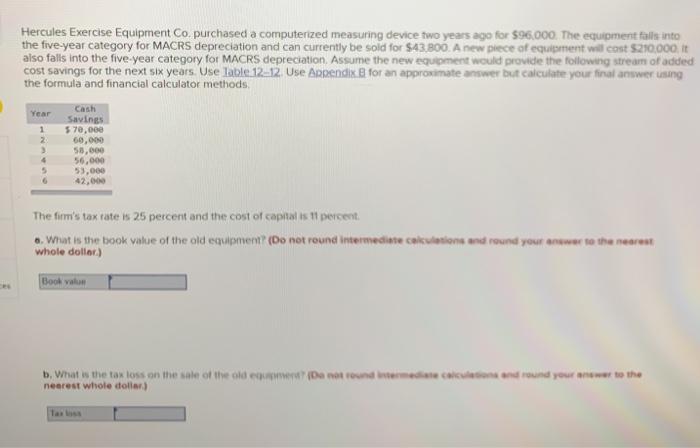

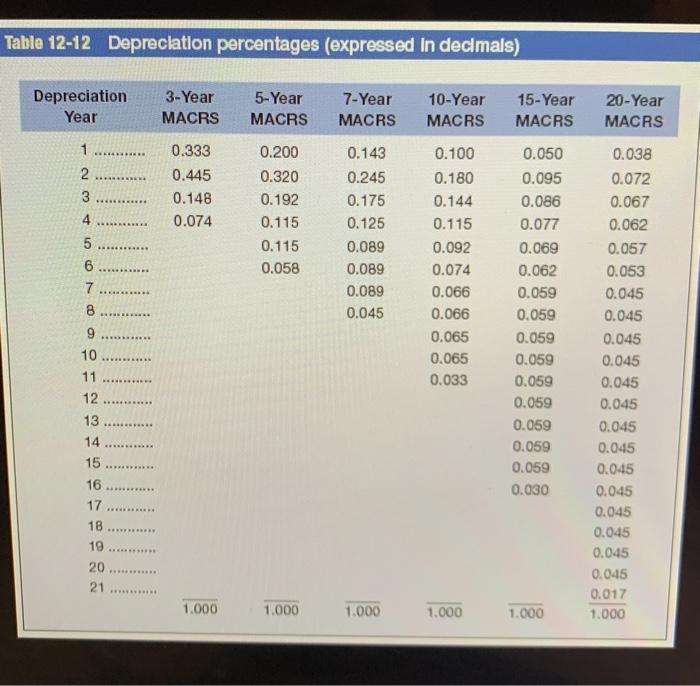

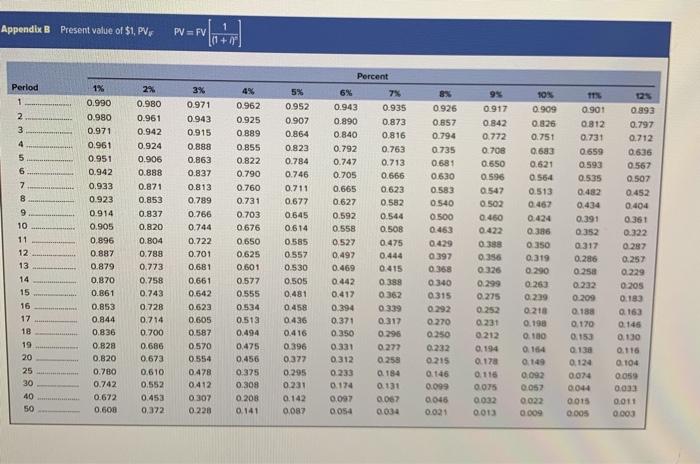

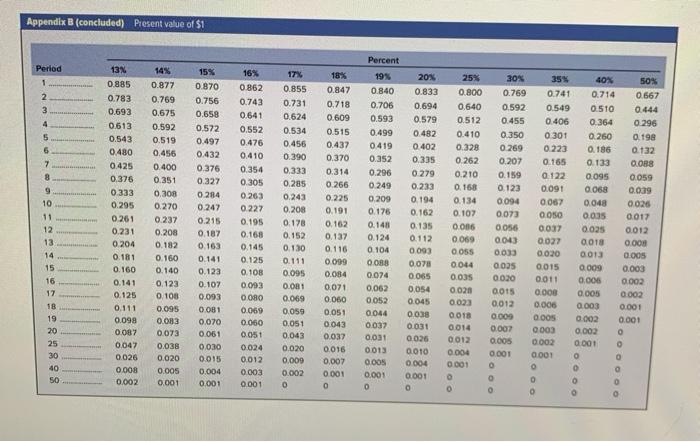

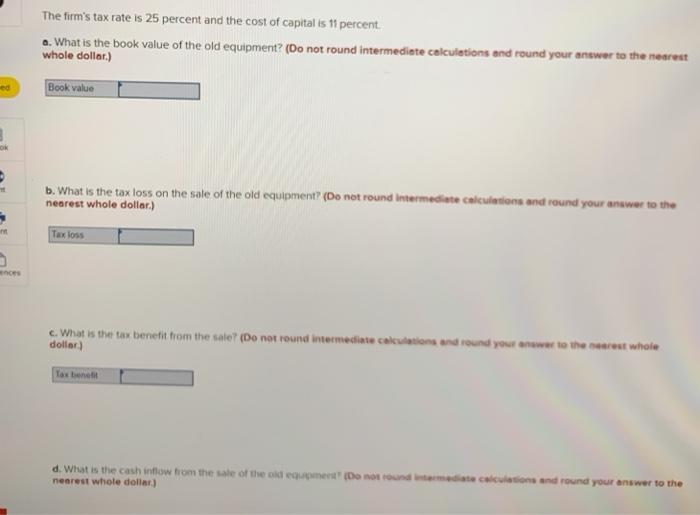

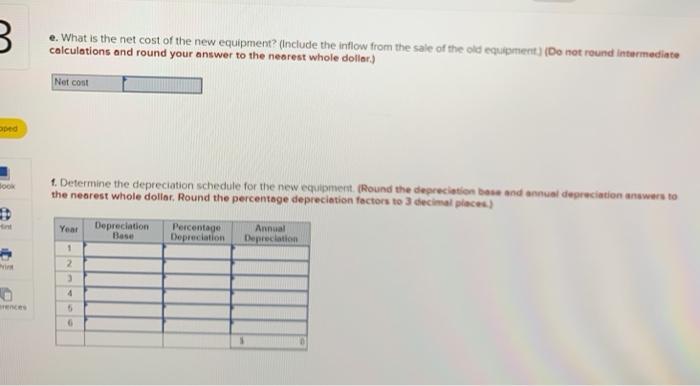

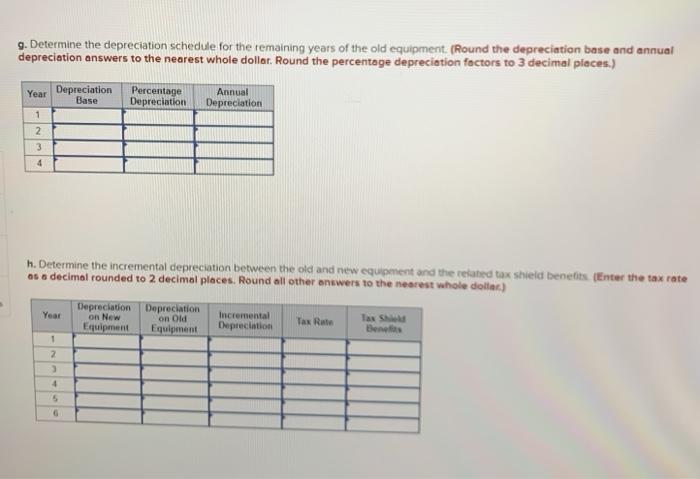

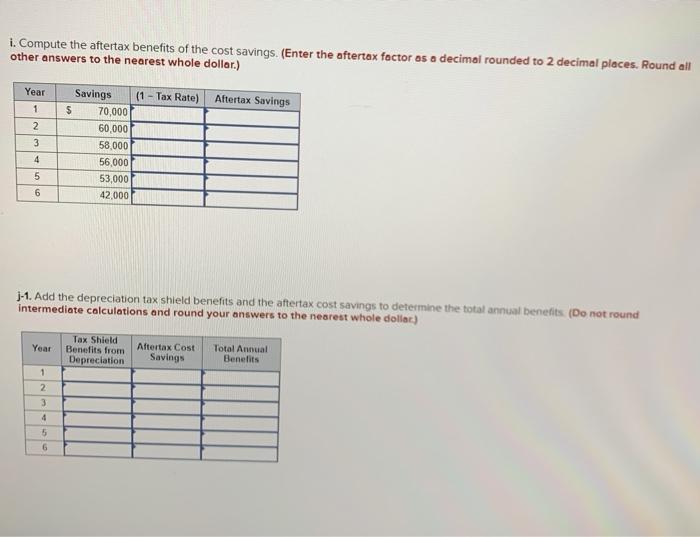

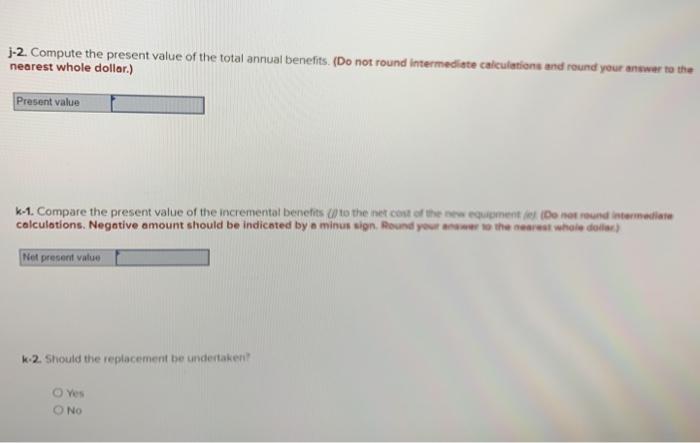

Hercules Exercise Equipment Co purchased a computerized measuring device two years ago for $96.000. The equipment falls into the five-year category for MACRS depreciation and can currently be sold for $43.800. A new piece of equipment will cost $210,000.it also falls into the five-year category for MACRS depreciation Assume the new equipment would provide the following stream of added cost savings for the next six years. Use Table 12-12 Use Appendix for an approximate answer but calculate your final answer using the formula and financial calculator methods Year Cash Savings 570,000 60,000 58.000 56,000 53,000 42,000 1 2 4 The firm's tax rate is 25 percent and the cost of capital is it percent. What is the book value of the old equipment (Do not round intermediate coklations and round your answer to the nearest whole dollar) Book voor b. What is the tax loss on the sale of the older (Do not found stermediare calculation and round your answer to the nearest whole dollar) Table 12-12 Depreclation percentages (expressed in decimals) Depreciation Year 3-Year MACRS 5-Year MACRS 7-Year MACRS 10-Year MACRS 15-Year MACRS 20-Year MACRS SHER 1 2 3 2 0.333 0.445 0.148 0.074 0.200 0.320 0.192 0.115 0.115 0.058 4 0.143 0.245 0.175 0.125 0.089 0.089 0.089 0.045 5 6 7 0.100 0.180 0.144 0.115 0.092 0.074 0.066 0.066 0.065 0.065 0.033 HER 8 ***** 0.050 0.095 0.086 0.077 0.069 0.062 0.059 0.059 0.059 0.059 0.059 0.059 0.059 0.059 0.059 0.030 *** 9 10 11 12 13 14 0.038 0.072 0.067 0.062 0.057 0.053 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.017 1.000 ********** 15 ............. 16 .......**** 17 18 19 20 21 1.000 1.000 1.000 1.000 1.000 Appendix B Present value of $1, PVF PV=FV 1 Percent Period 1 0.893 2 3 4 5 6 0:917 0842 0.772 0.708 0.650 0.596 0547 0502 0.460 0.422 0.797 0.712 0.636 0.567 0.507 0.452 0.404 7 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 B 9 1% 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.861 0.853 0.844 0.836 0.828 0.820 0.780 0.742 0.672 0.608 10 2%. 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0.673 0,610 0.552 0.453 0,372 3% 0.971 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.542 0.623 0.605 0.587 0570 0.554 0.478 0.412 0 307 0.228 8 0.926 0.857 0.794 0.735 0681 0.630 0.583 0540 0.500 0.463 0.429 0397 0.368 0340 0.315 11 12 13 14 15 16 17 18 19 5% 0952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.545 0.614 0.585 0.557 0.530 0.505 0.481 0.458 0.436 0.416 0.396 0.377 0.295 0.231 0.142 0.087 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 0.417 0.394 0.371 0.350 0331 0.312 0.233 0.174 0,097 0054 7% 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0388 0362 0339 0.317 0.296 0.272 0.258 0.184 0.131 0.067 0.356 0.326 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0:319 0 290 0.263 0.239 0218 0.198 0.100 0164 0149 0092 0.057 0022 0009 0901 0812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0:317 0.286 0.258 0.232 0.209 0.188 0.170 0.150 0.133 0.124 0.074 0.044 8 8 8 8 8 o 0.577 0.555 0534 0.513 0.494 0.475 0.456 0.375 0.308 0.208 0.141 0.361 0.322 0.287 0.257 0.229 0205 0.183 0.163 0.146 0.130 0.116 0104 0.059 0.033 0011 0.003 0.275 0.252 0.231 0212 0.194 0.178 0.116 0.075 0.032 0.013 0.270 0.250 0232 0215 0.146 0.099 0.046 0.021 0.015 0.005 Appendix B (concluded) Present value of $1 20 Period 1 2 3 4 S 6 7 8 9 10 13 0885 0.783 0.693 o613 0.543 0480 0.42 0.376 0333 0.295 o 261 0.231 o 204 0.11 0.160 0.141 0.12 0.111 0.098 0007 0047 14x 0.877 0.769 0.675 0592 0.519 0.466 0 400 0.351 0 308 0.270 o 237 0.208 0.102 0 160 0 140 0 123 0, 10 0.095 0.003 0073 0.038 0.020 0.00s 0,001 0870 0.756 0.650 0.572 0497 0432 0376 0327 0 204 0.247 0.2016 0,107 0 163 0 141 0.123 0.107 0003 1 0070 0 061 0030 0018 0.004 0001 16 0862 0.743 0.641 0,552 0476 0,410 0354 0 305 o 263 o 227 019 0.168 0 145 0.126 0 093 0069 0060 t 0024 0012 0 003 0 001 17 0855 0.731 0.624 0.534 0456 0.30 0,333 0,286 0 243 0, 208 0.178 0 152 20 0 111 oogs 0 0 1 0069 0 059 0,051 0.043 000 0.000 0.002 0 12 13 14 15 16 17 18 19 0 Percent 19 .840 0593 0.499 0419 0.352 0.296 0 249 0 209 0 176 0.14 0 124 o 104 0.083 0.074 0062 0 052 0 044 000? 0013 ooos 0001 0 18 0.847 0,718 0609 0515 0437 0.370 0.314 o 266 0226 0.101 0, 162 0.17 0 110 0 000 . 0.071 0 000 0.05 0 043 ? 0016 0,007 ! 0.833 0.694 0579 0.482 0402 0335 0279 0233 0 194 0 162 0 135 0.112 009) 007 0 000 0,054 0 04s ao26 0010 0 004 0 001 0 25 0.640 0.512 0.410 0.328 0262 0.210 0 168 0.134 0 107 0006 0 000 0 065 0 044 0035 0028 002) 0010 0 014 0012 0004 ! 0 0.769 0.592 0455 0350 0 269 0.207 0.100 0.122 0004 0.07 0 000 004) 0025 000 oots 0012 0 000 ? ocos ! 0 0 35 0741 0549 0406 0 301 0223 0 165 0.12 009 007 ? 0027 0015 2011 0.000 o oos 0 000 0002 0001 4ons 0.714 Osto 0364 0 260 . 186 0 133 0.09 0 068 004 oos oos a018 0013 0 000 0 000 a cos 0 02 0 002 0 000 50% 0667 0444 o 296 0.19 0 132 0.088 o 059 0039 0017 0012 goos 0003 0 002 2 0 000 25 30 OOOOOOOOOO 0 026 o o o o o o o 40 0 000 2 S0 The firm's tax rate is 25 percent and the cost of capital is 11 percent a. What is the book value of the old equipment? (Do not round intermediate calculations and round your answer to the nearest whole dollar) Book value OK b. What is the tax loss on the sale of the old equipment? (Do not round Intermediate calculations and round your answer to the nearest whole dollar) Tax loss aces c. What is the tax benefit from the sale? (Do not round intermediate calculations and round your answer to the rest whole dollar d. What is the cash inflow from the sale of the old equipment (Donde calculations and round your answer to the nearest whole dollar) B e. What is the net cost of the new equipment? (Include the inflow from the sale of the old equipment) (Do not round intermediate calculations and round your answer to the nearest whole dollar) Netcost oped OOK 1. Determine the depreciation schedule for the new equipment. (Round the depreciation base and annual depreciation answ the nearest whole dollar. Round the percentage depreciation factors to 3 decimal places) swers to Year Depreciation Base Percentage Depreciation Annual Depreciation 1 2 3 4 enes 5 g. Determine the depreciation schedule for the remaining years of the old equipment. (Round the depreciation base and annual depreciation answers to the nearest whole dollar. Round the percentage depreciation factors to 3 decimal places.) Year Depreciation Base Percentage Depreciation Annual Depreciation 1 2 3 4 h. Determine the incremental depreciation between the old and new equipment and the related tax shield benefits (Enter the tax rate os a decimal rounded to 2 decimal places. Round all other answers to the nearest whole dollar) Year Depreciation on New Equipment Depreciation on Old Equipment incremental Depreciation Tax Rate Tax S 1 2 3 4 5 1. Compute the aftertax benefits of the cost savings. (Enter the aftertax factor as a decimal rounded to 2 decimal places. Round all other answers to the nearest whole dollar.) Year 1 Aftertax Savings 2 3 4 5 6 Savings (1 - Tax Rate) $ 70,000 60,000 58,000 56,000 53,000 42,000 J-1. Add the depreciation tax shield benefits and the aftertax cost savings to determine the total annual benefits. (Do not round intermediate calculations and round your answers to the nearest whole dollar) Year Tax Shield Benefits from Aftertax Cost Depreciation Savings Total Annual Benefits 1 2 3 4 5 G 1-2 Compute the present value of the total annual benefits. (Do not round intermediate calculations and round your answer to the nearest whole dollar.) Present value k-1. Compare the present value of the incremental benefits to the net cost of the sequement (Do not round intermedia calculations. Negative amount should be indicated by a minus sign. Round your to the nearest whole dollar) Net present value k2. Should the replacement be undertaken! Yes No