Answered step by step

Verified Expert Solution

Question

1 Approved Answer

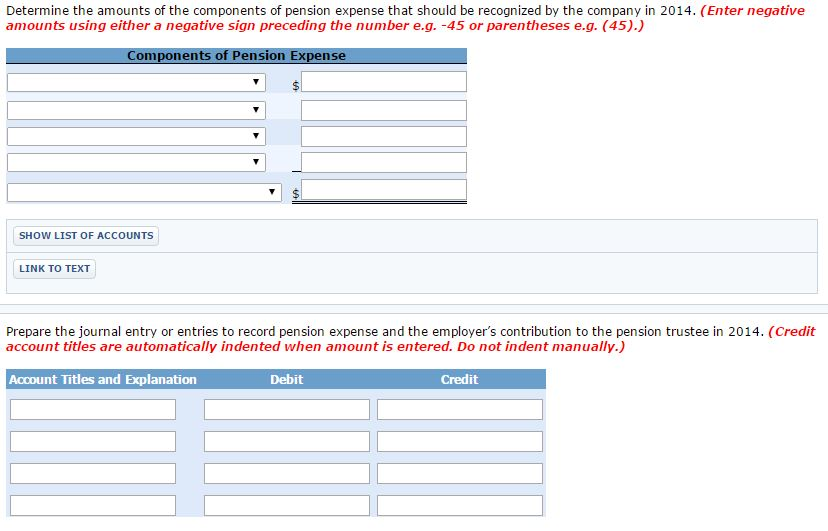

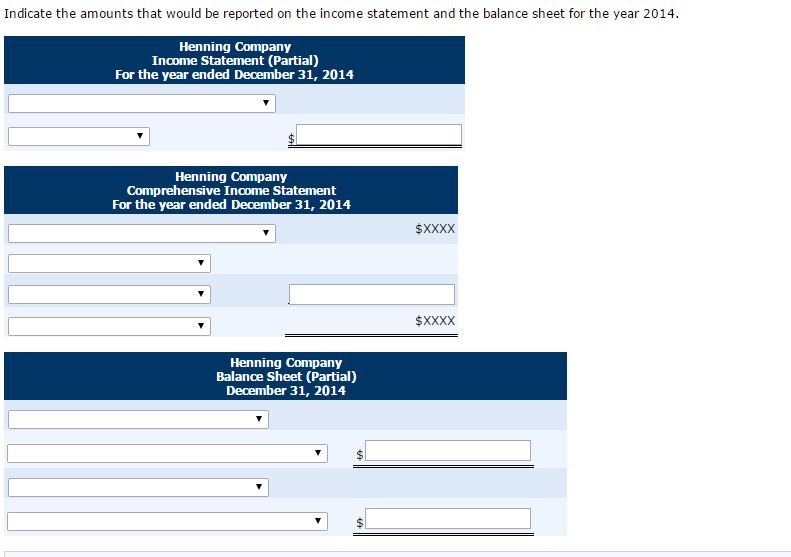

Henning Company sponsors a defined benefit pension plan for its employees. The following data relate to the operation of the plan for the year 2014

Henning Company sponsors a defined benefit pension plan for its employees. The following data relate to the operation of the plan for the year 2014 in which no benefits were paid.

| 1. | The actuarial present value of future benefits earned by employees for services rendered in 2014 amounted to $57,630. | |

| 2. | The companys funding policy requires a contribution to the pension trustee amounting to $147,120 for 2014. | |

| 3. | As of January 1, 2014, the company had a projected benefit obligation of $965,300, an accumulated benefit obligation of $825,550, and a debit balance of $432,040 in accumulated OCI (PSC). The fair value of pension plan assets amounted to $616,990 at the beginning of the year. The actual and expected return on plan assets was $62,000. The settlement rate was 10%. No gains or losses occurred in 2014 and no benefits were paid. | |

| 4. | Amortization of prior service cost was $40,760 in 2014. Amortization of net gain or loss was not required in 2014. |

Thank you!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started