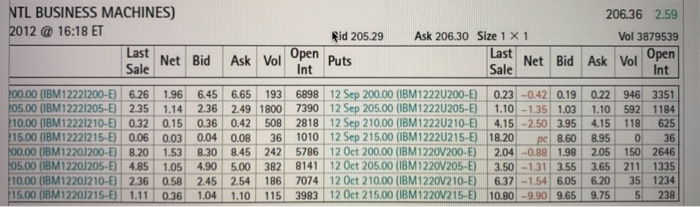

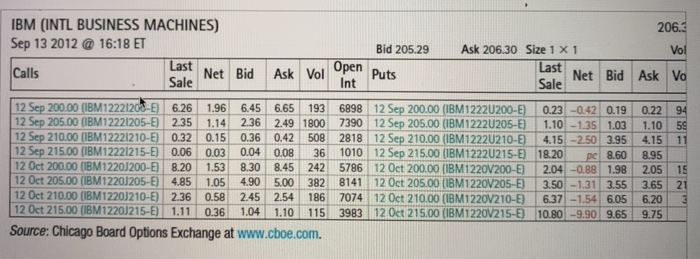

Here EEB is an option quote on IBM from the CBOE website. a. Which option contract had the most trades today? b. Which option contract is being held the most overall? c. Suppose you purchase one option contract with symbol IBM12221210-E. How much will you need to pay your broker for the option contract (ignoring commissions)? d. Suppose you sell one option contract with symbol IBM12221210-E. How much will you receive for the option contract (ignoring commissions)? e. The calls with which strike prices are currently in-the-money? Which puts are in-the-money? a. Which option contract had the most trades today The option contract with the most trades today is: (Select the best choice below.) 0 A, OB. O c. O D. 12 Oct 200.00 put 12 Sep 205.00 call 12 Oct 205.00 call 12 Sep 200.00 put b. Which option contract is being held the most overall? The option contract being held the most overall is: (Select the best choice below.) OA, O B. 12Sep 20500 call 12 Oct 205.00 call 12 Sep 200.00 put 12 Oct 200.00 put C. 0 D. c. Suppose you purchase one option contract with symbol IBM12221210-E. How much will you need to pay your broker for the option contract (ignoring commissions)? The amount you will need to pay your broker for the contract (ignoring commissions) is s(Round to the nearest dolar.) d. Suppose you sell one option contract with symbol IBM12221210-E. How much will you receive for the option contract (ignoring commissions)? The amount you will receive for the contract (ignoring commissions) is $ (Round to the nearest dollar.) e. The calls with which strike prices are currently in-the-money? Which puts are in-the-money? The calls currently in-the-money are: (Select the best choice below.) 0 A, O B. C. those with strike prices of 200 and 205. only those with strike price of 205. those with strike prices of 205 and 210. D, only those with strike price of 200. The puts currently in-the-money are: (Select the best choice below.) 0 A, those with strike prices of 205 and 210. O B. those with strike prices of 210 and 215 O C. only those with strike price of 215. D, only those with strike price of 210. IBM (INTL BUSINESS MACHINES) Sep 13 2012 @ 16:18 ET 206.3 Bid 205.29 Ask 206.30 Size 1 x1 Last Sale Last Sale Net Bid Ask Vol OpenP Calls Net Bid Ask Vo Int 2 Sep 20000 (BM1222120 6.26 1.96 645 665 193 6898 12 Sep 200.00 IBM1222U200- 0.23-042) 0.19 0.22 12 Sep 205.00 (IBM12221205- 235 1.14 236 249 1800 7390 12 Sep 205.00 (IBM1222U205-) 1.10 -135 103 1.10 5 2 Sep 210.00 (1BM12221210-8 0.32 0.15 036 042 508 2818 12 Sep 210.00 (1BM1222U210- 4.15 -250 395 415 11 2 Sep 215.00 (IBM12221215-E) 0.06 0.03 0.04 0.08 36 1010 12 Sep 215.00 (IBM1222U215-2) 18.20p 8.60 8.95 2 Oct 200.00 (BM12201200-6 8.20 1.53 830 8.45 242 5786 12 Oct 200.00 (BM1220V200-E) 204-0.88 198 2.05 19 2 Oct 205.00 (IBM 12201205-E) 485 1.05 490 500 382 8141 1Oct 205.00 (IBM1220V205-E) 3.50-1.31 355 3.65 21 2 Oct 210.00 (08M12201210-E) 2.36 0.58 245 2.54 186 7074 12 Oct 210.00 (18M1220V210-E) 6.37-1.54 6.05 6.20 12 Oct 215,00 (BM1220215-8 1.11 036 104 1.10 115 3983 20ct 215.00 (IBM1220V215- 10.80 -9.90 9.65 9.75 Source: Chicago Board Options Exchange at www.cboe.com. Here EEB is an option quote on IBM from the CBOE website. a. Which option contract had the most trades today? b. Which option contract is being held the most overall? c. Suppose you purchase one option contract with symbol IBM12221210-E. How much will you need to pay your broker for the option contract (ignoring commissions)? d. Suppose you sell one option contract with symbol IBM12221210-E. How much will you receive for the option contract (ignoring commissions)? e. The calls with which strike prices are currently in-the-money? Which puts are in-the-money? a. Which option contract had the most trades today The option contract with the most trades today is: (Select the best choice below.) 0 A, OB. O c. O D. 12 Oct 200.00 put 12 Sep 205.00 call 12 Oct 205.00 call 12 Sep 200.00 put b. Which option contract is being held the most overall? The option contract being held the most overall is: (Select the best choice below.) OA, O B. 12Sep 20500 call 12 Oct 205.00 call 12 Sep 200.00 put 12 Oct 200.00 put C. 0 D. c. Suppose you purchase one option contract with symbol IBM12221210-E. How much will you need to pay your broker for the option contract (ignoring commissions)? The amount you will need to pay your broker for the contract (ignoring commissions) is s(Round to the nearest dolar.) d. Suppose you sell one option contract with symbol IBM12221210-E. How much will you receive for the option contract (ignoring commissions)? The amount you will receive for the contract (ignoring commissions) is $ (Round to the nearest dollar.) e. The calls with which strike prices are currently in-the-money? Which puts are in-the-money? The calls currently in-the-money are: (Select the best choice below.) 0 A, O B. C. those with strike prices of 200 and 205. only those with strike price of 205. those with strike prices of 205 and 210. D, only those with strike price of 200. The puts currently in-the-money are: (Select the best choice below.) 0 A, those with strike prices of 205 and 210. O B. those with strike prices of 210 and 215 O C. only those with strike price of 215. D, only those with strike price of 210. IBM (INTL BUSINESS MACHINES) Sep 13 2012 @ 16:18 ET 206.3 Bid 205.29 Ask 206.30 Size 1 x1 Last Sale Last Sale Net Bid Ask Vol OpenP Calls Net Bid Ask Vo Int 2 Sep 20000 (BM1222120 6.26 1.96 645 665 193 6898 12 Sep 200.00 IBM1222U200- 0.23-042) 0.19 0.22 12 Sep 205.00 (IBM12221205- 235 1.14 236 249 1800 7390 12 Sep 205.00 (IBM1222U205-) 1.10 -135 103 1.10 5 2 Sep 210.00 (1BM12221210-8 0.32 0.15 036 042 508 2818 12 Sep 210.00 (1BM1222U210- 4.15 -250 395 415 11 2 Sep 215.00 (IBM12221215-E) 0.06 0.03 0.04 0.08 36 1010 12 Sep 215.00 (IBM1222U215-2) 18.20p 8.60 8.95 2 Oct 200.00 (BM12201200-6 8.20 1.53 830 8.45 242 5786 12 Oct 200.00 (BM1220V200-E) 204-0.88 198 2.05 19 2 Oct 205.00 (IBM 12201205-E) 485 1.05 490 500 382 8141 1Oct 205.00 (IBM1220V205-E) 3.50-1.31 355 3.65 21 2 Oct 210.00 (08M12201210-E) 2.36 0.58 245 2.54 186 7074 12 Oct 210.00 (18M1220V210-E) 6.37-1.54 6.05 6.20 12 Oct 215,00 (BM1220215-8 1.11 036 104 1.10 115 3983 20ct 215.00 (IBM1220V215- 10.80 -9.90 9.65 9.75 Source: Chicago Board Options Exchange at www.cboe.com