Answered step by step

Verified Expert Solution

Question

1 Approved Answer

your task is to assist the companys accounting department to improve its activities in terms of external reporting and relation with stakeholders. As an adviser

your task is to assist the companys accounting departmentto improve its activities in terms of external reporting and relation with stakeholders. As an adviser, you must check the coherence of the information provided on the reports (including themes such as profitability, short and long-term financial health, short and long-term strategies, risks, and sustainability of the company) with the overall message presented on directors letters and announcements. With this aim, you might consider checking some of the calculated figures depicted on the reports and examining industry best practices and trends.Write a professional and well-presented report to the companys directors providing your assessment of the current reporting practices of the company and offer your overall recommendations for improving it. If appropriate draw on relevant academic literature in building andsupporting your arguments.

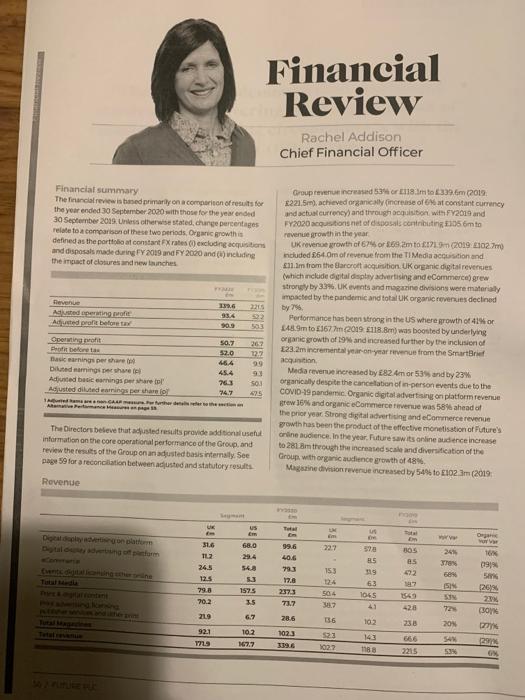

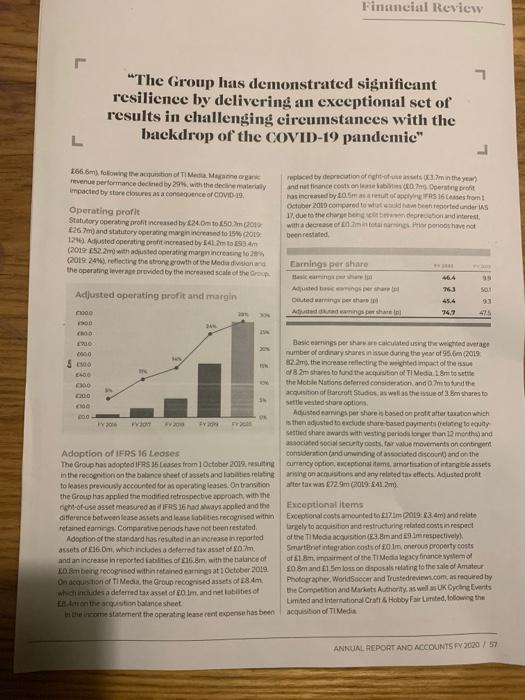

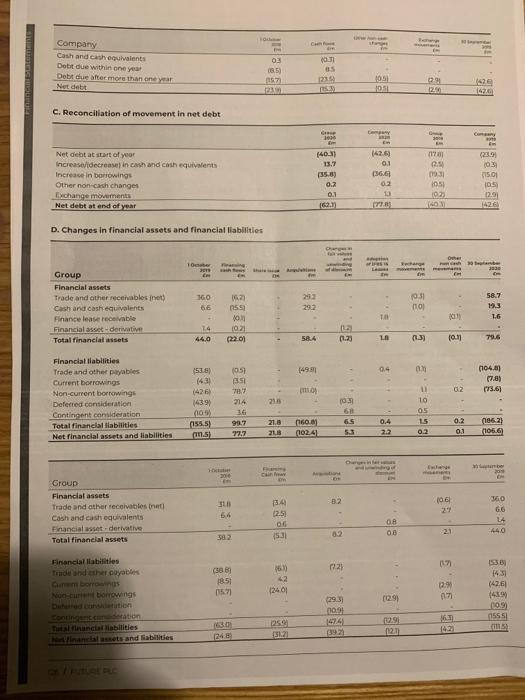

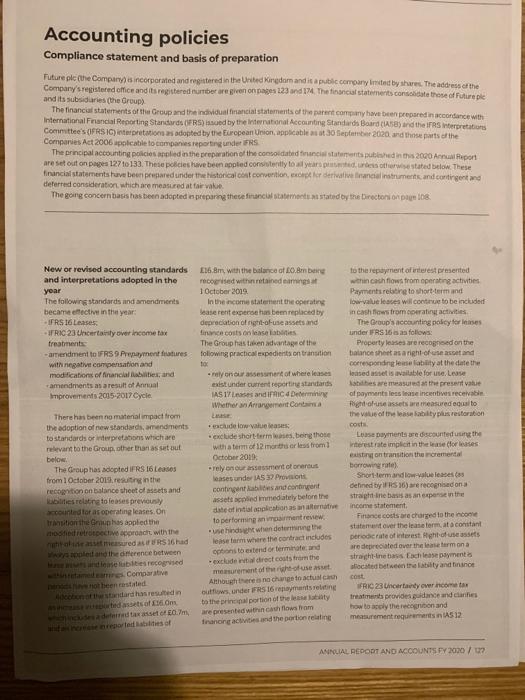

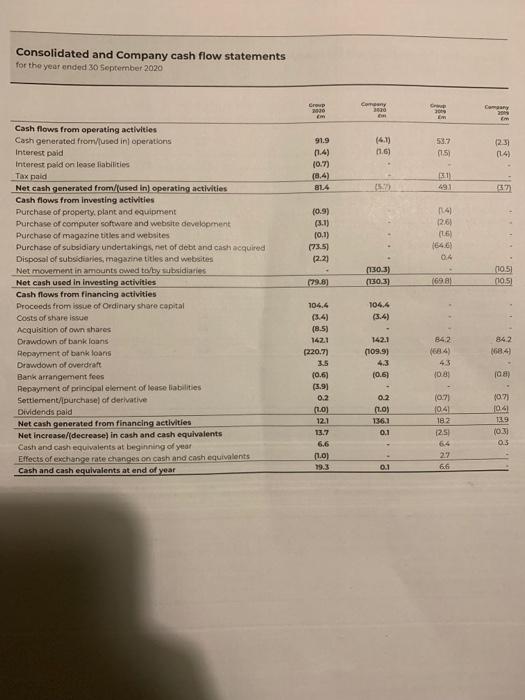

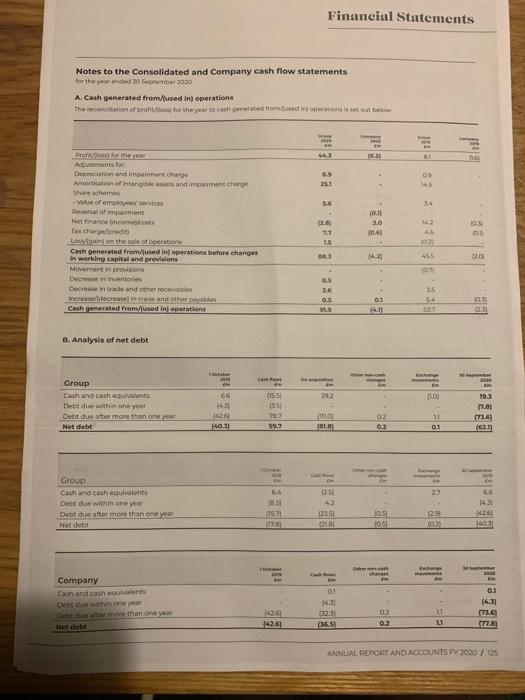

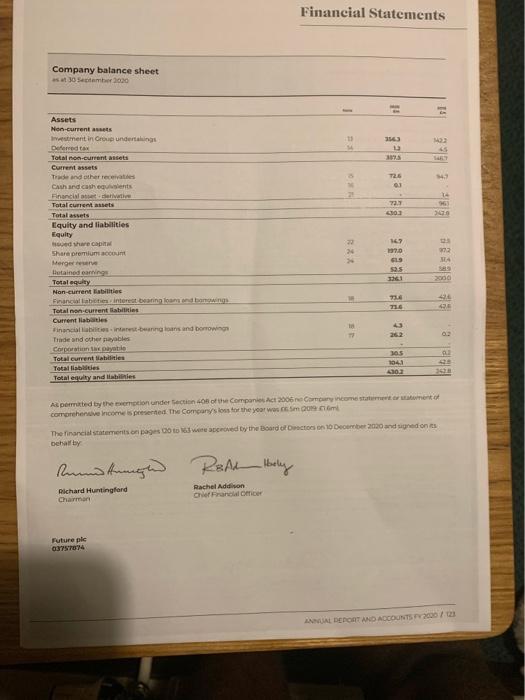

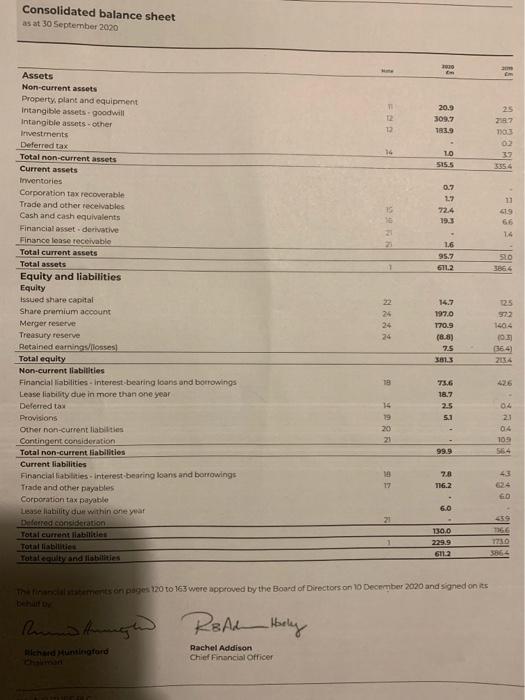

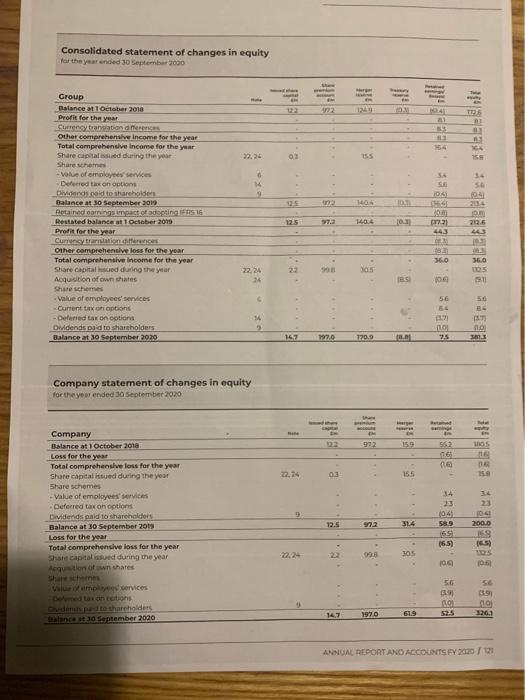

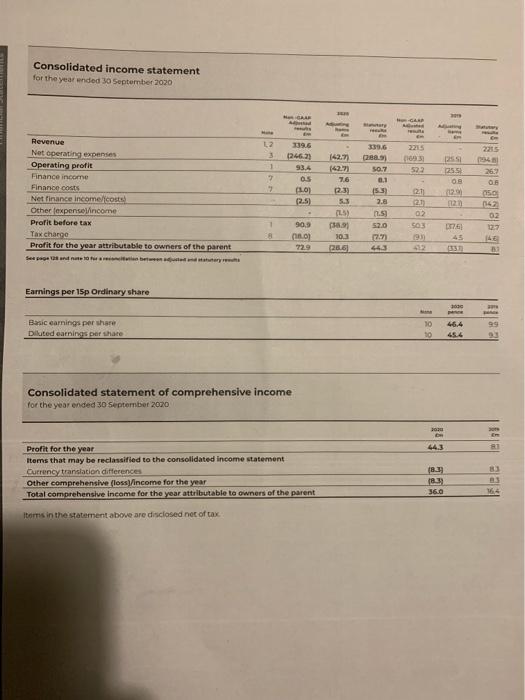

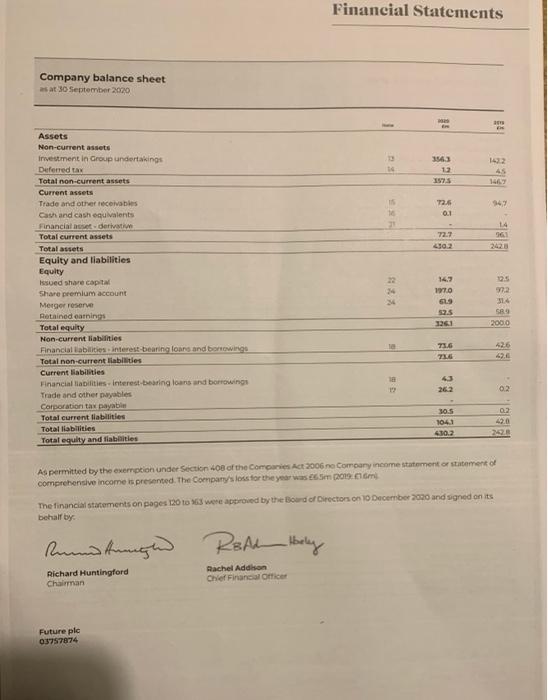

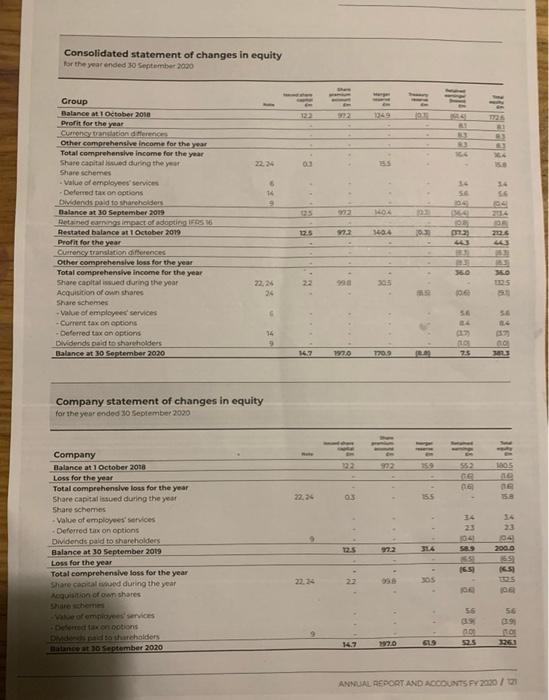

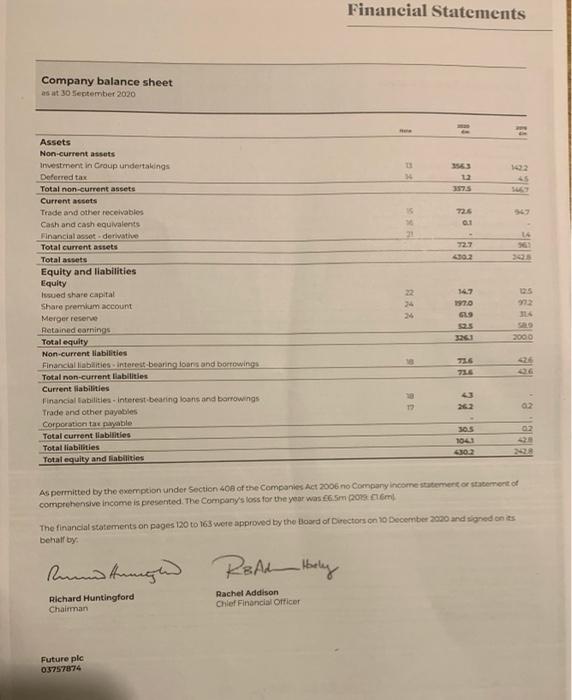

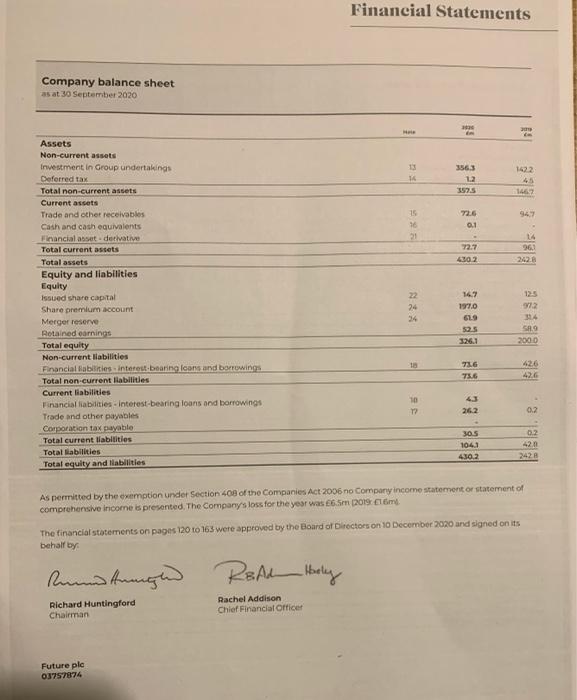

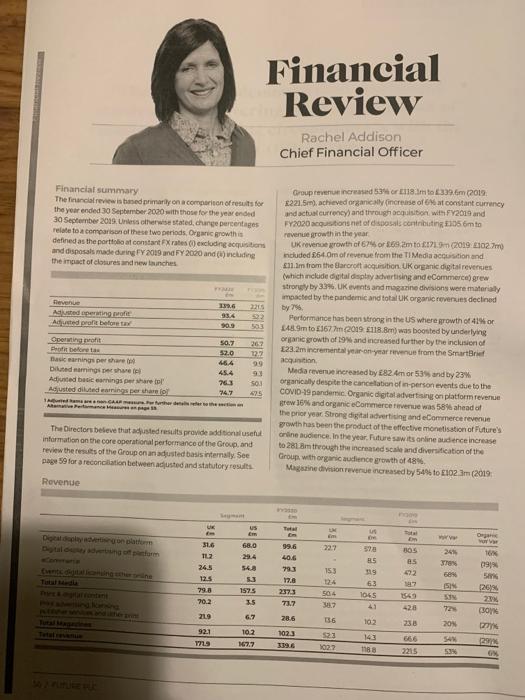

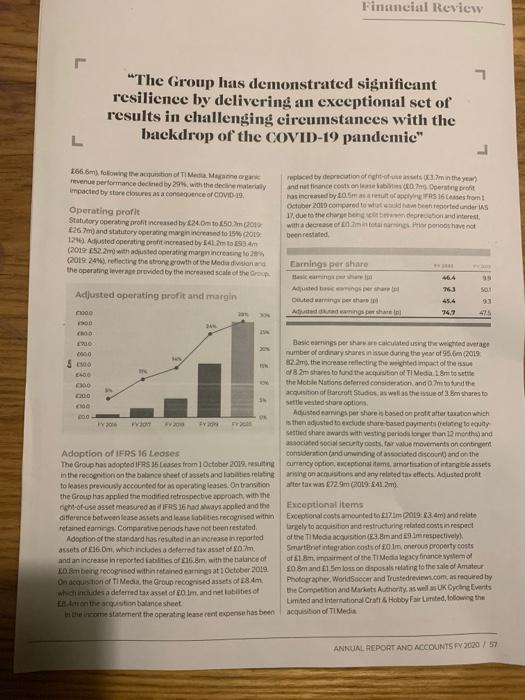

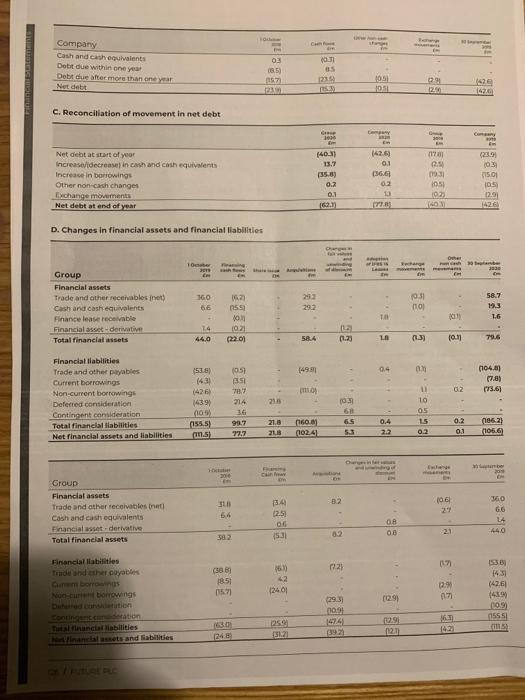

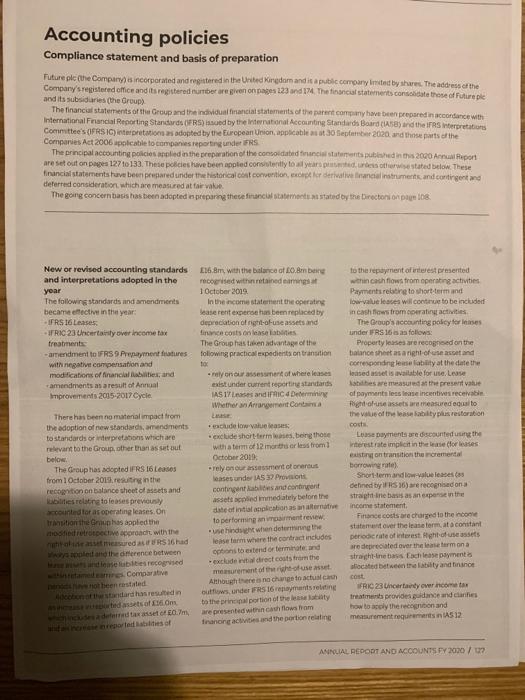

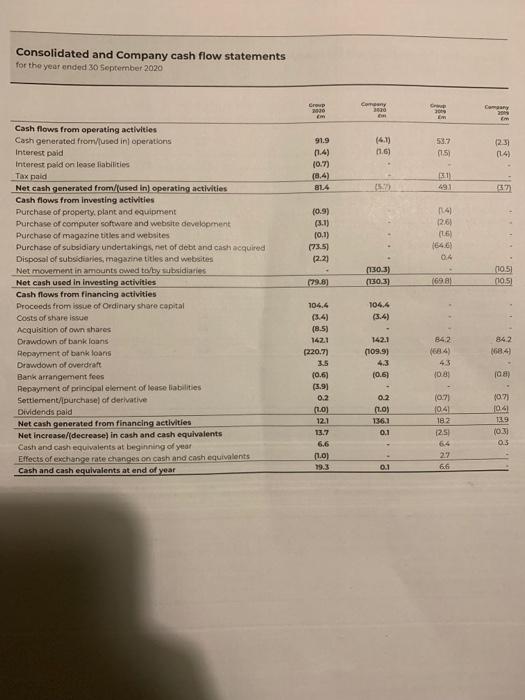

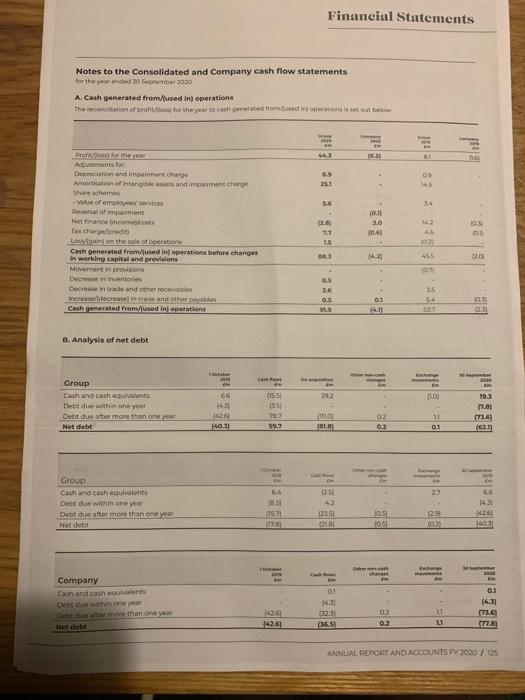

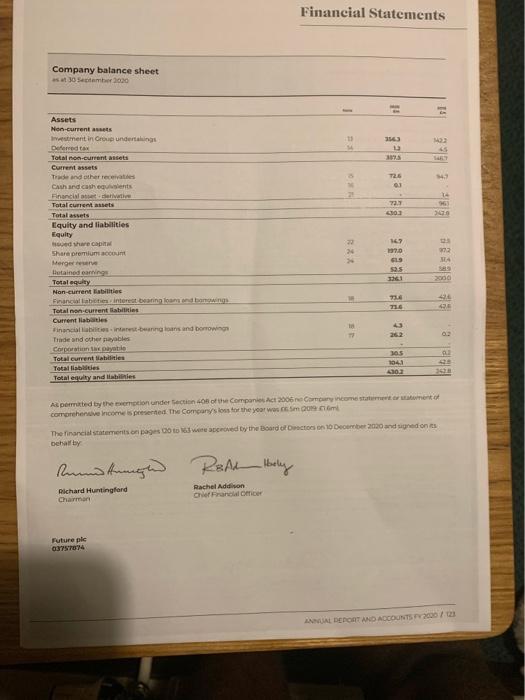

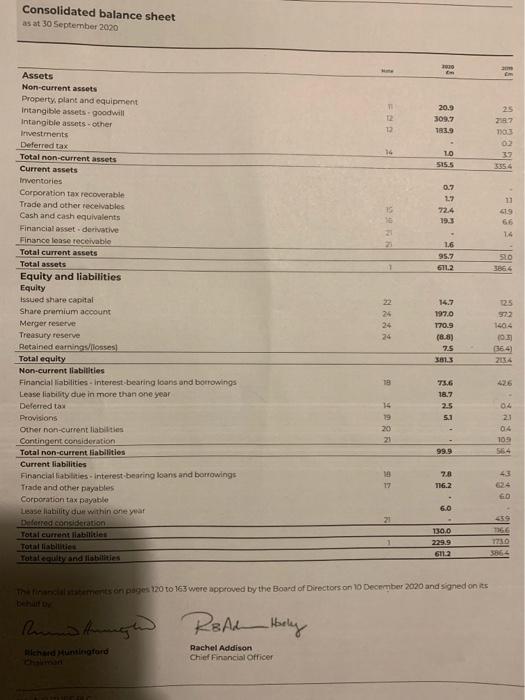

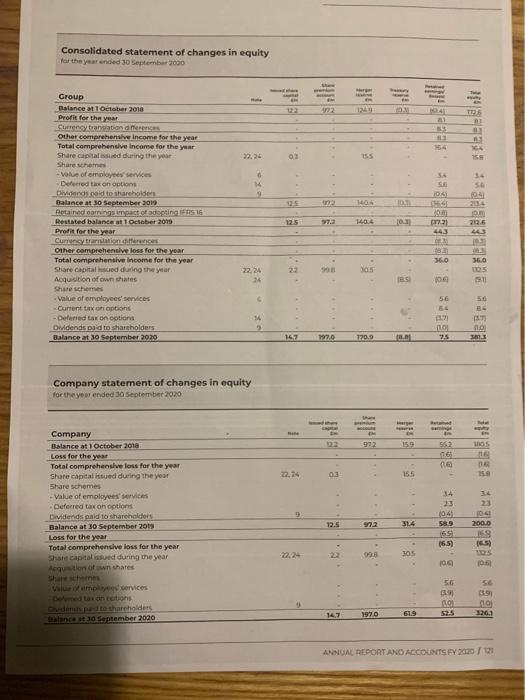

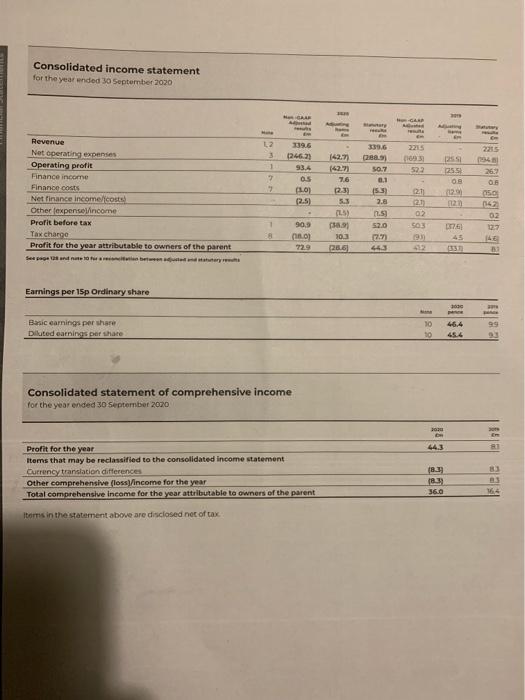

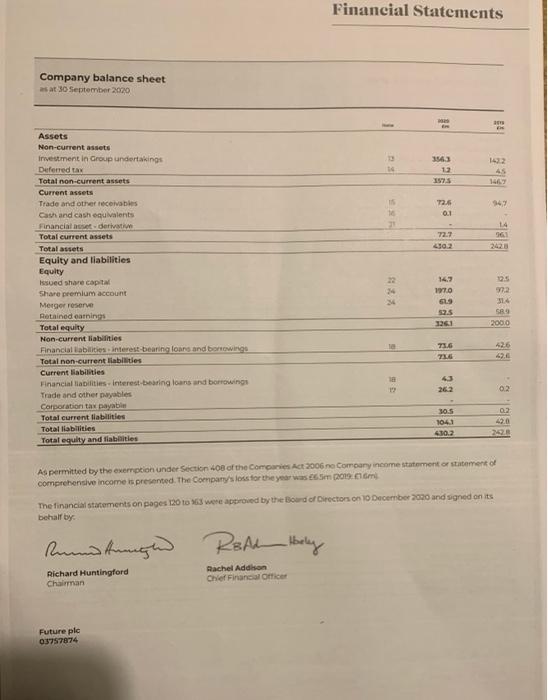

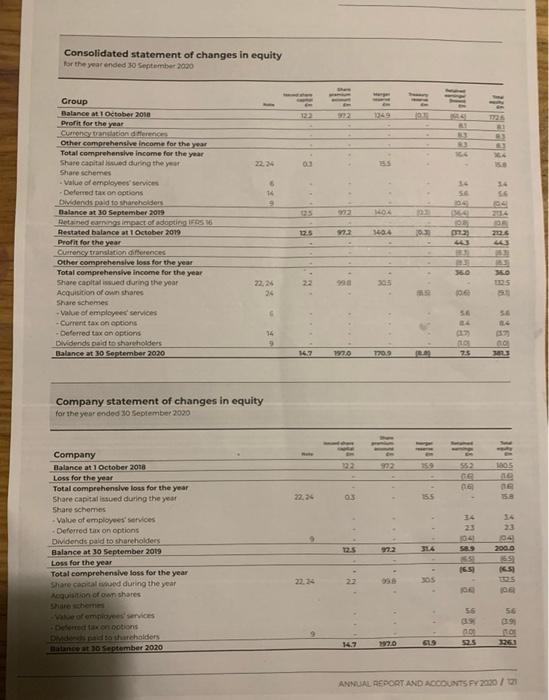

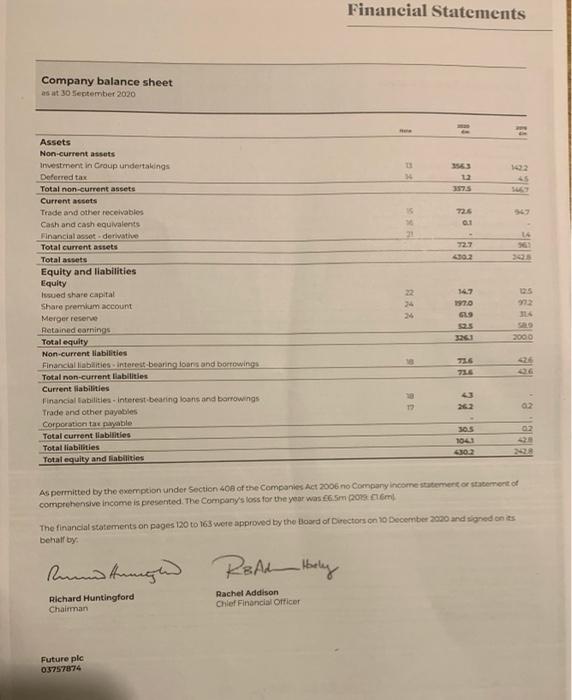

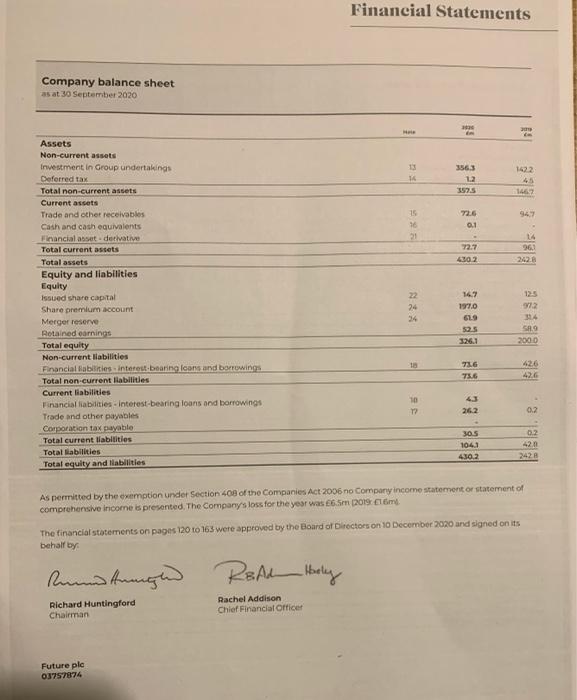

Financial Review Rachel Addison Chief Financial Officer Financial summary The financial review is based primarily on a comparison of results for the year ended 30 September 2020 with those for the year ended 30 September 2013. Unless otherwise stated, change percentages relate to comparison of these two periods. Organic growth is defined as the portfolio of constantFXrates (excluding action and disposals made during FY 2019 and FY2020 and including the impact of closures and new lunches thene Aperating of Adjusted profit before tay 139.6 93.6 2215 12 503 Group revenue increased 534 or 113 m 329.6m (2019 22215mm), achieved organically increase of a constant currency and actual currency and throughoulition with FY2019 and FY2020 acquisitions net of discosas contributing 1056m to revenue growth in the year UK revenue growth of 67rm1129 (2019 102.7m) included 564 Om of revenue from the TI Media acquisition and 11.im from the Barcroft acquisition UK organe digital revenues (which include digital display advertising and eCommerce grew strony by 3:34. UK events and magazine divisions were materiay impacted by the pandemic and total UK organic revenues declined by 9, Performance has been strong in the US where growth of 41% or 1489m 1677 (2019 118.8m) was boosted by underlying organic growth of 19 and increased further by the inclusion of 223.2m incrementalya-on-year revenue from the SmartBef action Media revenue increased by E82 Amor 53 and by 23% organically despite the cancellation of in-person events due to the COVID-19 pandemic. Organic digital advertising on platform revenue Brew 16% and organic eCommercevere was 58% ahead of the prior year Strong digital advertising and eCommerce revenue growth has been the product of the effective monetisation of Future's online hodience. In the year. Future saw its online audience increase to 28 though the increased scale and diversification of the Group, with organic audience growth of 48% Magazine division revenue increased by 54% to 1023m (2019 262 19.2 99 Speriat 50.7 before 52.0 Basic rings per there 46.4 Daringse share 45.4 Adebat earnings petshare o Adjusted dilunderings per shareler 94.7 1 ms here AR 763 503 25 The Directors believe that adjusted results provide additionaluset information on the core operational performance of the Group, and review the results of the Group on an austed basis internaty See page 59 for a reconciliation between adjusted and statutory results Revenue UK US Em UN Dially to 23.7 24 316 TLZ 24.5 1225 793 70.2 68.0 29.4 5408 53 1575 35 99.6 40.6 79.3 17.8 2173 73.7 BOS es 472 153 12 504 17 590 85 119 63 1045 41 ses 15 TOX 091 50% 2014 27 (BON IN 1549 428 72 219 6.7 28.6 136 102 20 92.1 521 102 167.7 1023 319 027 143 1188 SAN 57 29 ON 2215 Financial Review "The Group has demonstrated significant resilience by delivering an exceptional set of results in challenging circumstances with the backdrop of the COVID-19 pandemic" L 1666m), following the son of Media Mark revenue performance dened by 29 with the decine material impacted by store closures as a consequence of COVID-29. Operating profit Statutory operating profit increased by 240 to 150.mx 1267m) and statutory parang margineato 15 20 121) Ajusted operating profit increased by 4to.Am (2019 52.2m with adjusted operating pincreasin 2019 24), reflecting the strong wrowth of the Mediation and the operating leverage vided by the increased scale of the Group replaced by deprecation of his min the year) and not finance controles 7 ertert has increased by out of a 16 anses from October 2010 compared to weareported under 17. due to the chorendon and interest with a decrease of minorir penshavent been restate Earnings per share Adjusted operating profit and margin Aed Duterning the A wingspersen 73 45.4 99 SO 31 435 000 74,7 20 C00 Basic earnings per saluted used avatage 0000 number of ordinary sharesnis during the year of 95.6m (2019 5 g 82.2m the increase reflecting the weighted impact of the issue 082 sure to fund the acquisition of TI Media 18mto strie 60 the Mobile Nations deferred consideration and to and the 100 sition of Barcroft Studios, as well as the issue of 3.8m tharesto COG settlevested shore options 000 Adjustamines per shore is based on profitate taxation which 20 Fon 200 FY 2 then adjusted to exclude share-based payments into ty Setted share awards with vesting periodsonger than 12 months and sted social security costs, ar value movements on contingen Adoption of IFRS 16 Leoses consideration and unwinding of associated discount and on the The Group has adopted IFRS 15eases from 1 October 2019 resulting currency option caption items, amortization of intangible assets in the recognition on the balance sheet of sand labs relating ring on actions and any related the effects, dusted profit to leases previousy accounted for at operating leases. On transition after tax was 72.9m (2019 1.2m the Group has applied the modified retrospective approach with the right-of-use asset measured and IFRS 16 had ways applied and the Exceptional items difference between lease assets andelables recognised within Exceptional costs mounted tozim (2019-3.4m) and relate retained earings Comparative periods have not been restated largely to couisition and restructuring related costsin respect Adoption of the standard has resulted in an increase is reported of the Mediation (3.8mandimiectively) assets of 16.0m, which includes a deferred tax asset of om Surrointegration costs of om ontrous property costs and an increase in reported isbilities of 16.8m with the balance of of Elm, meet the T Media cyfrancese being recognised within toined camngat 1 October 2010 108mand Elmsson disposals relating to the sale of Amateur On acquisition of Ti Media, the Group recognised assets of 8.4m, Photographer, WorldSoccer and Trustedreview.com, as equired by which des a deferred tax asset of Elmandelblities of the Competition and Markets Authority as well UK Cycling Events ta on the act balance sheet Limited and international Craft Hobbywed tow the the income statement the operating lease rent expense has been acquisition of TI Media ANNUAL REPORT AND ACCOUNTS FV 302057 Company Cash and cathequivalents Debit due within one year Dette er more than one year Net det 0.31 03 18.53 22 1091 1051 21 1292 120 26 1420 C. Reconciliation of movement in net debt Com 1173 09 Net debt at start of your Increase idecrease in cash and cash equivalent Increase in borowings Other non-cash changes Exchange moments Net debt at end of year 93 (403 13.7 135.8) 0.2 0.1 162.1 142.69 0.1 136.6 02 123.91 (03 15.01 105 12.9 1426 102 D. Changes in financial assets and financial liabilities w La Group Financial assets Trade and other receivables int) Cash and cash equivalents Finance lease receivable Financial asset derivative Total financial assets 160 66 23 29.2 05 58.7 19.3 16 T 55 10 021 (22.01 14 44.0 58.4 (1.30 LA (1.3) 10.11 796 149. 04 0 1104. (7.8) (13.6) 02 Financial liabilities Trade and other payables Current borrowings Non-current borrowings Deferred consideration Contingent consideration Total financial liabilities Net financial assets and liabilities . 15161 143 (426) 1439 (109) (155.5) s) 051 15 78.7 214 16 93.7 92.7 23 10 103 61 65 Gle. 0.4 21.8 28 160.01 10241 0.2 0.1 (1962) (105.6 0.2 Dan 30 B2 Group Financial assets Trade and other receivables et Cash and cash equivalents Financial asset derivative Total financial assets 106 27 64 34 12.50 OG 1531 30 G6 14 440 OB OB 2.1 32 382 012 Financial abilities Trade in the puyat Gumem borrowings Noborowings (38 85 1571 161) 2 (2401 02.9 07 (2.91 1530 1431 (426) 419 009 1555 (15) 293) 00 2.9 25 3121 B. Talinancial abilities inanses and abilities 24 (392) Accounting policies Compliance statement and basis of preparation Future plc (the Companies incorporated and registered in the United Kingdom and is a public company intet by share. The address of the Company's registered office and its registered number are given on page 123 ond IM The financial statements consolidate those of future pe and its subsidiaries (the Group) The financial statements of the Group and the individual financial statements of the parent company have been prepared in accordance with International Financial Reporting Standards (IFRS)od by the international Accounting Standards Board (sa) and the interpretations Committees ORSIC) interpretations adopted by the European Union, applicable to fetumbar 2020, and those parts of the Companies Act 2006 applicable to companies reporting under FRS The principal accounting policies anledin the preparation of the consolidated financial statements published in this 2000 Anul port are set out on pages 127 to 133. These policies have been applied constantly folytas prestated below. These financial statements have been prepared under the historical cont convention, le derivative financial instruments and contingent and deferred consideration, which are measured at far vale The going concern basis has been adopted es preparing these financial statement stated by the Directorion page is New or revised accounting standards 16.8m with the balance of 0.8mbre and interpretations adopted in the recognised within retained year 1 October 2013 The following standards and amendments In the income statement the operating became elective in the year Jease rent expense has been replaced by IFRS 16 Leases: depreciation of right-of-use assets and TRIC 23 Uncertainty over income tax ice costs on seats treatments The Group has taken advantage of the -amendment to FRS 9 Prepayment features following practical expedients on transition with negative compensation and tox modifications of financial and - rely on our assessment of where leases amendments as a result of Annual exist under current reporting standards Improvements 2015-2017 Cycle IASI Lases and indetermine Whether in Arrangement Contra There has been no material impact from the adoption of new standards, amendments oudew Values to standards orderpretations which are exclude short-term being those relevant to the Group, other than as set out with term of 12 month or less from below October 2013 The Group has adopted IFRS 16 Leases * rely on our assessment of onerus from 1 October 2015. resting in the lases under IAS 39 Provision rection on balance sheet of assets and contingents and content bities relating to leases previously assets immediately before the counted for at operating leases. On date in conas anternative transition the rup has applied the to performing animant review morte pract with the use hindright when doing the mesured 16 had lease farm where the contract includes and the diference between option to extend or terminate and naselbites recognised excluide wirect costs from the de Comparative mesurement of the house not been stated Although there is no chance to actual contandard hasrestedin outflows, onder FRS16 repayments relating ed assets of 16 am to the proportion of the best da determ are presented within a foram inancing activities and the portion relating to the repayment of interest presented within cash flows from operating activities Paymentseting to short-term and low-valueleases will continue to be includert in cash flows from coating activities The Group's accounting policy for inses under FRS 16 s as follows: Property leases are recognised on the balance sheet as right festand corresponding lease alty at the date the leased seis vitable for use Lease bies are measured at the presentatie of payments les trase incentives receivable Poghouse assets are measured gasto the value of the lease ability plus restoration cost Lease payments are discounted using the terest rate implicitin the leases estion transition the cremental borrowing rate) Short-term and low value less defined by FRS16) we recogidon strane basis as an expert in the income statement Finance costs are changed to the one statement over the lasa tormata constant periodic rate of interest. Hightof useassets are deprecated over the sermona straight-inets Each ease payments located between the tity and finance co FRI 23 Uncertady ever income tax treatment provides guidance and caries how to cely the recognition and mement requirements IAS 12 ANILIAL REPORT AND ACCOUNTS FY 2020 / 7 Consolidated and Company cash flow statements for the year ended 30 September 2020 crop 90 Carry 1920 30 EM Cry 20 91.9 1.6) 53.7 (15) (2.37 (14) 1.4) 10.7 (8.4) 814 21 491 114 12.61 (0.9) (3.1) 10.1) (735) (2.2) 16 640 04 130.3) (1303) 10.5 110.5 29.8) (698) Cash flows from operating activities Cash generated from/used in operations Interest paid Interest paid on lease fiabilities Tax paid Net cash generated from/used in operating activities Cash flows from investing activities Purchase of property, plant and equipment Purchase of computer software and website development Purchase of magazine titles and websites Purchase of subsidiary undertakings net of debt and cash acquired Disposal of subsidiaries, magazine titles and websites Net movement in amounts owed by subsidiaries Net cash used in investing activities Cash flows from financing activities Proceeds from issue of Ordinary share capital Costs of share issue Acquisition of own shares Drawdown of bank loans Repayment of bank loans Drawdown of overdraft Bank arrangement fees Repayment of principal element of lase liabilities Settlement/ purchase of derivative Dividends paid Net cash generated from financing activities Net Increase/decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Effects of exchange rate changes on cash and cash equivalents Cash and cash equivalents at end of year 104.4 142.1 104,4 (5.4) (8.5) 1421 (220.7) 3.5 (0.6) (5.9) 0.2 842 1684 (109.9) 4.3 (0.6) 842 1684 43 10.81 10.) 10.71 LO 0.2 (10) 136.2 0.1 12.1 13.7 6.6 11.01 19.3 04 182 12.5 64 27 6.6 10.7 06 12.9 (0.33 0.3 0 1 Financial Statements Notes to the Consolidated and Company cash flow statements for the year ended 10 September 2010 A. Cash generated from used in operations The reconciliation of both your to cash generated from onerationele wartout BE ne 6 25.1 15 14 Do the you Adjustments for Deption and impairment change Amortation intangible and impairment charge Share scheme - of employees convices Dewal of impairment Net finance income costs Texchange credit Login on the sale of persons Cash generated from used in operations before changes In working capital and provisions Movement in provisions Decrease in inventore Decin trade and other receivables Increase in and other ables Cash generated from used in operations - 10.11 30 10.3 03 1011 2.7 15 102 455 8803 20 10:21 LS as 26 OS 99 0.1 23 B. Analysis of net debt 202 Group Cash and cash quvons Detit du within one year Det due atter more than one yet Net debt 66 143 (155 025 77 59.7 11:03 - 11 0.1 193 67.8) 171.9 (623 40. ala - 25 27 Group Caith and cath equivalents Det due within one year Debt due after more than one year Net det 64 15 157 20 66 14.3 142.00 140 205 951 291 1023 110 EN Company cash and cash equivalents Det de within one year Did than one year et deb 01 1433 2211 36,51 0.3 1431 23.6 14264 142.6 02 02 1 L1 ANNUAL REPORT AND ACCOUNTS FY 2020 / Financial Statements Company balance sheet 30 September 1 11 DI 3 23 SARY 726 14 os 370 Assets Non-current Investment in Grou undertakings Deferred to Total non-current assets Current assets Trade and other receives Cash and cathesents Financiare Total current assets Total assets Equity and liabilities Equity ted vere cap Shar premium account Morge Betained caring Total equity Non-current abilities Financial interest bearing ang Total noncurrenties Current labas Financiering and borrow Trade and other payables Corporation that Total current abilities Totales Total equity and lines RA 17 199.0 02 25 SD 2000 TU 42 THE E 17 as 1041 430 lellele A permitted by the emotion under section of the Companies Act 2006 e come statement comprehensive income is presented the Company's oss for the year west 20 cm The financial statements on pages to recoved to the Board of Directors on 10 December 2000 and signed on its behalf by Rund kange REAN Read Ibely Richard Huntingford Chairman Rachel Addison Chanca Cicer Future plc 03757074 ANUAL DEPOSIT AND ACCOUNTS F2000/23 Consolidated balance sheet as at 30 September 2020 2000 12 20.9 309.2 183.9 13 25 287 103 02 37 5554 14 10 $15.5 0.7 27 72.4 19.3 11 419 66 16 . - SD 1.6 95.7 671.2 520 3864 Assets Non-current assets Property, plant and equipment Intangible assets-goodwill Intangible assets - other Investments Deferred tax Total non-current assets Current assets Erwentories Corporation Tax recoverable Trade and other receivables Cash and cash equivalents Financial asset derivative Finance lense receivable Total current assets Total assets Equity and liabilities Equity Issued share capital Share premium account Merger reserve Treasury reserve Retained earningslosses Total equity Non-current liabilities Financial liabilities. Interest bearing loans and borrowings Lease liability due in more than one year Deferred ta Provisions Other non-current liabilities Contingent consideration Total non-current liabilities Current liabilities Financial liabilitiesInterest-bearing loans and borrowings Trade and other payables Corporation tax payable Lease liability dur within one year Deferred consideration Total current liabilities Total liabilities Tatal equity and liabilities 14.7 1970 22 25 24 24 170.9 125 522 1404 10. (364) 2034 (8.8) 7.5 2013 18 426 75.6 18.7 2.5 5.1 04 15 19 20 2.1 04 105 564 99.9 7.8 116.2 43 4 17 6.0 23 130.0 229.9 612 176 7730 5864 mencatatements on pages 120 to 163 were approved by the Board of Directors on 10 December 2020 and signed on its Rund Anghe Read Hely Dilena d huntingford Rachel Addison Chief Financial Officer Consolidated statement of changes in equity for the year ended 30 September 2000 BA 992 1 23 333 54 22,24 03 155 34 56 SH 104 05 2 140 Group Balance at 1 October 2010 Profit for the year Currency translation der Other comprehensive income for the year Total comprehensive Income for the year Share capitalised during the year Share schemes - Volue of employees services Deferred tax on Options Dends paid to shareholders Balance at 30 September 2012 Retained ongimpact of adopting ESTE Restated balance at 1 October 2015 Profit the year Currency translation des Other comprehensive loss for the year Total comprehensive Income for the year Share Capitale during the year Acquisition of own shares Share schemes Value of employees services Current options -Deferred tax on options Didends paid to shareholders Balance at 30 September 2020 . 125 14024 com 443 43 360 sas 22.24 4 36.0 DS SU 106 56 84 50 BE 9 10 167 1970 120.9 0.01 25 Company statement of changes in equity for the year ended 30 September 2020 972 15.9 552 16 OS 03 155 15 14 9 Company Balance at 1 October 2018 Loss for the year Total comprehensive loss for the year Share capitalisted during the year Share schemes - Value of employees services Deferred tax on options Dividends paid to shareholders Balance at 30 September 2013 Loss for the year Total comprehensive loss for the year Share capitalised during the year Argution of shares Shares Vamp services tantations Det hareholders 30 September 2020 12.5 972 314 104 585 165 (6.5) 200.0 159 165 22.24 2. 305 100 106 399 10 1263 147 1970 619 ANNUAL REPORT AND ACCOUNTS 2002 Consolidated income statement for the year ended 30 September 2020 GAR HAP ty 2215 L2 3 1 1396 (2463) 93.4 142.7 2215 169 522 Revenue Net operating expenses Operating profit Finance income Finance costs Net Finance income cost Other expense income Profit before tax Tax charge Profit for the year attributable to owners of the parent 255 255 08 129 120 339.6 28831 50.7 0.1 153 2.a 1.59 52.0 12.07 43 (10) (2.5) 26.2 OB 150 76 12:39 5.3 (25) 5891 0.3 28.6 lelo sledi 211 2.1 02 503 193) 909 02 27 SE 45 13 22.9 Earnings per 15p Ordinary share 300 99 Basic earnings per share Diluted earnings por share 10 10 46.4 45.4 Consolidated statement of comprehensive income for the year ended 30 September 2020 3000 ON 443 Profit for the year Items that may be reclassified to the consolidated Income statement Currency translation differences Other comprehensive (loss]/income for the year Total comprehensive Income for the year attributable to owners of the parent lelelelor 8.39 36.0 itors in the statement above are disclosed net of tax Financial Statements Company balance sheet at 30 September 2020 3543 12 1575 45 947 72.6 0.1 72.7 14 36 Assets Non-current assets investment in Group undertakings Deferred tax Total non-current assets Current assets Trade and other receivables Cash and cash equivalents Financial se derivati Total current assets Total assets Equity and liabilities Equity Issued share capital Share premium account Merger reserve Retained earnings Total equity Non-current liabilities Financial abilities interest-bearing loans and boring Total non current liabilities Current abilities Financial abilities interest-bearing loans and borrowings Trade and other payables Corporation tax payable Total current liabilities Total liabilities Totaleguilty and liabilities 14.3 1970 24 34 2.5 972 314 589 2000 1261 Te 71.6 7 47.0 0.2 30.5 10431 4302 2420 As permitted by the exertion under Section 108 of the Companies Act 2006 no Coroary income statement or statement of comprehensive income is presented. The company's oss for the year was 65mon. The financial statements on pages 120 to 3 were aperoved by the Board of Director on 10 December 2000 and signed on its behalf by Rundhaugh Read Hely Richard Huntingford Chairman Rachel Addison Chief Financial Officer Future plc 03757874 Consolidated statement of changes in equity for the year ended 30 September 2000 oll 22 1049 16 22. ...e 14 14 1404 . Group Balance 1 October 2018 Profit for the year Currency translation derece Other comprehensive Income for the year Total comprehensive income for the year Share capital issued during the year Share schemes Value of employees' services Deferred taxon options Didends paid to shareholders Balance at 30 September 2009 Detained earnings impact of adopting IFRS 16 Restated balance at 1 October 2019 Profit for the year Currency translation differences Other comprehensive loss for the year Total comprehensive income for the year Share capitalised during the year Acquisition of owin shares Share schemes Value of employees' services -Current taxon options -Deferred tax on options Dividends said to shareholders Balance at 30 September 2010 des er steed 125 wa 1404 00 25 55.0 22 305 22:26 24 10 56 14 3 LO 75 14,7 w 1709 Company statement of changes in equity for the year ended 30 September 2020 22 259 1805 le RE 22.24 OS 155 Company Balance at 1 October 2018 Loss for the year Total comprehensive loss for the year Share capital issued during the year Share schemes Value of employees services Deferred tax on options Dividends paid to shareholders Balance at 30 September 2019 Loss for the year Total comprehensive loss for the year Share capital and during the year Acquin of own shares 23 23 * 589 200.0 65 16 1659 8. 56 56 93 femios Services on notions Didata that holders Batano September 2010 14.7 615 525 ANNUAL REPORT AND ACCOUNTS FY2000 / Financial Statements Company balance sheet ast 30 September 2020 14 1422 3575 SU 725 1 LA 727 Assets Non-current assets Investment in Group undertakings Deferred tax Total non-current assets Current assets Trade and other receivables Cash and cash equivalents Financial asset derivative Total current assets Total assets Equity and liabilities Equity Issued share capital Share premium account Merger reserve Retained earnings Total equity Non-current liabilities Financiallibilities interest-bearing loans and borrowings Total non-current liabilities Current liabilities Financial abilities. Interest-bearing loans and borrowings Trade and other payables Corporation table Total current liabilities Total liabilities Total equity and abilities 147 17.0 9 05 992 14 2 320 2000 LE 17 SOS 18 lele 02 N As permitted by the exemption under Section 40 of the Companies Act 2006 no company income statement or statement of comprehensive income is presented. The Company's loss for the year was 6 Sm 2018 m The financial statements on pages 120 to 163 wete approved by the Board of Directors on December 2000 and signed on its behalf by Raum Hampton Road Holy Richard Huntingford Chairman Rachel Addison Chlef Financial Officer Future plc 03757874 Financial Statements Company balance sheet as at 30 September 2020 30 13 1 1422 3563 12 3525 142 96 15 16 21 7226 0.1 . 72.7 4302 14 96.1 2020 Assets Non-current assets Investment in Group undertakings Deferred tax Total non-current assets Current assets Trade and other receivables Cash and cash equivalents Financial asset delvative Total current assets Total assets Equity and liabilities Equity Issued share capital Share premium account Merger reserve Retained earnings Total equity Non-current liabilities Financial abilities interest bearing loans and borrowings Total non-current liabilities Current liabilities Financial liabidities - Interest-bearing loans and borrowings Trade and other payables Corporation tax payable Total current liabilities Total liabilities Total equity and liabilities 24 34 147 197.0 629 5225 126.1 972 314 589 2000 736 75.6 42.6 10 Y? 43 262 0.2 02 3015 1043 430.2 2428 As permitted by the exemption under Section 408 of the Companies Act 2006 no Company income statement or statement of comprehensive income is presented. The Company's loss for the year was 65m 2019 Elem The financial statements on pages 120 to 163 were approved by the Board of Directors on 10 December 2020 and signed on its behalf by und Haughed Read Hely Richard Huntingford Chairman Rachel Addison Chief Financial Officer Future plc 03757874 Financial Review Rachel Addison Chief Financial Officer Financial summary The financial review is based primarily on a comparison of results for the year ended 30 September 2020 with those for the year ended 30 September 2013. Unless otherwise stated, change percentages relate to comparison of these two periods. Organic growth is defined as the portfolio of constantFXrates (excluding action and disposals made during FY 2019 and FY2020 and including the impact of closures and new lunches thene Aperating of Adjusted profit before tay 139.6 93.6 2215 12 503 Group revenue increased 534 or 113 m 329.6m (2019 22215mm), achieved organically increase of a constant currency and actual currency and throughoulition with FY2019 and FY2020 acquisitions net of discosas contributing 1056m to revenue growth in the year UK revenue growth of 67rm1129 (2019 102.7m) included 564 Om of revenue from the TI Media acquisition and 11.im from the Barcroft acquisition UK organe digital revenues (which include digital display advertising and eCommerce grew strony by 3:34. UK events and magazine divisions were materiay impacted by the pandemic and total UK organic revenues declined by 9, Performance has been strong in the US where growth of 41% or 1489m 1677 (2019 118.8m) was boosted by underlying organic growth of 19 and increased further by the inclusion of 223.2m incrementalya-on-year revenue from the SmartBef action Media revenue increased by E82 Amor 53 and by 23% organically despite the cancellation of in-person events due to the COVID-19 pandemic. Organic digital advertising on platform revenue Brew 16% and organic eCommercevere was 58% ahead of the prior year Strong digital advertising and eCommerce revenue growth has been the product of the effective monetisation of Future's online hodience. In the year. Future saw its online audience increase to 28 though the increased scale and diversification of the Group, with organic audience growth of 48% Magazine division revenue increased by 54% to 1023m (2019 262 19.2 99 Speriat 50.7 before 52.0 Basic rings per there 46.4 Daringse share 45.4 Adebat earnings petshare o Adjusted dilunderings per shareler 94.7 1 ms here AR 763 503 25 The Directors believe that adjusted results provide additionaluset information on the core operational performance of the Group, and review the results of the Group on an austed basis internaty See page 59 for a reconciliation between adjusted and statutory results Revenue UK US Em UN Dially to 23.7 24 316 TLZ 24.5 1225 793 70.2 68.0 29.4 5408 53 1575 35 99.6 40.6 79.3 17.8 2173 73.7 BOS es 472 153 12 504 17 590 85 119 63 1045 41 ses 15 TOX 091 50% 2014 27 (BON IN 1549 428 72 219 6.7 28.6 136 102 20 92.1 521 102 167.7 1023 319 027 143 1188 SAN 57 29 ON 2215 Financial Review "The Group has demonstrated significant resilience by delivering an exceptional set of results in challenging circumstances with the backdrop of the COVID-19 pandemic" L 1666m), following the son of Media Mark revenue performance dened by 29 with the decine material impacted by store closures as a consequence of COVID-29. Operating profit Statutory operating profit increased by 240 to 150.mx 1267m) and statutory parang margineato 15 20 121) Ajusted operating profit increased by 4to.Am (2019 52.2m with adjusted operating pincreasin 2019 24), reflecting the strong wrowth of the Mediation and the operating leverage vided by the increased scale of the Group replaced by deprecation of his min the year) and not finance controles 7 ertert has increased by out of a 16 anses from October 2010 compared to weareported under 17. due to the chorendon and interest with a decrease of minorir penshavent been restate Earnings per share Adjusted operating profit and margin Aed Duterning the A wingspersen 73 45.4 99 SO 31 435 000 74,7 20 C00 Basic earnings per saluted used avatage 0000 number of ordinary sharesnis during the year of 95.6m (2019 5 g 82.2m the increase reflecting the weighted impact of the issue 082 sure to fund the acquisition of TI Media 18mto strie 60 the Mobile Nations deferred consideration and to and the 100 sition of Barcroft Studios, as well as the issue of 3.8m tharesto COG settlevested shore options 000 Adjustamines per shore is based on profitate taxation which 20 Fon 200 FY 2 then adjusted to exclude share-based payments into ty Setted share awards with vesting periodsonger than 12 months and sted social security costs, ar value movements on contingen Adoption of IFRS 16 Leoses consideration and unwinding of associated discount and on the The Group has adopted IFRS 15eases from 1 October 2019 resulting currency option caption items, amortization of intangible assets in the recognition on the balance sheet of sand labs relating ring on actions and any related the effects, dusted profit to leases previousy accounted for at operating leases. On transition after tax was 72.9m (2019 1.2m the Group has applied the modified retrospective approach with the right-of-use asset measured and IFRS 16 had ways applied and the Exceptional items difference between lease assets andelables recognised within Exceptional costs mounted tozim (2019-3.4m) and relate retained earings Comparative periods have not been restated largely to couisition and restructuring related costsin respect Adoption of the standard has resulted in an increase is reported of the Mediation (3.8mandimiectively) assets of 16.0m, which includes a deferred tax asset of om Surrointegration costs of om ontrous property costs and an increase in reported isbilities of 16.8m with the balance of of Elm, meet the T Media cyfrancese being recognised within toined camngat 1 October 2010 108mand Elmsson disposals relating to the sale of Amateur On acquisition of Ti Media, the Group recognised assets of 8.4m, Photographer, WorldSoccer and Trustedreview.com, as equired by which des a deferred tax asset of Elmandelblities of the Competition and Markets Authority as well UK Cycling Events ta on the act balance sheet Limited and international Craft Hobbywed tow the the income statement the operating lease rent expense has been acquisition of TI Media ANNUAL REPORT AND ACCOUNTS FV 302057 Company Cash and cathequivalents Debit due within one year Dette er more than one year Net det 0.31 03 18.53 22 1091 1051 21 1292 120 26 1420 C. Reconciliation of movement in net debt Com 1173 09 Net debt at start of your Increase idecrease in cash and cash equivalent Increase in borowings Other non-cash changes Exchange moments Net debt at end of year 93 (403 13.7 135.8) 0.2 0.1 162.1 142.69 0.1 136.6 02 123.91 (03 15.01 105 12.9 1426 102 D. Changes in financial assets and financial liabilities w La Group Financial assets Trade and other receivables int) Cash and cash equivalents Finance lease receivable Financial asset derivative Total financial assets 160 66 23 29.2 05 58.7 19.3 16 T 55 10 021 (22.01 14 44.0 58.4 (1.30 LA (1.3) 10.11 796 149. 04 0 1104. (7.8) (13.6) 02 Financial liabilities Trade and other payables Current borrowings Non-current borrowings Deferred consideration Contingent consideration Total financial liabilities Net financial assets and liabilities . 15161 143 (426) 1439 (109) (155.5) s) 051 15 78.7 214 16 93.7 92.7 23 10 103 61 65 Gle. 0.4 21.8 28 160.01 10241 0.2 0.1 (1962) (105.6 0.2 Dan 30 B2 Group Financial assets Trade and other receivables et Cash and cash equivalents Financial asset derivative Total financial assets 106 27 64 34 12.50 OG 1531 30 G6 14 440 OB OB 2.1 32 382 012 Financial abilities Trade in the puyat Gumem borrowings Noborowings (38 85 1571 161) 2 (2401 02.9 07 (2.91 1530 1431 (426) 419 009 1555 (15) 293) 00 2.9 25 3121 B. Talinancial abilities inanses and abilities 24 (392) Accounting policies Compliance statement and basis of preparation Future plc (the Companies incorporated and registered in the United Kingdom and is a public company intet by share. The address of the Company's registered office and its registered number are given on page 123 ond IM The financial statements consolidate those of future pe and its subsidiaries (the Group) The financial statements of the Group and the individual financial statements of the parent company have been prepared in accordance with International Financial Reporting Standards (IFRS)od by the international Accounting Standards Board (sa) and the interpretations Committees ORSIC) interpretations adopted by the European Union, applicable to fetumbar 2020, and those parts of the Companies Act 2006 applicable to companies reporting under FRS The principal accounting policies anledin the preparation of the consolidated financial statements published in this 2000 Anul port are set out on pages 127 to 133. These policies have been applied constantly folytas prestated below. These financial statements have been prepared under the historical cont convention, le derivative financial instruments and contingent and deferred consideration, which are measured at far vale The going concern basis has been adopted es preparing these financial statement stated by the Directorion page is New or revised accounting standards 16.8m with the balance of 0.8mbre and interpretations adopted in the recognised within retained year 1 October 2013 The following standards and amendments In the income statement the operating became elective in the year Jease rent expense has been replaced by IFRS 16 Leases: depreciation of right-of-use assets and TRIC 23 Uncertainty over income tax ice costs on seats treatments The Group has taken advantage of the -amendment to FRS 9 Prepayment features following practical expedients on transition with negative compensation and tox modifications of financial and - rely on our assessment of where leases amendments as a result of Annual exist under current reporting standards Improvements 2015-2017 Cycle IASI Lases and indetermine Whether in Arrangement Contra There has been no material impact from the adoption of new standards, amendments oudew Values to standards orderpretations which are exclude short-term being those relevant to the Group, other than as set out with term of 12 month or less from below October 2013 The Group has adopted IFRS 16 Leases * rely on our assessment of onerus from 1 October 2015. resting in the lases under IAS 39 Provision rection on balance sheet of assets and contingents and content bities relating to leases previously assets immediately before the counted for at operating leases. On date in conas anternative transition the rup has applied the to performing animant review morte pract with the use hindright when doing the mesured 16 had lease farm where the contract includes and the diference between option to extend or terminate and naselbites recognised excluide wirect costs from the de Comparative mesurement of the house not been stated Although there is no chance to actual contandard hasrestedin outflows, onder FRS16 repayments relating ed assets of 16 am to the proportion of the best da determ are presented within a foram inancing activities and the portion relating to the repayment of interest presented within cash flows from operating activities Paymentseting to short-term and low-valueleases will continue to be includert in cash flows from coating activities The Group's accounting policy for inses under FRS 16 s as follows: Property leases are recognised on the balance sheet as right festand corresponding lease alty at the date the leased seis vitable for use Lease bies are measured at the presentatie of payments les trase incentives receivable Poghouse assets are measured gasto the value of the lease ability plus restoration cost Lease payments are discounted using the terest rate implicitin the leases estion transition the cremental borrowing rate) Short-term and low value less defined by FRS16) we recogidon strane basis as an expert in the income statement Finance costs are changed to the one statement over the lasa tormata constant periodic rate of interest. Hightof useassets are deprecated over the sermona straight-inets Each ease payments located between the tity and finance co FRI 23 Uncertady ever income tax treatment provides guidance and caries how to cely the recognition and mement requirements IAS 12 ANILIAL REPORT AND ACCOUNTS FY 2020 / 7 Consolidated and Company cash flow statements for the year ended 30 September 2020 crop 90 Carry 1920 30 EM Cry 20 91.9 1.6) 53.7 (15) (2.37 (14) 1.4) 10.7 (8.4) 814 21 491 114 12.61 (0.9) (3.1) 10.1) (735) (2.2) 16 640 04 130.3) (1303) 10.5 110.5 29.8) (698) Cash flows from operating activities Cash generated from/used in operations Interest paid Interest paid on lease fiabilities Tax paid Net cash generated from/used in operating activities Cash flows from investing activities Purchase of property, plant and equipment Purchase of computer software and website development Purchase of magazine titles and websites Purchase of subsidiary undertakings net of debt and cash acquired Disposal of subsidiaries, magazine titles and websites Net movement in amounts owed by subsidiaries Net cash used in investing activities Cash flows from financing activities Proceeds from issue of Ordinary share capital Costs of share issue Acquisition of own shares Drawdown of bank loans Repayment of bank loans Drawdown of overdraft Bank arrangement fees Repayment of principal element of lase liabilities Settlement/ purchase of derivative Dividends paid Net cash generated from financing activities Net Increase/decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Effects of exchange rate changes on cash and cash equivalents Cash and cash equivalents at end of year 104.4 142.1 104,4 (5.4) (8.5) 1421 (220.7) 3.5 (0.6) (5.9) 0.2 842 1684 (109.9) 4.3 (0.6) 842 1684 43 10.81 10.) 10.71 LO 0.2 (10) 136.2 0.1 12.1 13.7 6.6 11.01 19.3 04 182 12.5 64 27 6.6 10.7 06 12.9 (0.33 0.3 0 1 Financial Statements Notes to the Consolidated and Company cash flow statements for the year ended 10 September 2010 A. Cash generated from used in operations The reconciliation of both your to cash generated from onerationele wartout BE ne 6 25.1 15 14 Do the you Adjustments for Deption and impairment change Amortation intangible and impairment charge Share scheme - of employees convices Dewal of impairment Net finance income costs Texchange credit Login on the sale of persons Cash generated from used in operations before changes In working capital and provisions Movement in provisions Decrease in inventore Decin trade and other receivables Increase in and other ables Cash generated from used in operations - 10.11 30 10.3 03 1011 2.7 15 102 455 8803 20 10:21 LS as 26 OS 99 0.1 23 B. Analysis of net debt 202 Group Cash and cash quvons Detit du within one year Det due atter more than one yet Net debt 66 143 (155 025 77 59.7 11:03 - 11 0.1 193 67.8) 171.9 (623 40. ala - 25 27 Group Caith and cath equivalents Det due within one year Debt due after more than one year Net det 64 15 157 20 66 14.3 142.00 140 205 951 291 1023 110 EN Company cash and cash equivalents Det de within one year Did than one year et deb 01 1433 2211 36,51 0.3 1431 23.6 14264 142.6 02 02 1 L1 ANNUAL REPORT AND ACCOUNTS FY 2020 / Financial Statements Company balance sheet 30 September 1 11 DI 3 23 SARY 726 14 os 370 Assets Non-current Investment in Grou undertakings Deferred to Total non-current assets Current assets Trade and other receives Cash and cathesents Financiare Total current assets Total assets Equity and liabilities Equity ted vere cap Shar premium account Morge Betained caring Total equity Non-current abilities Financial interest bearing ang Total noncurrenties Current labas Financiering and borrow Trade and other payables Corporation that Total current abilities Totales Total equity and lines RA 17 199.0 02 25 SD 2000 TU 42 THE E 17 as 1041 430 lellele A permitted by the emotion under section of the Companies Act 2006 e come statement comprehensive income is presented the Company's oss for the year west 20 cm The financial statements on pages to recoved to the Board of Directors on 10 December 2000 and signed on its behalf by Rund kange REAN Read Ibely Richard Huntingford Chairman Rachel Addison Chanca Cicer Future plc 03757074 ANUAL DEPOSIT AND ACCOUNTS F2000/23 Consolidated balance sheet as at 30 September 2020 2000 12 20.9 309.2 183.9 13 25 287 103 02 37 5554 14 10 $15.5 0.7 27 72.4 19.3 11 419 66 16 . - SD 1.6 95.7 671.2 520 3864 Assets Non-current assets Property, plant and equipment Intangible assets-goodwill Intangible assets - other Investments Deferred tax Total non-current assets Current assets Erwentories Corporation Tax recoverable Trade and other receivables Cash and cash equivalents Financial asset derivative Finance lense receivable Total current assets Total assets Equity and liabilities Equity Issued share capital Share premium account Merger reserve Treasury reserve Retained earningslosses Total equity Non-current liabilities Financial liabilities. Interest bearing loans and borrowings Lease liability due in more than one year Deferred ta Provisions Other non-current liabilities Contingent consideration Total non-current liabilities Current liabilities Financial liabilitiesInterest-bearing loans and borrowings Trade and other payables Corporation tax p

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started