Answered step by step

Verified Expert Solution

Question

1 Approved Answer

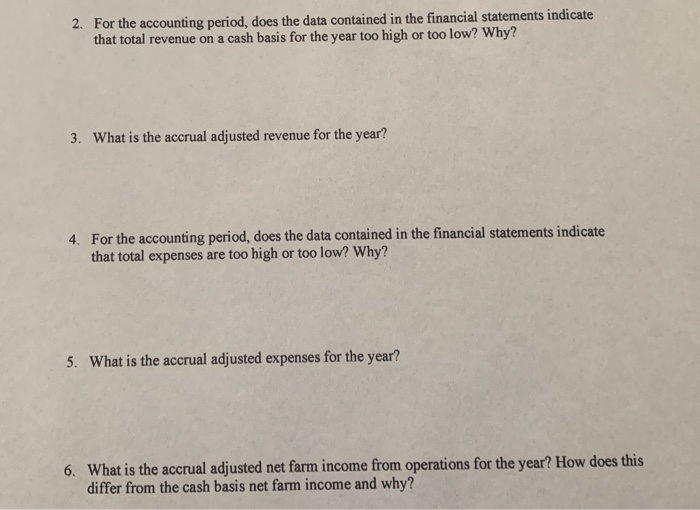

help with 2-6. the Beginning and End Balance and Income Statement is provided. Please and thank you. New Images below. help with 2-6 beginning balance

help with 2-6. the Beginning and End Balance and Income Statement is provided. Please and thank you.

New Images below. help with 2-6

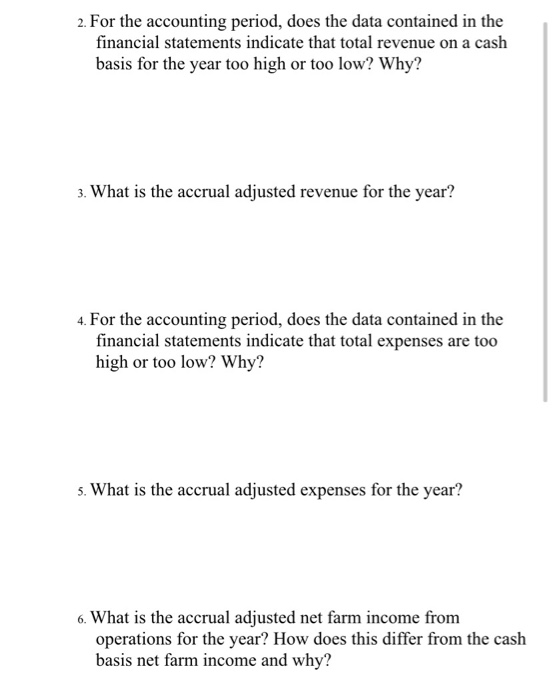

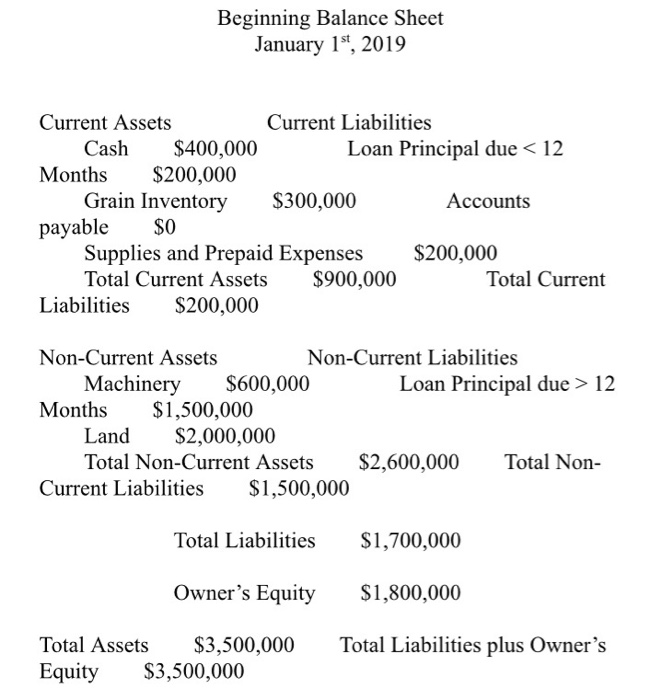

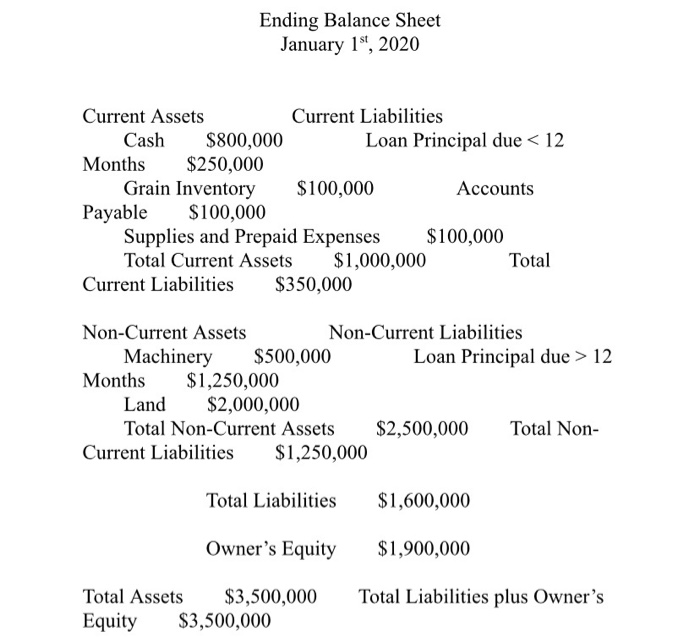

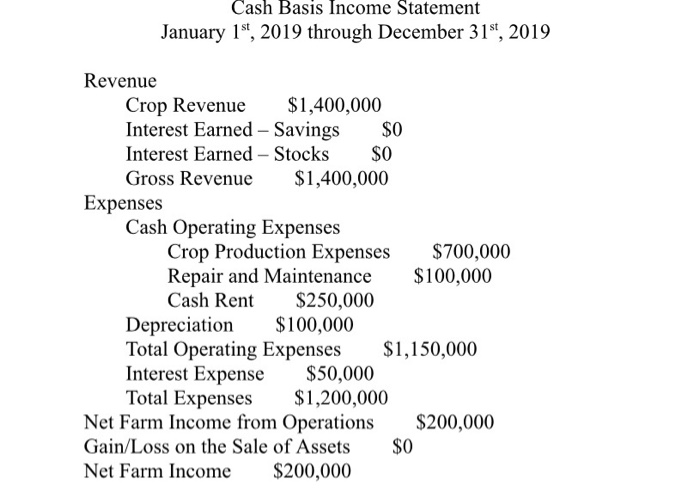

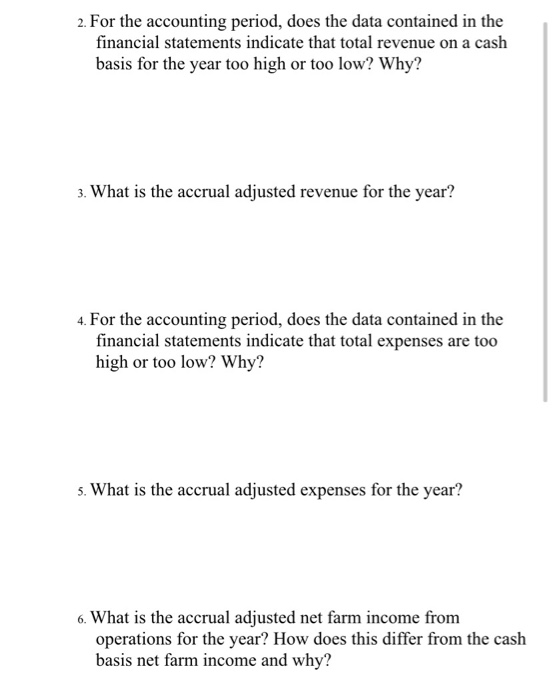

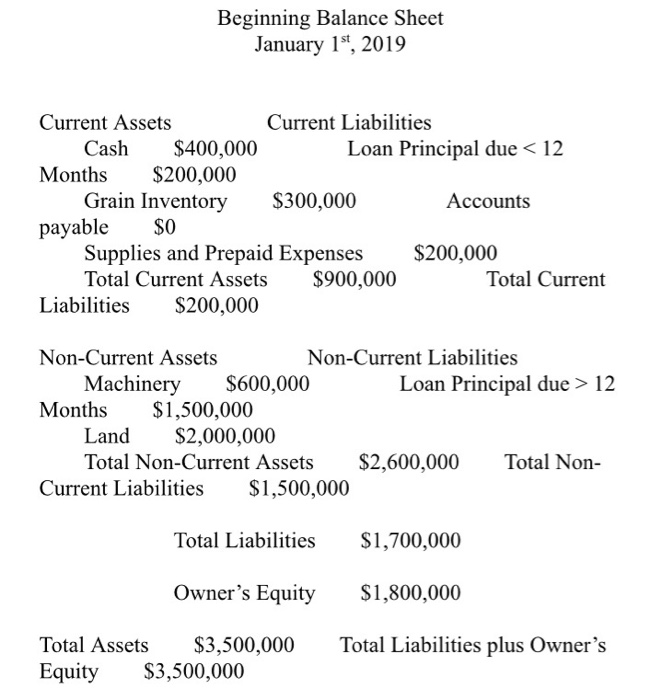

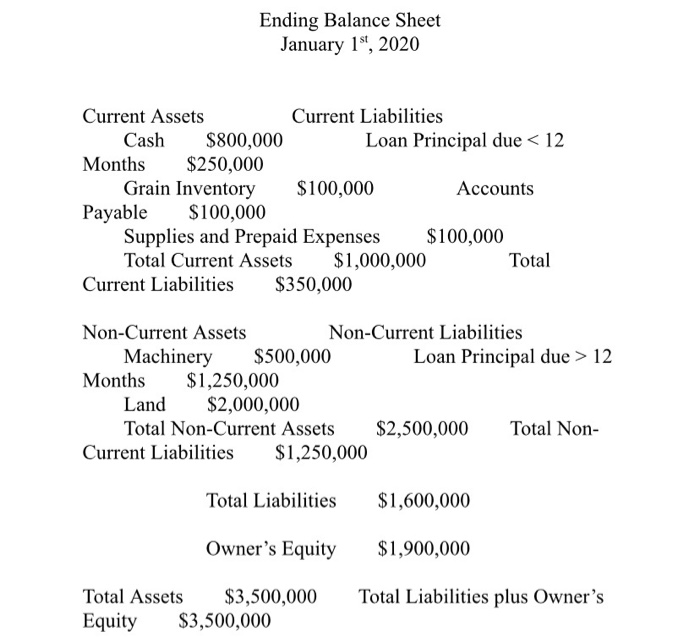

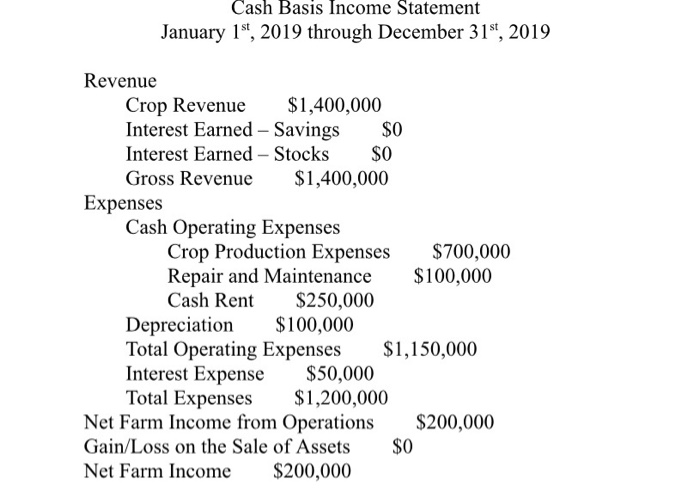

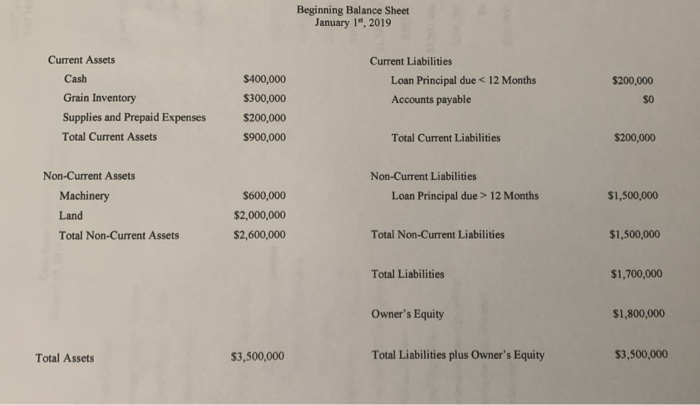

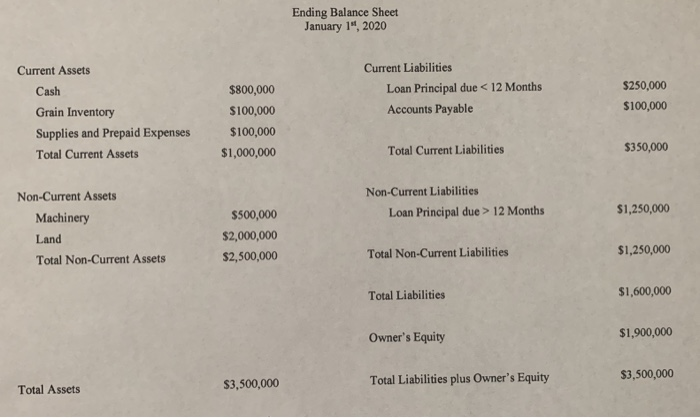

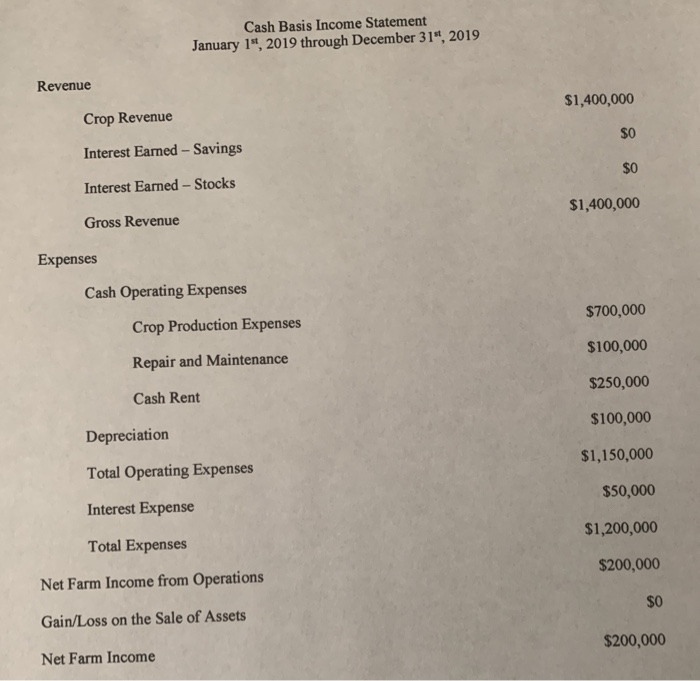

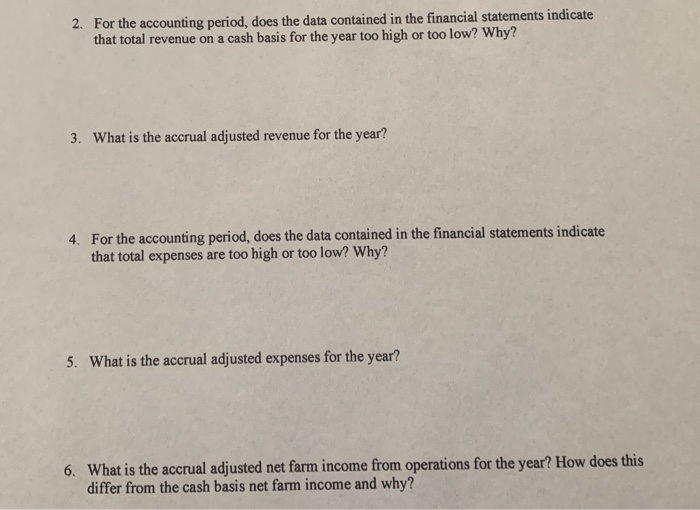

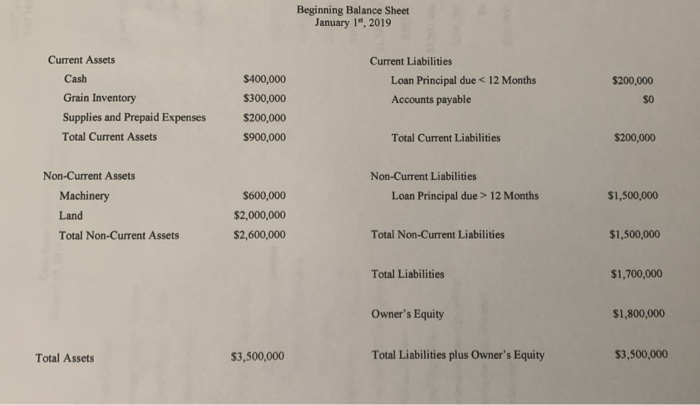

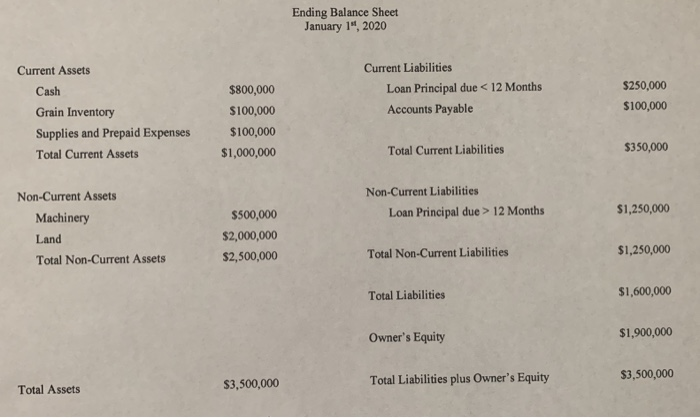

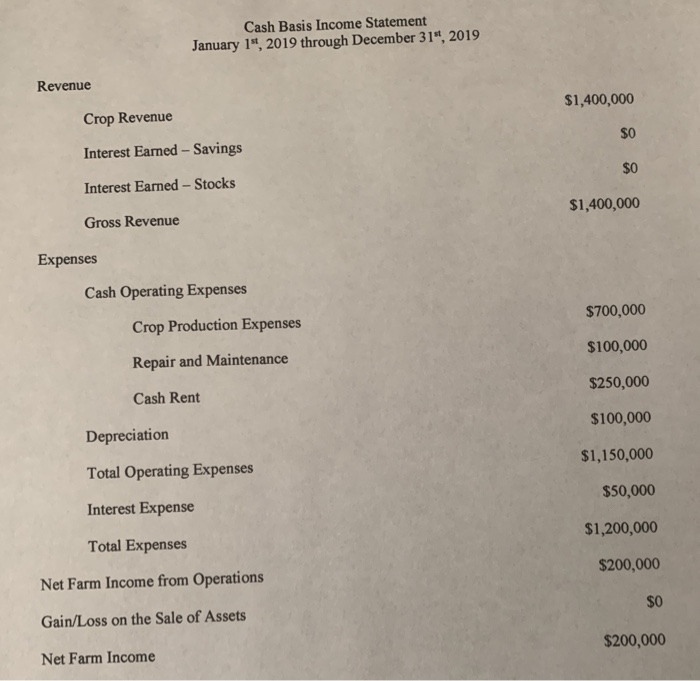

2. For the accounting period, does the data contained in the financial statements indicate that total revenue on a cash basis for the year too high or too low? Why? 3. What is the accrual adjusted revenue for the year? 4. For the accounting period, does the data contained in the financial statements indicate that total expenses are too high or too low? Why? 5. What is the accrual adjusted expenses for the year? 6. What is the accrual adjusted net farm income from operations for the year? How does this differ from the cash basis net farm income and why? Beginning Balance Sheet January 1st, 2019 Current Assets Current Liabilities Cash $400,000 Loan Principal due 12 Months $1,500,000 Land $2,000,000 Total Non-Current Assets $2,600,000 Total Non- Current Liabilities $1,500,000 Total Liabilities $1,700,000 Owner's Equity $1,800,000 Total Liabilities plus Owner's Total Assets $3,500,000 Equity $3,500,000 Ending Balance Sheet January 19, 2020 Current Assets Current Liabilities Cash $800,000 Loan Principal due 12 Months $1,250,000 Land $2,000,000 Total Non-Current Assets $2,500,000 Total Non- Current Liabilities $1,250,000 Total Liabilities $1,600,000 Owner's Equity $1,900,000 Total Liabilities plus Owner's Total Assets $3,500,000 Equity $3,500,000 Cash Basis Income Statement January 15, 2019 through December 31st, 2019 $0 Revenue Crop Revenue $1,400,000 Interest Earned - Savings $0 Interest Earned - Stocks Gross Revenue $1,400,000 Expenses Cash Operating Expenses Crop Production Expenses $700,000 Repair and Maintenance $100,000 Cash Rent $250,000 Depreciation $100,000 Total Operating Expenses $1,150,000 Interest Expense $50,000 Total Expenses $1,200,000 Net Farm Income from Operations $200,000 Gain/Loss on the Sale of Assets $0 Net Farm Income $200,000 2. For the accounting period, does the data contained in the financial statements indicate that total revenue on a cash basis for the year too high or too low? Why? 3. What is the accrual adjusted revenue for the year? 4. For the accounting period, does the data contained in the financial statements indicate that total expenses are too high or too low? Why? 5. What is the accrual adjusted expenses for the year? 6. What is the accrual adjusted net farm income from operations for the year? How does this differ from the cash basis net farm income and why? Beginning Balance Sheet January 1", 2019 Current Assets Cash Grain Inventory Supplies and Prepaid Expenses Total Current Assets Current Liabilities Loan Principal due 12 Months $1,500,000 Non-Current Assets Machinery Land Total Non-Current Assets $600,000 $2,000,000 $2,600,000 Total Non-Current Liabilities $1,500,000 Total Liabilities $1,700,000 Owner's Equity $1,800,000 Total Assets $3,500,000 Total Liabilities plus Owner's Equity $3,500,000 Ending Balance Sheet January 14, 2020 Current Assets Cash Grain Inventory Supplies and Prepaid Expenses Total Current Assets Current Liabilities Loan Principal due 12 Months $1,250,000 Non-Current Assets Machinery Land Total Non-Current Assets $500,000 $2,000,000 $2,500,000 Total Non-Current Liabilities $1,250,000 Total Liabilities $1,600,000 Owner's Equity $1,900,000 $3,500,000 Total Liabilities plus Owner's Equity $3,500,000 Total Assets Cash Basis Income Statement January 19, 2019 through December 31", 2019 Revenue $1,400,000 Crop Revenue SO Interest Earned - Savings $0 Interest Earned - Stocks $1,400,000 Gross Revenue Expenses Cash Operating Expenses $700,000 Crop Production Expenses $100,000 Repair and Maintenance $250,000 Cash Rent $100,000 Depreciation $1,150,000 Total Operating Expenses $50,000 Interest Expense $1,200,000 Total Expenses $200,000 Net Farm Income from Operations $0 Gain/Loss on the Sale of Assets $200,000 Net Farm Income

beginning balance sheet

end balance sheet

income statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started