Answered step by step

Verified Expert Solution

Question

1 Approved Answer

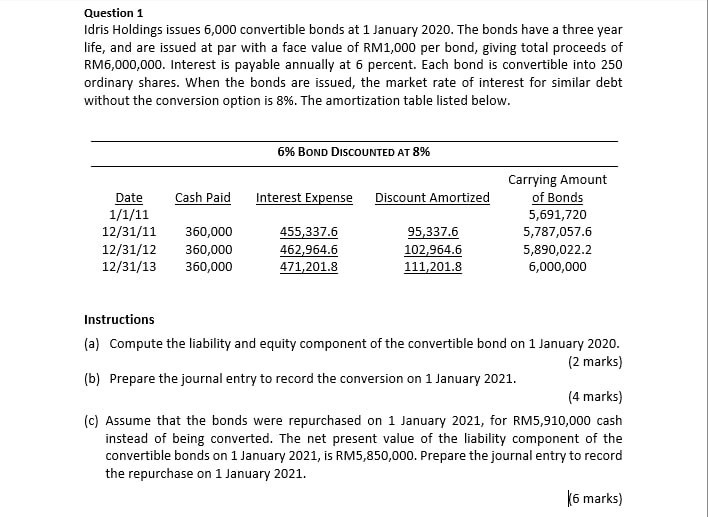

helpQuestion 1 Idris Holdings issues 6 , 0 0 0 convertible bonds at 1 January 2 0 2 0 . The bonds have a three

helpQuestion

Idris Holdings issues convertible bonds at January The bonds have a three year life, and are issued at par with a face value of RM per bond, giving total proceeds of RM Interest is payable annually at percent. Each bond is convertible into ordinary shares. When the bonds are issued, the market rate of interest for similar debt without the conversion option is The amortization table listed below.

table Bond Discounted AT Date Cash Paid Interest Expense Discount Amortized tableCarrying Amountof Bonds

Instructions

a Compute the liability and equity component of the convertible bond on January

marks

b Prepare the journal entry to record the conversion on January

marks

c Assume that the bonds were repurchased on January for RM cash instead of being converted. The net present value of the liability component of the convertible bonds on January is RM Prepare the journal entry to record the repurchase on January

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started