Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ch.11 Q.2 Pls, help with the question. Margin, Turnover, Return on Investment, Average Operating Assets Nakamura Company provided the following income statement for the last

Ch.11 Q.2

Pls, help with the question.

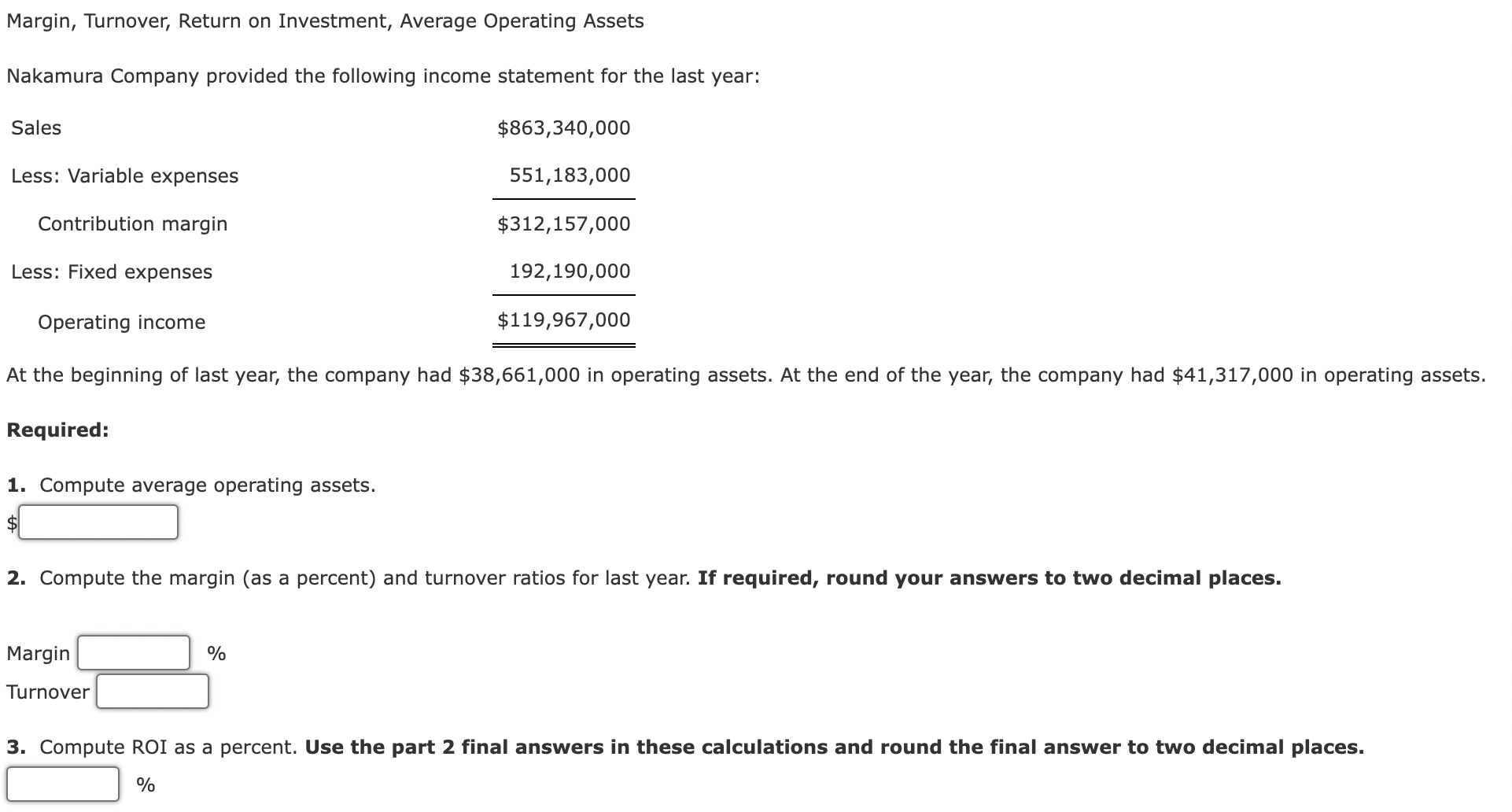

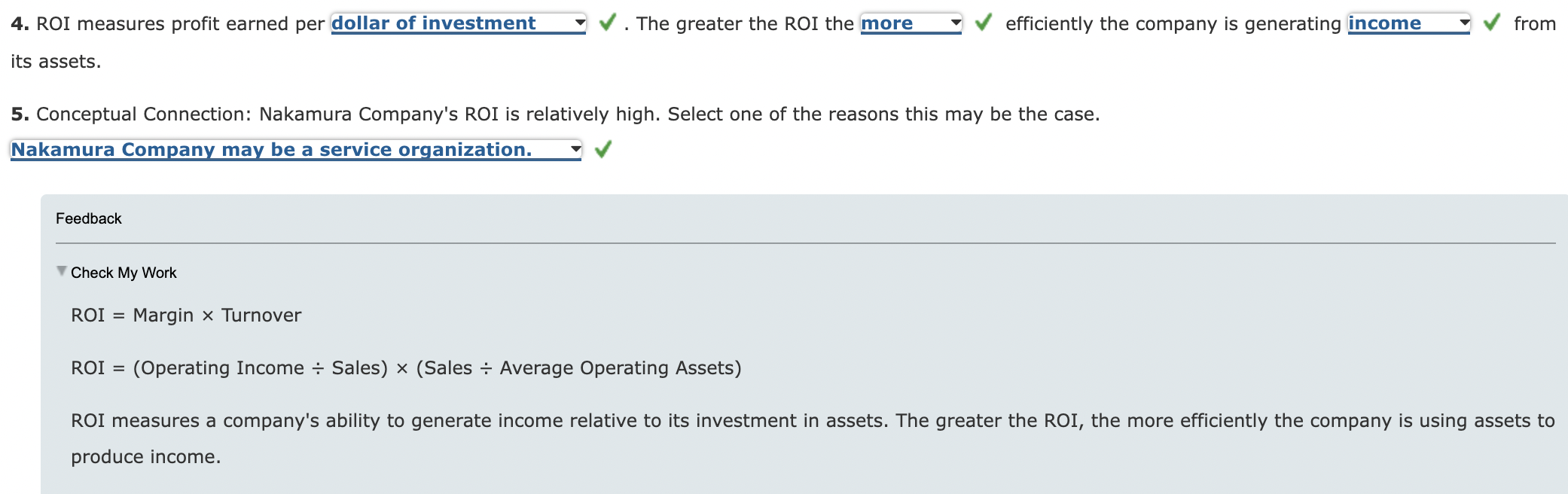

Margin, Turnover, Return on Investment, Average Operating Assets Nakamura Company provided the following income statement for the last year: At the beginning of last year, the company had $38,661,000 in operating assets. At the end of the year, the company had $41,317,000 in operating ass Required: 1. Compute average operating assets. $ 2. Compute the margin (as a percent) and turnover ratios for last year. If required, round your answers to two decimal places. Margin % Turnover 3. Compute ROI as a percent. Use the part 2 final answers in these calculations and round the final answer to two decimal places. % ROI measures profit earned per . The greater the ROI the efficiently the company is generating from s assets. Conceptual Connection: Nakamura Company's ROI is relatively high. Select one of the reasons this may be the case. lakamura Company may be a service organization. Feedback Check My Work ROI = Margin Turnover ROI = (Operating Income Sales )( Sales Average Operating Assets ) ROI measures a company's ability to generate income relative to its investment in assets. The greater the ROI, the more efficiently the company is using assets to produce income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started