Answered step by step

Verified Expert Solution

Question

1 Approved Answer

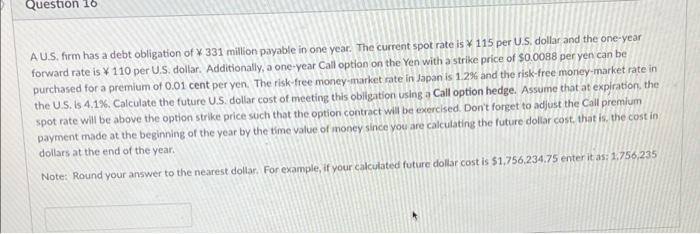

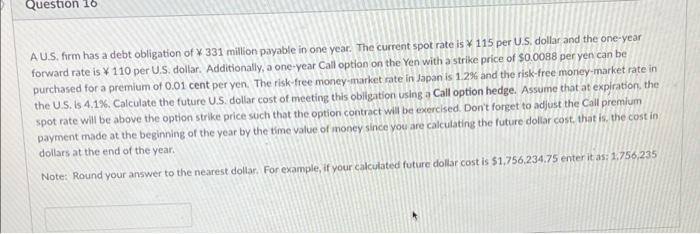

helppppp Question 16 A U.S. firm has a debt obligation of X 331 million payable in one year. The current spot rate is 115 per

helppppp

Question 16 A U.S. firm has a debt obligation of X 331 million payable in one year. The current spot rate is 115 per U.S. dollar and the one-year forward rate is 110 per U.S. dollar. Additionally, a one-year Call option on the Yen with a strike price of $0.0088 per yen can be purchased for a premium of 0.01 cent per yen. The risk-free money-market rate in Japan is 1.2% and the risk-free money-market rate in the U.S. Is 4.1%. Calculate the future U.S. dollar cost of meeting this obligation using a Call option hedge. Assume that at expiration, the spot rate will be above the option strike price such that the option contract will be exercised. Don't forget to adjust the Call premium payment made at the beginning of the year by the time value of money since you are calculating the future dollar cost, that is, the cost in dollars at the end of the year. Note: Round your answer to the nearest dollar. For example, if your calculated future dollar cost is $1,756,234.75 enter it as: 1.756,235

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started