Answered step by step

Verified Expert Solution

Question

1 Approved Answer

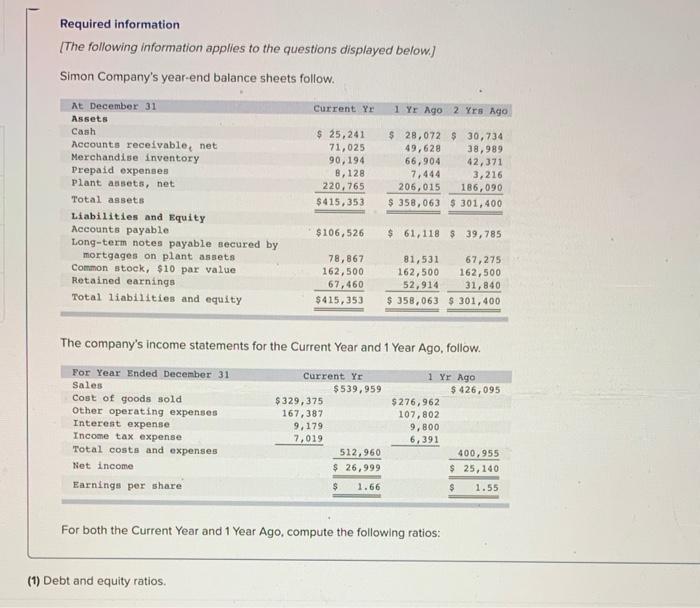

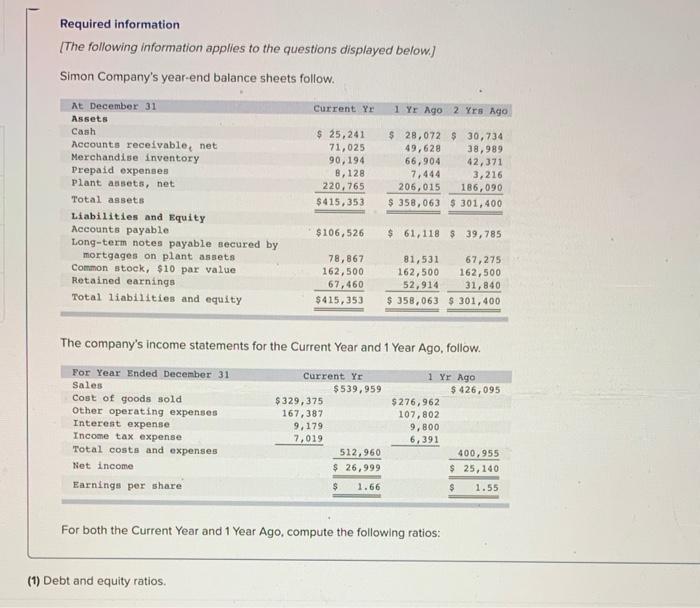

Required information (The following information applies to the questions displayed below.) Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago

Required information (The following information applies to the questions displayed below.) Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 25,241 71,025 90,194 8,128 220,765 $415,353 $ 28,072 $ 30,734 49,628 38,989 66,904 42,371 7,444 3,216 206,015 186,090 $ 358,063 $ 301,400 $ 106,526 $ 61,118 $ 39,785 78,867 162,500 67,460 $415, 353 81,531 67,275 162,500 162,500 52,914 31,840 $ 358,063 $ 301,400 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Current Yr 1 Yr Ago Sales $539,959 $ 426,095 Cost of goods sold $329,375 $ 276,962 Other operating expenses 167,387 107,802 Interest expense 9,179 9,800 Income tax expense 7,019 6,391 Total costs and expenses 512,960 400,955 Net income $ 26,999 $ 25,140 Earnings per share $ 1.66 $ 1.55 For both the Current Year and 1 Year Ago, compute the following ratios: (1) Debt and equity ratios

Required information (The following information applies to the questions displayed below.) Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 25,241 71,025 90,194 8,128 220,765 $415,353 $ 28,072 $ 30,734 49,628 38,989 66,904 42,371 7,444 3,216 206,015 186,090 $ 358,063 $ 301,400 $ 106,526 $ 61,118 $ 39,785 78,867 162,500 67,460 $415, 353 81,531 67,275 162,500 162,500 52,914 31,840 $ 358,063 $ 301,400 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Current Yr 1 Yr Ago Sales $539,959 $ 426,095 Cost of goods sold $329,375 $ 276,962 Other operating expenses 167,387 107,802 Interest expense 9,179 9,800 Income tax expense 7,019 6,391 Total costs and expenses 512,960 400,955 Net income $ 26,999 $ 25,140 Earnings per share $ 1.66 $ 1.55 For both the Current Year and 1 Year Ago, compute the following ratios: (1) Debt and equity ratios

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started