help with all questions please

question 1

question 2

question 3

question 4

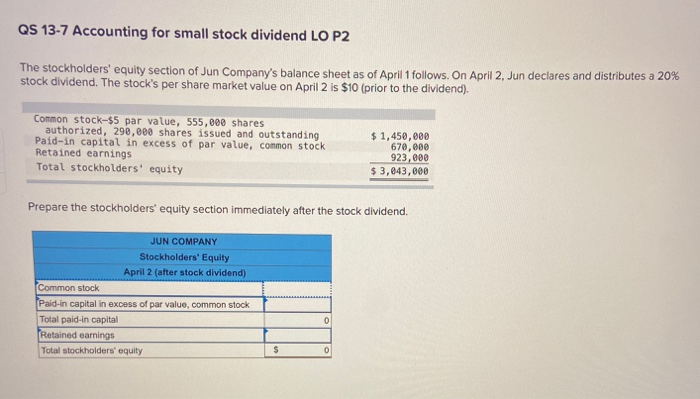

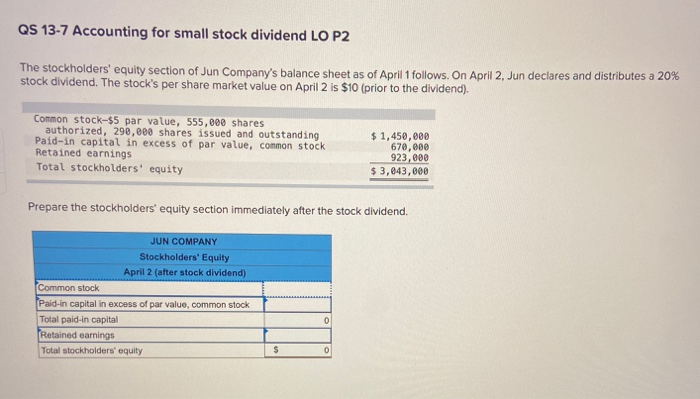

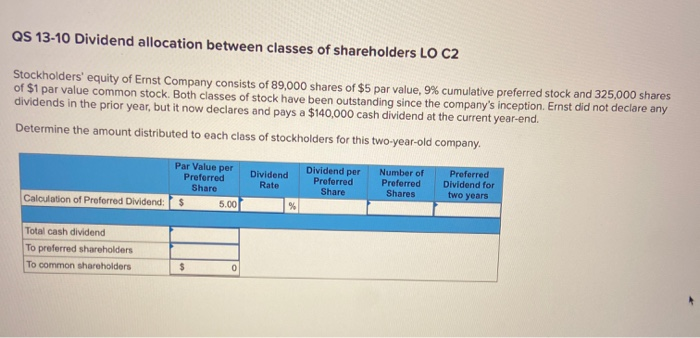

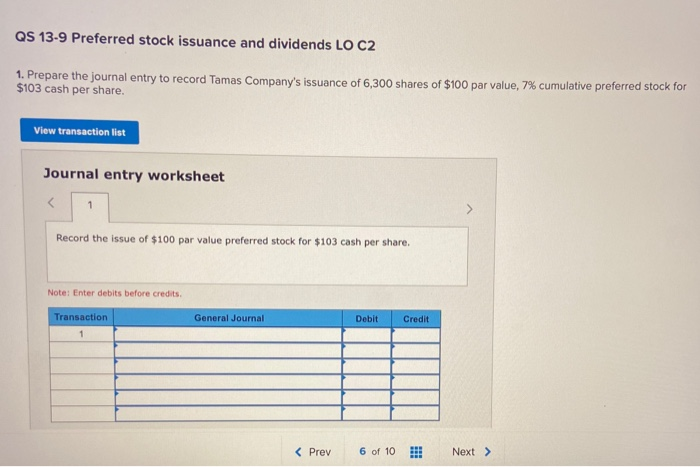

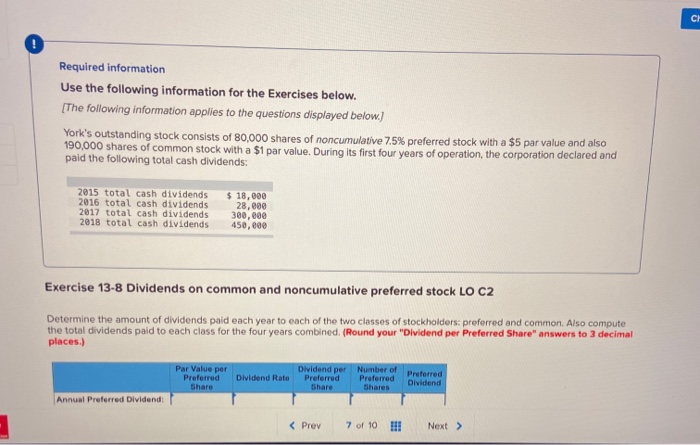

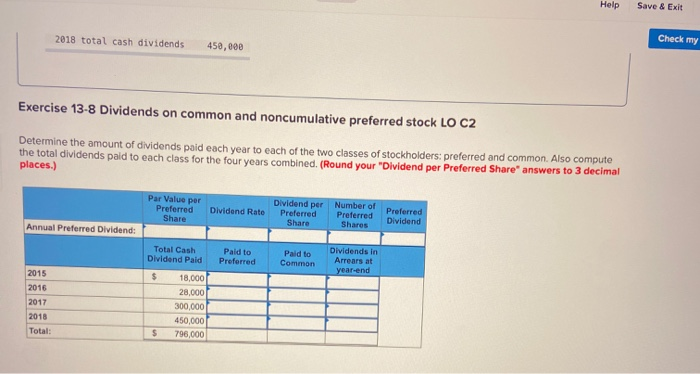

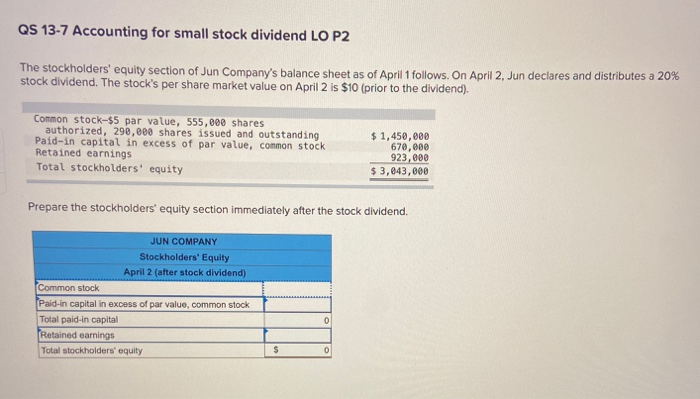

QS 13-7 Accounting for small stock dividend LO P2 The stockholders' equity section of Jun Company's balance sheet as of April 1 follows. On April 2, Jun declares and distributes a 20% stock dividend. The stock's per share market value on April 2 is $10 (prior to the dividend). Common stock-$5 par value, 555,000 shares authorized, 290,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $1,450,000 670,000 923,000 $ 3,043,000 Prepare the stockholders' equity section immediately after the stock dividend. JUN COMPANY Stockholders' Equity April 2 (after stock dividend) Common stock Paid-in capital in excess of par value, common stock Total paid-in capital (Retained earnings Total stockholders' equity S QS 13-10 Dividend allocation between classes of shareholders LO C2 Stockholders' equity of Ernst Company consists of 89,000 shares of $5 par value, 9% cumulative preferred stock and 325,000 shares of $1 par value common stock. Both classes of stock have been outstanding since the company's inception. Ernst did not declare any dividends in the prior year, but it now declares and pays a $140,000 cash dividend at the current year-end. Determine the amount distributed to each class of stockholders for this two-year-old company. Par Value per Preferred Share $ Dividend Rate Dividend per Preferred Share Number of Preferred Shares Preferred Dividend for two years Calculation of Proforred Dividend: ind: 5.00 Total cash dividend To preferred shareholders To common shareholders S 0 QS 13-9 Preferred stock issuance and dividends LO C2 1. Prepare the journal entry to record Tamas Company's issuance of 6,300 shares of $100 par value, 7% cumulative preferred stock for $103 cash per share. View transaction list Journal entry worksheet Record the issue of $100 par value preferred stock for $103 cash per share. Note: Enter debits before credits Transaction General Journal Debit Credit Required information Use the following information for the Exercises below. [The following information applies to the questions displayed below.) York's outstanding stock consists of 80,000 shares of noncumulative 7.5% preferred stock with a $5 par value and also 190,000 shares of common stock with a $1 par value. During its first four years of operation, the corporation declared and paid the following total cash dividends: 2015 total cash dividends 2016 total cash dividends 2017 total cash dividends 2018 total cash dividends $ 18,000 28,000 300,000 450,000 Exercise 13-8 Dividends on common and noncumulative preferred stock LO C2 Determine the amount of dividends paid each year to each of the two classes of stockholders: preferred and common. Also compute the total dividends paid to each class for the four years combined. (Round your "Dividend per Preferred Share" answers to 3 decimal places.) Par Value per Preferred Share Dividend Rato Didend per N Preferred Share ero Pedrad Preferred Dividend Shares Annual Preferred Dividend Check my 2018 total cash dividends 450,000 Exercise 13-8 Dividends on common and noncumulative preferred stock LO C2 Determine the amount of dividends paid each year to each of the two classes of stockholders: preferred and common. Also compute the total dividends paid to each class for the four years combined. (Round your "Dividend per Preferred Share" answers to 3 decimal places.) Par Value por Preferred Share Dividend Rate Dividend per Preferred Share Number of Preferred Preferred Dividend Shares Annual Preferred Dividend: Total Cash Dividend Paid Paid to Preferred Paid to o r Dividends in Arrears at year-end 2015 2016 2017 18.000 20,000 300.000 450,000 700.000 Total