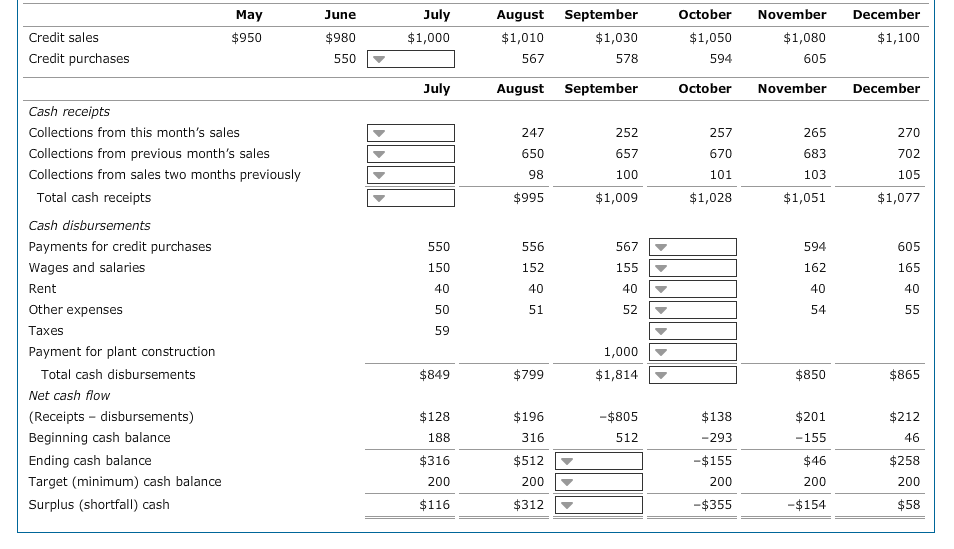

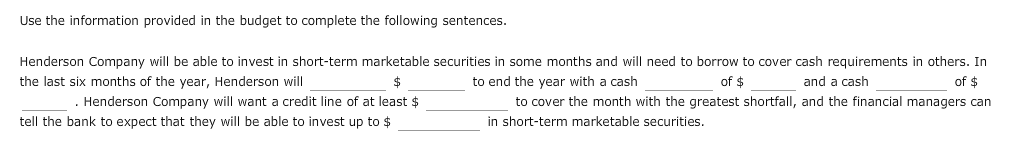

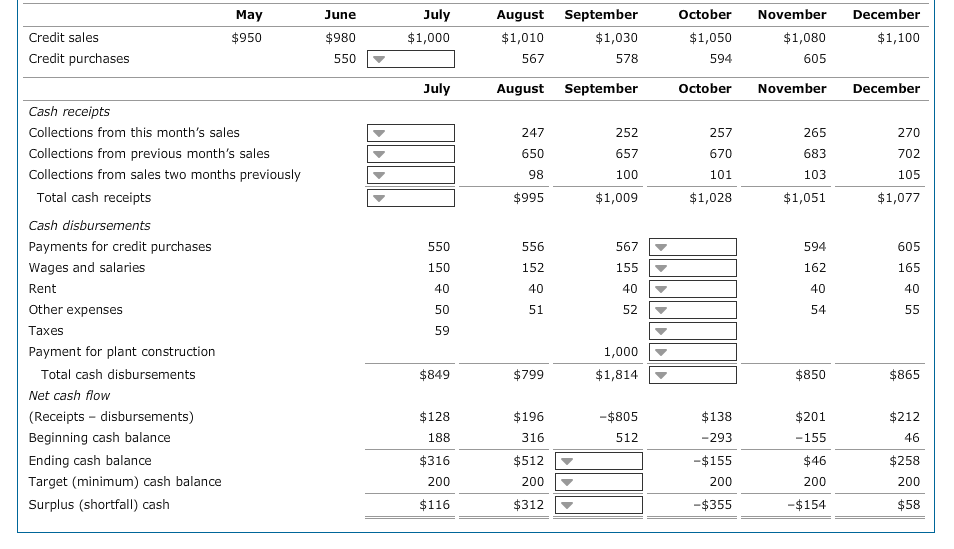

Henderson Company's financial managers are meeting with the company's bank to renew their line of credit and discuss their investment needs. They have prepared the company's operating cash budget for the last six months of the year. The following budget assumptions were used to construct the budget: Henderson's total sales for each month were first calculated in the sales budget and are reflected on the first line of the cash budget. Henderson's sales are made on credit with terms of 2/10, net 30. Henderson's experience is that 25% is collected from customers who take advantage of the discount, 65% is collected in the second month, and the last 10% is collected in the third month after the sale. The budget assumes that there are no bad debts. The cost of materials averages 55% of Henderson's finished product. The purchases are generally made one month in advance of the sale, and Henderson pays its suppliers in 30 days. Accordingly, if July sales are forecasted at $1,100 million, then purchases during June would be $605 ($1,100 million x 0.55), and this amount would be paid in July. Other cash expenses include wages and salaries at 15% of sales, monthly rent of $40 million, and other expenses at 5% of sales. Estimated tax payments of $59 million and $61 million are required to be paid on July 15 and October 15, respectively. In addition, a $1,000 million payment for a new plant must be made in September. Assume that Henderson's targeted cash balance is $200, and the estimated cash on hand on July 1 is $188. May $950 June $980 550 July $1,000 Credit sales Credit purchases August September $1,010 $1,030 567 578 October $1,050 594 November $1,080 605 December $1,100 July August September October November December Cash receipts Collections from this month's sales Collections from previous month's sales Collections from sales two months previously Total cash receipts 247 650 252 657 100 $1,009 257 670 101 $1,028 265 683 103 $1,051 98 270 702 105 $1,077 $995 Cash disbursements Payments for credit purchases Wages and salaries Rent Other expenses Taxes Payment for plant construction Total cash disbursements Net cash flow (Receipts - disbursements) Beginning cash balance Ending cash balance Target (minimum) cash balance Surplus (shortfall) cash 1,000 $1,814 $849 $799 $850 $865 $212 -$805 512 $201 -155 46 $128 188 $316 200 $116 $196 316 $512 200 $312 $138 -293 -$155 200 -$355 $46 200 $258 200 -$154 $58 Use the information provided in the budget to complete the following sentences. of $ Henderson Company will be able to invest in short-term marketable securities in some months and will need to borrow to cover cash requirements in others. In the last six months of the year, Henderson will to end the year with a cash and a cash of $ . Henderson Company will want a credit line of at least $ to cover the month with the greatest shortfall, and the financial managers can tell the bank to expect that they will be able to invest up to $ in short-term marketable securities