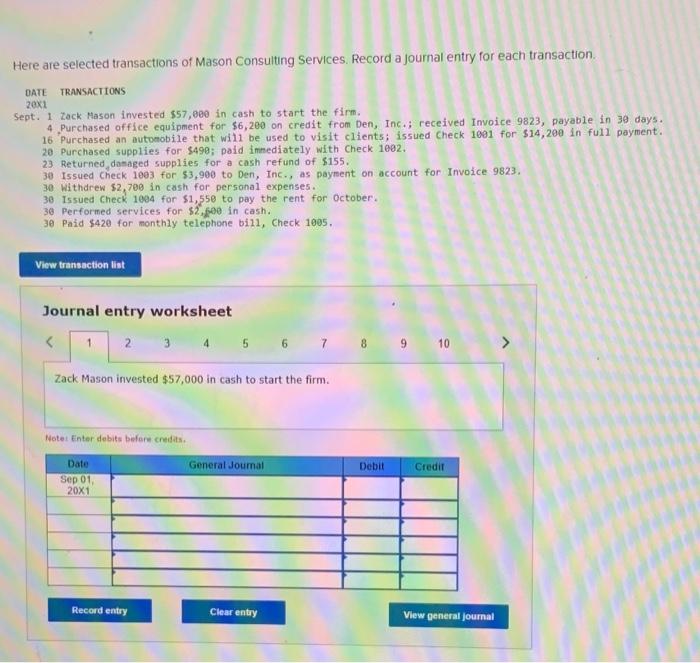

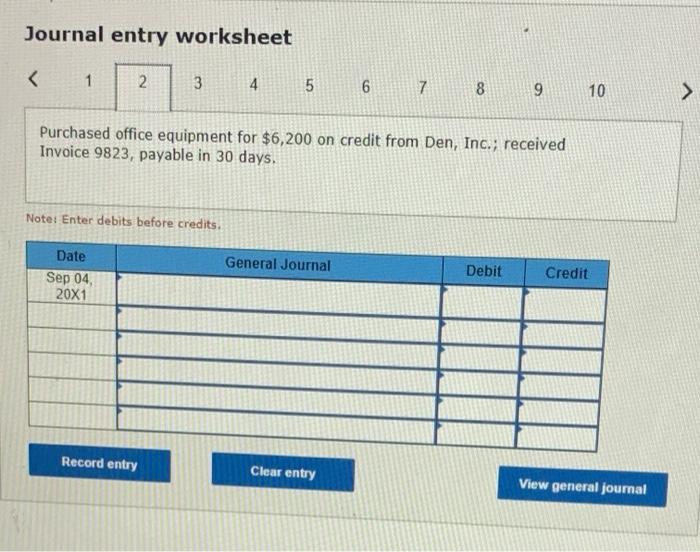

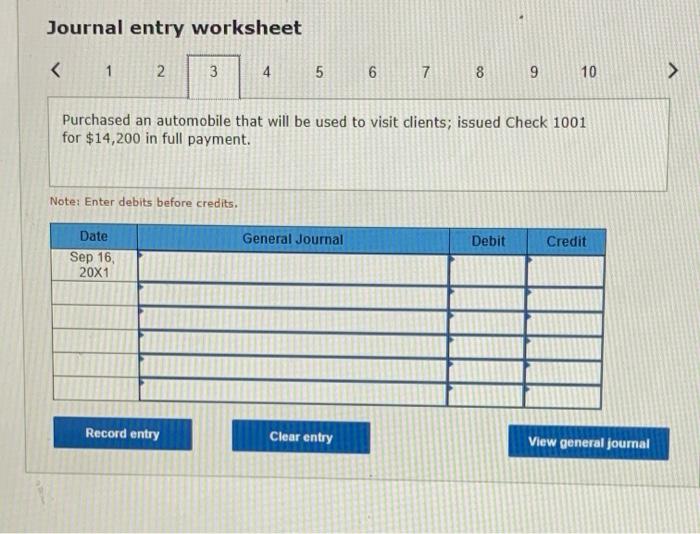

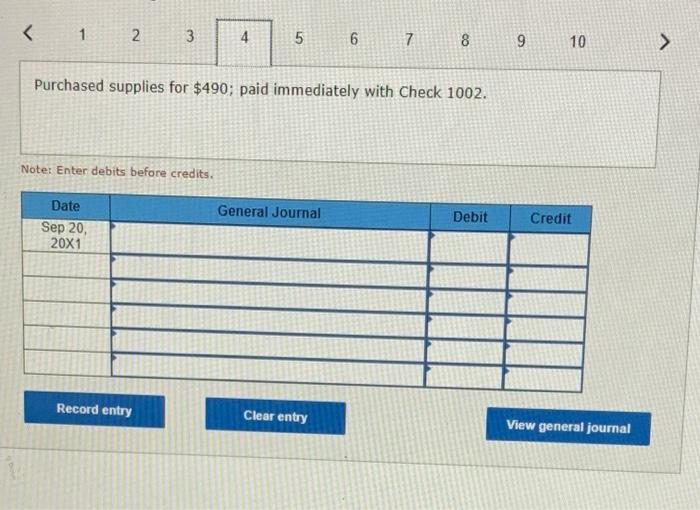

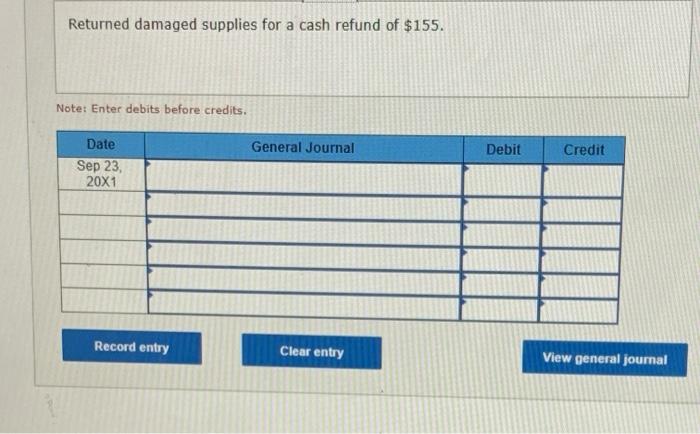

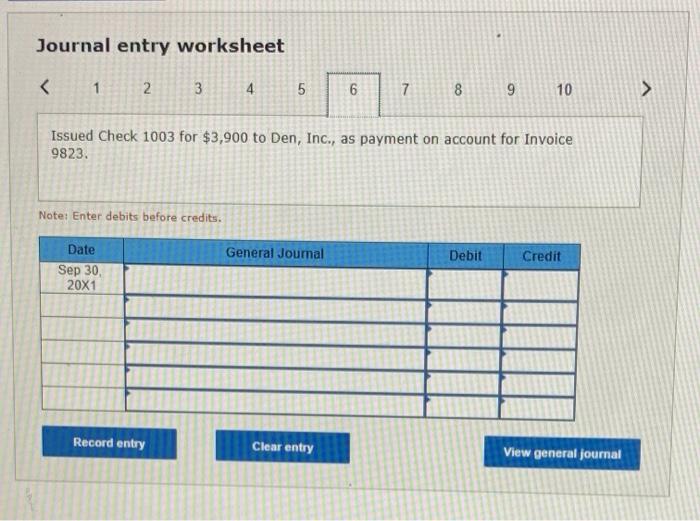

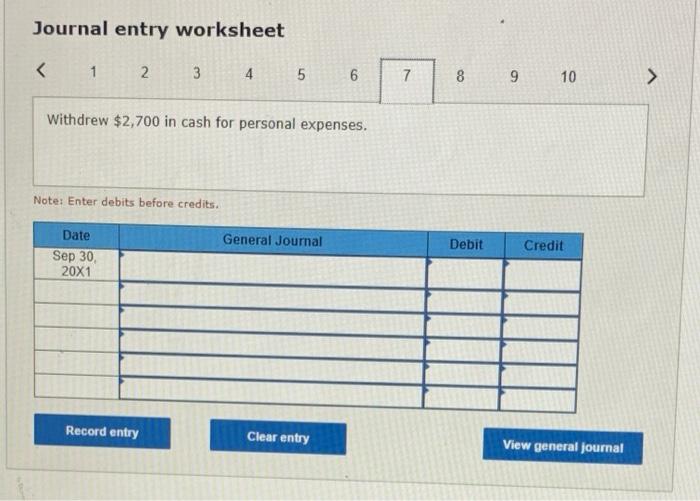

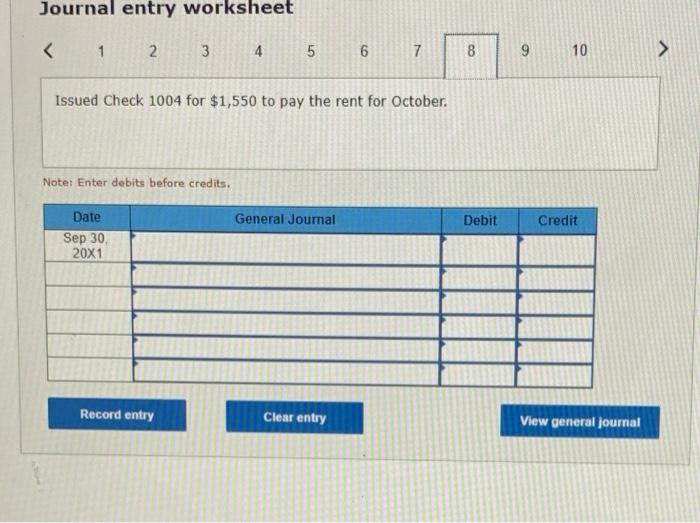

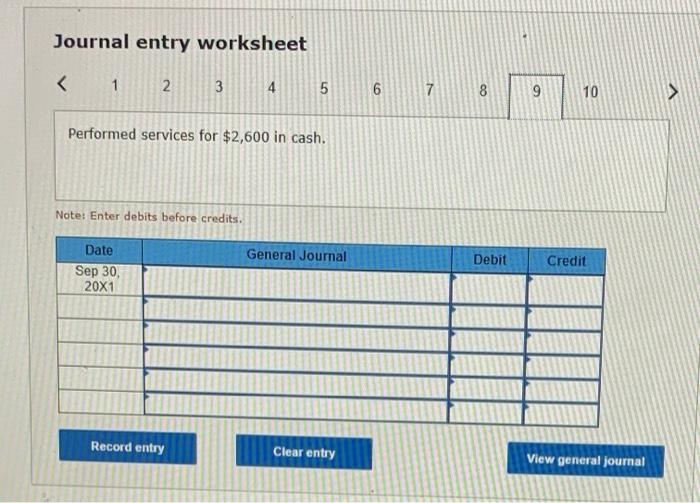

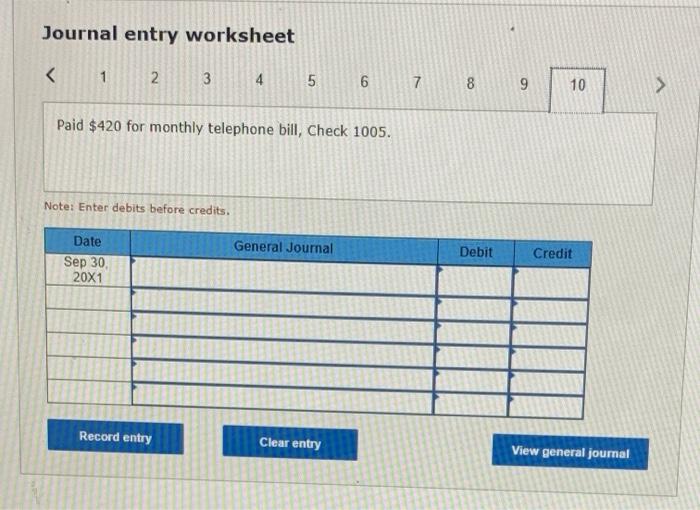

Here are selected transactions of Mason Consulting Services. Record a Journal entry for each transaction DATE TRANSACTIONS 20x1 Sept. 1 Zack Mason invested $57,000 in cash to start the firm. 4 Purchased office equipment for $6,200 on credit from Den, Inc.; received Invoice 9823, payable in 30 days. 16 'Purchased an automobile that will be used to visit clients; issued Check 1001 for $14,200 in full payment. 20 Purchased supplies for $490; paid immediately with Check 1002. 23 Returned damaged supplies for a cash refund of $155. 30 Issued Check 1003 for $3,900 to Den, Inc., as payment on account for Invoice 9823. 30 Withdrew $2,700 in cash for personal expenses. 30 Issued Check 1004 for $1,550 to pay the rent for October 30 Performed services for $2.00 in cash. 30 Paid $420 for monthly telephone bill, Check 1005 View transaction list Journal entry worksheet Zack Mason invested $57,000 in cash to start the firm. Note: Enter debits before credits General Journal Debit Credit Date Sep 01, 20X1 Record entry Clear entry View general Journal View general Journal Journal entry worksheet 1 2 3 4 5 6 7 9 10 > Purchased office equipment for $6,200 on credit from Den, Inc.; received Invoice 9823, payable in 30 days. Note: Enter debits before credits. General Journal Date Sep 04 20X1 Debit Credit Record entry Clear entry View general journal Journal entry worksheet 1 2. 3 4 5 6 7 8 8 9 10 Purchased an automobile that will be used to visit clients; issued Check 1001 for $14,200 in full payment. Note: Enter debits before credits. General Journal Debit Credit Date Sep 16 20X1 Record entry Clear entry View general journal Purchased supplies for $490; paid immediately with Check 1002. Note: Enter debits before credits General Journal Date Sep 20, 20X1 Debit Credit Record entry Clear entry View general journal Returned damaged supplies for a cash refund of $155. Note: Enter debits before credits. General Journal Debit Credit Date Sep 23, 20X1 Record entry Clear entry View general journal Journal entry worksheet Withdrew $2,700 in cash for personal expenses. Note: Enter debits before credits. General Journal Debit Credit Date Sep 30, 20X1 Record entry Clear entry View general journal Journal entry worksheet Performed services for $2,600 in cash. Note: Enter debits before credits. General Journal Debit Date Sep 30, 20X1 Credit Record entry Clear entry View general journal Journal entry worksheet