Answered step by step

Verified Expert Solution

Question

1 Approved Answer

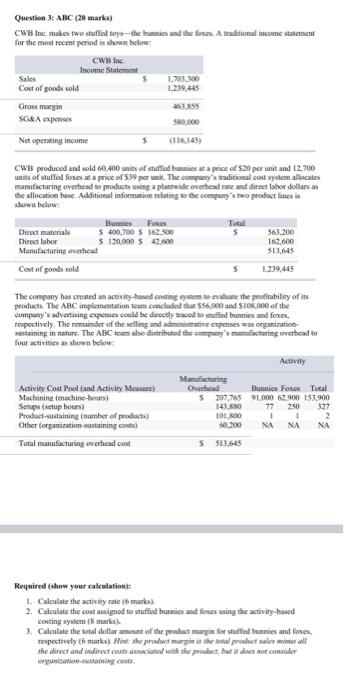

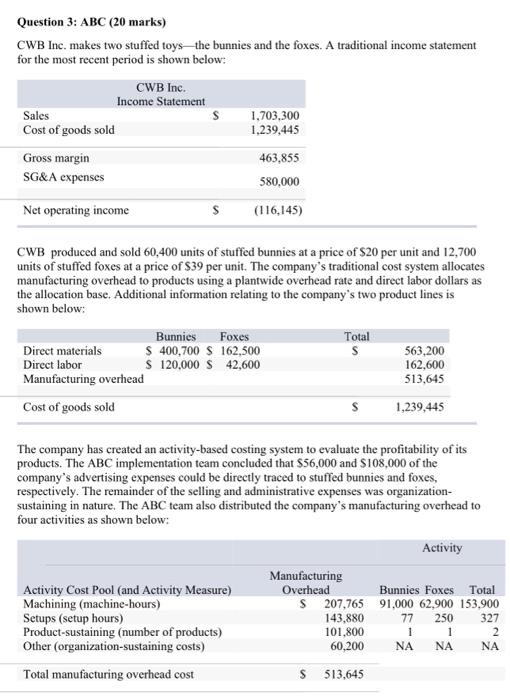

Here are clearer pictures. Questien 3: ABC (20 marks) for the most necent period a shown below: CWB peoduced and sold 60,400 anits of stuffod

Here are clearer pictures.

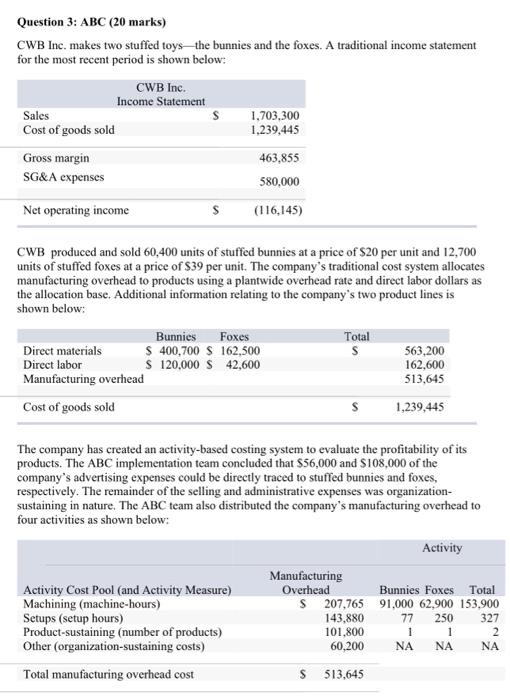

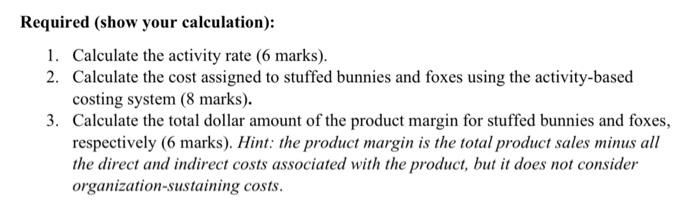

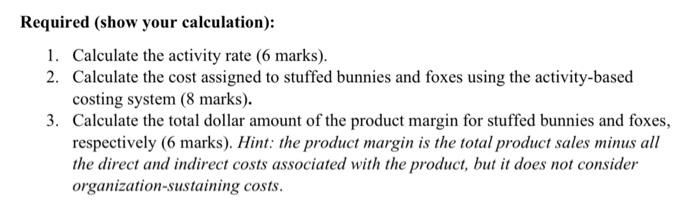

Questien 3: ABC (20 marks) for the most necent period a shown below: CWB peoduced and sold 60,400 anits of stuffod benniss at a price ef 520 per unit and 12,700 units of stuffed foues at a price of $39 per anin. The cunpuny's tralitimal ceat systom allocates manufacturing ovechead so products using a plantwide ovethead nate and direct laber dellass as the allocatioe base. Additional informution relating to the consuny"s two prodict lines is alowa below: The cumpany has created an activity-besed ending paten wo nalume the prodiabilisy of its peoducts. The ABC implementacian teams conclubal thar 566.000 and 5108,000 of the eompuay's advertaing expenies coeld be directly trwed to senfled bunnies and foxes, rospectively. The remuinder of the selling and administative copenses was organirativeswataining in nature. The ABC team alse cintributod the eocepury's musufachuring ovatbead to four activieies as shown below; Required (show your calcelation): 1. Calculate the activity rale (b marks) 2. Calculate the cost asigaed to stuffed trunties and forser using the activity-baied conting system (8 marka). 3. Calculate the sotal dollar armont of the poobuct murpin for shifflal tuneies and foses. erganisurian-remaining cosis. Question 3: ABC (20 marks) CWB Inc. makes two stuffed toys - the bunnies and the foxes. A traditional income statement for the most recent period is shown below: CWB produced and sold 60,400 units of stuffed bunnies at a price of $20 per unit and 12,700 units of stuffed foxes at a price of $39 per unit. The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company's two product lines is shown below: The company has created an activity-based costing system to evaluate the profitability of its products. The ABC implementation team concluded that $56,000 and $108,000 of the company's advertising expenses could be direetly traced to stuffed bunnies and foxes, respectively. The remainder of the selling and administrative expenses was organizationsustaining in nature. The ABC team also distributed the company's manufacturing overhead to four activities as shown below: Required (show your calculation): 1. Calculate the activity rate ( 6 marks). 2. Calculate the cost assigned to stuffed bunnies and foxes using the activity-based costing system ( 8 marks). 3. Calculate the total dollar amount of the product margin for stuffed bunnies and foxes, respectively (6 marks). Hint: the product margin is the total product sales minus all the direct and indirect costs associated with the product, but it does not consider organization-sustaining costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started