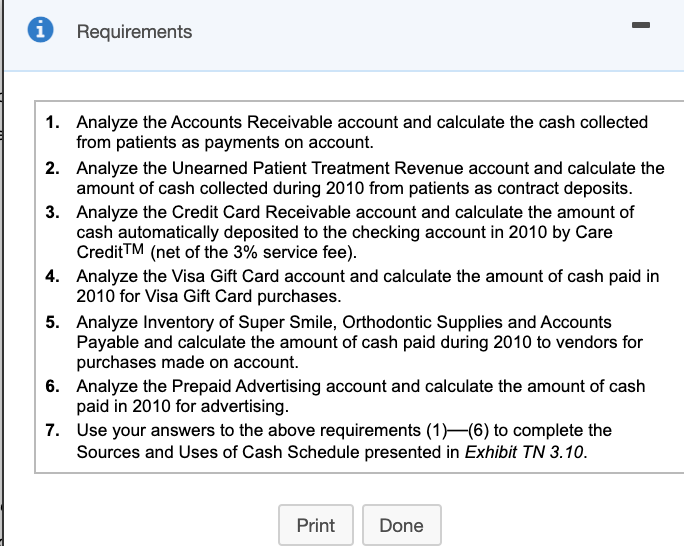

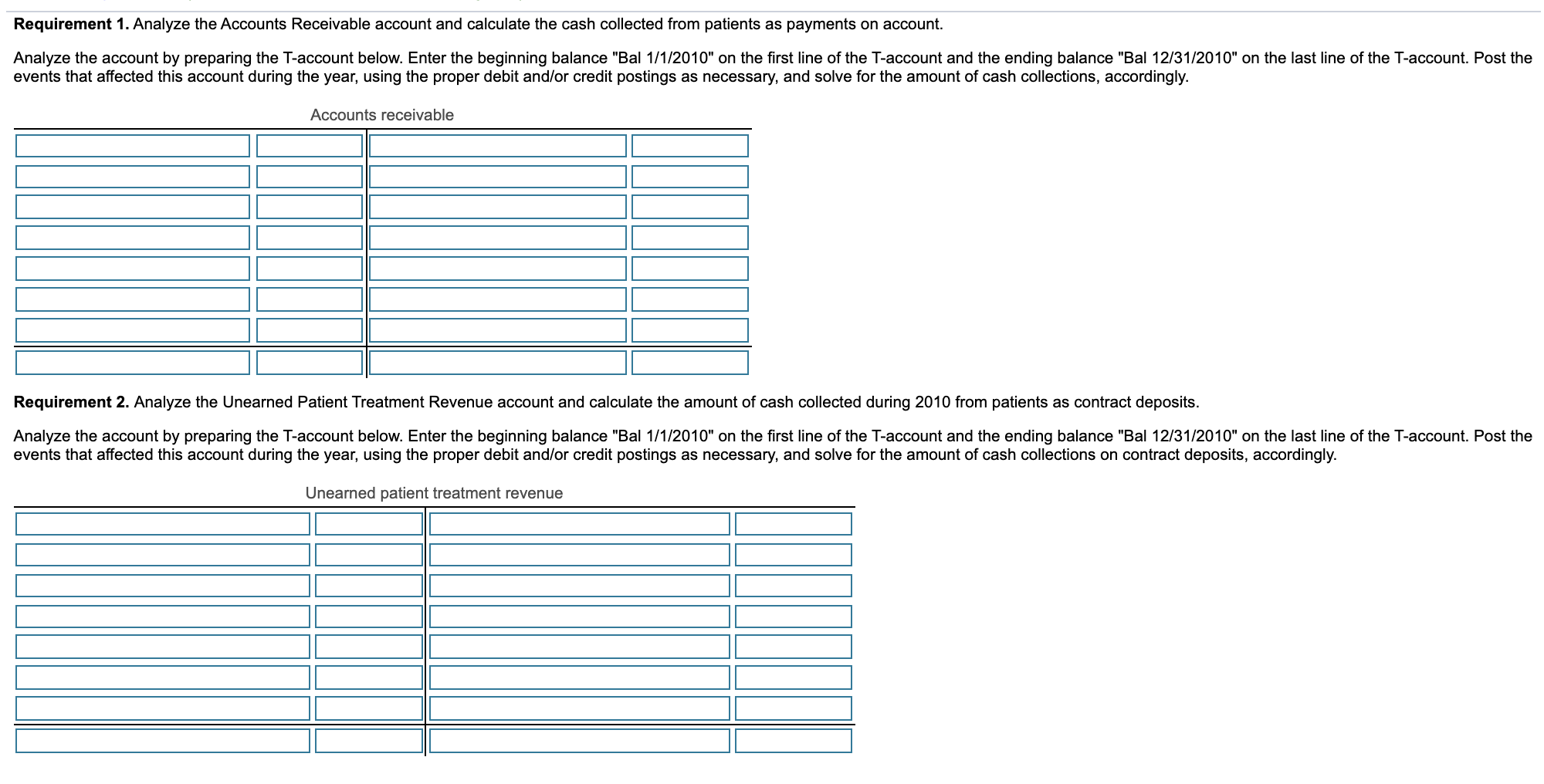

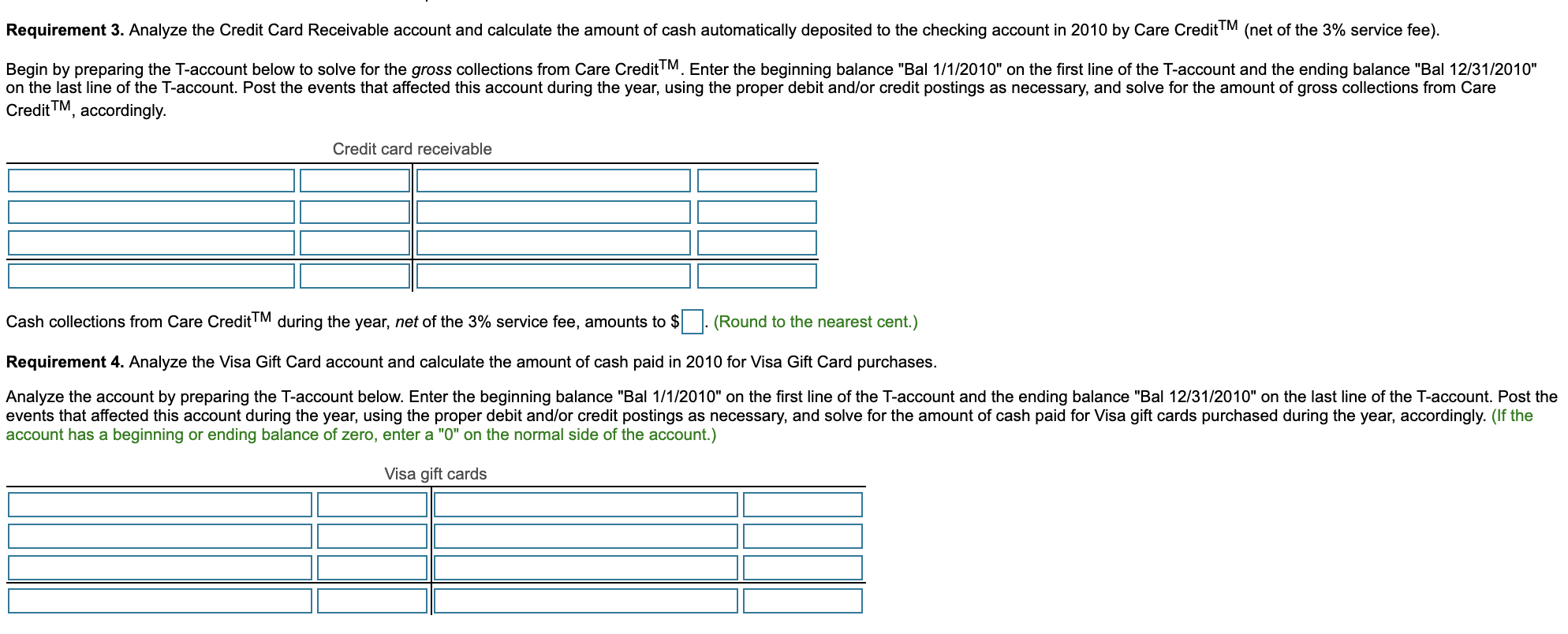

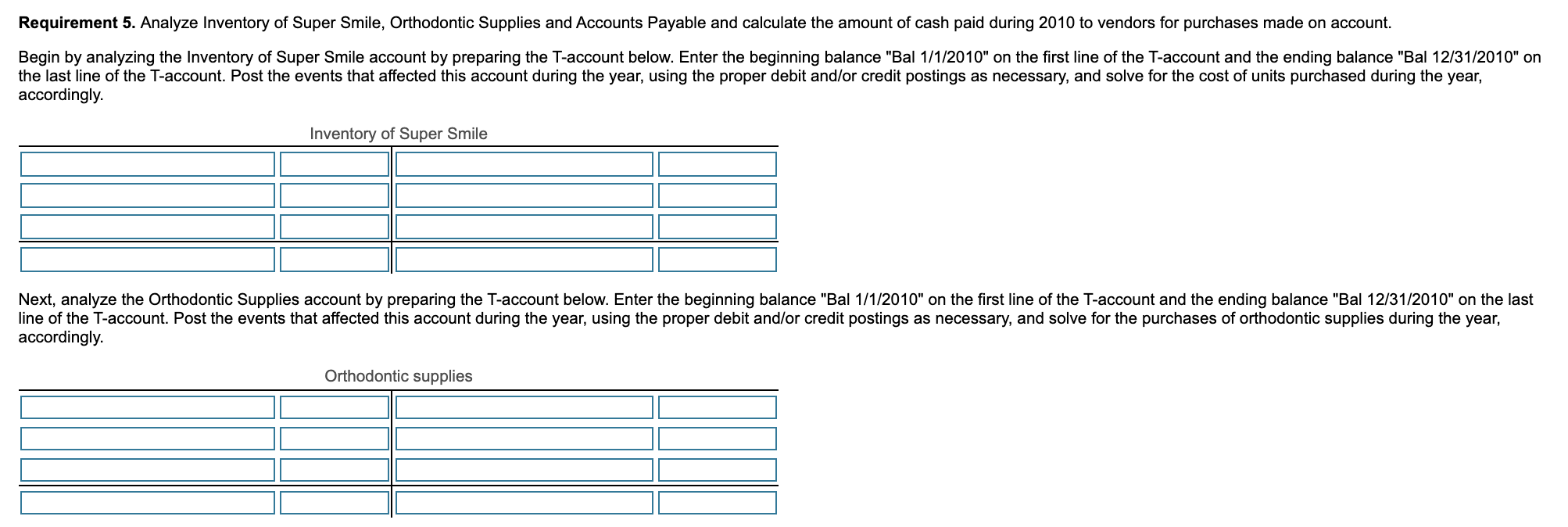

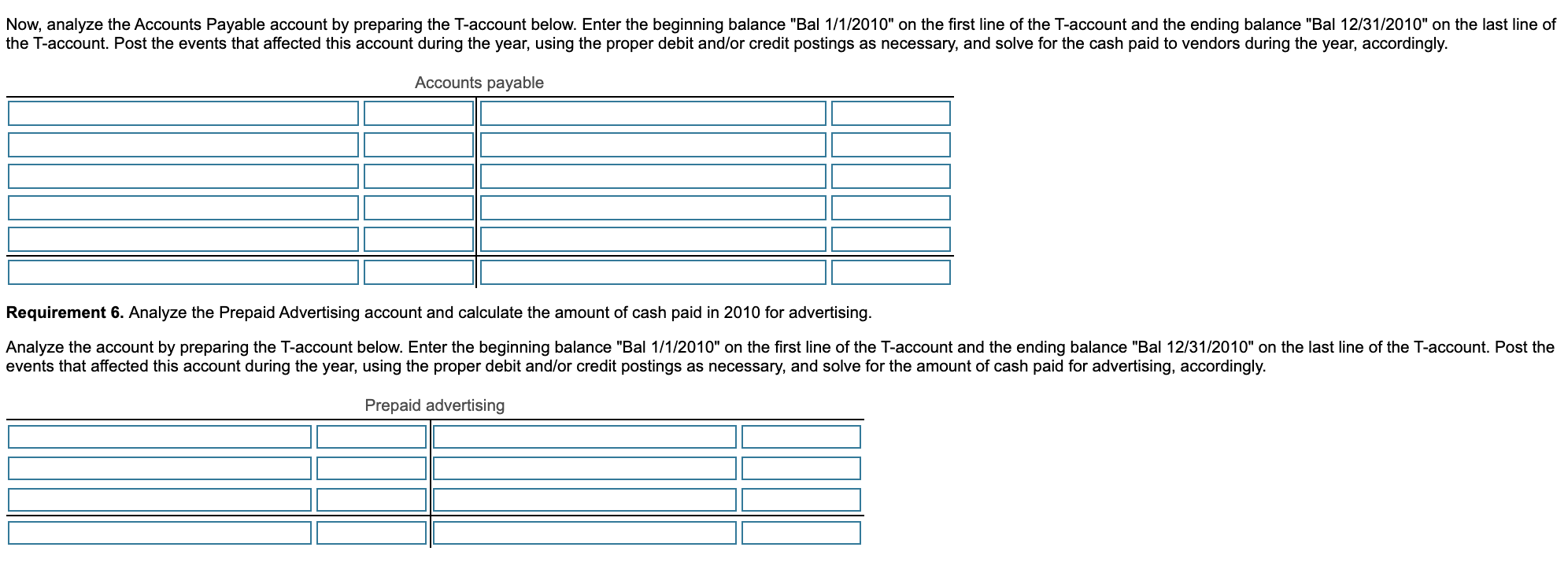

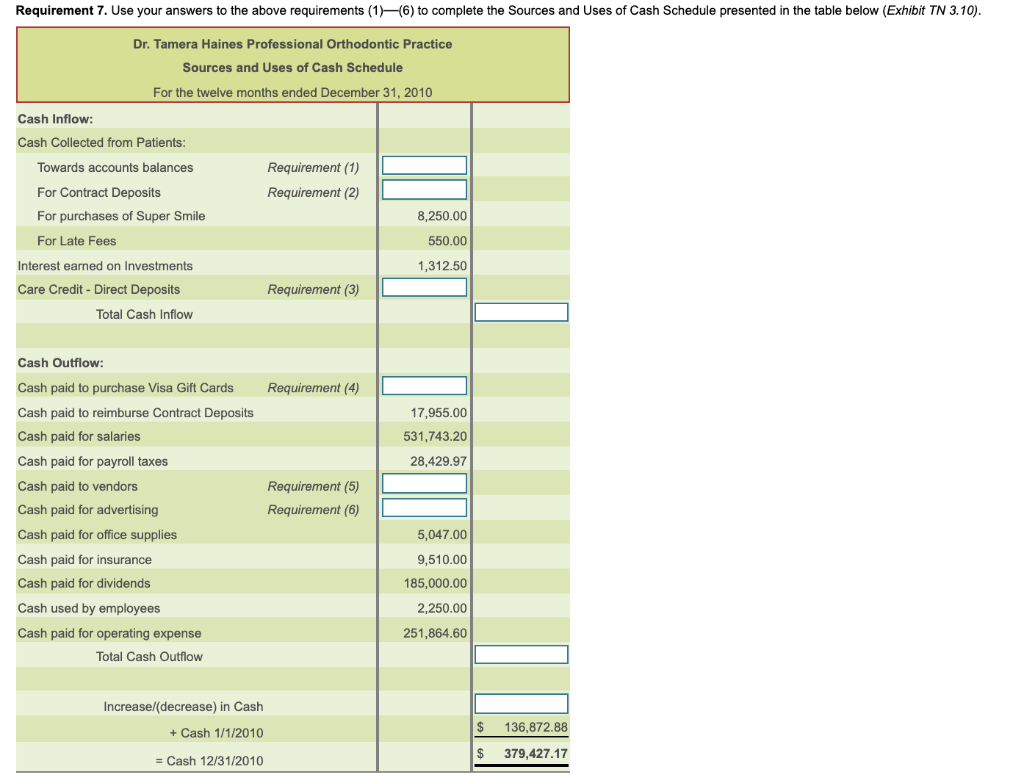

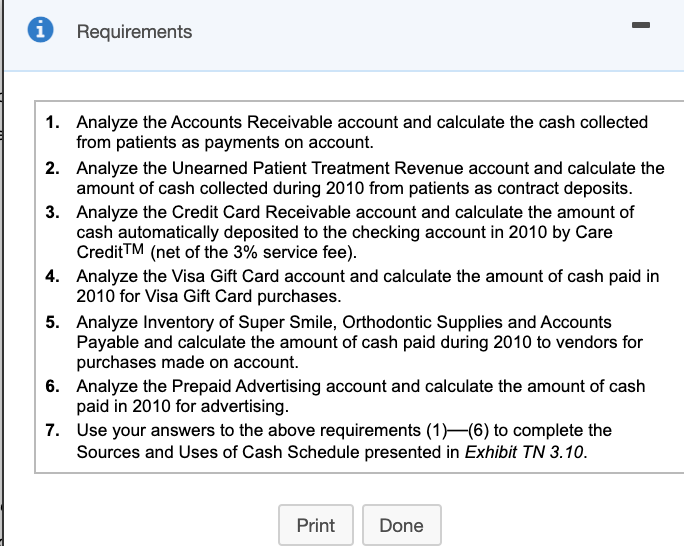

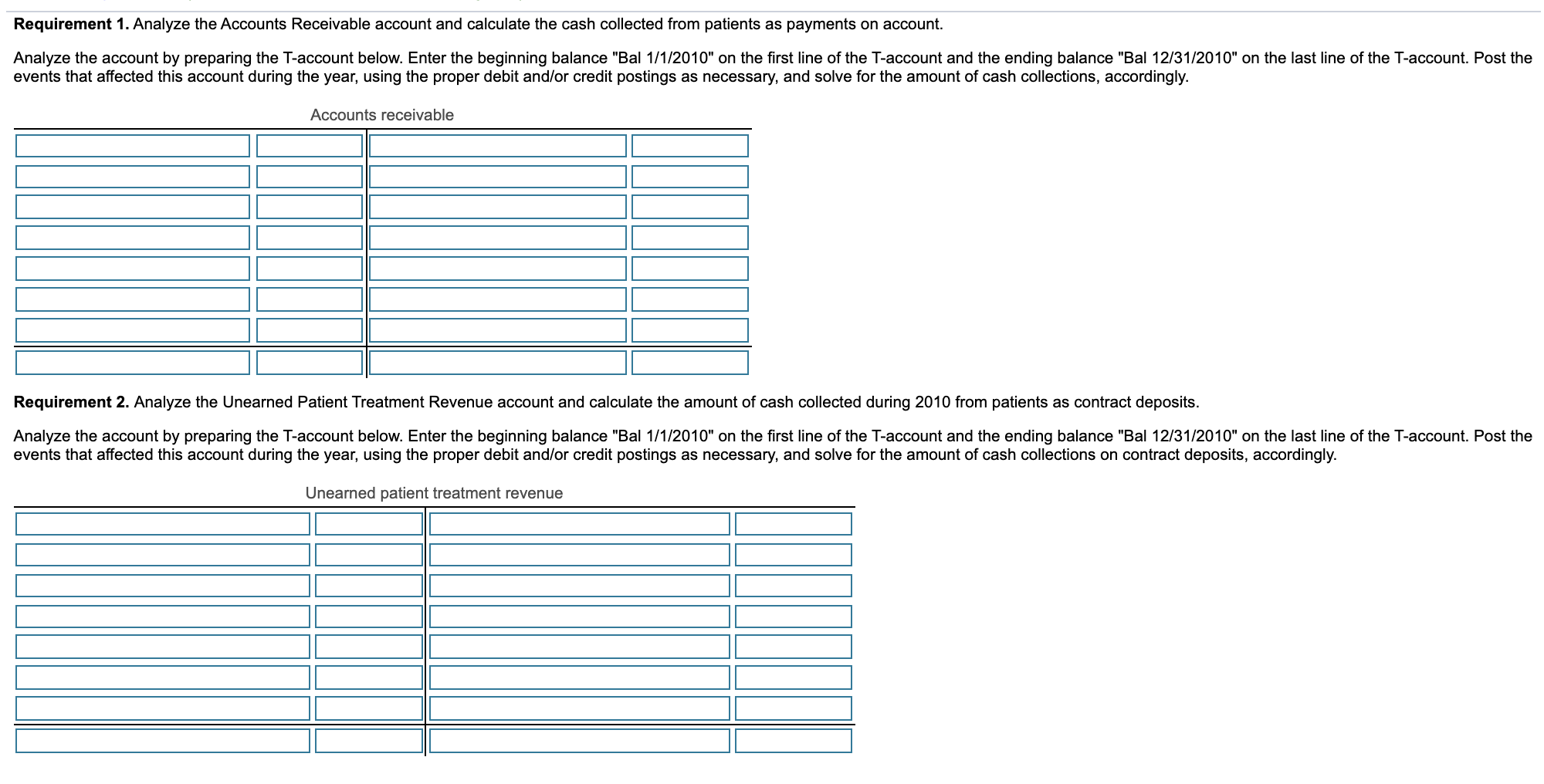

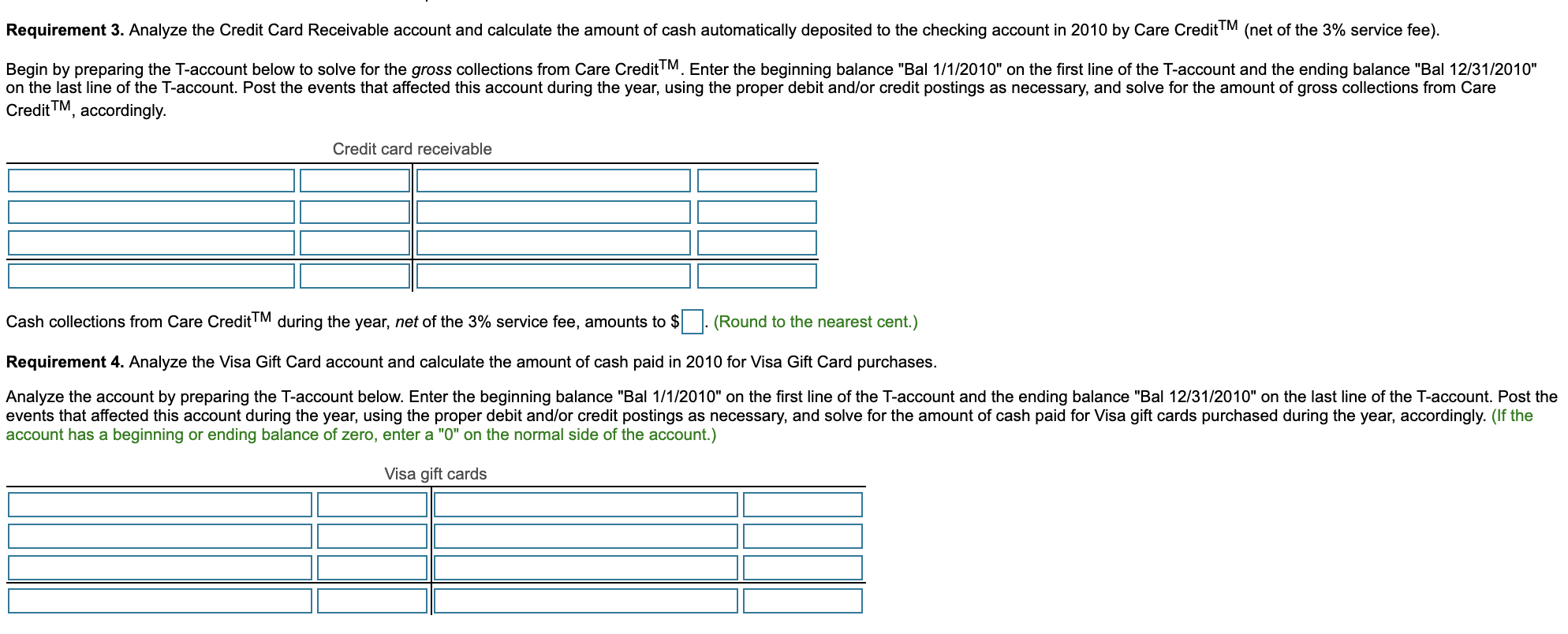

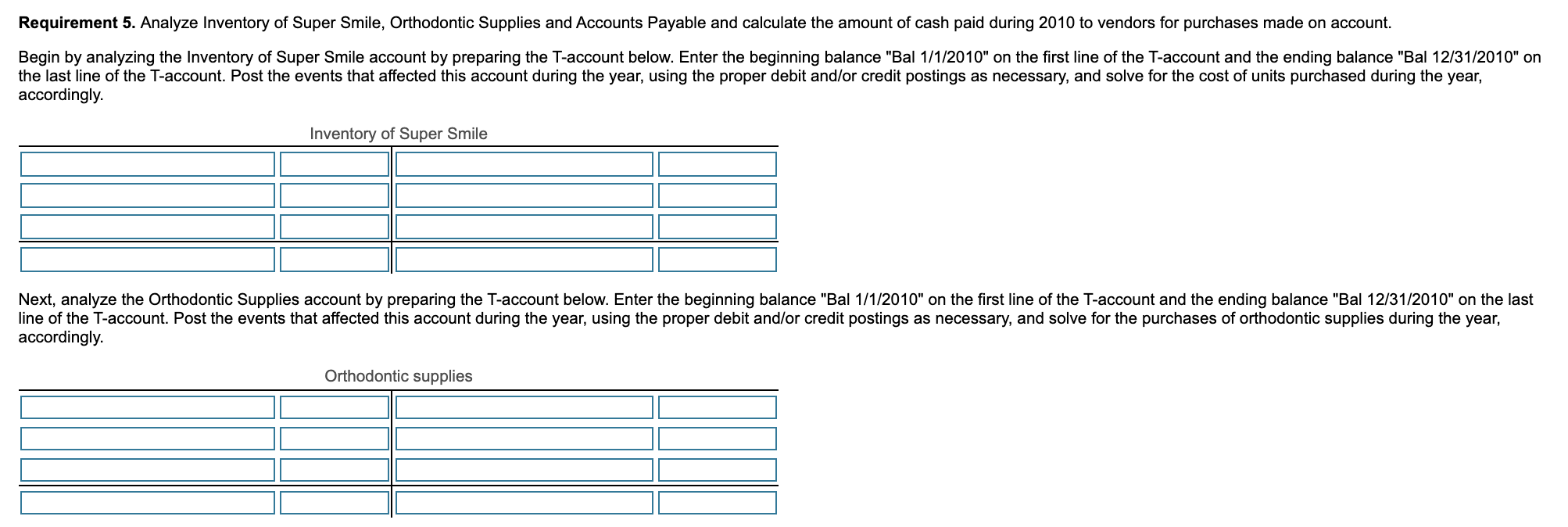

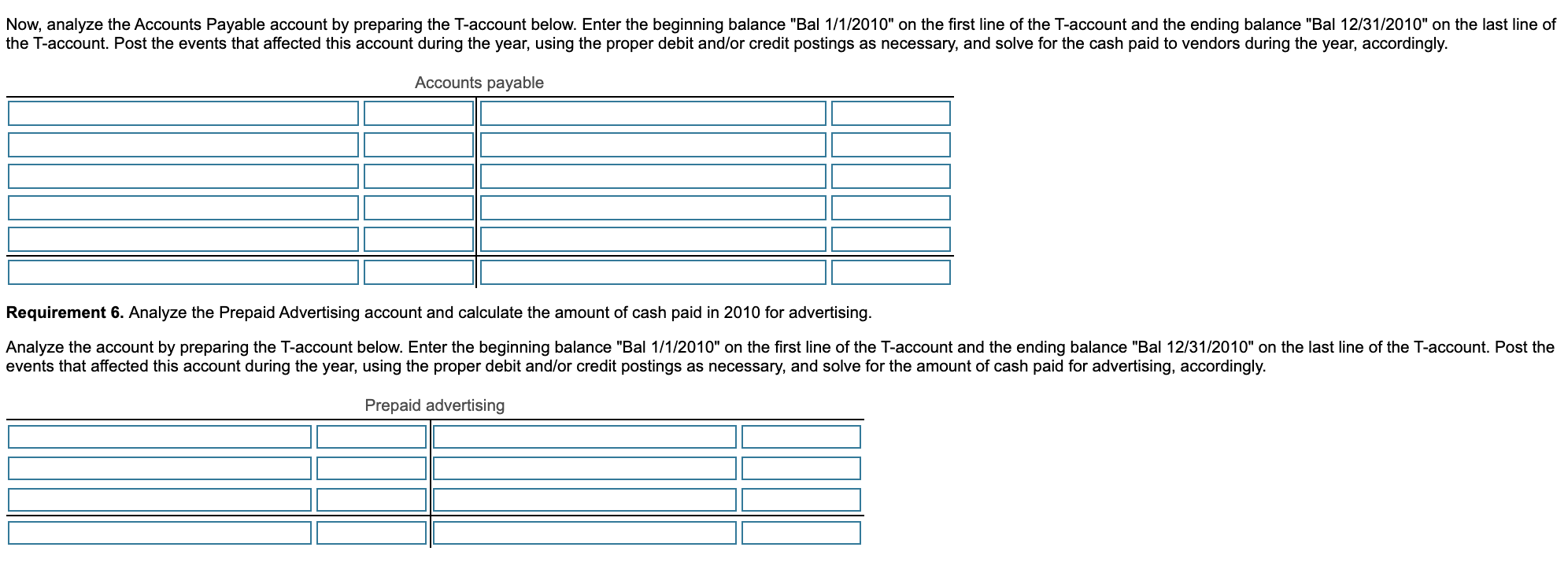

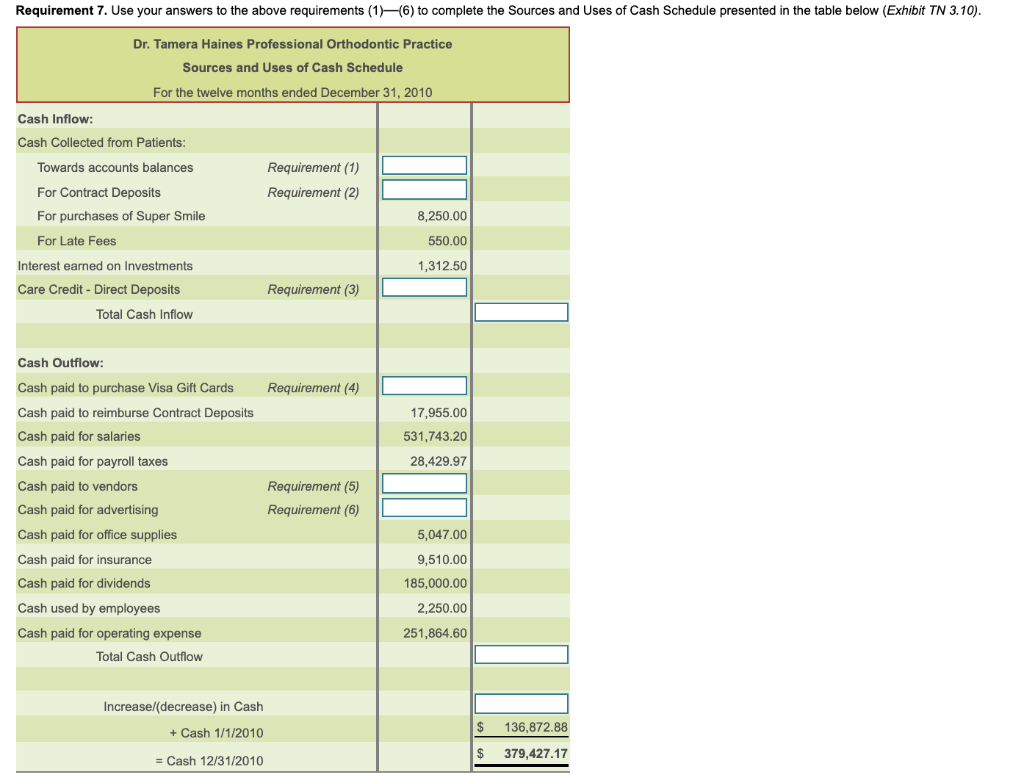

i Requirements 1. Analyze the Accounts Receivable account and calculate the cash collected from patients as payments on account. 2. Analyze the Unearned Patient Treatment Revenue account and calculate the amount of cash collected during 2010 from patients as contract deposits. 3. Analyze the Credit Card Receivable account and calculate the amount of cash automatically deposited to the checking account in 2010 by Care CreditTM (net of the 3% service fee). 4. Analyze the Visa Gift Card account and calculate the amount of cash paid in 2010 for Visa Gift Card purchases. 5. Analyze Inventory of Super Smile, Orthodontic Supplies and Accounts Payable and calculate the amount of cash paid during 2010 to vendors for purchases made on account. 6. Analyze the Prepaid Advertising account and calculate the amount of cash paid in 2010 for advertising. 7. Use your answers to the above requirements ( 16) to complete the Sources and Uses of Cash Schedule presented in Exhibit TN 3.10. Print Done Requirement 1. Analyze the Accounts Receivable account and calculate the cash collected from patients as payments on account. Analyze the account by preparing the T-account below. Enter the beginning balance "Bal 1/1/2010" on the first line of the T-account and the ending balance "Bal 12/31/2010" on the last line of the T-account. Post the events that affected this account during the year, using the proper debit and/or credit postings as necessary, and solve for the amount of cash collections, accordingly. Accounts receivable Requirement 2. Analyze the Unearned Patient Treatment Revenue account and calculate the amount of cash collected during 2010 from patients as contract deposits. Analyze the account by preparing the T-account below. Enter the beginning balance "Bal 1/1/2010" on the first line of the T-account and the ending balance "Bal 12/31/2010" on the last line of the T-account. Post the events that affected this account during the year, using the proper debit and/or credit postings as necessary, and solve for the amount of cash collections on contract deposits, accordingly. Unearned patient treatment revenue Requirement 3. Analyze the Credit Card Receivable account and calculate the amount of cash automatically deposited to the checking account in 2010 by Care Credit TM (net of the 3% service fee). Begin by preparing the T-account below to solve for the gross collections from Care CreditTM. Enter the beginning balance "Bal 1/1/2010" on the first line of the T-account and the ending balance "Bal 12/31/2010" on the last line of the T-account. Post the events that affected this account during the year, using the proper debit and/or credit postings as necessary, and solve for the amount of gross collections from Care CreditTM, accordingly. Credit card receivable Cash collections from Care CreditTM during the year, net of the 3% service fee, amounts to $ (Round to the nearest cent.) Requirement 4. Analyze the Visa Gift Card account and calculate the amount of cash paid in 2010 for Visa Gift Card purchases. Analyze the account by preparing the T-account below. Enter the beginning balance "Bal 1/1/2010" on the first line of the T-account and the ending balance "Bal 12/31/2010" on the last line of the T-account. Post the events that affected this account during the year, using the proper debit and/or credit postings as necessary, and solve for the amount of cash paid for Visa gift cards purchased during the year, accordingly. (If the account has a beginning or ending balance of zero, enter a "0" on the normal side of the account.) Visa gift cards Requirement 5. Analyze Inventory of Super Smile, Orthodontic Supplies and Accounts Payable and calculate the amount of cash paid during 2010 to vendors for purchases made on account. Begin by analyzing the Inventory of Super Smile account by preparing the T-account below. Enter the beginning balance "Bal 1/1/2010" on the first line of the T-account and the ending balance "Bal 12/31/2010" on the last line of the T-account. Post the events that affected this account during the year, using the proper debit and/or credit postings as necessary, and solve for the cost of units purchased during the year, accordingly. Inventory of Super Smile Next, analyze the Orthodontic Supplies account by preparing the T-account below. Enter the beginning balance "Bal 1/1/2010" on the first line of the T-account and the ending balance "Bal 12/31/2010" on the last line of the T-account. Post the events that affected this account during the year, using the proper debit and/or credit postings as necessary, and solve for the purchases of orthodontic supplies during the year, accordingly. Orthodontic supplies Now, analyze the Accounts Payable account by preparing the T-account below. Enter the beginning balance "Bal 1/1/2010" on the first line of the T-account and the ending balance "Bal 12/31/2010" on the last line of the T-account. Post the events that affected this account during the year, using the proper debit and/or credit postings as necessary, and solve for the cash paid to vendors during the year, accordingly. Accounts payable Requirement 6. Analyze the Prepaid Advertising account and calculate the amount of cash paid in 2010 for advertising. Analyze the account by preparing the T-account below. Enter the beginning balance "Bal 1/1/2010" on the first line of the T-account and the ending balance "Bal 12/31/2010" on the last line of the T-account. Post the events that affected this account during the year, using the proper debit and/or credit postings as necessary, and solve for the amount of cash paid for advertising, accordingly. Prepaid advertising Requirement 7. Use your answers to the above requirements (1)(6) to complete the sources and Uses of Cash Schedule presented in the table below (Exhibit TN 3.10). Dr. Tamera Haines Professional Orthodontic Practice Sources and Uses of Cash Schedule For the twelve months ended December 31, 2010 Cash Inflow: Cash Collected from Patients: Requirement (1) Requirement (2) 8,250.00 Towards accounts balances For Contract Deposits For purchases of Super Smile For Late Fees Interest earned on Investments Care Credit - Direct Deposits Total Cash Inflow 550.00 1,312.50 Requirement (3) Cash Outflow: Requirement (4) 17,955.00 531,743.20 28,429.97 Requirement (5) Requirement (6) Cash paid to purchase Visa Gift Cards Cash paid to reimburse Contract Deposits Cash paid for salaries Cash paid for payroll taxes Cash paid to vendors Cash paid for advertising Cash paid for office supplies Cash paid for insurance Cash paid for dividends Cash used by employees Cash paid for operating expense Total Cash Outflow 5,047.00 9,510.00 185,000.00 2,250.00 251,864.60 Increase/(decrease) in Cash $ + Cash 1/1/2010 136,872.88 $ 379,427.17 = Cash 12/31/2010 i Requirements 1. Analyze the Accounts Receivable account and calculate the cash collected from patients as payments on account. 2. Analyze the Unearned Patient Treatment Revenue account and calculate the amount of cash collected during 2010 from patients as contract deposits. 3. Analyze the Credit Card Receivable account and calculate the amount of cash automatically deposited to the checking account in 2010 by Care CreditTM (net of the 3% service fee). 4. Analyze the Visa Gift Card account and calculate the amount of cash paid in 2010 for Visa Gift Card purchases. 5. Analyze Inventory of Super Smile, Orthodontic Supplies and Accounts Payable and calculate the amount of cash paid during 2010 to vendors for purchases made on account. 6. Analyze the Prepaid Advertising account and calculate the amount of cash paid in 2010 for advertising. 7. Use your answers to the above requirements ( 16) to complete the Sources and Uses of Cash Schedule presented in Exhibit TN 3.10. Print Done Requirement 1. Analyze the Accounts Receivable account and calculate the cash collected from patients as payments on account. Analyze the account by preparing the T-account below. Enter the beginning balance "Bal 1/1/2010" on the first line of the T-account and the ending balance "Bal 12/31/2010" on the last line of the T-account. Post the events that affected this account during the year, using the proper debit and/or credit postings as necessary, and solve for the amount of cash collections, accordingly. Accounts receivable Requirement 2. Analyze the Unearned Patient Treatment Revenue account and calculate the amount of cash collected during 2010 from patients as contract deposits. Analyze the account by preparing the T-account below. Enter the beginning balance "Bal 1/1/2010" on the first line of the T-account and the ending balance "Bal 12/31/2010" on the last line of the T-account. Post the events that affected this account during the year, using the proper debit and/or credit postings as necessary, and solve for the amount of cash collections on contract deposits, accordingly. Unearned patient treatment revenue Requirement 3. Analyze the Credit Card Receivable account and calculate the amount of cash automatically deposited to the checking account in 2010 by Care Credit TM (net of the 3% service fee). Begin by preparing the T-account below to solve for the gross collections from Care CreditTM. Enter the beginning balance "Bal 1/1/2010" on the first line of the T-account and the ending balance "Bal 12/31/2010" on the last line of the T-account. Post the events that affected this account during the year, using the proper debit and/or credit postings as necessary, and solve for the amount of gross collections from Care CreditTM, accordingly. Credit card receivable Cash collections from Care CreditTM during the year, net of the 3% service fee, amounts to $ (Round to the nearest cent.) Requirement 4. Analyze the Visa Gift Card account and calculate the amount of cash paid in 2010 for Visa Gift Card purchases. Analyze the account by preparing the T-account below. Enter the beginning balance "Bal 1/1/2010" on the first line of the T-account and the ending balance "Bal 12/31/2010" on the last line of the T-account. Post the events that affected this account during the year, using the proper debit and/or credit postings as necessary, and solve for the amount of cash paid for Visa gift cards purchased during the year, accordingly. (If the account has a beginning or ending balance of zero, enter a "0" on the normal side of the account.) Visa gift cards Requirement 5. Analyze Inventory of Super Smile, Orthodontic Supplies and Accounts Payable and calculate the amount of cash paid during 2010 to vendors for purchases made on account. Begin by analyzing the Inventory of Super Smile account by preparing the T-account below. Enter the beginning balance "Bal 1/1/2010" on the first line of the T-account and the ending balance "Bal 12/31/2010" on the last line of the T-account. Post the events that affected this account during the year, using the proper debit and/or credit postings as necessary, and solve for the cost of units purchased during the year, accordingly. Inventory of Super Smile Next, analyze the Orthodontic Supplies account by preparing the T-account below. Enter the beginning balance "Bal 1/1/2010" on the first line of the T-account and the ending balance "Bal 12/31/2010" on the last line of the T-account. Post the events that affected this account during the year, using the proper debit and/or credit postings as necessary, and solve for the purchases of orthodontic supplies during the year, accordingly. Orthodontic supplies Now, analyze the Accounts Payable account by preparing the T-account below. Enter the beginning balance "Bal 1/1/2010" on the first line of the T-account and the ending balance "Bal 12/31/2010" on the last line of the T-account. Post the events that affected this account during the year, using the proper debit and/or credit postings as necessary, and solve for the cash paid to vendors during the year, accordingly. Accounts payable Requirement 6. Analyze the Prepaid Advertising account and calculate the amount of cash paid in 2010 for advertising. Analyze the account by preparing the T-account below. Enter the beginning balance "Bal 1/1/2010" on the first line of the T-account and the ending balance "Bal 12/31/2010" on the last line of the T-account. Post the events that affected this account during the year, using the proper debit and/or credit postings as necessary, and solve for the amount of cash paid for advertising, accordingly. Prepaid advertising Requirement 7. Use your answers to the above requirements (1)(6) to complete the sources and Uses of Cash Schedule presented in the table below (Exhibit TN 3.10). Dr. Tamera Haines Professional Orthodontic Practice Sources and Uses of Cash Schedule For the twelve months ended December 31, 2010 Cash Inflow: Cash Collected from Patients: Requirement (1) Requirement (2) 8,250.00 Towards accounts balances For Contract Deposits For purchases of Super Smile For Late Fees Interest earned on Investments Care Credit - Direct Deposits Total Cash Inflow 550.00 1,312.50 Requirement (3) Cash Outflow: Requirement (4) 17,955.00 531,743.20 28,429.97 Requirement (5) Requirement (6) Cash paid to purchase Visa Gift Cards Cash paid to reimburse Contract Deposits Cash paid for salaries Cash paid for payroll taxes Cash paid to vendors Cash paid for advertising Cash paid for office supplies Cash paid for insurance Cash paid for dividends Cash used by employees Cash paid for operating expense Total Cash Outflow 5,047.00 9,510.00 185,000.00 2,250.00 251,864.60 Increase/(decrease) in Cash $ + Cash 1/1/2010 136,872.88 $ 379,427.17 = Cash 12/31/2010