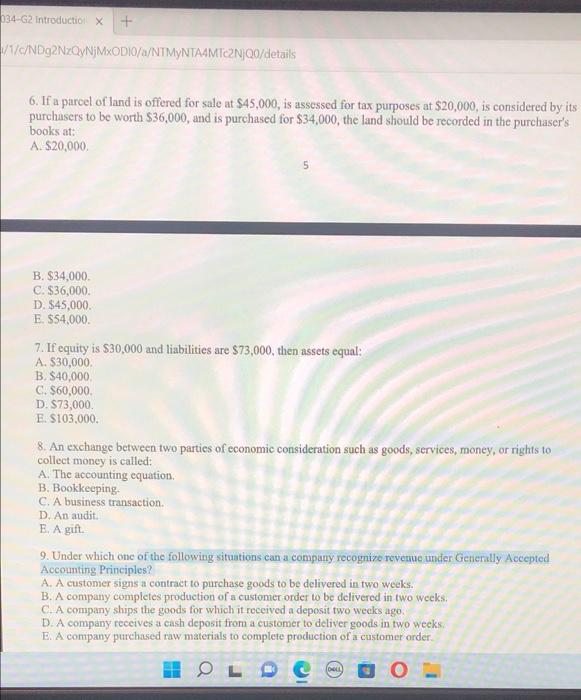

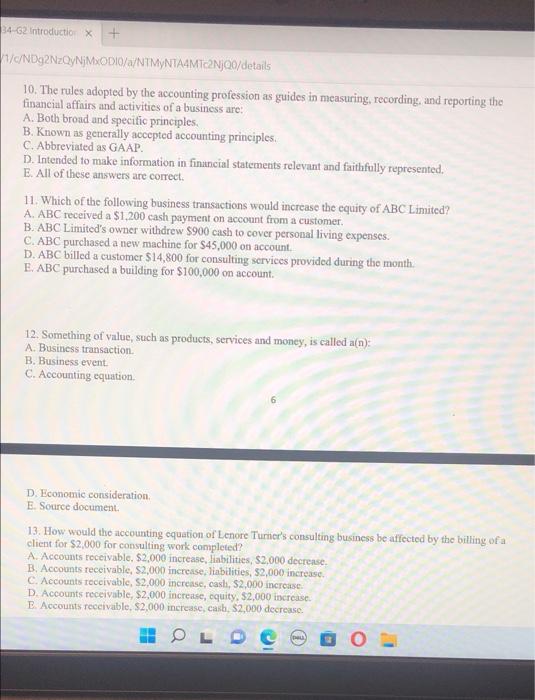

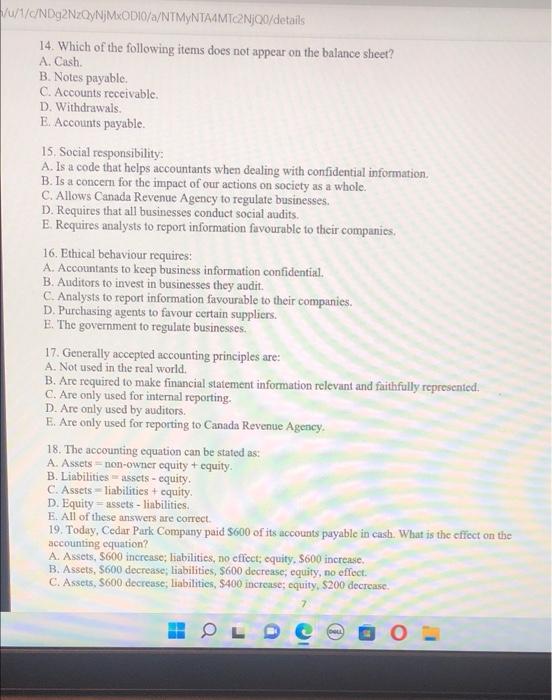

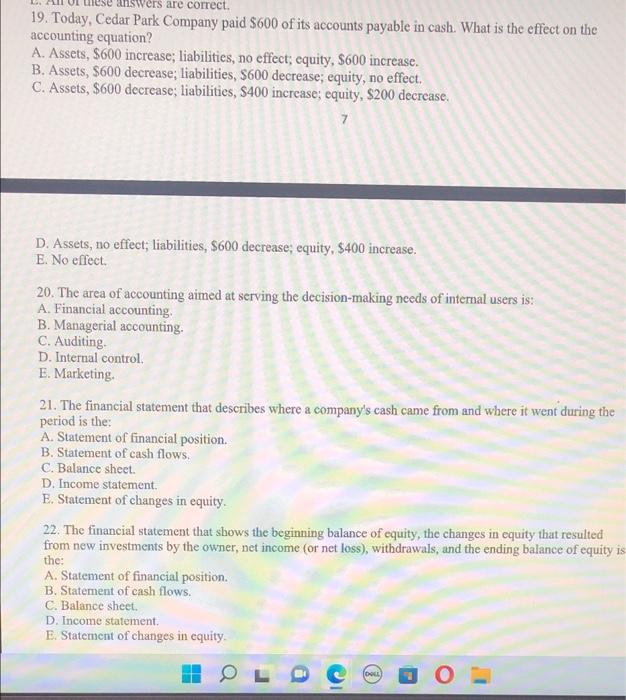

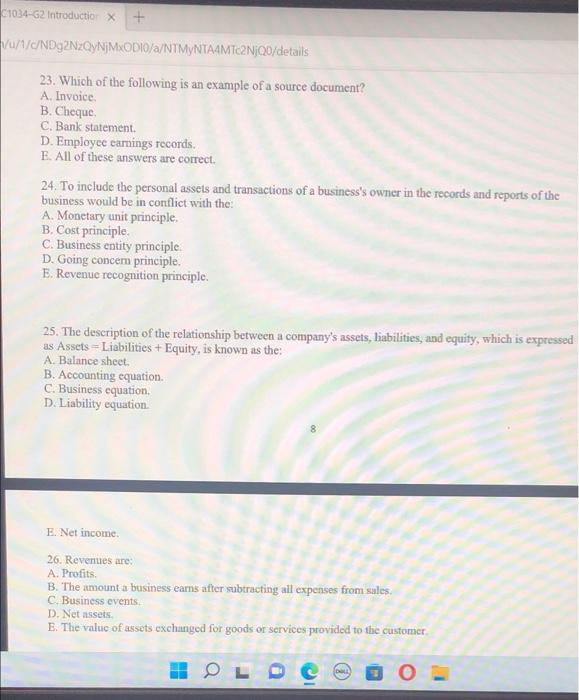

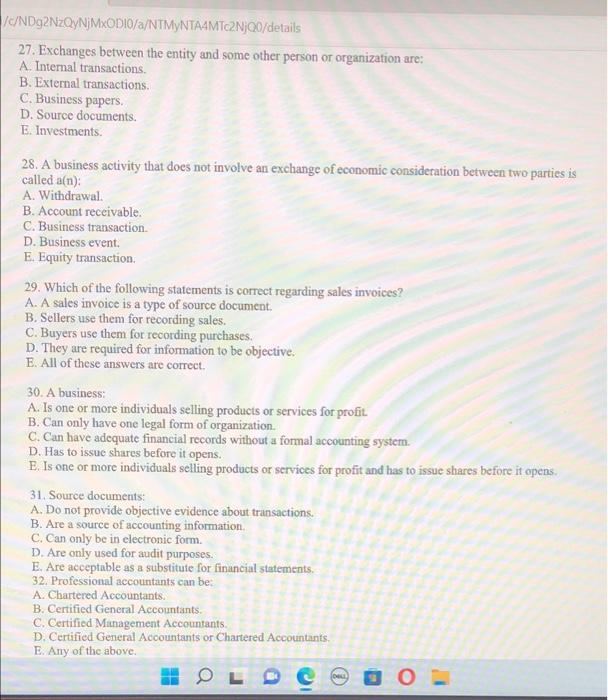

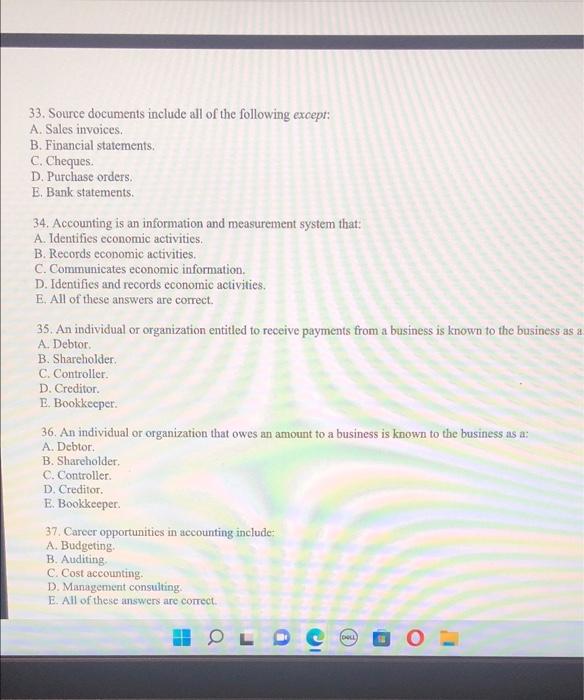

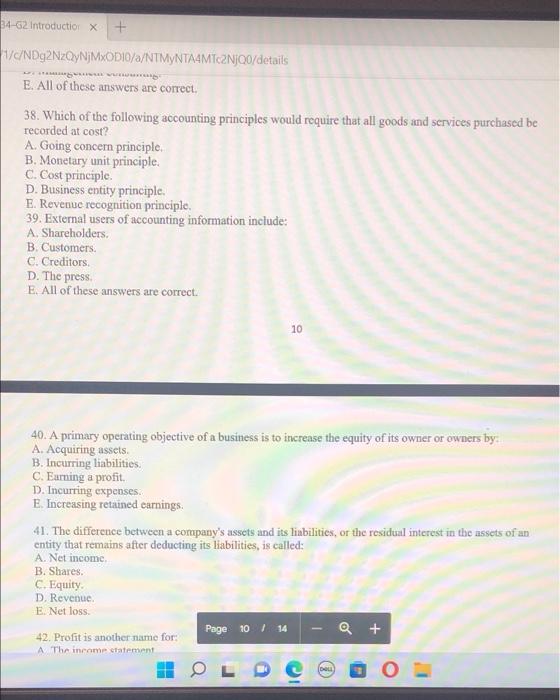

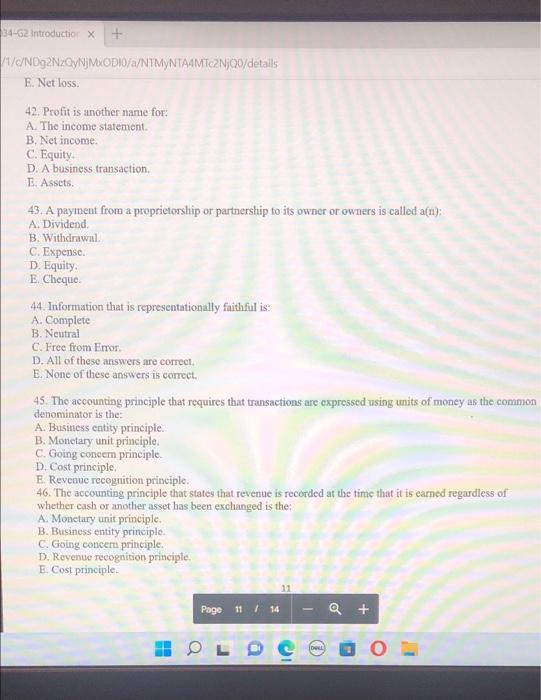

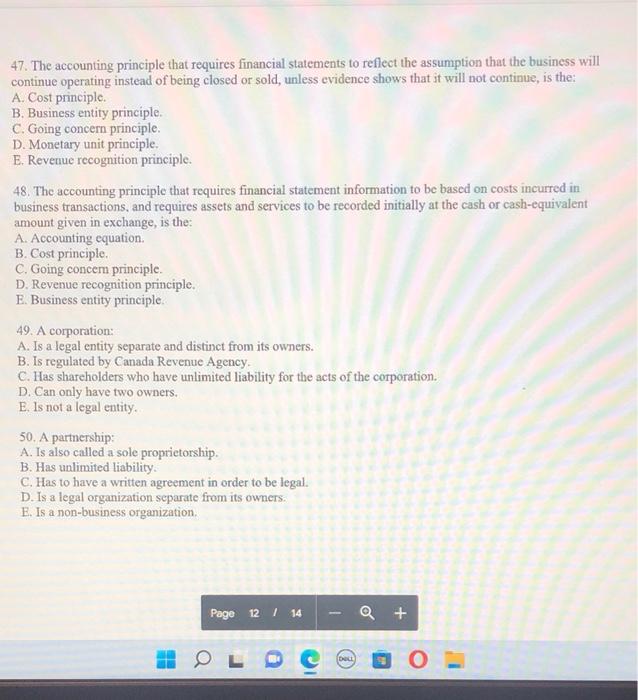

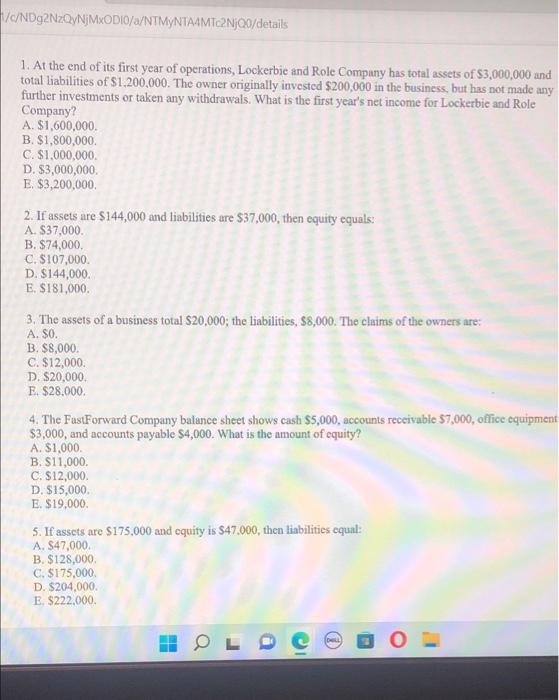

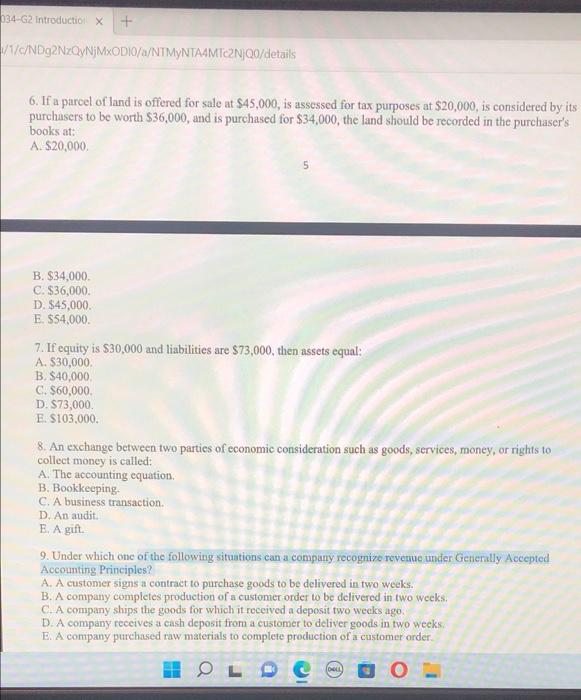

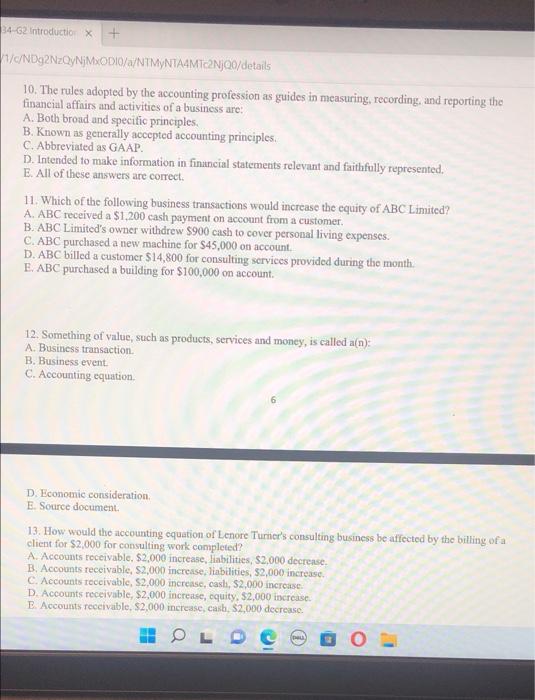

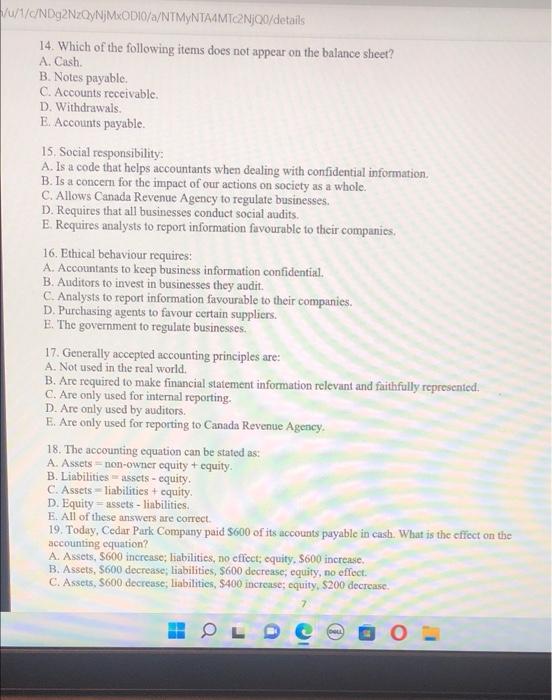

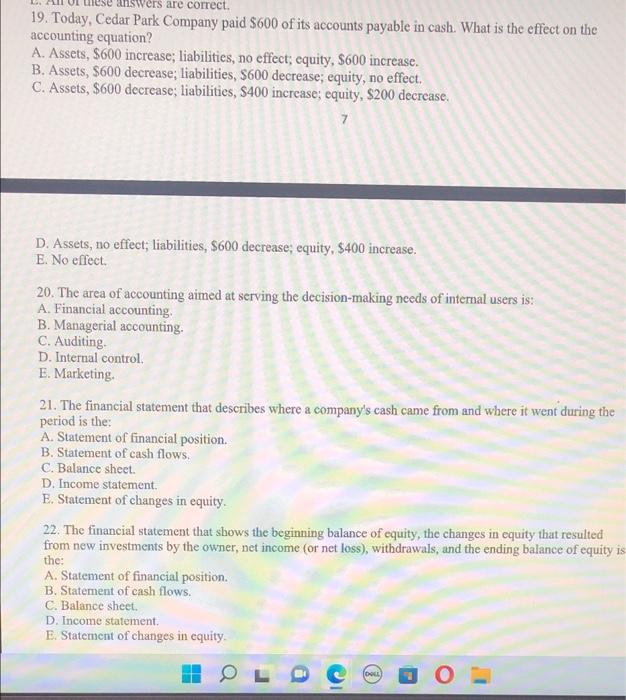

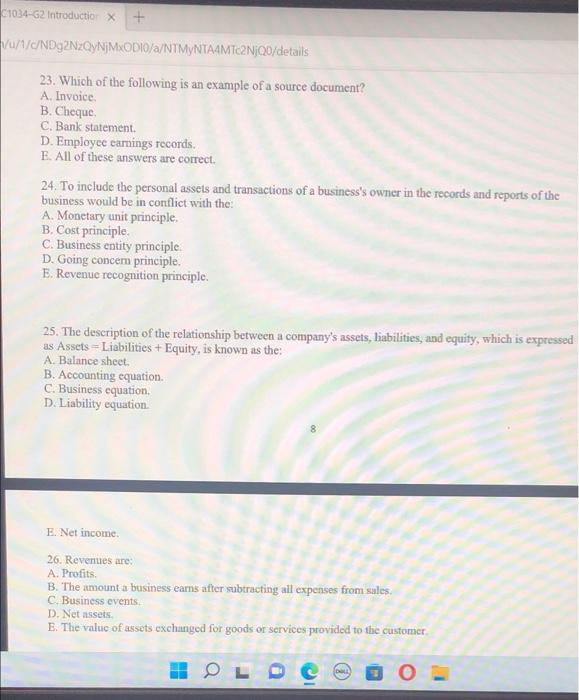

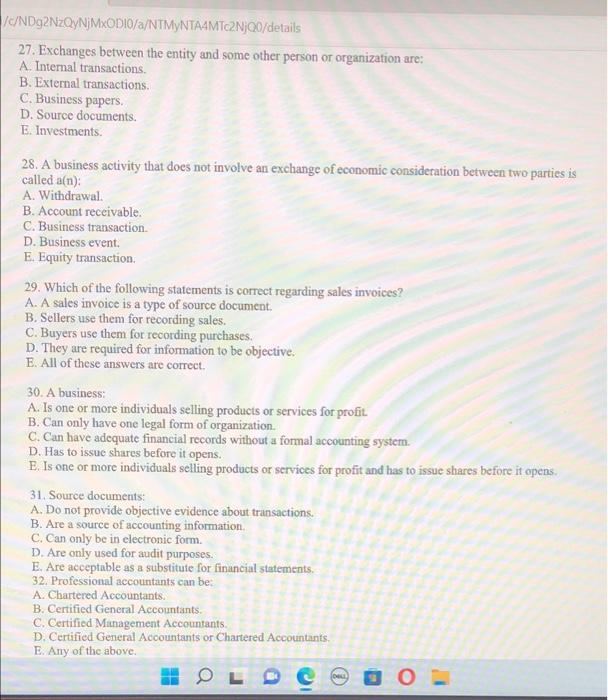

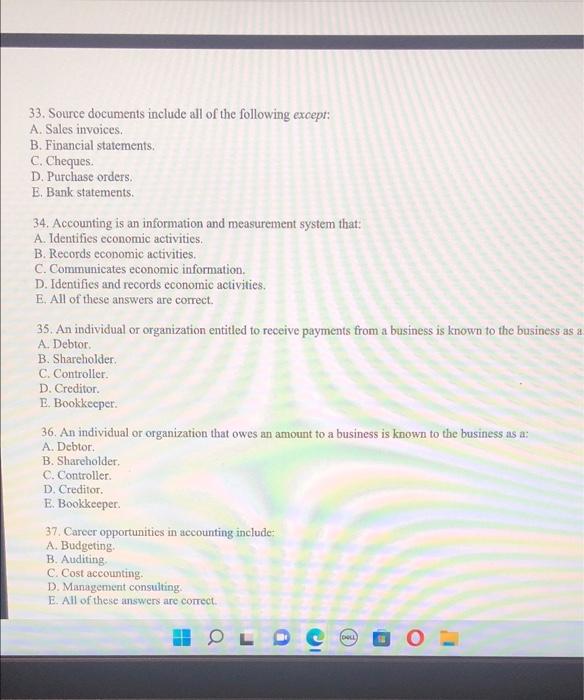

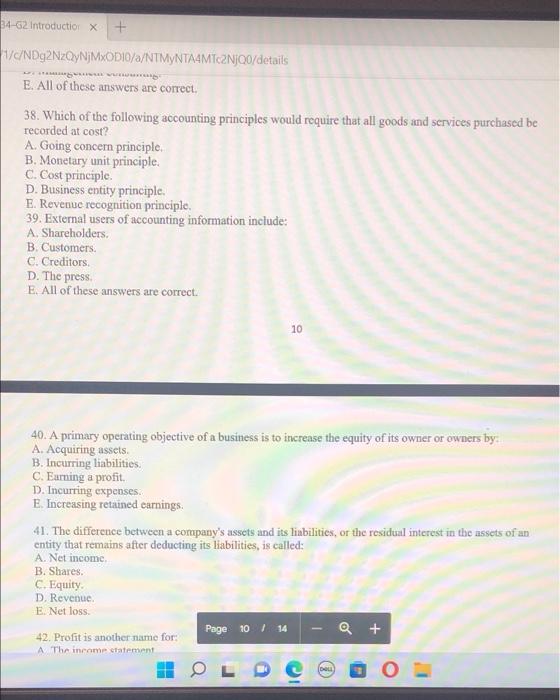

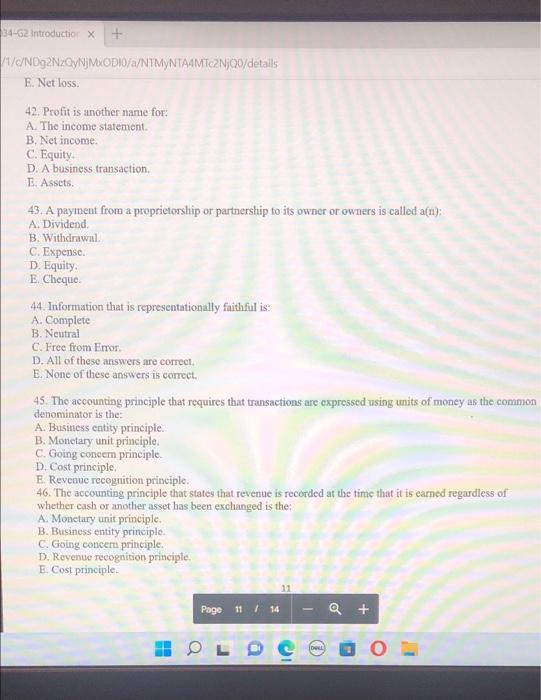

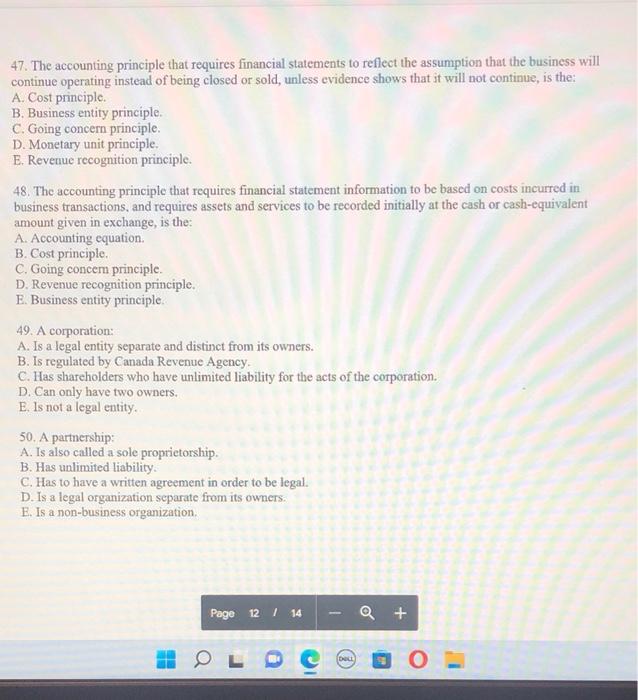

/c/NDg2NzQyNjMxODIO/a/NTMyNTA4MTc2NjQ0/details 1. At the end of its first year of operations, Lockerbie and Role Company has total assets of $3,000,000 and total liabilities of $1,200,000. The owner originally invested $200,000 in the business, but has not made any further investments or taken any withdrawals. What is the first year's net income for Lockerbie and Role Company? A. $1,600,000. B. $1,800,000. C. $1,000,000. D. $3,000,000. E. $3,200,000. 2. If assets are $144,000 and liabilities are $37,000, then equity equals: A. $37,000. B. $74,000. C. $107,000. D. $144,000.. E. $181,000. 3. The assets of a business total $20,000; the liabilities, $8,000. The claims of the owners are: A. $0. B. $8,000. C. $12,000. D. $20,000. E. $28,000. 4. The FastForward Company balance sheet shows cash $5,000, accounts receivable $7,000, office equipment $3,000, and accounts payable $4,000. What is the amount of equity? A. $1,000. B. $11,000. C. $12,000. D. $15,000. E. $19,000. 5. If assets are $175,000 and equity is $47.000, then liabilities equal: A. $47,000. B. $128,000. C. $175,000. D. $204,000. E. $222,000. ME - 034-G2 Introduction X /1/c/NDg2NzQyNjMxODIO/a/NTMyNTA4MTc2NjQ0/details 6. If a parcel of land is offered for sale at $45,000, is assessed for tax purposes at $20,000, is considered by its purchasers to be worth $36,000, and is purchased for $34,000, the land should be recorded in the purchaser's books at: A. $20,000. B. $34,000. C. $36,000. D. $45,000. E. $54,000. 7. If equity is $30,000 and liabilities are $73,000, then assets equal: A. $30,000. B. $40,000. C. $60,000. D. $73,000. E. $103,000. 8. An exchange between two parties of economic consideration such as goods, services, money, or rights to collect money is called: A. The accounting equation. B. Bookkeeping. C. A business transaction. D. An audit. E. A gift. 9. Under which one of the following situations can a company recognize revenue under Generally Accepted Accounting Principles? A. A customer signs a contract to purchase goods to be delivered in two weeks. B. A company completes production of a customer order to be delivered in two weeks. C. A company ships the goods for which it received a deposit two weeks ago. D. A company receives a cash deposit from a customer to deliver goods in two weeks. E. A company purchased raw materials to complete production of a customer order. (DOLL OLD + 34-62 Introduction x + 1/c/NDg2NzQyNjMxODIO/a/NTMyNTA4MTc2NjQ0/details 10. The rules adopted by the accounting profession as guides in measuring, recording, and reporting the financial affairs and activities of a business are: A. Both broad and specific principles. B. Known as generally accepted accounting principles. C. Abbreviated as GAAP. D. Intended to make information in financial statements relevant and faithfully represented. E. All of these answers are correct. 11. Which of the following business transactions would increase the equity of ABC Limited? A. ABC received a $1,200 cash payment on account from a customer. B. ABC Limited's owner withdrew $900 cash to cover personal living expenses. C. ABC purchased a new machine for $45,000 on account. D. ABC billed a customer $14,800 for consulting services provided during the month. E. ABC purchased a building for $100,000 on account. 12. Something of value, such as products, services and money, is called a(n): A. Business transaction. B. Business event. C. Accounting equation. D. Economic consideration. E. Source document. 13. How would the accounting equation of Lenore Turner's consulting business be affected by the billing of a client for $2,000 for consulting work completed? A. Accounts receivable, $2,000 increase, liabilities, $2,000 decrease. B. Accounts receivable, $2,000 increase, liabilities, $2,000 increase. C. Accounts receivable, $2,000 increase, cash, $2,000 increase. D. Accounts receivable, $2,000 increase, equity, $2,000 increase. E. Accounts receivable, $2,000 increase, cash, $2,000 decrease. OL DELL Vu/1/c/NDg2NzQyNjMxODI0/a/NTMyNTA4MTc2NjQ0/details 14. Which of the following items does not appear on the balance sheet? A. Cash. B. Notes payable. C. Accounts receivable. D. Withdrawals. E. Accounts payable. 15. Social responsibility: A. Is a code that helps accountants when dealing with confidential information. B. Is a concern for the impact of our actions on society as a whole. C. Allows Canada Revenue Agency to regulate businesses. D. Requires that all businesses conduct social audits. E. Requires analysts to report information favourable to their companies. 16. Ethical behaviour requires: A. Accountants to keep business information confidential. B. Auditors to invest in businesses they audit. C. Analysts to report information favourable to their companies. D. Purchasing agents to favour certain suppliers. E. The government to regulate businesses. 17. Generally accepted accounting principles are: A. Not used in the real world. B. Are required to make financial statement information relevant and faithfully represented. C. Are only used for internal reporting. D. Are only used by auditors. E. Are only used for reporting to Canada Revenue Agency. 18. The accounting equation can be stated as: A. Assets non-owner equity + equity. B. Liabilities assets - equity. C. Assets liabilities + equity. D. Equity assets - liabilities. E. All of these answers are correct. 19. Today, Cedar Park Company paid $600 of its accounts payable in cash. What is the effect on the accounting equation? A. Assets, $600 increase; liabilities, no effect; equity, $600 increase. B. Assets, $600 decrease; liabilities, $600 decrease; equity, no effect. C. Assets, $600 decrease; liabilities, $400 increase; equity, $200 decrease. 0 nswers are correct. 19. Today, Cedar Park Company paid $600 of its accounts payable in cash. What is the effect on the accounting equation? A. Assets, $600 increase; liabilities, no effect; equity, $600 increase. B. Assets, $600 decrease; liabilities, $600 decrease; equity, no effect. C. Assets, $600 decrease; liabilities, $400 increase; equity, $200 decrease. 7 D. Assets, no effect; liabilities, $600 decrease; equity, $400 increase. E. No effect. 20. The area of accounting aimed at serving the decision-making needs of internal users is: A. Financial accounting. B. Managerial accounting. C. Auditing. D. Internal control. E. Marketing. 21. The financial statement that describes where a company's cash came from and where it went during the period is the: A. Statement of financial position. B. Statement of cash flows. C. Balance sheet. D. Income statement. E. Statement of changes in equity. 22. The financial statement that shows the beginning balance of equity, the changes in equity that resulted from new investments by the owner, net income (or net loss), withdrawals, and the ending balance of equity is the: A. Statement of financial position. B. Statement of cash flows. C. Balance sheet. D. Income statement. E. Statement of changes in equity. 0 (DOLL O C1034-G2 Introduction X + /u/1/c/NDg2NzQyNjMxODI0/a/NTMyNTA4MTc2NjQ0/details 23. Which of the following is an example of a source document? A. Invoice. B. Cheque. C. Bank statement. D. Employee earnings records. E. All of these answers are correct. 24. To include the personal assets and transactions of a business's owner in the records and reports of the business would be in conflict with the: A. Monetary unit principle. B. Cost principle. C. Business entity principle. D. Going concern principle. E. Revenue recognition principle. 25. The description of the relationship between a company's assets, liabilities, and equity, which is expressed as Assets - Liabilities + Equity, is known as the: A. Balance sheet. B. Accounting equation. C. Business equation. D. Liability equation. E. Net income. 26. Revenues are:) A. Profits. B. The amount a business earns after subtracting all expenses from sales. C. Business events. D. Net assets. E. The value of assets exchanged for goods or services provided to the customer. CHILL /c/NDg2NzQyNjMxODIO/a/NTMyNTA4MTc2NjQ0/details 27. Exchanges between the entity and some other person or organization are: A. Internal transactions. B. External transactions. C. Business papers. D. Source documents. E. Investments. 28. A business activity that does not involve an exchange of economic consideration between two parties is called a(n): A. Withdrawal. B. Account receivable. C. Business transaction. D. Business event. E. Equity transaction. 29. Which of the following statements is correct regarding sales invoices? A. A sales invoice is a type of source document. B. Sellers use them for recording sales. C. Buyers use them for recording purchases. D. They are required for information to be objective. E. All of these answers are correct. 30. A business: A. Is one or more individuals selling products or services for profit. B. Can only have one legal form of organization. C. Can have adequate financial records without a formal accounting system. D. Has to issue shares before it opens. E. Is one or more individuals selling products or services for profit and has to issue shares before it opens. 31. Source documents: A. Do not provide objective evidence about transactions. B. Are a source of accounting information. C. Can only be in electronic form. D. Are only used for audit purposes. E. Are acceptable as a substitute for financial statements. 32. Professional accountants can be: A. Chartered Accountants. B. Certified General Accountants. C. Certified Management Accountants. D. Certified General Accountants or Chartered Accountants. E. Any of the above. DOLL O 33. Source documents include all of the following except: A. Sales invoices. B. Financial statements. C. Cheques. D. Purchase orders. E. Bank statements. 34. Accounting is an information and measurement system that: A. Identifies economic activities. B. Records economic activities. C. Communicates economic information. D. Identifies and records economic activities. E. All of these answers are correct. 35. An individual or organization entitled to receive payments from a business is known to the business as a A. Debtor. B. Shareholder. C. Controller. D. Creditor. E. Bookkeeper. 36. An individual or organization that owes an amount to a business is known to the business as a: A. Debtor. B. Shareholder, C. Controller. D. Creditor. E. Bookkeeper. 37. Career opportunities in accounting include: A. Budgeting. B. Auditing. C. Cost accounting. D. Management consulting. E. All of these answers are correct. O [DOLL + 34-62 Introduction X 1/c/NDg2NzQyNjMxODIO/a/NTMyNTA4MTc2NjQ0/details mung E. All of these answers are correct. 38. Which of the following accounting principles would require that all goods and services purchased be recorded at cost? A. Going concern principle. B. Monetary unit principle. C. Cost principle. D. Business entity principle. E. Revenue recognition principle. 39. External users of accounting information include: A. Shareholders. B. Customers. C. Creditors. D. The press. E. All of these answers are correct. 10 40. A primary operating objective of a business is to increase the equity of its owner or owners by: A. Acquiring assets. B. Incurring liabilities. C. Earning a profit. D. Incurring expenses. E. Increasing retained earnings. 41. The difference between a company's assets and its liabilities, or the residual interest in the assets of an entity that remains after deducting its liabilities, is called: A. Net income. B. Shares. C. Equity. D. Revenue. E. Net loss. Page 10 14 Q + 42. Profit is another name for: A The income statement. OLD (DOLL O- 34-G2 Introduction X + /1/c/NDg2NzQyNjMxODI0/a/NTMyNTA4MTc2NjQ0/details E. Net loss. 42. Profit is another name for: A. The income statement. B. Net income. C. Equity. D. A business transaction. E. Assets. 43. A payment from a proprietorship or partnership to its owner or owners is called a(n): A. Dividend. B. Withdrawal. C. Expense. D. Equity. E. Cheque. 44. Information that is representationally faithful is: A. Complete B. Neutral C. Free from Error. D. All of these answers are correct. E. None of these answers is correct. 45. The accounting principle that requires that transactions are expressed using units of money as the common denominator is the: A. Business entity principle. B. Monetary unit principle. C. Going concern principle. D. Cost principle. E. Revenue recognition principle. 46. The accounting principle that states that revenue is recorded at the time that it is earned regardless of whether cash or another asset has been exchanged is the: A. Monetary unit principle. B. Business entity principle. C. Going concern principle. D. Revenue recognition principle. E. Cost principle. Page 11 / 14 OL [DWILL + ON 47. The accounting principle that requires financial statements to reflect the assumption that the business will continue operating instead of being closed or sold, unless evidence shows that it will not continue, is the: A. Cost principle. B. Business entity principle. C. Going concern principle. D. Monetary unit principle. E. Revenue recognition principle. 48. The accounting principle that requires financial statement information to be based on costs incurred in business transactions, and requires assets and services to be recorded initially at the cash or cash-equivalent amount given in exchange, is the: A. Accounting equation. B. Cost principle. C. Going concern principle. D. Revenue recognition principle. E. Business entity principle. 49. A corporation: A. Is a legal entity separate and distinct from its owners. B. Is regulated by Canada Revenue Agency. C. Has shareholders who have unlimited liability for the acts of the corporation. D. Can only have two owners. E. Is not a legal entity. 50. A partnership: A. Is also called a sole proprietorship. B. Has unlimited liability. C. Has to have a written agreement in order to be legal. D. Is a legal organization separate from its owners. E. Is a non-business organization. Page 12 / 14 OLDO - DELL Q + O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started