Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for $54,000. The equipment falls into the five-year category for MACRS depreciation and can currently be sold for $22,800. A new piece of equipment will cost $144,000. It also falls into the five-year category for MACRS depreciation. Assume the new equipment would provide the following stream of added cost savings for the next six years. Use Table 1212. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods.

| Year | | Cash Savings |

| 1 | | $ | 60,000 | |

| 2 | | | 52,000 | |

| 3 | | | 50,000 | |

| 4 | | | 48,000 | |

| 5 | | | 45,000 | |

| 6 | | | 34,000 | |

| |

The firms tax rate is 25 percent and the cost of capital is 10 percent.

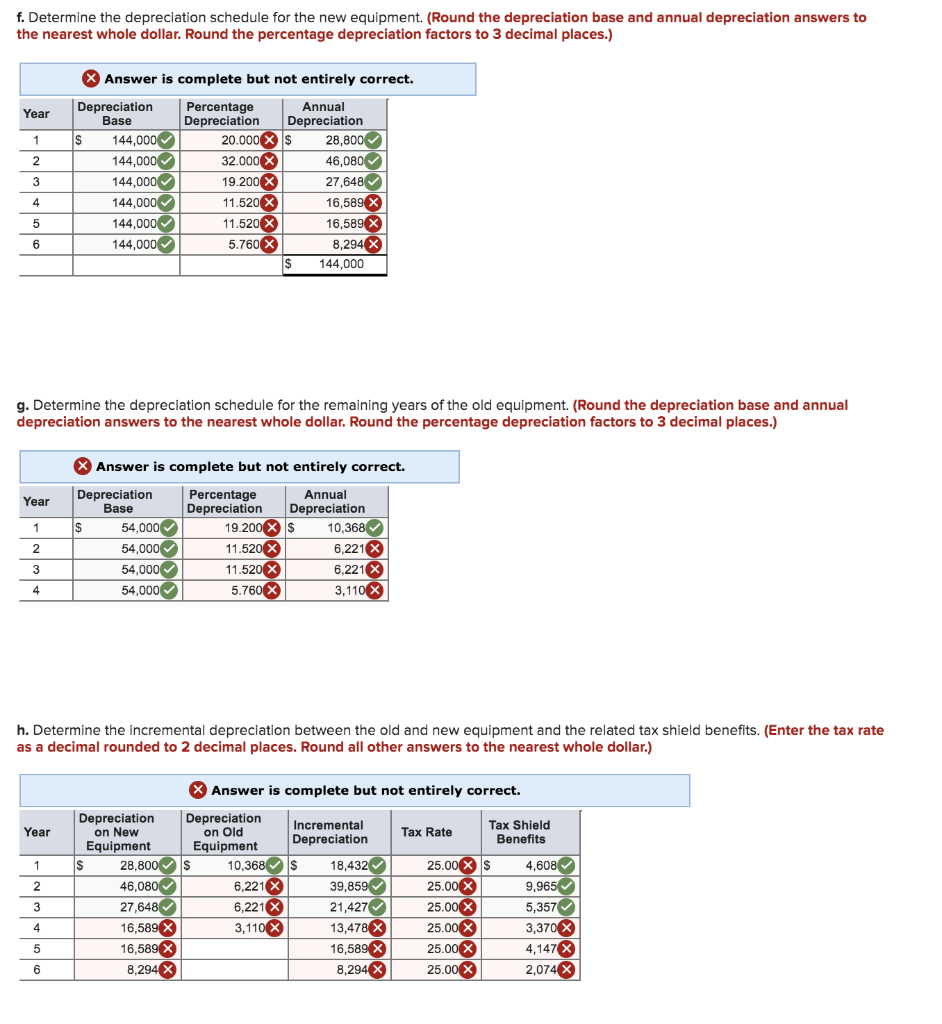

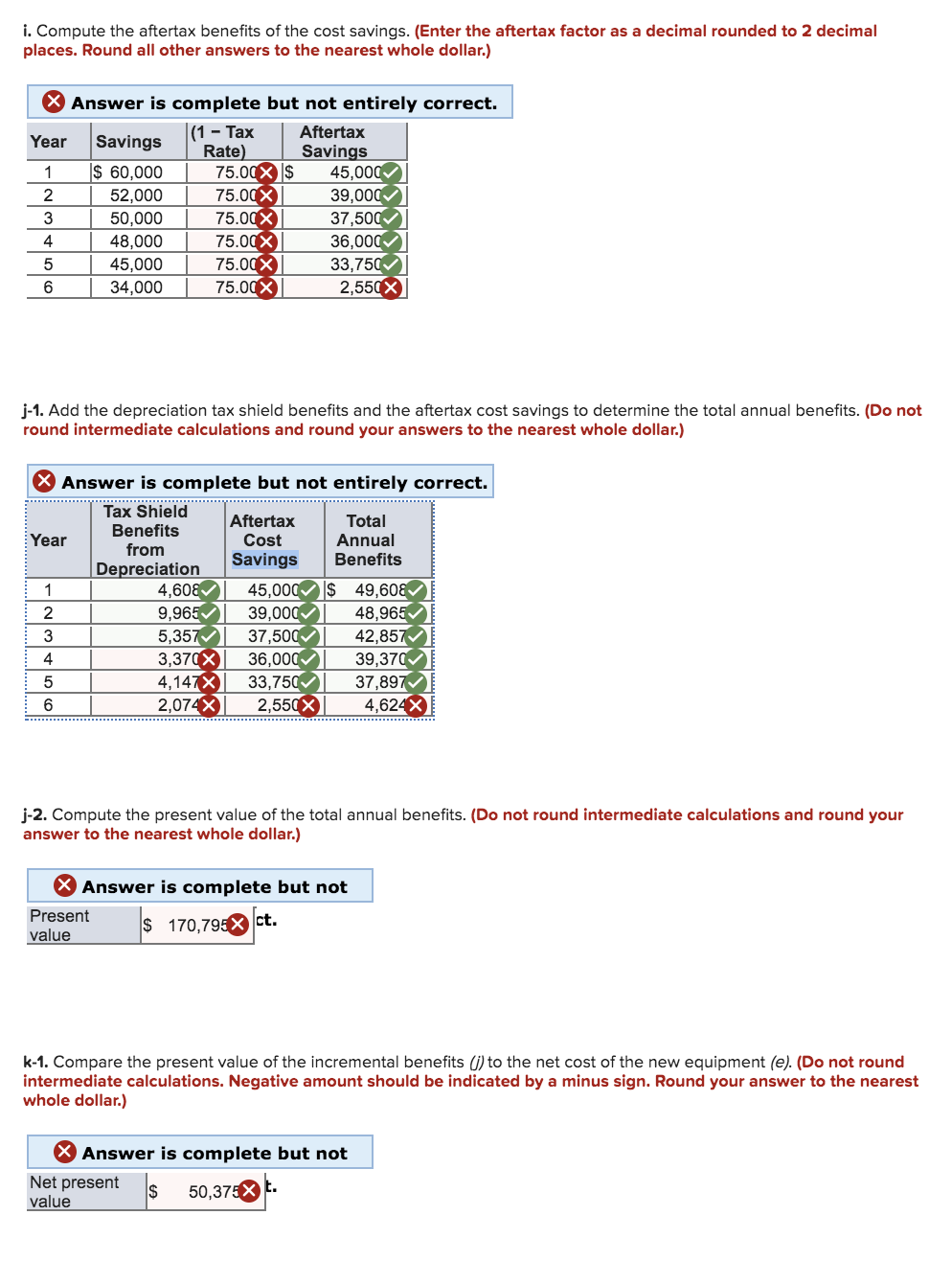

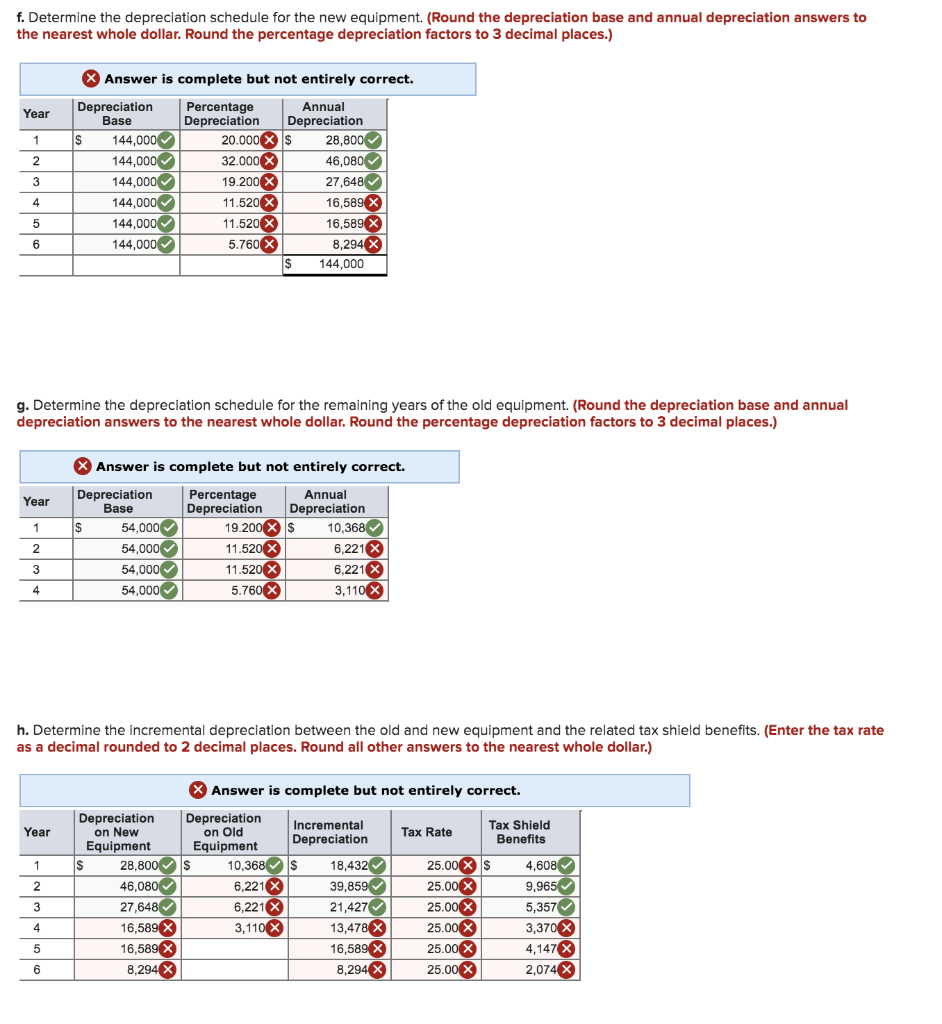

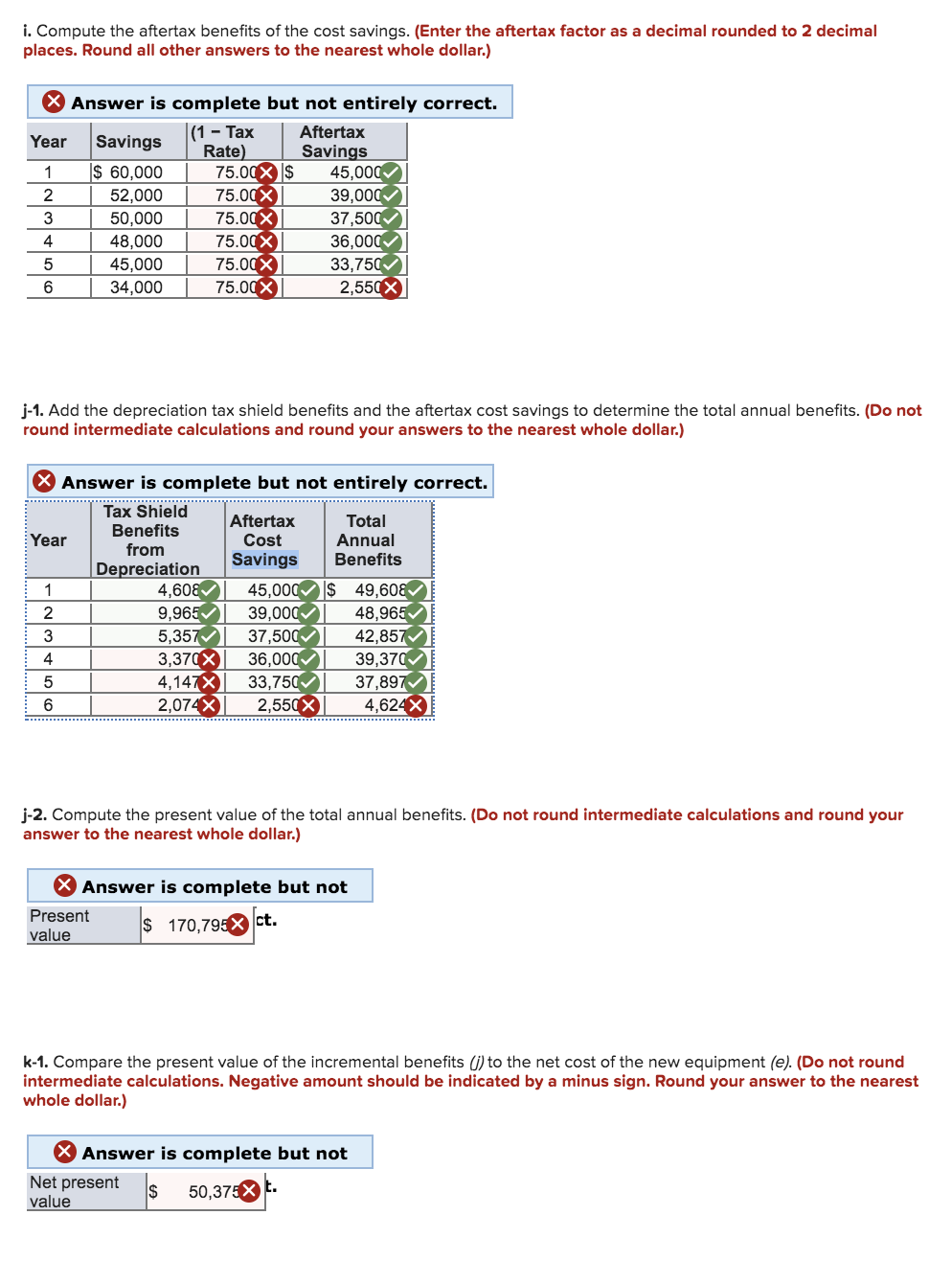

f. Determine the depreciation schedule for the new equipment. (Round the depreciation base and annual depreciation answers to the nearest whole dollar. Round the percentage depreciation factors to 3 decimal places.) Answer is complete but not entirely correct. Year 1 Depreciation Base $ 144,000 144,000 144,000 144,000 144,000 144,000 Percentage Depreciation 20.000 X 32.000 19.200 X 11.520 X 11.520 X 5.760 X Annual Depreciation $ 28,800 46,080 27,648 16,589 16,589 X 8,294 X $ 144,000 g. Determine the depreciation schedule for the remaining years of the old equipment. (Round the depreciation base and annual depreciation answers to the nearest whole dollar. Round the percentage depreciation factors to 3 decimal places.) Year Answer is complete but not entirely correct. Depreciation Percentage Annual Base Depreciation Depreciation 54,000 19.200 $ 10,368 54,000 11.520 6,221 54,000 11.520 6,221 X 54,000 5.760 3,110 h. Determine the incremental depreciation between the old and new equipment and the related tax shield benefits. (Enter the tax rate as a decimal rounded to 2 decimal places. Round all other answers to the nearest whole dollar.) Answer is complete but not entirely correct. Year Tax Rate Tax Shield Benefits 1 Depreciation on New Equipment $ 28,800 46,080 27,648 16,589 16,589 X 8,294 X Depreciation on Old Equipment $ 10,368 6,221 6,221 3,110 Incremental Depreciation $ 18,432 39,859 21,427 13,478 X 16,589 X 8,2941 25.00 XS 25.00 25.00 X 25.00 25.00 25.00 X 4,608 9,965 5,357 3,370 X 4,147 X 2,074 X i. Compute the aftertax benefits of the cost savings. (Enter the aftertax factor as a decimal rounded to 2 decimal places. Round all other answers to the nearest whole dollar.) X Answer is complete but not entirely correct. Year |(1 Tax Aftertax Savings Rate) Savings $ 60,000 75.00 $ 45,000 2 52,000 75.00 39,000 3 50.000 75.00 37,500 48,000 75.00% | 36,000 5 45,000 75.00% 33,750 34,000 75.00% 2,550X j-1. Add the depreciation tax shield benefits and the aftertax cost savings to determine the total annual benefits. (Do not round intermediate calculations and round your answers to the nearest whole dollar.) X Answer is complete but not entirely correct. Tax Shield Aftertax Total Benefits Year Cost Annual from Depreciation Savings Benefits 4,608 45,000 $ 49,608 9,965l 39,000 48,965 3 5,357 37,500 42,857 3,370XL 36,000 39,370 4,147% 33,750 37,897 2,0741 2,550%) 4,624 1 j-2. Compute the present value of the total annual benefits. (Do not round intermediate calculations and round your answer to the nearest whole dollar.) X Answer is complete but not Present value $ 170,795 ct. k-1. Compare the present value of the incremental benefits (i) to the net cost of the new equipment (e) (Do not round intermediate calculations. Negative amount should be indicated by a minus sign. Round your answer to the nearest whole dollar.) Answer is complete but not Net presents 50,375 value