Question

HepTones, Inc., is a U.S. based firm that designs and manufactures high-end stereo speakers. They have been successfully manufacturing and selling their speakers in the

HepTones, Inc., is a U.S. based firm that designs and manufactures high-end stereo speakers. They have been successfully manufacturing and selling their speakers in the U.S. for the last five years. Although they are still somewhat small, their U.S. sales have been growing at a rate of 20% annually and HepTones has achieved an excellent reputation for providing high-quality products at reasonable prices. Based on their success in the U.S., HepTones would like to expand their production and sales to Asia. Since their speakers are heavy, bulky, and somewhat delicate, exporting U.S.-made speakers to Europe appears to be too expensive and risky.

HepTones Chief Financial Officer, Brenda Mendez, and her staff have been evaluating several potential production locations in Asia. Based on Ms. Mendez staffs initial assessments, Ms. Mendez has narrowed the decision to one potential locationDelhi, India. Her decision was based on several criteria. First, average income in India has been growing rapidly in recent decades, and a viable market for HepTones products is emerging. Second, although there have been ups and downs, India has progressively implemented western-style economic, political, and business principles. Third, Indias labor force is well-educated and still relatively inexpensive compared to other Asian countries. Finally, transportation links between India and other Asian countries are also expanding rapidly, which bodes well for future exports to other Asian countries. Ms. Mendez has tasked you, as a financial analyst for HepTones, with preparing a more-extensive capital budgeting forecast for establishing a subsidiary in the Delhi location. She would like your recommendation as to whether the location is financially feasible and whether the locational decision is sensitive to any particular factors. She has asked you to use a 10-year forecasting horizon. Several departments at HepTones have provided you with the following information for your analysis:

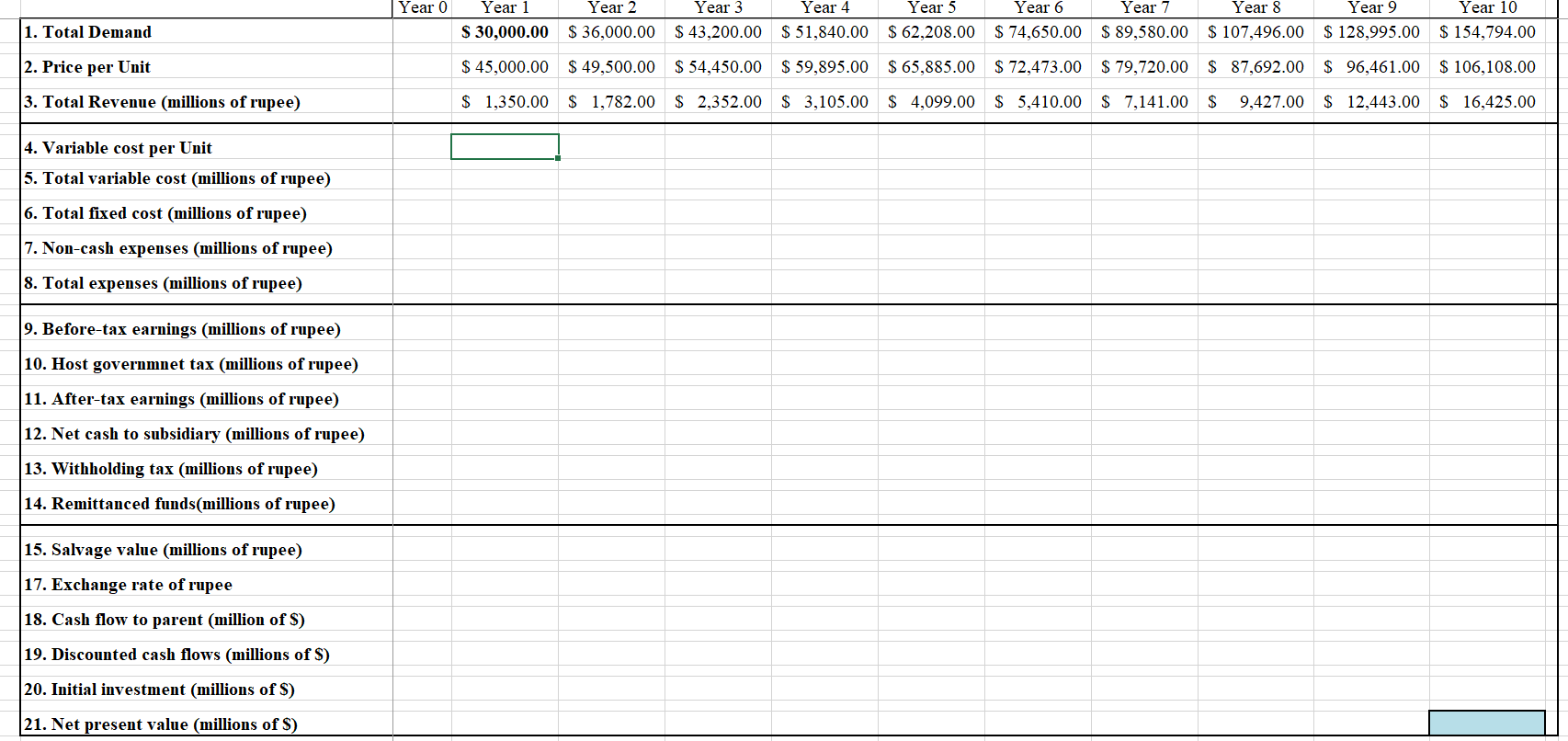

- The building and equipment needed for production in Delhi can be acquired at a a cost of 600 million rupee. The equipment is valued at 300 million rupee and will be depreciated using straight-line depreciation, which implies 30 million of depreciation per year for 10 years.

- Estimated sales in the first year are 30,000 pairs of speakers at a per-unit price of 45,000 rupee. Unit sales are projected to increase at 20 percent per year in following years.

- The variable costs needed manufacture the speakers are estimated to be 40,000 per pair in the first year of production.

- Fixed operating expenses, such as administrative salaries will be 25 million rupee in the first year of operations.

- The Indian government will impose a 25 percent tax on income, and a 10 percent withholding tax on any funds remitted to the U.S. Any earnings remitted to the U.S. will not be taxed further.

- The Indian government has agreed to buy HepTones Indian subsidiary after 10 years for about 700 million rupee, after considering any capital gains.

- The current exchange rate for the Indian rupee is $0.015. The rupee is expected to depreciate by an average of 2 percent per year for the next 10 years.

- Average annual inflation in India is expected to be 10 percent. Revenues, variable costs, and fixed costs are expected to change by the same rate as annual inflation.

HepTones currently uses a 20 percent rate of return to evaluate potential investment projects in the U.S. It has decided to use a 25 percent rate of return to evaluate the Indian project. All excess funds generated by the Indian subsidiary will be remitted back to the U.S. Do your analysis in the tab called Baseline Scenario. After you have completed your analysis answer to the following question: Based on the information provided in the case, should HepTones proceed with the project? Why or why not? Please record your answer in the appropriate box in the tab called Questions. Ms. Mendez is somewhat concerned about the project made by the marketing department that unit sales will increase at a 20 percent annual rate. She is interested in knowing what annual rate of increase in sales would make the net present value (NPV) equal to zero. Anything less than this break-even rate of increase would mean the project is not financially feasible.To answer her question, make a copy of the Baseline Scenario worksheet. Rename it Sensitivity Analysis. Vary the sales rate increase until the NPV is approximately zero, and then answer this question: What annual rate of increase in sales will yield an NPV of zero? Please record your answer in the appropriate box in the tab called Questions.

Year 0 1. Total Demand Year 1 $ 30,000.00 $ 45,000.00 $ 1,350.00 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 $ 36,000.00 $ 43,200.00 $ 51,840.00 $ 62,208.00 $ 74,650.00 $ 89,580.00 $ 49,500.00 $ 54,450.00 $ 59,895.00 $ 65,885.00 $ 72,473.00 $ 79,720.00 $ 1,782.00 $ 2,352.00 $ 3,105.00 $ 4,099.00 $ 5,410.00 $ 7,141.00 Year 8 Year 9 $ 107,496.00 $ 128,995.00 $ 87,692.00 $ 96,461.00 $ 9,427.00 $ 12,443.00 Year 10 $ 154,794.00 $ 106,108.00 $ 16,425.00 2. Price per Unit 3. Total Revenue (millions of rupee) 4. Variable cost per Unit 5. Total variable cost (millions of rupee) 6. Total fixed cost (millions of rupee) 7. Non-cash expenses (millions of rupee) 8. Total expenses (millions of rupee) 19. Before-tax earnings (millions of rupee) 10. Host governmnet tax (millions of rupee) 11. After-tax earnings (millions of rupee) 12. Net cash to subsidiary (millions of rupee) 13. Withholding tax (millions of rupee) 14. Remittanced funds(millions of rupee) 15. Salvage value (millions of rupee) 17. Exchange rate of rupee 18. Cash flow to parent (million of S) 19. Discounted cash flows (millions of S) 20. Initial investment (millions of $) 21. Net present value (millions of S)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started