Answered step by step

Verified Expert Solution

Question

1 Approved Answer

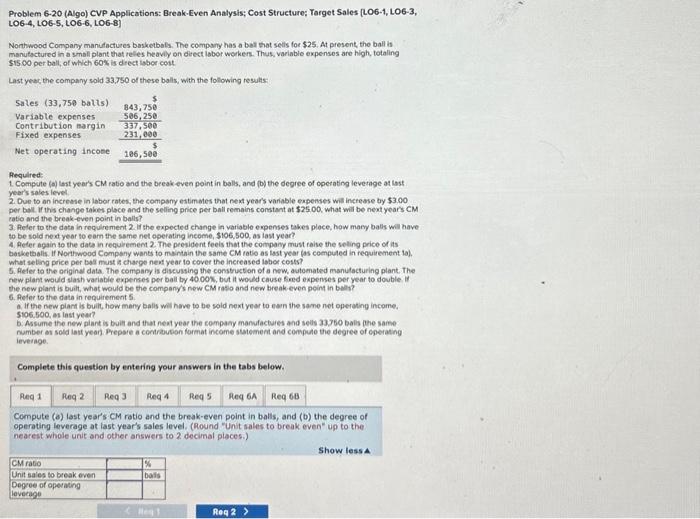

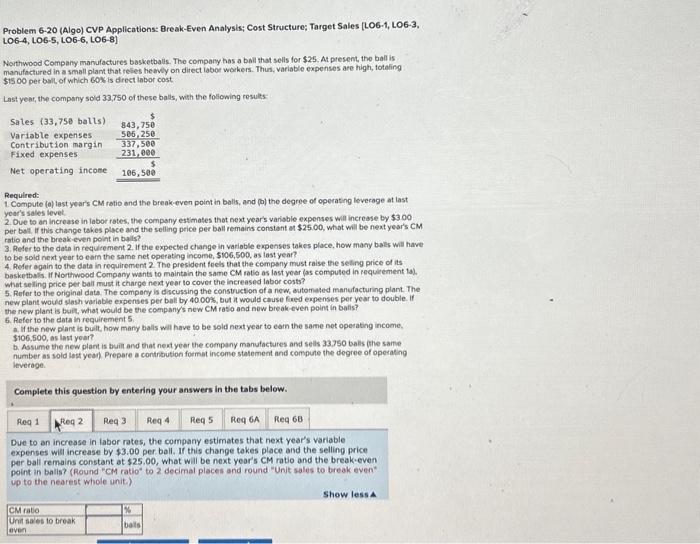

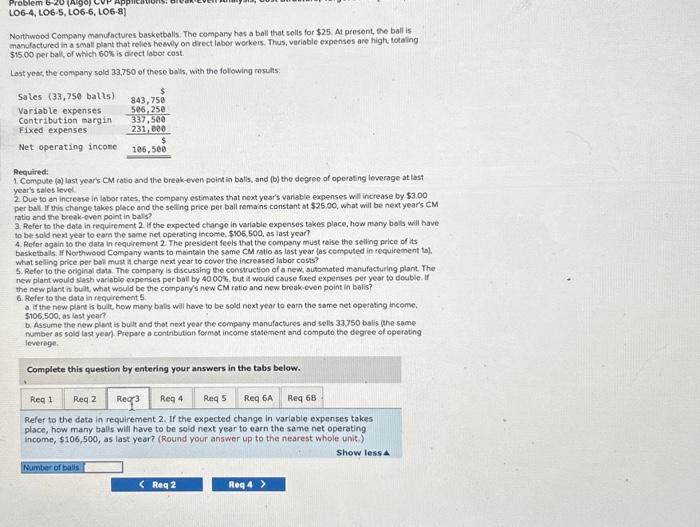

HELP WITH THIS PLEASE Problem 6-20 (Algo) CVP Applications: Break-Even Analysis; Cost Structure; Target Sales [L06-1, L06-3, LOG-4, LOG-5, LOG-6, LOG-8) Norhwood Company manutactures basketbals.

HELP WITH THIS PLEASE

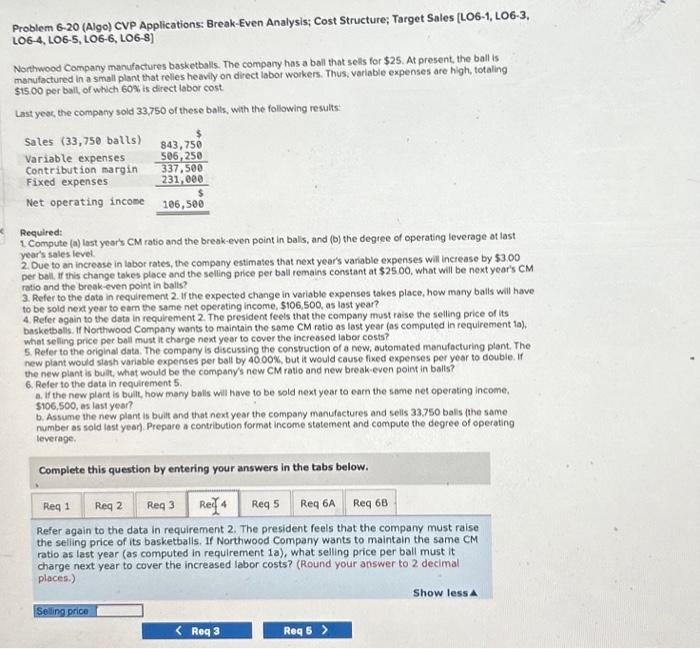

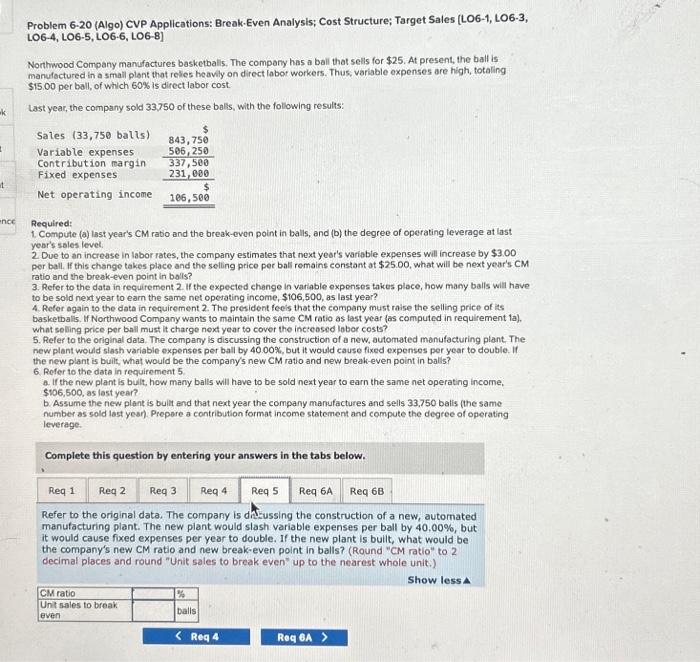

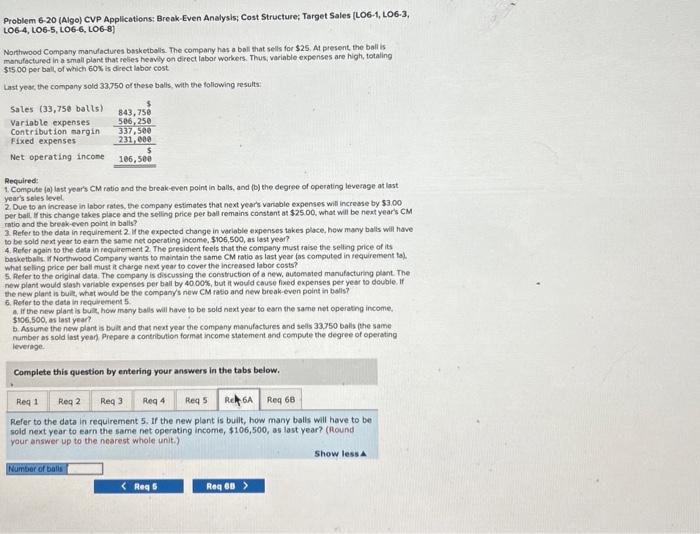

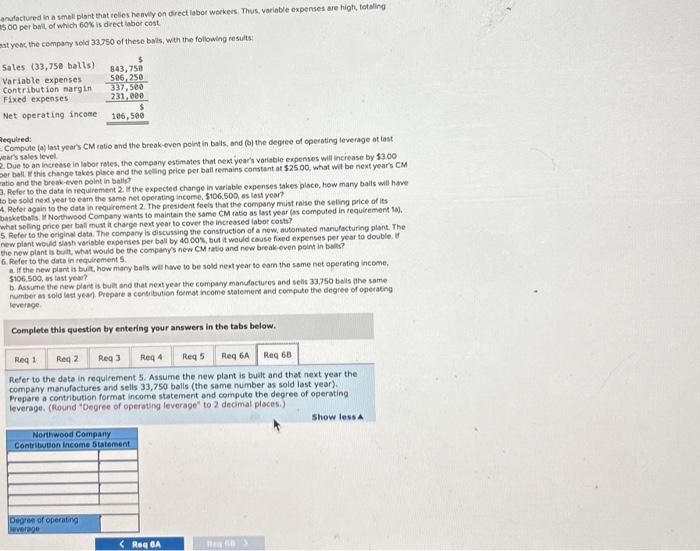

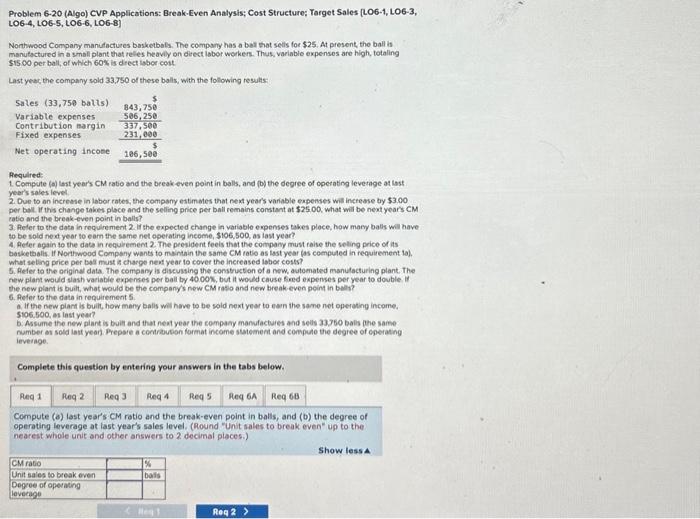

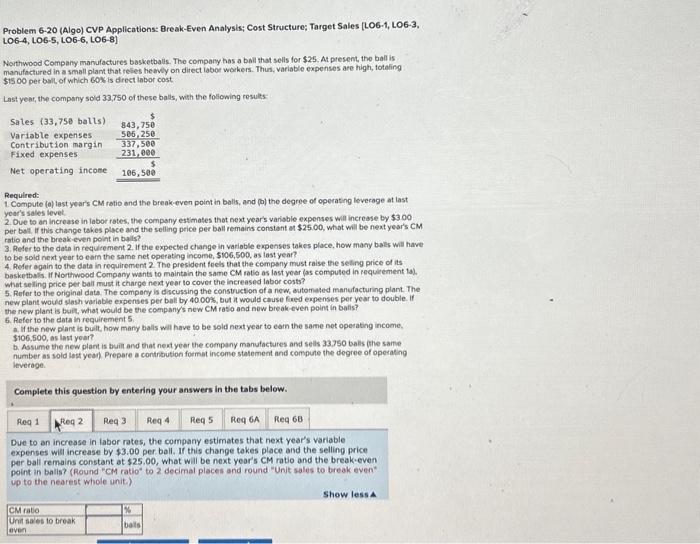

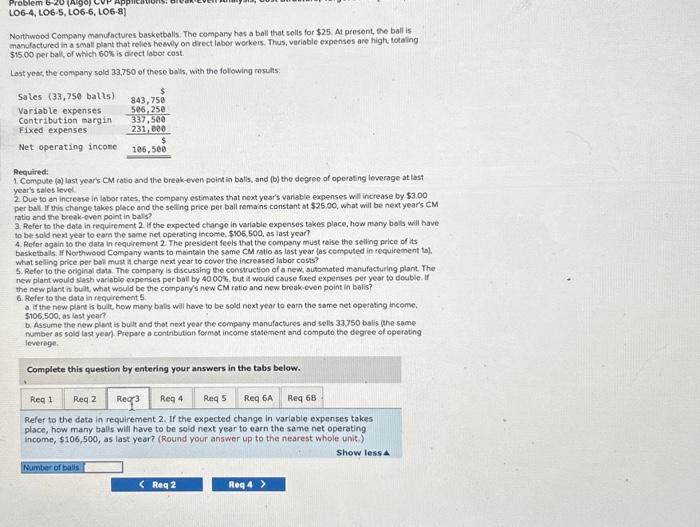

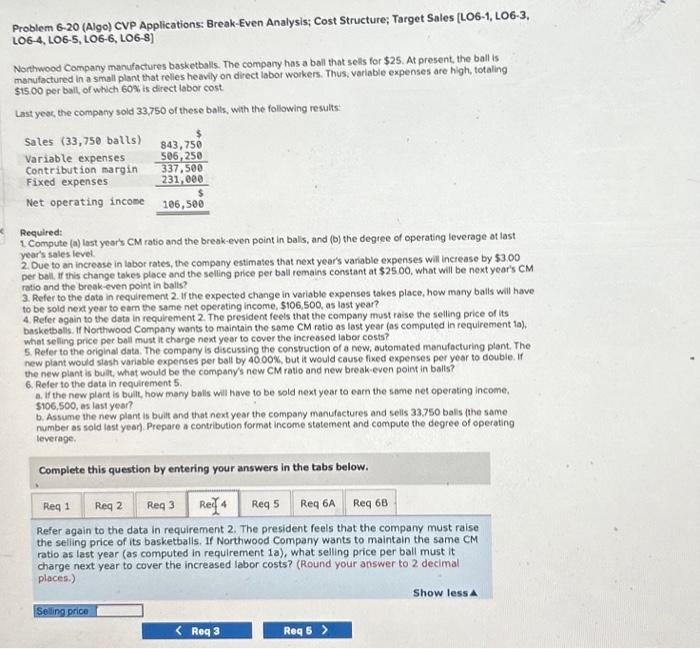

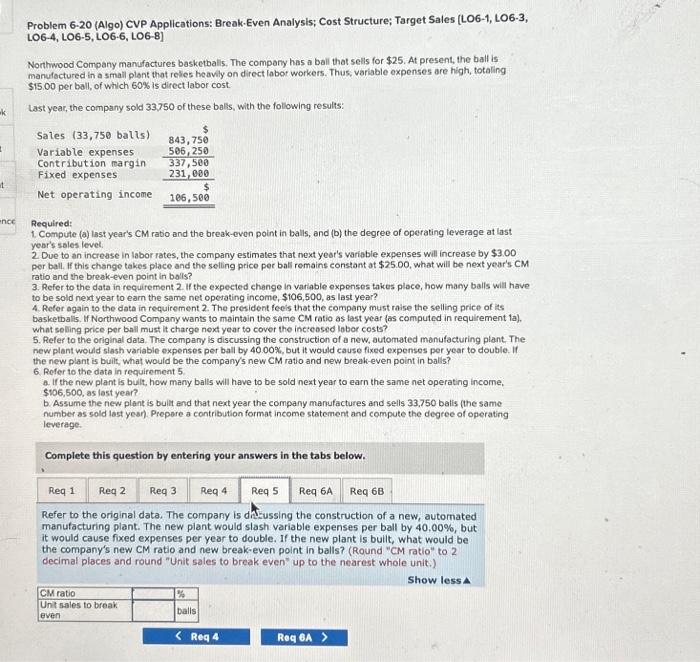

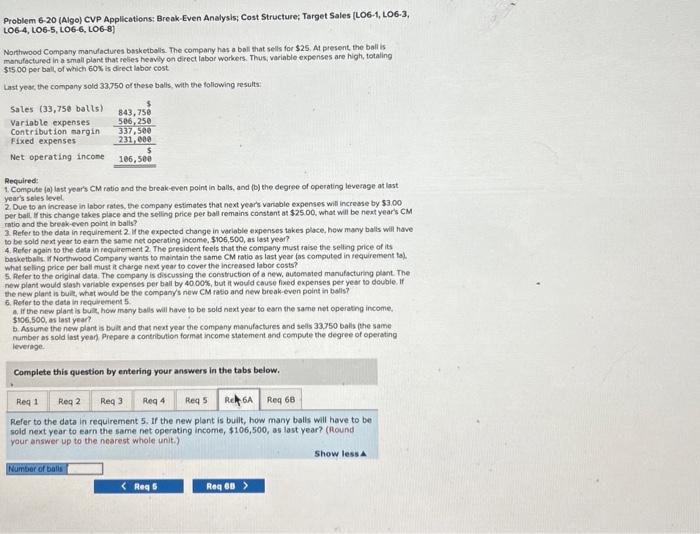

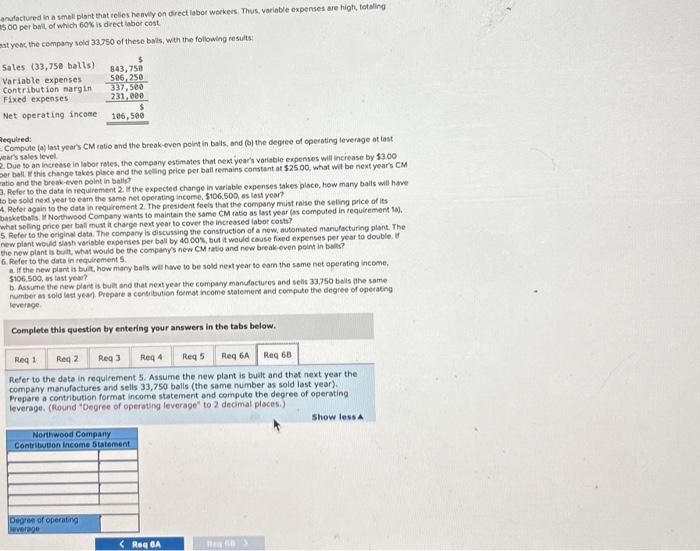

Problem 6-20 (Algo) CVP Applications: Break-Even Analysis; Cost Structure; Target Sales [L06-1, L06-3, LOG-4, LOG-5, LOG-6, LOG-8) Norhwood Company manutactures basketbals. The compary has a bel that sells foe $25. At present, the ball is manutactured in a smali plant that reles heavly on deect labor workers. Thus, variable expenses are high, totaling 51500 per ball; of which 60% is diect isber cott Last yeac, the company sold 33,750 of these balis, with the following results: Pequlred: 1. Compute (s) last year's CM ratio and the break even point in bals, and (b) the degree of operating leverage at last yedr's sales level. 2. Due to an increase in labor rates, the company estimates that eext year's variable eapenses will increase by $3.00 per ball. If this change takes ploce and the seling price per ball remains constant at $2500, what will be neatyears CM catio and the break-even point in balls? 3. Peler to the data in requlrement 2 . If the expected change in variable e menses takes place, how mary balls wil have to be sold next year to earn the same net operating income, $106,500, as last year? 4. Aeder again to the date in requirement 2 . The president feeis that the company must raise the seling price of is basketbals, If Northwood Compeny wants to manthin the same CM ratio as last year (as compuled in requirement ia). whet seling price per bas must is charge new year to cover the increased labor costs? 5. Aefer to the original data. The compary is discussing the constructon of a new, automated manulacturing plant, The new plant would slash variable expenses per ball by 40 OON, but it wosld cause fiad expenses per year to double if the new plant is built, what would be the company/s new CM ratso and new breat-even peint in bely? 6. Aeder to the data in requirement 5 . a. If the new plant is built, how many balis will have to be sold next year to earn the same net operating income. 5106.500, as last yeur? b. Assume the new piant is buit and that neat year the company mantactures and seds 33.360 ball ahe same number at sold iast years. Drepse a contraveon format income statement and compule the degree of coerating ieverage. Complete this question by entering your answers in the tabs below. Compute (a) last year's CM ratio and the break-even point in balls, and (b) the degree of operating leverage at last year's sales level. (Round "Unit sales to break even" ug to the nearest whole unit and other answers to 2 decimal places.) Problem 6-20 (Algo) CVP Applications: Break-Even Analysis; Cost Structure; Target Sales [LO6-1, L06-3, LOG-4, LOG-5, LO6-6, LOG-8] Northwood Company manufactures basketbalis. The company has a ball that sells for $25. At present, the ball is manufactured in a small plant that relies heewly on direct labor workers. Thus, variable expenses are high, totaling $500 per bell of which 60s is drect labor cost Last yeat, the compsiny soid 33,750 of these balls, wht the following results: Required: 1. Compute (a) lest year's CM ratio and the breakeeven point in balk, and (b) the degree of operating leverage at last your's sales levet. 2. Due to an increase in labor rates, the compsny estimases that next year's varisble expenses will increase by $300 per bett if this change takes ploce and the selling price per ball remains constant 9.$25.00, what will be next year's CM ratio and the breakeven point in bals? 3. Refer to the data in requirement 2. If the expected change in variable expenses takes place, how mamy balk will have to be sold next year to earn the same net operating income, 5106,500 , as last year? 4. Refer again to the dota in requiroment 2 . The president feels that the company must ralse the selling price of its basketbals. If Nort twood Company wants to maintain the same CM ratio as last year (as compuled in requirement la), what seling price per ball must it charge next yeer to cover the increased labor costs? 5. Refor to the original data The company is discussing the constuction of a new, eutomated manufacturing plant. The new plant would slash vaciable expenses per ball by 40.00%, but it would couse faed expenses per year to double. If the new plant is buil, what would be the companys new CM raso and now breakeven point in batis? 6. Refer to the data in requirement 5 . a. If the new plant is bult, how many balls will have to be sold next year to eath the same net operating income, $106,500, as iast your? b. Assume the new plant is buil and that next yeer the company manufactures and sells 33.750 balls (the same number as sold lost yea). Prepare a contrbution format income statement and compule the degree of operating inerage. Complete this question by entering your answers in the tabs below. s. Due to an increase in labor rates, the company estimates that next year's variable expenses wisl increase by $3.00 per boll. If this change takes place and the selling price per balf remains constant at $25.00, what will be next year's CM rotio and the break-even point in balis? (Round "CM ratio" to 2 decimal pleces and round "Unit sales to break even" up to the nearest whole unit) Northwood Company manufactures basketballs. The compary has a ball that solls for $25. At present, the ball is manufsctured in a small plant that reles heevly on direct labor workers. Thus, variable expenses are high, totaling $1500 per balt, of which 60% is decet labor cest. Last yest, the company sold 33,750 of these bolls, with the following results: Required: 1. Compute (a) last year's CM ratio and the break-even point in balls, and (b) the degree of operating leverage at last year's sales level 2 Oue to an incresse in isbor rates, the company estimates that next year's variable expenses will increase by $3.00 per bal ir this chenge takes place and the seling price per ball remains constant at $25.00, what will be neat years CM ratio and the break-even point in bals? 3. Pefer to the data in requirement 2 . If the expected change in variable expenses takes place, how many bols will have to besold next year to earn the same net operating income, $106,500, as last year? 4. Reter again to the data in requirement 2. The president feels that the company must raise the seling peice of its boskethsls. If Northused Cempany wants to maintain the same CM ratio as last year (as cemputed in secuirement to), What seling price per bel must it charge next year to cevor the increased labor costs? 5. Refer to the orginal data. The coenpany is discussing the construction of a new, automated manufacturing plant. The new plant would slash variable expenses per ball by 4000%, but is would cause fixed expenses per year to double. If the new plant is bult, what would be the company's new CM ratio and new break-even point in balis? 6. Pefer to the dots in requirement 5 a. If the new plant is bult, how many bals will have to be sold next year to earn the same net opesating income, $106,500, as last year? b. Assume the new plent is bult and that next year the company manufactures and sells 33,750 balis (the same number as sold lastyear). Prepare a contribution formst income statement and compute the dogree of eperating ievernge. Complete this question by entering your answers in the tabs below. Refer to the data in requirement 2. If the expected change in variable expenses takes place, how many balls will have to be sold next year to earn the same net operating income, $106,500, as last year? (Round your answer up to the nearest whole unit.) Problem 6-20 (Algo) CVP Applications: Break-Even Analysis; Cost Structure; Target Sales [LO6-1, LO6-3, LOG-4, LOG-5, LOG-6, LOG-8] Northwood Company manufactures basketballs. The company has a ball that sells for $25. At present, the ball is manufactured in a small plant that relles heavily on direct iabor woikers. Thus, variable expenses are high, totaling $1500 per bail, of which 60% is direct labor cost. Last yeor, the compary sold 33,750 of these balk, with the following results Required: 1. Compute (a) last year's CM ratio and the break-even point in bals, and (b) the degree of operating leverage at last year's sales level. 2. Due to an increase in labor rates, the company estimates that next year's variable expenses will increase by $3.00 per boll. if this change takes place and the selling price per ball remains constant at $2500, what will be next year's CM retio and the break-even point in balls? 3. Refer to the dato in requirement 2. If the expected change in variable expenses takes place, how many balls will have to be sold next yoar to earn the same net operating income, $106,500, as last year? 4. Refer again to the dota in requirement 2 . The president feels that the company must raise the selling price of its basketbals. If Northwood Company wants to maintain the same CM ratio as last year (as computed in requirement 1a), what selling price per boll must it charge next year to cover the increased labor costs? 5. Refer to the original data. The company is discussing the construction of a new, automated manufacturing plant. The new plant would slesh variable expenses per balt by 40.00%, but it would cause fixed expenses per year to double. If the new plant is bult, what would be the company's new CM ratio and new break-even point in balis? 6. Refer to the data in requirement 5 . a. If the new plart is buit, how many balls will have to be sold next year to earn the same net operating income. 5106,500 , as last year? b. Assume the new plant is buit and that next year the company manufactures and selis 33,750 bals (the same number as sold last year). Prepare a contribution format income stotement and compute the degree of eperating leverage. Complete this question by entering your answers in the tabs below. Refer again to the data in requirement 2. The president feels that the company must raise the seling price of its basketballs. If Northwood Company wants to maintain the same CM ratio as last year (as computed in requirement 1 a), what selling price per ball must it charge next year to cover the increased labor costs? (Round your answer to 2 decimal places.) Problem 6-20 (Algo) CVP Applications: Break-Even Analysis; Cost Structure; Target Sales [LO6-1, LO6-3, LOG-4, LOG-5, LOG-6, LOG-8] Northwood Company manufactures basketbalis. The company has a ball that sells for $25. At present, the ball is manufoctured in a small plont that reles heavly on direct labor workers. Thus, variable expenses are high, totaling $1500 per ball, of which 60% is direct labor cost. Last year, the company sold 33.750 of these balls, with the following results: Required: 1. Compute (a) last year's CM rabo and the break-even point in balls, and (b) the degree of operating leverage at last yobr's soles level. 2 Due to an increase in labor rates, the company estimates that next year's variable expenses will increase by $3.00 per ball, If this change takes place and the selling price per ball remains constant at $25.00, what will be next year's CM ratio and the break-even point in bolls? 3. Refer to the data in requirement 2 . If the expected change in varlable exponses takes place, how many balls will have. to be sold next year to earn the same net operating income, $106,500, as last year? 4. Refor again to the data in requirement 2 . The president feels that the company must raise the selling price of its baskethalls, If Northwood Company wants to maintain the same CM ratio as last year (as computed in requirement la), what soling price per ball must it charge next year to cover the inciessed lobor costs? 5. Refer to the original data. The company is discussing the construction of a new, automated manufacturing plant. The new plant would slash variable expenses per ball by 40.00%, but it would cause fixed expenses per year to double. If the new plant is built, what would be the company's new CM ratio and new break-even point in balls? 6. Refer to the data in requirement 5 a. If the new plant is buit, how many balls will have to be sold next year to earn the same net operating income, $106,500, as last year? b. Assume the new plant is bulit and that next year the company manufactures and sells 33,750 balis (the same number as sold last year). Prepore a contribution format income statement and compute the degree of operating leverage. Complete this question by entering your answers in the tabs below. Refer to the original data. The company is dazussing the construction of a new, automated manufacturing plant. The new plant would slash variable expenses per ball by 40,00%, but it would cause fixed expenses per year to double. If the new plant is buit, what would be the company's new CM ratio and new break-even point in balis? (Round " CM ratio" to 2 decimal places and round "Unit sales to break even" up to the nearest whole unit:) Problem 6-20 (Algo) CVP Applications: Break-Even Analysis; Cost Structure; Target Sales [LO6-1, LO6-3, 1064,1065,1066, LOG-8) Northwood Company manulactures basketbolls. The company has a bolithat sells for $25. At present, the ball is monufectured in a mall plant that resies heavly on drect labor workers. Thus, variable expenses are high, totaling 5+500 per ball of which 60% is dicect labor cost Last yeac, the company sold 33,750 of these balts, with the sollowing results: Required: 1. Compute (a) last year's CM ratio and the break-even point in balls, and (b) the degree of operating leverage at last 1egred year's seles level. 2. Due to an increase in iabor rates, the company estimates that next year's variable expenses will increase by 53.00 per ball If this change takes place and the selling price per ball remains constont at $2500, what will be nex years CM ratio and the bresk-even point in balis? 3. Refer to the data in requirement 2 if the expected change in varloble expenses takes place, hew many balts will have to be sold next year to earn the same net operating incens, $106,500, as last year? 4. Reter again to the deta in requirement 2 . The president feels that the company must raise the selting price of its besketbolis. If Normwood Compeny wants to maintain the same CM ratio as last year (as computed in iequirement tal what seling price per bell must it chwge next year to cover the increased labor costs? 5. Aefer to the original dasa. The company is discussing the construction of a new, ausommied manufacturing plant. The 5ew plant would slash varlable expenses per ball by 4000%, but it would couse fied expenses per yeur to double. If the new plant is buil, what would be the company's new CM raso and new break-even point in bells? 6. Reler to the data in requiernend 5 a. If the new plart is bul, how mary balls will have to be sold next yeat to esm the same net operating income. 5 to6,500, as tast year? b. Assume the new plant is buit and that next year the compeny manufactures and sels 33.750 balls (the same rumber as sold iast yean Prepare a contribution format income statement and compute the degree of operating leverage. Complete this question by entering your answers in the tabs below. Refer to the data in requirement 5 . If the new plant is built, how many balls will have to bet sold next year to earn the same net operating income, $106,500, as last year? (Round your answer up to the nearest whole unit.) anulactured in a small plant that telles heavly on direct labor workess. Thus, variable expenses are hight tot aling 500 per bal, of which 60% is drect labor cost yesc the company seid 33750 of these bwls, whth the following resuits: Aeculred: Compute (a) last year's CM ratio and the break-even point in bals, and (o) the degree of operating leverage at last wearls sales level. 2. Due 50 an increase in labor fales, the company estimates that next year's vatiabie expenses will increase by 53.00 Der bell If this change takes place and the seding peice per bali remains constant at 32500 , what wil be next year's CM ratio and the break-even point in batis? 3. Refer to the dath in requinement 2 . 4 the expected change in variable expenses takes ploce, hew many bails will have. to be sold nex year to earn the same net eperating income, $106,500, as last yoar? 4. Rofer again to the data in requirement 2. The president teels that the company must raise the seling price of its baswetbals. M Northweed Company wants to maintain the same CM ratio as last year (as computed in requirement la). what seling price per bali must it charge ned year to cover the increased labor costs? 5. Refer to the original data. The compary is discutsing the constructicn of a new, automated manufecturing glant. The. new plant wold sash variable expenses per boll by 40.90%, but it would casse fixed expenses per year to double. if the new plant is bult, what woild be the company's new CM ratio and new breakeven peint in balls? 6. Peefer to the date in requirement 5 . a. If the new plant is buit, how many balls wall have to be sold next year to eam the same net operating income, 5106,500, as last year? b. Assume the new plart is buik and that next year the cempary manufactures and sells 33,750 bals ahe same rumber as sold ust yeas. Prepare a centrbution format income statemen and compute the degree of ogerating leverage Complete this question by entering your answers in the tabs below. Refer to the data in requirement 5 . Assume the new plant is byat and that next year the company manufactures and selts 33,750 bals (the same number as sold last year). Prepare a contribution format income statement and compute the degree of operating leverage. (Hound "Degree of operatimy leverage" to 2 decimal pleces.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started