Answered step by step

Verified Expert Solution

Question

1 Approved Answer

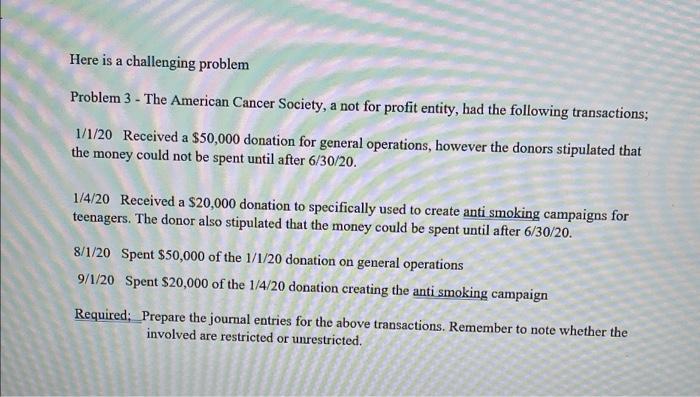

Here is a challenging problem Problem 3 - The American Cancer Society, a not for profit entity, had the following transactions; 1/1/20 Received a

Here is a challenging problem Problem 3 - The American Cancer Society, a not for profit entity, had the following transactions; 1/1/20 Received a $50,000 donation for general operations, however the donors stipulated that the money could not be spent until after 6/30/20. 1/4/20 Received a $20,000 donation to specifically used to create anti smoking campaigns for teenagers. The donor also stipulated that the money could be spent until after 6/30/20. 8/1/20 Spent $50,000 of the 1/1/20 donation on general operations 9/1/20 Spent $20,000 of the 1/4/20 donation creating the anti smoking campaign Required; Prepare the journal entries for the above transactions. Remember to note whether the involved are restricted or unrestricted. order Someon

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer journal entry Date particulars 2020 Cash mis...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started