Help with the financial economics questions below

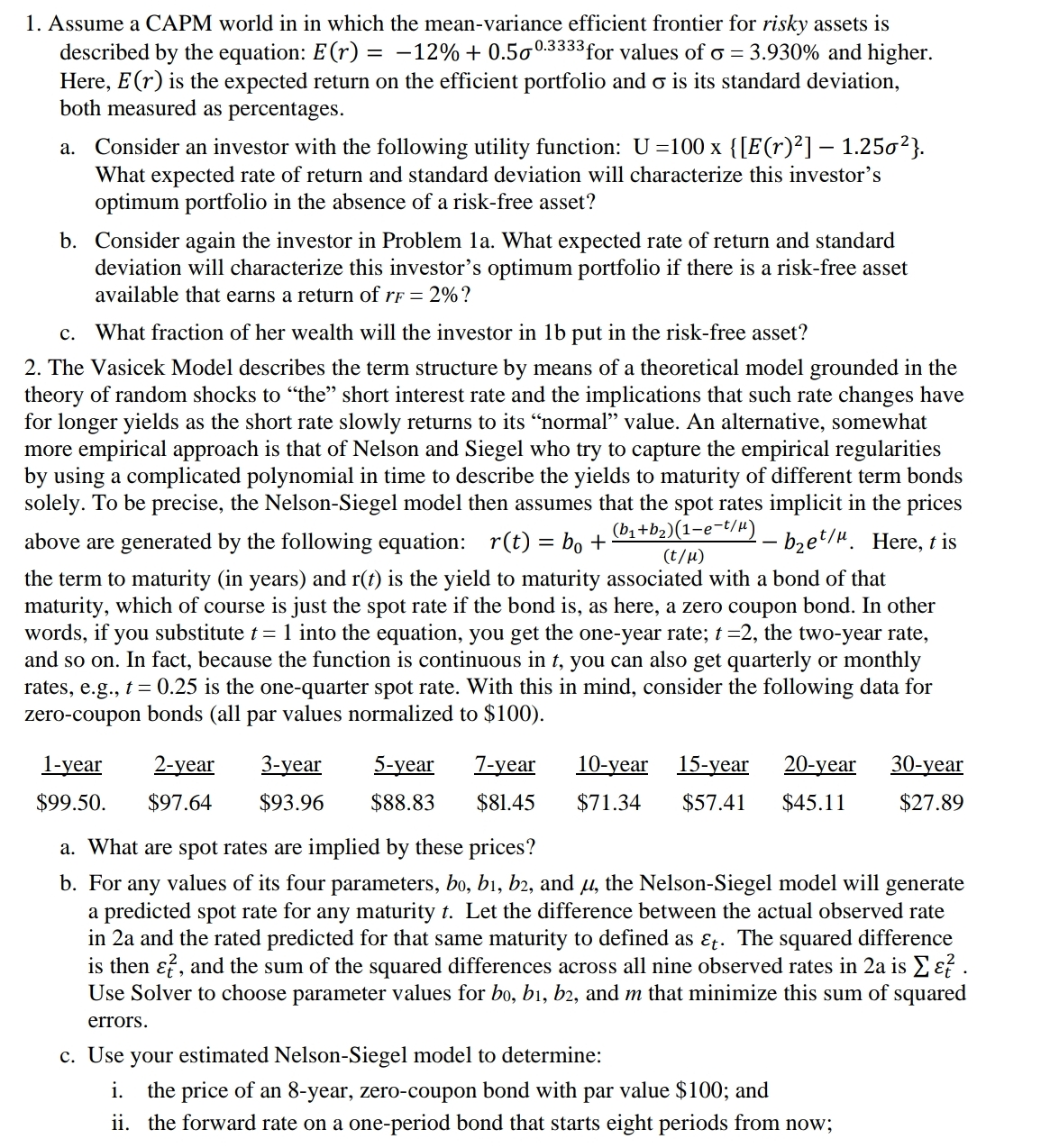

1. Assume a CAPM world in in which the mean-variance efficient frontier for risky assets is described by the equation: E (r) = 12% + 0.50'0'3333for values of o = 3.930% and higher. Here, E (r) is the expected return on the efcient portfolio and 0' is its standard deviation, both measured as percentages. a. Consider an investor with the following utility function: U 2100 x { [E (02] 1.2502}. What expected rate of return and standard deviation will characterize this investor's optimum portfolio in the absence of a risk-free asset? b. Consider again the investor in Problem 1a. What expected rate of return and standard deviation will characterize this investor's optimum portfolio if there is a risk-free asset available that earns a return of rs = 2%? c. What fraction of her wealth will the investor in lb put in the risk-free asset? 2. The Vasicek Model describes the term structure by means of a theoretical model grounded in the theory of random shocks to \"the\" short interest rate and the implications that such rate changes have for longer yields as the short rate slowly returns to its \"normal\" value. An alternative, somewhat more empirical approach is that of Nelson and Siegel who try to capture the empirical regularities by using a complicated polynomial in time to describe the yields to maturity of different term bonds solely. To be precise, the NelsonSiegel model then assumes that the spot rates implicit in the prices (b1+b2)(1e\"'/\") 0/1\"} the term to maturity (in years) and r(t) is the yield to maturity associated with a bond of that maturity, which of course is just the spot rate if the bond is, as here, a zero coupon bond. In other words, if you substitute t = 1 into the equation, you get the one-year rate; I :2, the twoyear rate, and so on. In fact, because the function is continuous in I, you can also get quarterly or monthly rates, e.g., t 2 0.25 is the one-quarter spot rate. With this in mind, consider the following data for zero-coupon bonds (all par values normalized to $100). above are generated by the following equation: r(t) = b0 + bzem Here, t is 1-year 2-year 3-year 5-year 7-year 10-year 15-year 20-year 30-year $99.50. $97.64 $93.96 $88.83 $81.45 $71.34 $57.41 $45.11 $27.89 a. What are spot rates are implied by these prices? b. For any values of its four parameters, b0, b1, b2, and ,u, the Nelson-Siege] model will generate a predicted spot rate for any maturity t. Let the difference between the actual observed rate in 2a and the rated predicted for that same maturity to dened as at. The squared difference is then 83, and the sum of the squared differences across all nine observed rates in 2a is Z 53 . Use Solver to choose parameter values for b0, b1, b2, and m that minimize this sum of squared errors. c. Use your estimated Nelson-Siegel model to determine: i. the price of an 8-year, zero-coupon bond with par value $100; and ii. the forward rate on a oneperiod bond that starts eight periods from now