Question

Henredon purchases a high-precision programmable router for shaping furniture components for $190,000. It is expected to last 12 years and have a salvage value of

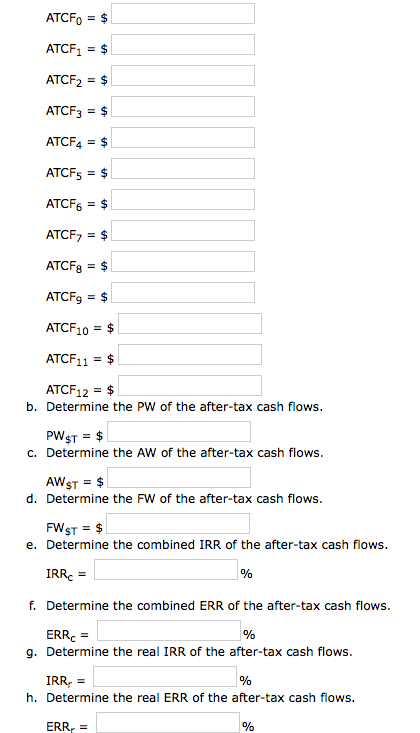

Henredon purchases a high-precision programmable router for shaping furniture components for $190,000. It is expected to last 12 years and have a salvage value of $5,400. Henredon will borrow $100,000 at 13.8% over 6 years, paying only interest each year and paying all the principle in the sixth year. It will produce $47,000 in net revenue each year during its life. All dollar amounts are expressed in real dollars. Depreciation follows MACRS 7-year property, taxes are 40%, the real after-tax MARR is 10%, and inflation is 3.9%. Determine the actual after-tax cash flows for each year from 0 to 12. Determine the PW of the after-tax cash flows. Determine the AW of the after-tax cash flows. Determine the FW of the after-tax cash flows. Determine the combined IRR of the after-tax cash flows. Determine the combined ERR of the after-tax cash flows. Determine the real IRR of the after-tax cash flows. Determine the real ERR of the after-tax cash flows.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started