Help with the following question, all forms need to be completed:

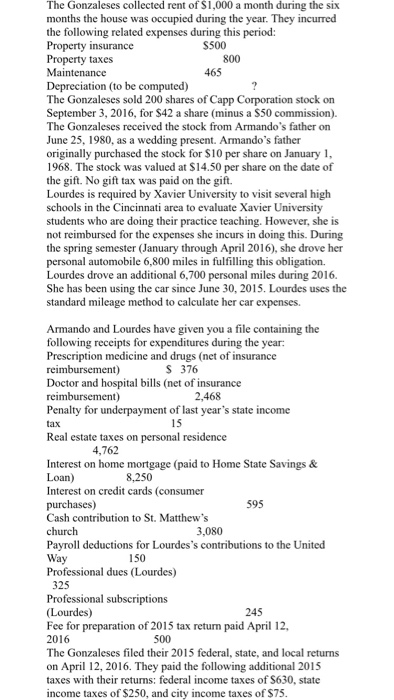

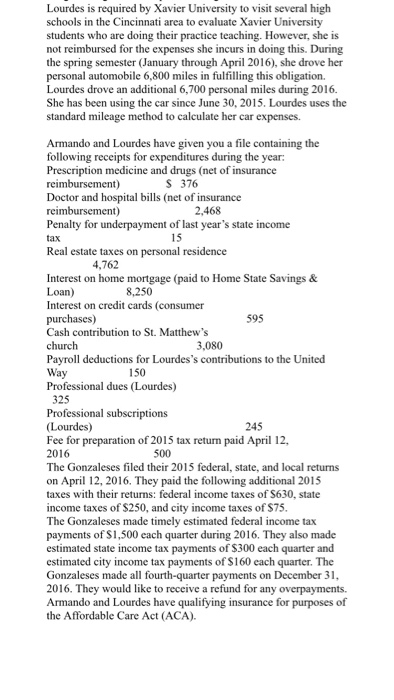

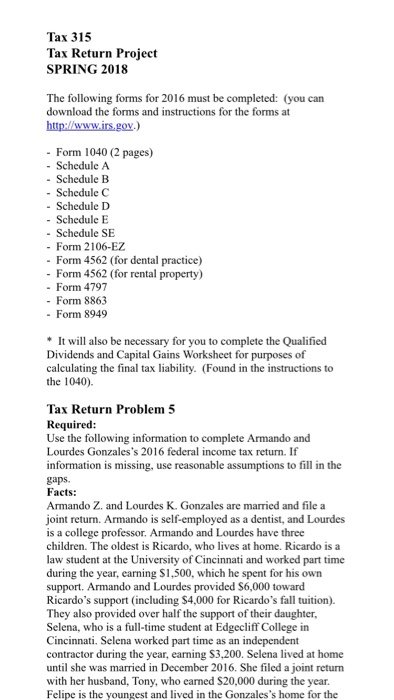

Tax 315 Tax Return Project SPRING 2018 The following forms for 2016 must be completed: (you can download the forms and instructions for the forms at - Form 1040 (2 pages) - Schedule A - Schedule B - Schedule C - Schedule D - Schedule E - Schedule SE - Form 2106-EZ - Form 4562 (for dental practice) Form 4562 (for rental property) - Form 4797 - Form 8863 - Form 8949 It will also be necessary for you to complete the Qualified Dividends and Capital Gains Worksheet for purposes of calculating the final tax liability. (Found in the instructions to the 1040). Tax Return Problem 5 Required Use the following information to complete Armando and Lourdes Gonzales's 2016 federal income tax return. If information is missing, use reasonable assumptions to fill in the gaps Facts: Armando Z. and Lourdes K. Gonzales are married and file a joint return. Armando is self-employed as a dentist, and Lourdes is a college professor. Armando and Lourdes have three children. The oldest is Ricardo, who lives at home. Ricardo is a law student at the University of Cincinnati and worked part time during the year, earning S1,500, which he spent for his own support. Armando and Lourdes provided S6,000 toward Ricardo's support (including $4,000 for Ricardo's fall tuition). They also provided over half the support of their daughter, Selena, who is a full-time student at Edgecliff College in Cincinnati. Selena worked part time as an independent contractor during the year, earning S3,200. Selena lived at home until she was married in December 2016. She filed a joint return with her husband, Tony, who earned S20,000 during the year. Felipe is the youngest and lived in the Gonzales's home for the Tax 315 Tax Return Project SPRING 2018 The following forms for 2016 must be completed: (you can download the forms and instructions for the forms at - Form 1040 (2 pages) - Schedule A - Schedule B - Schedule C - Schedule D - Schedule E - Schedule SE - Form 2106-EZ - Form 4562 (for dental practice) Form 4562 (for rental property) - Form 4797 - Form 8863 - Form 8949 It will also be necessary for you to complete the Qualified Dividends and Capital Gains Worksheet for purposes of calculating the final tax liability. (Found in the instructions to the 1040). Tax Return Problem 5 Required Use the following information to complete Armando and Lourdes Gonzales's 2016 federal income tax return. If information is missing, use reasonable assumptions to fill in the gaps Facts: Armando Z. and Lourdes K. Gonzales are married and file a joint return. Armando is self-employed as a dentist, and Lourdes is a college professor. Armando and Lourdes have three children. The oldest is Ricardo, who lives at home. Ricardo is a law student at the University of Cincinnati and worked part time during the year, earning S1,500, which he spent for his own support. Armando and Lourdes provided S6,000 toward Ricardo's support (including $4,000 for Ricardo's fall tuition). They also provided over half the support of their daughter, Selena, who is a full-time student at Edgecliff College in Cincinnati. Selena worked part time as an independent contractor during the year, earning S3,200. Selena lived at home until she was married in December 2016. She filed a joint return with her husband, Tony, who earned S20,000 during the year. Felipe is the youngest and lived in the Gonzales's home for the